Trusted by 1000+ leading businesses across the globe

Reduce fraud losses

Identify where your business is losing money to fraud and prevent it in real-time with minimal impact to your customers. Detect transactions originating from suspicious locations, currencies, deviations in behavior, and transactions from new accounts.

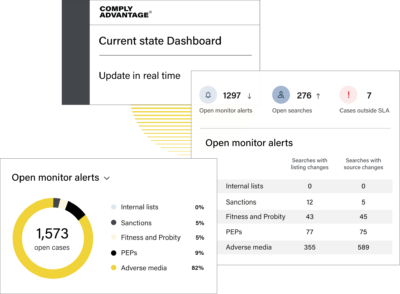

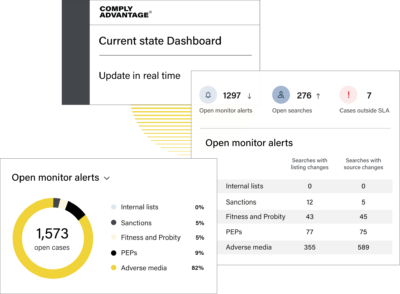

Identify risks

Monitor hundreds of known typologies and trends within customer transactions to detect suspicious behavior. Screen risks before they materialize and stop in real time.

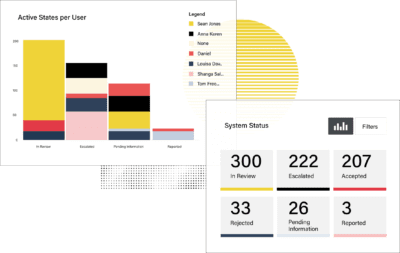

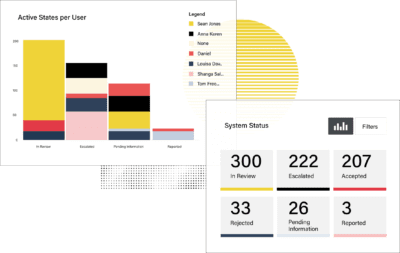

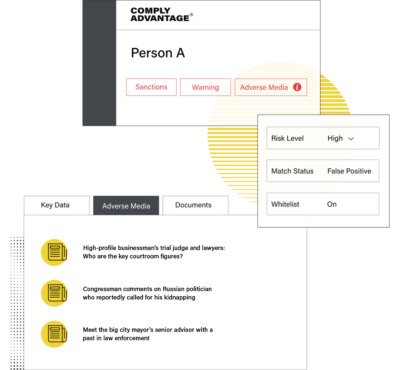

Calibrate your risk based approach

Leverage our proprietary combination of risk data, intuitive case management, and smarter matching capabilities to tailor your AML screening & monitoring process to the unique needs of your business.

Why use us?

Future proof your business

The future of financial risk insights

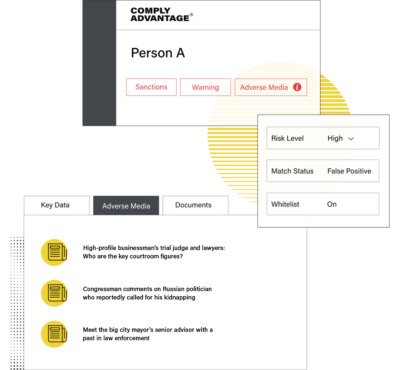

ComplyAdvantage was born out of the frustration experienced by our founder while evaluating AML data providers. Despite trying tool after tool, Charles came across the same problems: they were difficult to integrate, hard-to-use, and provided too many ‘false-positive alerts.

Legacy solutions rely on manual labor to create and maintain data, limiting update frequency. Data can rapidly become obsolete, resulting in more false positives and increased exposure to risk.

By distracting compliance professionals from stopping financial crime, false positives facilitate human trafficking and terrorism. The need to equip compliance professionals with effective financial crime-fighting tools led Charles to found ComplyAdvantage in 2014.

1000+

Companies

200+

Countries and territories covered

50%

reduction in onboarding cycle time

70%

false positive reduction

Latest news and press releases

Top 5 fraud trends in 2024 and how to mitigate them