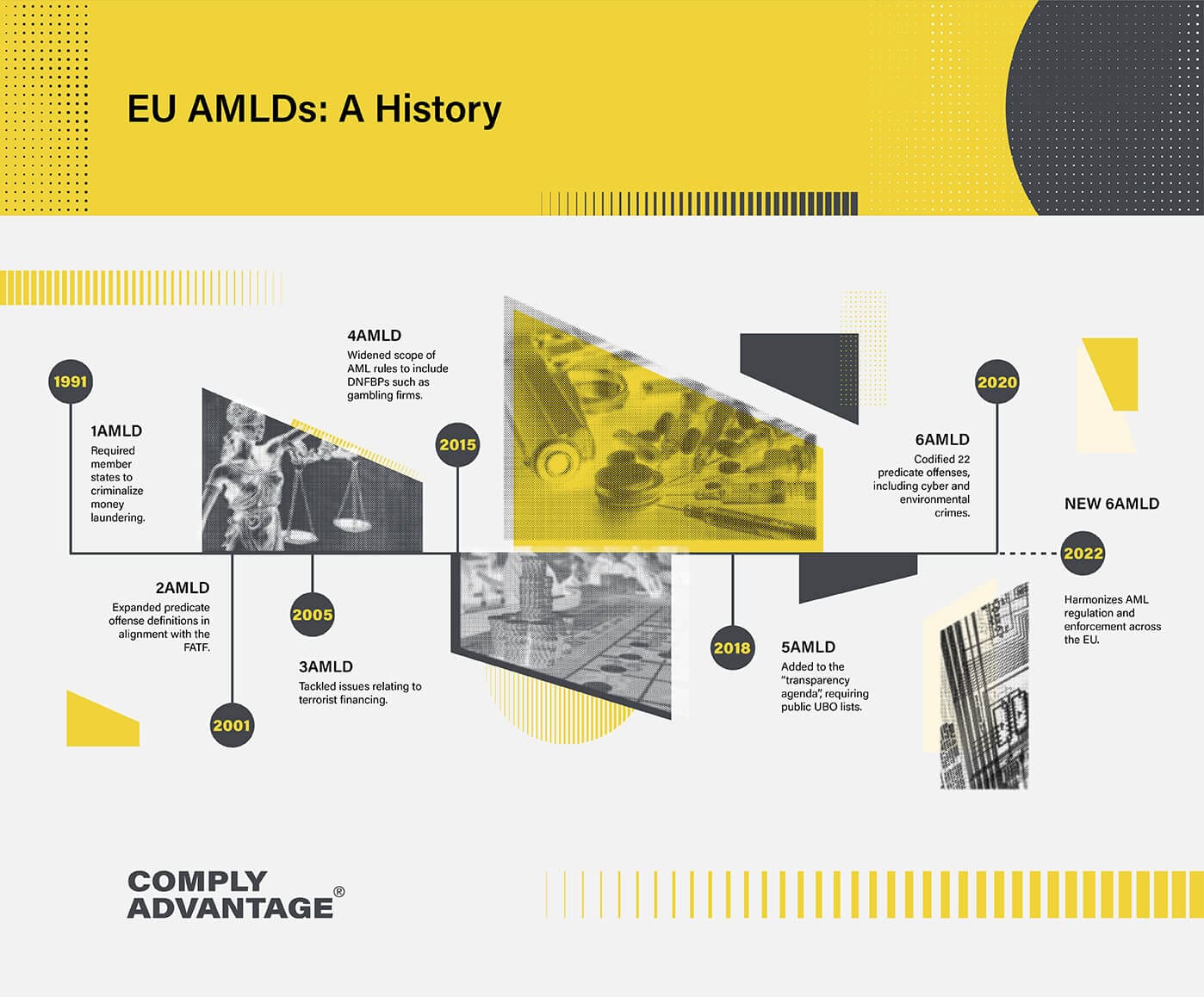

Following the succession of five previous anti-money laundering directives (AMLDs), the 6th Money Laundering Directive reinforces the foundations of the European Union’s anti-money laundering and combatting the financing of terrorism (AML/CFT) framework. The first AMLD came into force in 1991 due to growing global concerns about drug money washing through the legitimate financial system. Since then, subsequent AML directives – 2AMLD in 2001, 3AMLD in 2006, 4AMLD in 2017, and 5AMLD in 2018 – have expanded and enhanced the framework to include revised goals and standards for individual member states to achieve with their own legislation.

What is the 6th Money Laundering Directive (6AMLD)?

The 6th Money Laundering Directive (6AMLD) is a European Union directive that aims to strengthen the existing anti-money laundering framework. The directive was adopted in October 2018 and enacted in December 2020.

6AMLD aims to empower financial institutions and authorities in their fight against money laundering and terrorism financing by expanding the scope of existing legislation, harmonizing the criminal law across the EU, and improving the cooperation between the member states.

What are the Key Highlights of 6AMLD?

Harmonization

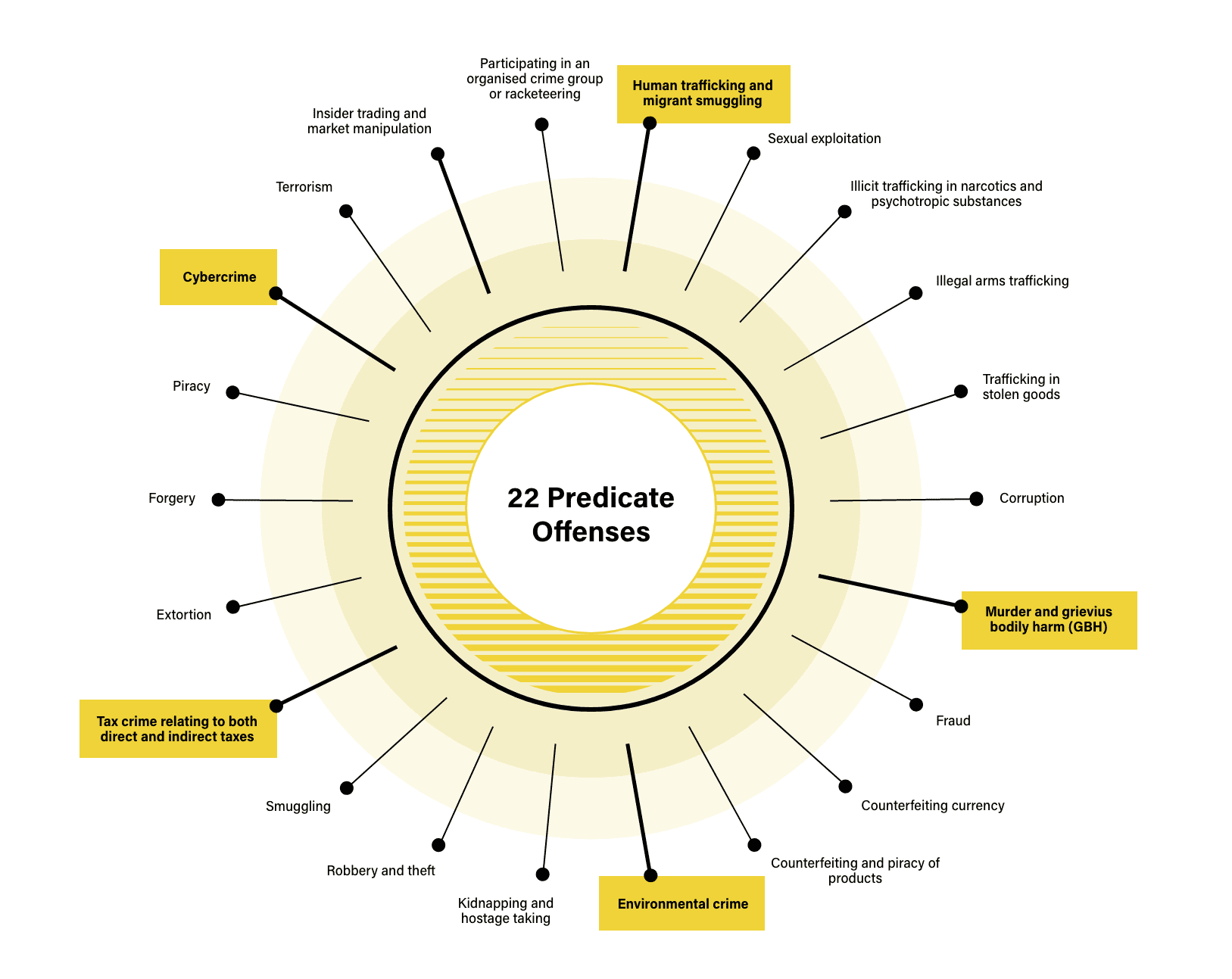

6AMLD harmonizes the definition of money laundering across the EU with the goal of removing loopholes in the domestic legislation of member states. As a response to changing criminal methodologies and legislative priorities, 6AMLD provides a harmonized list of the 22 predicate offenses that constitute money laundering, including certain tax crimes, environmental crime, and cybercrime money laundering. The inclusion of cybercrime as a predicate offense is significant since it is the first time it has been featured in this context in an EU money laundering directive.

6AMLD: 22 Predicate Offenses for Money Laundering

A predicate offense – or predicate crime – refers to a crime that is a component of a larger crime. In a financial context, the predicate offense would be any crime that generates monetary proceeds. The larger crime would be money laundering or financing of terrorism.

The 22 predicate offenses for money laundering consolidated in 6AMLD are:

- Participation in an organized criminal group and racketeering

- Terrorism

- Trafficking in human beings and migrant smuggling

- Sexual exploitation

- Illicit trafficking in narcotic drugs and psychotropic substances

- Illicit arms trafficking

- Illicit trafficking in stolen and other goods

- Corruption

- Fraud

- Counterfeiting of currency

- Counterfeiting and pirating of products

- Environmental crime

- Murder and grievous bodily injury

- Kidnapping, illegal restraint, and hostage-taking

- Robbery or theft

- Smuggling

- Tax crimes relating to direct and indirect taxes

- Extortion

- Forgery

- Piracy

- Insider trading and market manipulation

- Cybercrime

Expanded Regulatory Scope

6AMLD expands the number of offenses that fall under the definition of money laundering, including “aiding and abetting.” Before 6AMLD, EU money laundering regulations sought only to punish those who profited directly from the act of money laundering, but under the new rules, so-called “enablers” are also legally culpable.

Practically, “aiding and abetting” means that anyone who helps money launderers will themselves be committing the crime of money laundering: that expanded scope also includes anyone caught inciting money laundering or attempting to launder money. As with the harmonized list of predicate offenses, as part of their AML response, firms should now move to ensure their compliance programs are set up to detect and prevent the aiding and abetting of money laundering.

Extension of Criminal Liability

Previously, only individuals could be punished for the act of money laundering; however, 6AMLD extends criminal liability to allow for the punishment of legal persons, such as companies or partnerships. The new rules mean that a legal person can be considered culpable for the crime of money laundering if it is established that they failed to prevent a “directing mind” from within the company from carrying out the illegal activity. Practically, the new rules place AML/CFT responsibility on management employees, along with employees acting separately.

The extension of criminal liability in this context is intended to hold larger companies to account in the global effort to combat money laundering. The move will allow financial authorities to better target organizations not implementing AML/CFT effectively. Punishments for legal persons may range from a temporary ban on operations or judicial supervision to permanent closure.

Tougher Punishment

6AMLD introduced a minimum prison sentence of four years for money laundering offenses (the previous minimum sentence requirement was one year). Judges also have the power to fine individuals and exclude entities from accessing public funding.

The increased prison terms for money laundering and potential financial repercussions are part of the EU’s effort to bring consistency to AML/CFT regulation across all member states and reflect the EU parliament’s commitment to stricter enforcement of money laundering rules. Many EU member states already implement punishments for money laundering in excess of the minimum prison sentences required by the 6th money laundering directive.

Member-State Cooperation

The crime of money laundering may involve dual criminality, which is the principle that a crime may be committed in one jurisdiction before its financial proceeds are laundered in another. 6AMLD addresses the issue of dual criminality with specific information-sharing requirements between jurisdictions so that criminal prosecution for the connected offenses can occur in more than one EU member state.

In practice, 6AMLD’s provisions for dual criminality require EU member states to criminalize certain predicate offenses, whether they are illegal in that jurisdiction or not. Those predicate offenses are terrorism, drug trafficking, human trafficking, sexual exploitation, racketeering, and corruption. As part of the process, the member states involved in a prosecution will work together to centralize legal proceedings within a single jurisdiction. 6AMLD sets out a range of factors for authorities to consider when deciding how and where to conduct prosecutions, including:

- The victims’ country of origin

- The nationality (or residence) of the offender

- The jurisdiction in which the offense took place

How to Comply with 6AMLD

Obligated firms should seek to understand the adjusted regulatory scope that 6AMLD has brought, including new predicate offenses that must be monitored and the new risk environment in which they will be operating. In addition to managing their AML resources and training compliance staff, firms need to review their technology deployment to ensure that they have the capability to meet the current transaction monitoring and screening obligations.

Adverse Media Categorization

The broad spectrum of money laundering predicate offenses set out in 6AMLD means that financial institutions must adjust their adverse media screening process to ensure they identify appropriate news stories.

It’s important to make sure that any negative news screening tool used can identify media by specific categories – some examples of which are highlighted in the gif below. This reduces noise and keeps alerts focused on what’s relevant by avoiding false positives.

Categorization also complements automated screening, helping to reduce employee workloads and transform an institution’s ongoing compliance performance. Depending on the AML risk-based approach businesses are taking, it may be prudent to receive different alerts based on different categories to make it easier for compliance officers to discover what’s relevant.

The EU’s New AML/CFT Framework

Since 6AMLD came into force in 2020, the European Commission issued a set of proposals for a radical overhaul of its AML/CFT framework. These are commonly know by compliance professionals as the “new” 6AMLD, given the popular use of 6AMLD to refer to the existing directive which was enacted in 2020. Financial institutions and other AML/CFT-obliged businesses should ensure they remain up-to-date with the developments around the reform plan.

For more information on the new proposed framework, download our report covering the key essentials.

*A note on definitions: The EU Directive 2018/1673, issued in November 2018, created a new foundation for the EU’s criminal law on money laundering. EU member states were required to transpose it into national law by December 3 2020, with the private sector required to make any necessary changes by June 3 2022. This directive is widely known in the financial services industry as the 6th Anti-Money Laundering Directive (6AMLD). However, the European Commission now sees this directive as a standalone regulation. As a result, we are calling the proposed directive referenced here the “new” 6AMLD.

A Guide to “The Original 6AMLD”

Learn more about the 6th Money Laundering Directive and consider what more needs to be done by firms operating in the EU to ensure they are compliant.

Download nowOriginally published 01 May 2020, updated 11 December 2023

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).

EN

EN FR

FR