Russia Sanctions Compliance

Use the latest technology in your AML/KYC program to ensure Russia sanctions compliance with a real-time AML risk database.

ComplyAdvantage features:

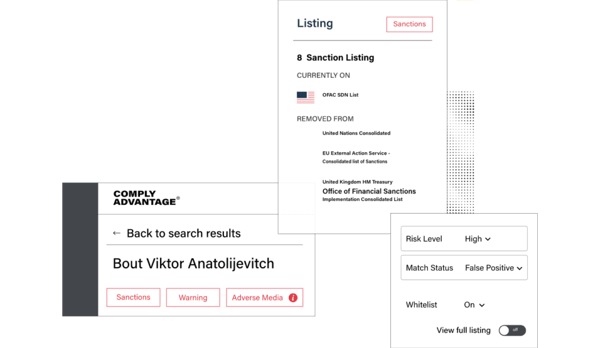

- Real-time sanctions data (100% lists globally)

- Reduce engineering dependence: Plug-and-Play Cloud service with easy REST API integration in a matter of hours

- Transaction screening (real-time sanctions & BIC screening)

- AI and Machine Learning driven Adverse Media

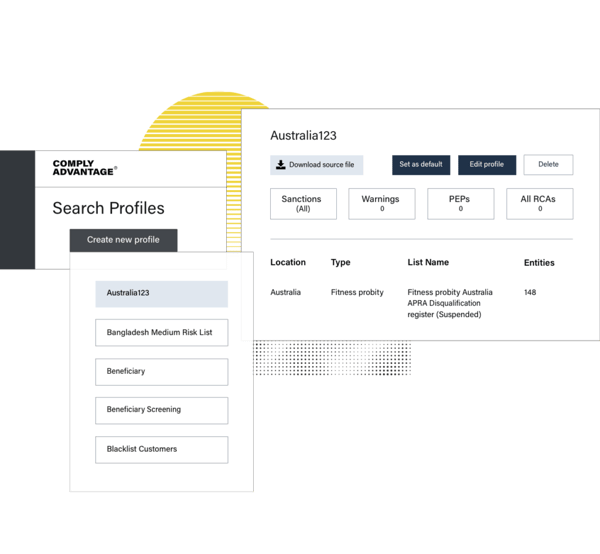

- Automate your onboarding & ongoing monitoring

- Whitelisting capabilities to reduce false positives

- Improve efficiency with combined entity-based profiles

- ISO27001 level security

Request a Demo →

Request a Demo →

The Compliance Team’s Guide to Customer Onboarding - Part 1

The Compliance Team’s Guide to Customer Onboarding - Part 1

The State of Financial Crime 2023

The State of Financial Crime 2023

ComplyAdvantage Takes on Payment Fraud with New AI-powered Solution

ComplyAdvantage Takes on Payment Fraud with New AI-powered Solution