A look at the newest trends and updates from key sanction regimes around the world.

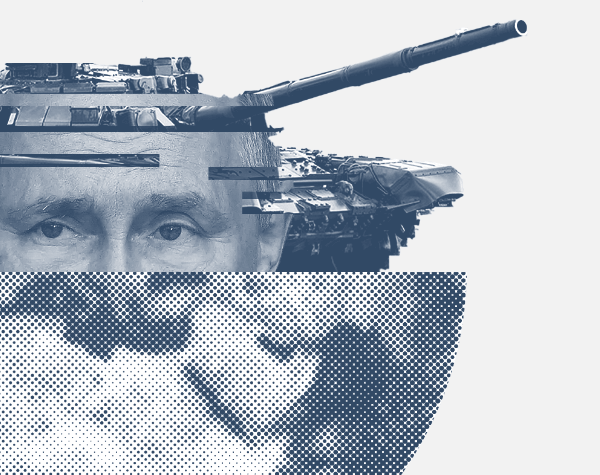

This report explores the evolution of the current international sanctions environment, and the biggest issues in sanctions today. From the war in Ukraine to Afghanistan and Myanmar, learn about key regimes, geopolitical trends and sanctions evasion risks. You can also review the development of national policy, national perspectives, and thematic trends.

Access our report covering the sanctions tips and trends you need to know, including:

- Key Concepts: What are sanctions? How are they triggered? How are they enforced?

- Key Sanctions Regimes: From the United Nations to the United States, the European Union and the United Kingdom.

- Geopolitical Hotspots: Russia, China, Iran, North Korea, Myanmar and thematic issues in sanctions regimes.

- Sanctions Evasion: While there’s no ‘textbook’ approach to evading sanctions, common tactics can be observed.

- Key Regime Trends: The Biden administration, civil society organizations and the prospects for a ‘China bloc’.

- Sanctions and Financial Institutions: The responsibilities, processes and responses businesses should have in place to manage sanctions risk and exposure.

Sanctions risks are real, but firms are better placed to tackle them than ever before.

Read the Guide:

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2022 IVXS UK Limited (trading as ComplyAdvantage).

Request a Demo →

Request a Demo →

The Compliance Team’s Guide to Customer Onboarding - Part 1

The Compliance Team’s Guide to Customer Onboarding - Part 1

The State of Financial Crime 2023

The State of Financial Crime 2023

ComplyAdvantage Takes on Payment Fraud with New AI-powered Solution

ComplyAdvantage Takes on Payment Fraud with New AI-powered Solution