Regional Regulatory Trends

Uncover the evolving anti-money laundering regulatory landscape, examining global trends and key themes in major economies.

Download nowThe Hong Kong Monetary Authority (HKMA) has announced the launch of a new pilot program for the potential rollout of a retail central bank digital currency (CBDC), known as e-HKH. On May 18, 2023, the regulator confirmed that 16 firms from the financial, technology, and payments sectors had been chosen to participate in the first round of trials.

The HKMA began researching CBDCs under Project LionRock in 2017. Since then, the regulator has collaborated with other central banks to broaden its understanding and experience in wholesale CBDC. Building on this knowledge, HKMA launched Project e-HKD in June 2021, focusing on retail or “general-purpose” CBDCs.

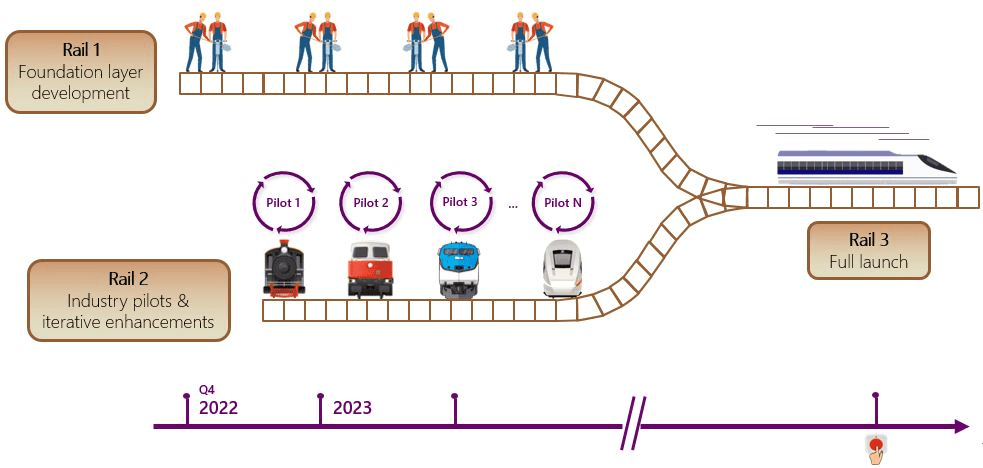

The e-HKD pilot program is part of Rail 2 under the HKMA’s three-rail approach to the potential implementation of a retail CBDC. While the purpose of Rail 1 is to lay the legal and technical foundations of e-HKD, Rail 2 runs parallel to facilitate “deep dives” into issues relating to application and design and CBDC use cases across six categories, including:

HKMA plans to deepen its research and gain experience from various stakeholders during the various pilot stages before potentially launching a digital version of the local currency (Rail 3).

Source: The Hong Kong Monetary Authority

The Chief Executive of the HKMA, Eddie Yue, said, “While the HKMA has not yet made a decision on whether and when to introduce e-HKD, we are excited to kick-start the e-HKD Pilot Programme, which serves as a tremendous opportunity for the HKMA to collaborate with the industry in exploring innovative use cases and maximizing our readiness for a potential e-HKD.” The outcome and results of the first pilot program are due to be shared with the public by the HKMA at Hong Kong FinTech Week 2023 – which is due to take place between October 30 and November 5.

In addition to the Pilot Program, the HKMA reiterated its intentions to foster closer “government-industry-academia” collaboration on CBDC research. To do this, the regulator plans to establish a CBDC Expert Group, bringing together leading professors from local universities across different fields, including computer science, business, and law.

The HKMA will work with the Expert Group to study various issues, including:

These issues were listed as “problem statements” received from those who participated in the regulator’s 2021 CBDC consultation period. In regards to compliance, the HKMA found that many respondents highlighted the need to seek a balance between privacy, traceability, and support of anti-money laundering and combatting the financing of terrorism (AML/CFT) compliance. Some firms suggested a tiered privacy approach – with full anonymity for small-value transactions and traceability for high-value transactions – would enable companies to take a risk-based approach to compliance while protecting privacy to a certain degree.

In response to these comments, the HKMA agreed that managing competing design principles, with appropriate regard for regulatory and compliance standards, would be one of the critical aspects in the design architecture of CBDC.

As the HKMA embarks on the first of what may be many pilot programs before the potential launch of e-HKD, compliance staff should aim to keep up-to-date with the trials, familiarizing themselves with the outcomes as the regulator shares them. For firms looking to prepare for the possible introduction of a CBDC, staff should:

Uncover the evolving anti-money laundering regulatory landscape, examining global trends and key themes in major economies.

Download nowOriginally published 25 May 2023, updated 26 May 2023

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).