Financial crime risk intelligence

Power your compliance engine with full-stack risk intelligence

Automate your risk analysis with an engine that does more than source data – it interprets it. By controlling the full pipeline from ingestion to resolution, we connect the dots across sanctions, PEPs, and adverse media in real time, delivering the auditability and speed modern regulators require.

Fuel your compliance engine with full-stack risk intelligence

Power every stage of the customer lifecycle with a proprietary intelligence layer designed for risk-based decisioning. From seamless onboarding to real-time transaction monitoring, our insights fuel your workflows – enabling your team to minimize customer friction while meeting the highest regulatory standards.

Strengthen your compliance decisions with real-time intelligence

Identify true risks with precision

Accurate alerts and faster resolution, driven by proprietary data and intelligent search.

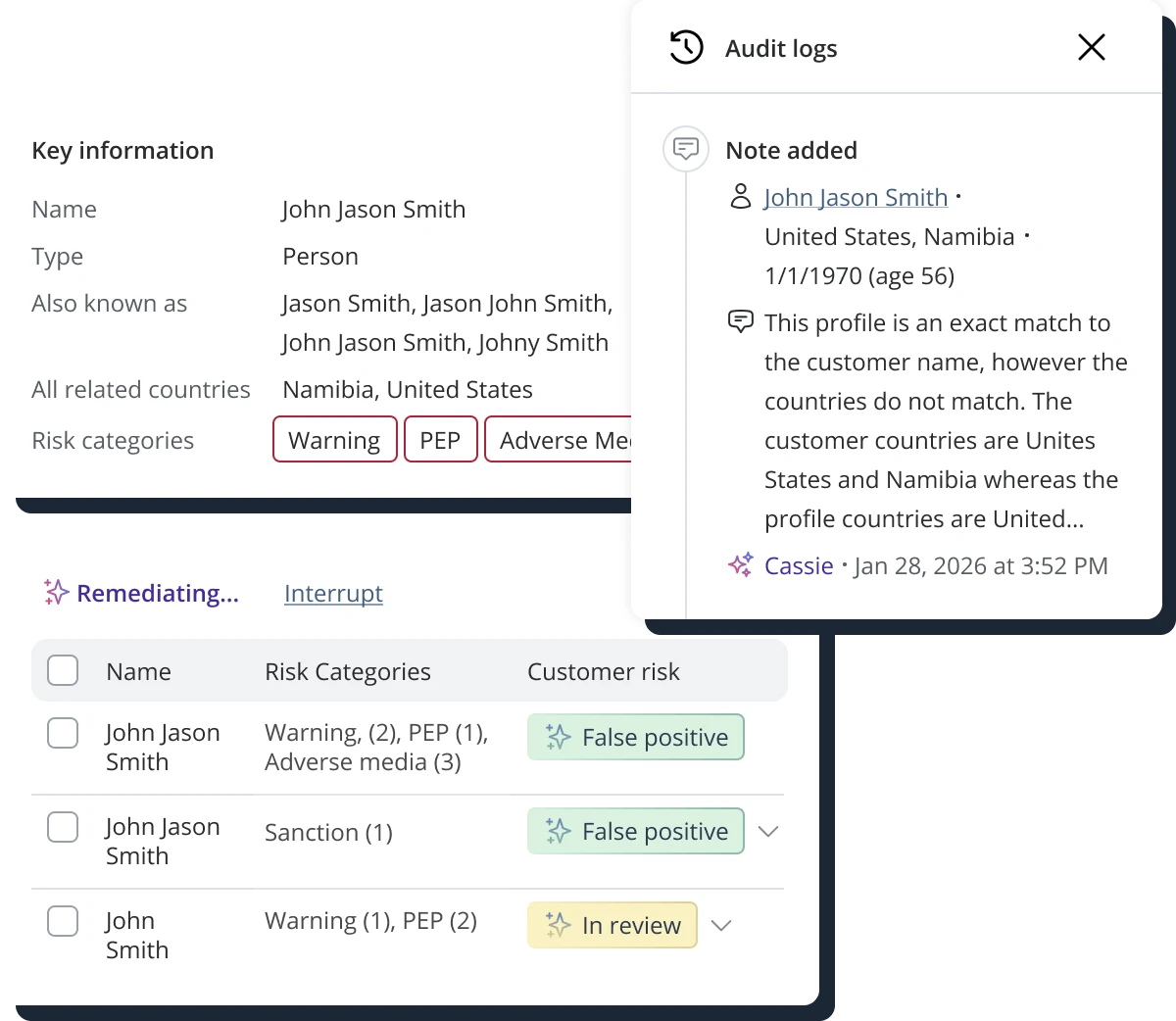

- Focus on genuine threats: Reduce your manual workload with an 82% reduction in false positives, achieved by feeding our proprietary, expert-validated data into advanced resolution models.

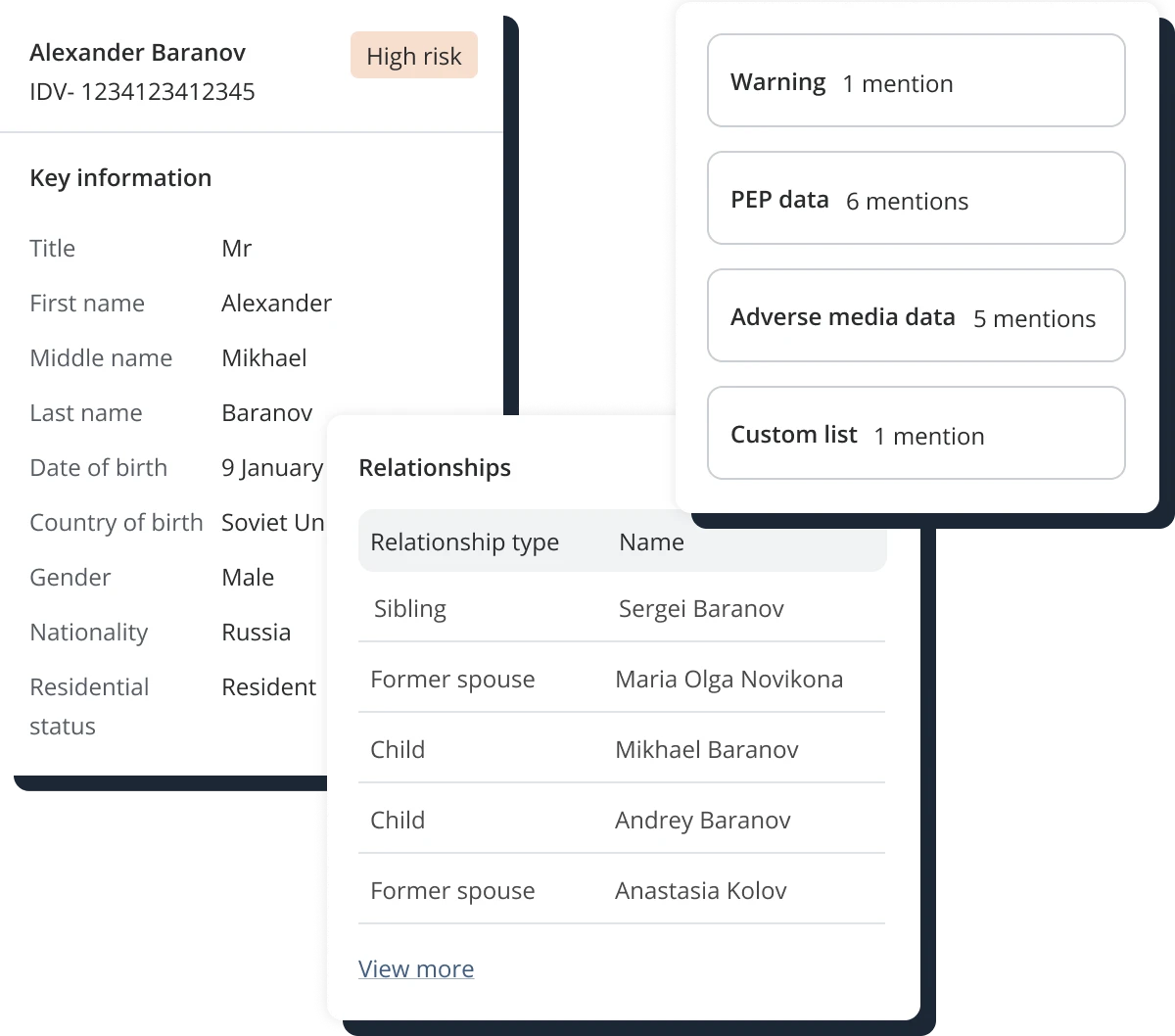

- Uncover hidden networks: Our knowledge graph and intelligent search connect 24 million+ entities and billions of shared identifiers, revealing the full picture behind complex relationships so you can act with confidence.

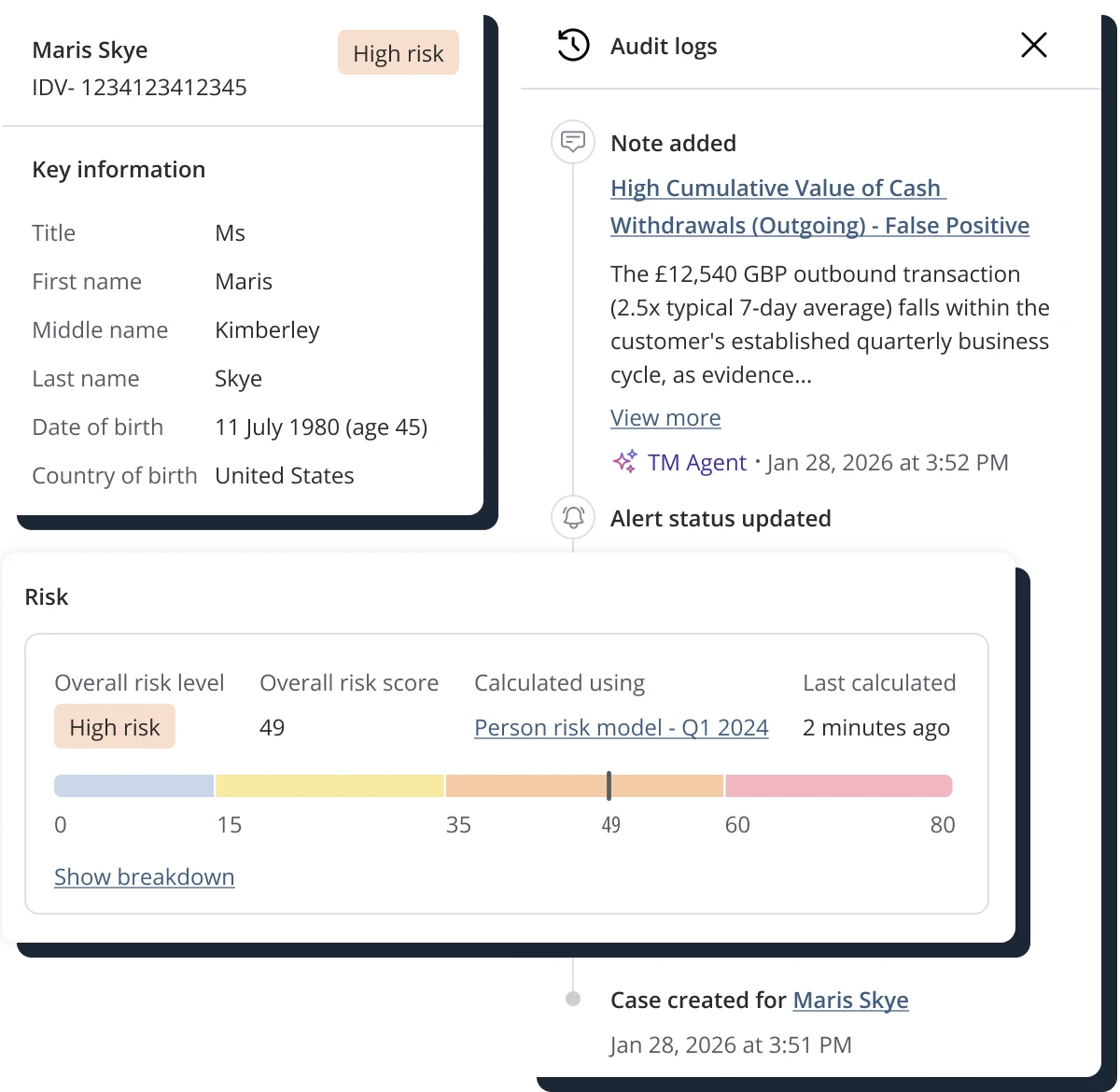

- Prove your compliance instantly: Justify every decision to regulators with clear explanations generated directly from our structured data points and audit-ready history.

- Grow without limits: Ensure your workflows remain fast even as volumes grow, thanks to a data architecture built to handle hundreds of millions of records with no loss in speed.

- Connect via a single API: Access our entire proprietary database through a developer-friendly API designed for seamless integration into any existing tech stack or internal workflow.

Trust every decision you make

Transparent audit trails and structured evidence for every alert.

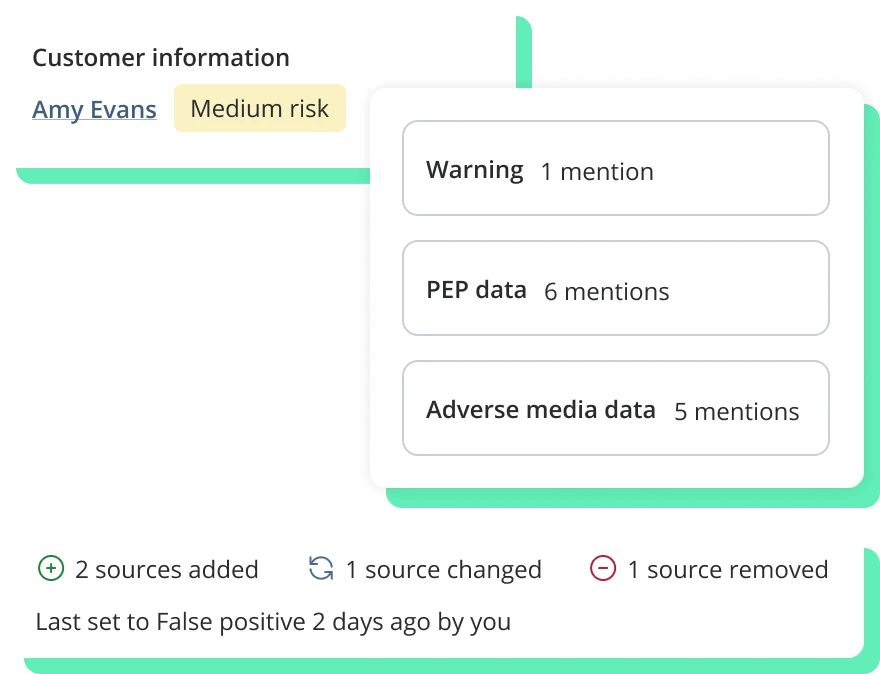

- Make decisions in one place: Eliminate the need to search multiple systems with risk profiles that arrive pre-enriched with instant context and categorized media insights.

- Prioritize what matters most: Protect your business by using our intelligent risk scoring to automatically highlight the most critical threats within your data set.

- Transparent auditability: Every risk signal comes with detailed data lineage. Move from “black-box” AI to a transparent audit trail that builds regulatory confidence through clear, structured evidence for every alert.

- Reduce research time: Accelerate your onboarding cycles with automated profiles that instantly pull in corporate links and associated risks from our global database.

- Control your risk appetite: Ensure your intelligence stays relevant by adjusting how our data is filtered in real-time to match your specific business requirements.

Grow globally with confidence

Predictable protection across every market.

- Local depth on a global scale: Identify overlooked risks with intelligence ingested directly from thousands of primary sources, including national PEP and regional lists.

- Eliminate external bottlenecks: By owning ingestion and enrichment, we eliminate third-party delays, enabling your business to scale globally and screen hundreds of millions of entities instantly.

- Streamline your technology: Lower your total cost of ownership by powering your entire stack with a single, high-quality intelligence layer that replaces fragmented data vendors.

- Protect your reputation everywhere: Gain early warning of emerging risks with access to 15 million adverse media profiles, providing coverage that is 5x deeper than traditional providers.

- Maintain consistent standards: Simplify cross-border reporting with risk intelligence that is pre-mapped to global regulatory standards and schemas.

- Stay ahead of regulatory shifts: Adapt to changing global regimes instantly as our proprietary pipeline updates the moment new sanctions or watchlists are announced.

Tangible benefits seen by our customers

Reduction in false positives using AI-powered intelligence to filter out noise.

Reduction in manual research by integrating primary-source intelligence into your workflow.

Faster investigation speeds with alerts pre-enriched by connected risk insights.

Reduction in total cost of ownership by consolidating fragmented data vendors into one platform.

Frequently asked questions

Each of our consolidated risky entity profiles undergoes immediate updates upon receiving new relevant information, ensuring unparalleled timeliness in risk mitigation.

ComplyAdvantage sets the industry pace for sanctions data updates, with all affected entity profiles swiftly refreshed and made accessible to our clients within minutes of a sanction list update announcement by any jurisdiction.

Our relentless mining of tens of thousands of watchlists, media, and reference data sources ensures comprehensive coverage of risks by association, safeguarding against indirect sanctions evasion and identifying PEP relatives and close associates with unparalleled accuracy. Our mapping to the EU and FATF predicate crimes (and the FinCEN national priorities) is market-leading.

Entity resolution ML models need constant monitoring and improvement to ensure they are still reflective of ever-changing real-world data. Compared to other providers who may depend on external entity resolution engines or old-school rules-based linking, ComplyAdvantage has built a custom-made model for our proprietary data. This model is constantly evolving to stay in sync with the real-world data.

ComplyAdvantage’s award-winning machine learning model employs advanced algorithms to comprehend and assess the global distribution of names and other identifiers, optimizing true matches while minimizing erroneous, false matches. We also apply many options for narrowing name screening using detailed customer information as additional matching criteria.

Absolutely. ComplyAdvantage is one of the few vendors offering a comprehensive solution to meet a wide range of fincrime and compliance needs.

ComplyAdvantage Mesh is an industry-leading and trusted SaaS-based risk intelligence platform that unites global intelligence to beat financial crime. It offers cutting-edge technology for customer risk scoring and customer screening and monitoring.

Mesh comes packed with advanced case management, risk scoring, audit history, enterprise-level security and resilience, and more – all seamlessly tuned to complement our proprietary data. Upcoming features will include payment screening, transaction monitoring, and beyond.

ComplyAdvantage data accelerates remediation processes by providing rich, detailed profiles that succinctly summarize all pertinent information about every individual, company, vessel, and aircraft. This enables quicker dismissal of false positives and more confident confirmation of true positives.

Furthermore, ComplyAdvantage consolidates data from tens of thousands of global sources into a single standard data schema, facilitating seamless API integrations and empowering advanced auto-remediation measures.

ComplyAdvantage leads the fincrime and compliance data market. We offer an unparalleled array of proprietary data, encompassing sanctions, watchlists, fitness & probity, PEPs, RCAs, and adverse media, ensuring comprehensive coverage for all compliance needs.

Ready to consolidate your risk data and accelerate growth?

Move beyond fragmented systems with a unified intelligence layer that automates routine decision-making, shortens investigation times, and provides a scalable foundation for global growth.

Get a demoStarter Plan

Category-leading AML solutions

Our customers and financial services analysts all rate us as a category leader quarter after quarter.