Ongoing Monitoring

Automate ongoing monitoring and rescreening of customers

Supports a targeted risk-based approach, allowing efficient evaluation of changes to risk profiles. Quicker remediation with more intelligent data coverage, adaptable to meet regulation changes.

Proven value for businesses

Effortlessly balance growth, risk, and costs with a powerful solution that enables easy monitoring of customers and companies, ensuring constant regulatory readiness and dynamic risk scoring to swiftly adapt to an evolving risk landscape.

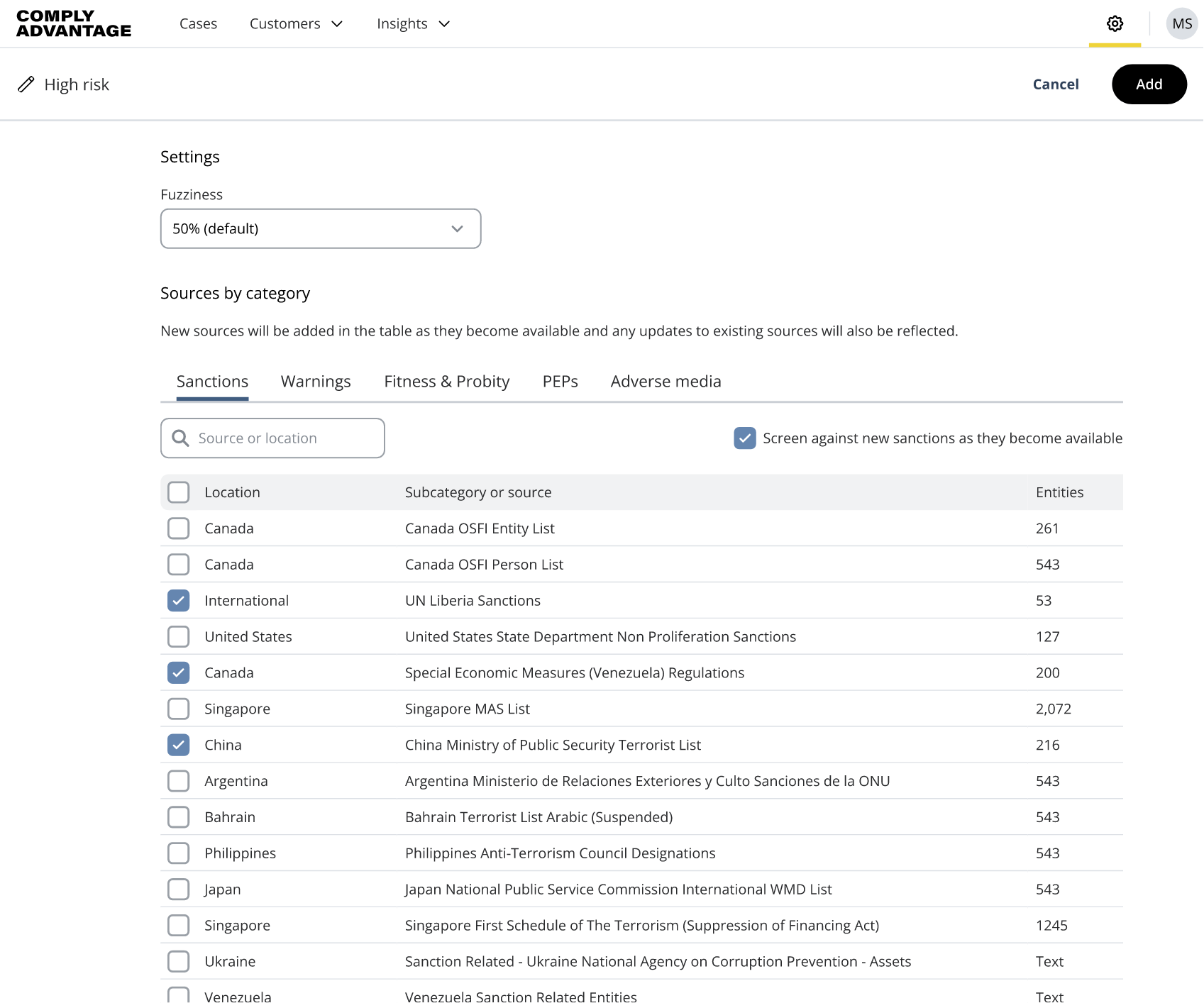

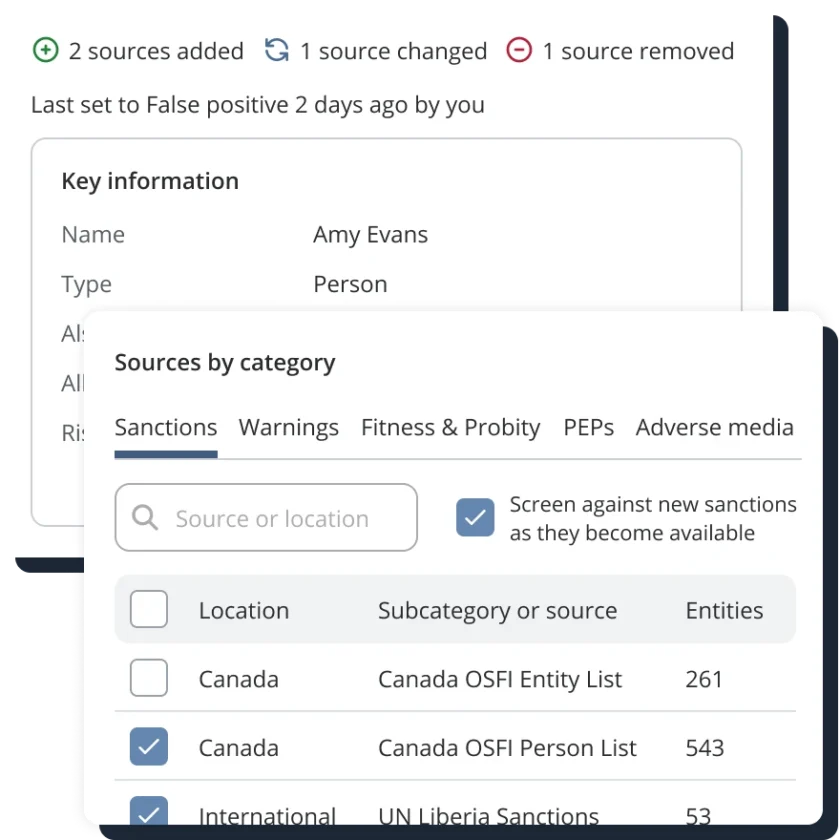

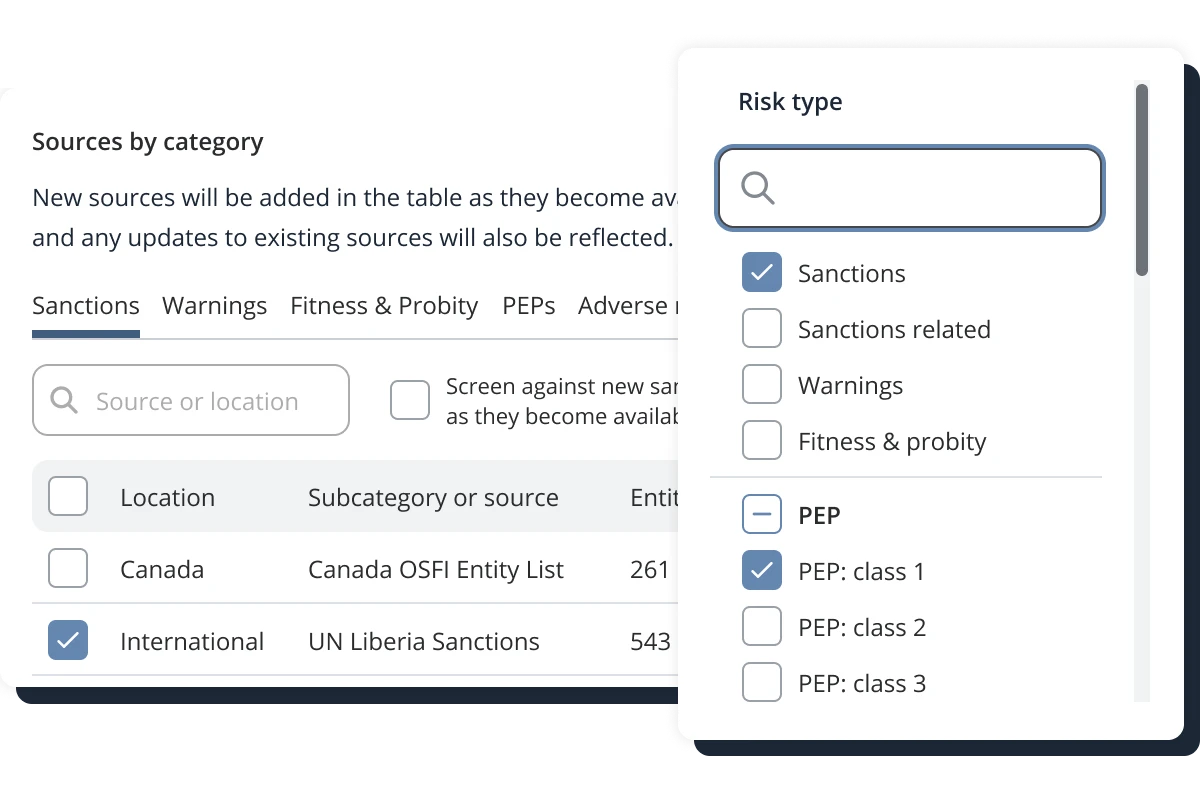

Compliance Officers & MLROs

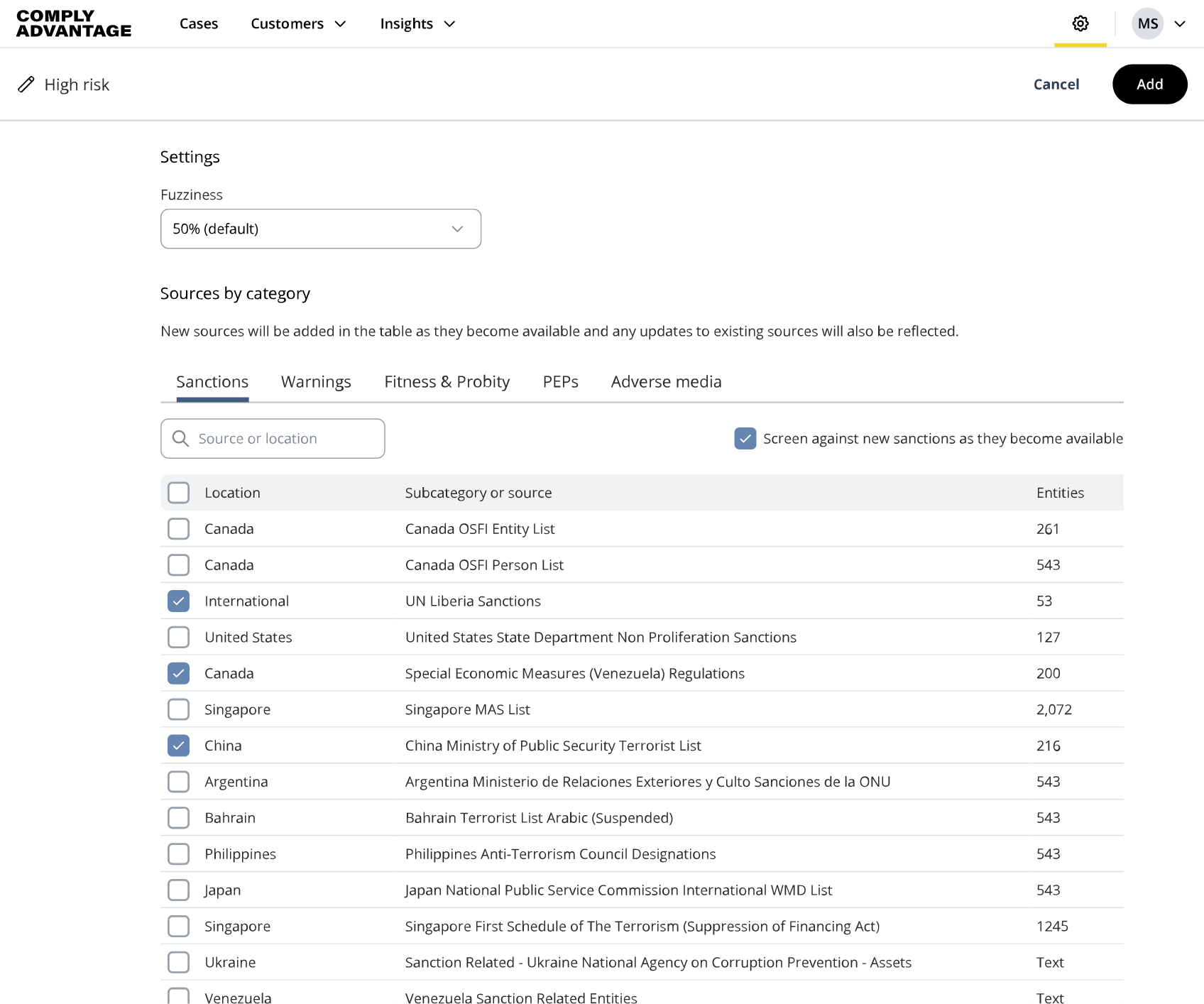

Aligning ongoing monitoring with risk policies with powerful configurability.

- Test configurations and thresholds in a sandbox before live use.

- Empower teams to tackle the highest risk monitoring alerts first.

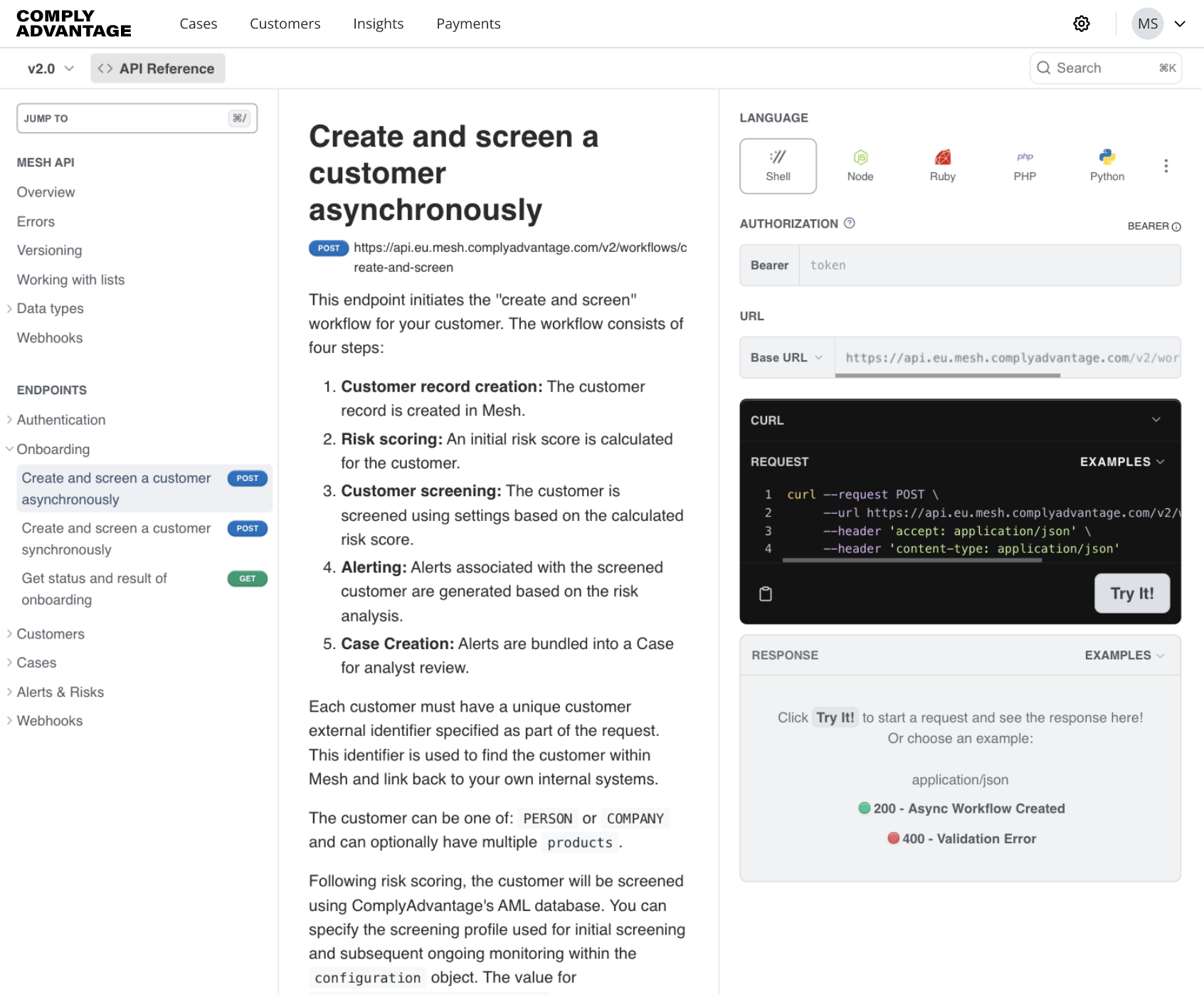

- Integrate with existing workflows or systems with full API coverage.

Swipe to scroll the full image

Got it

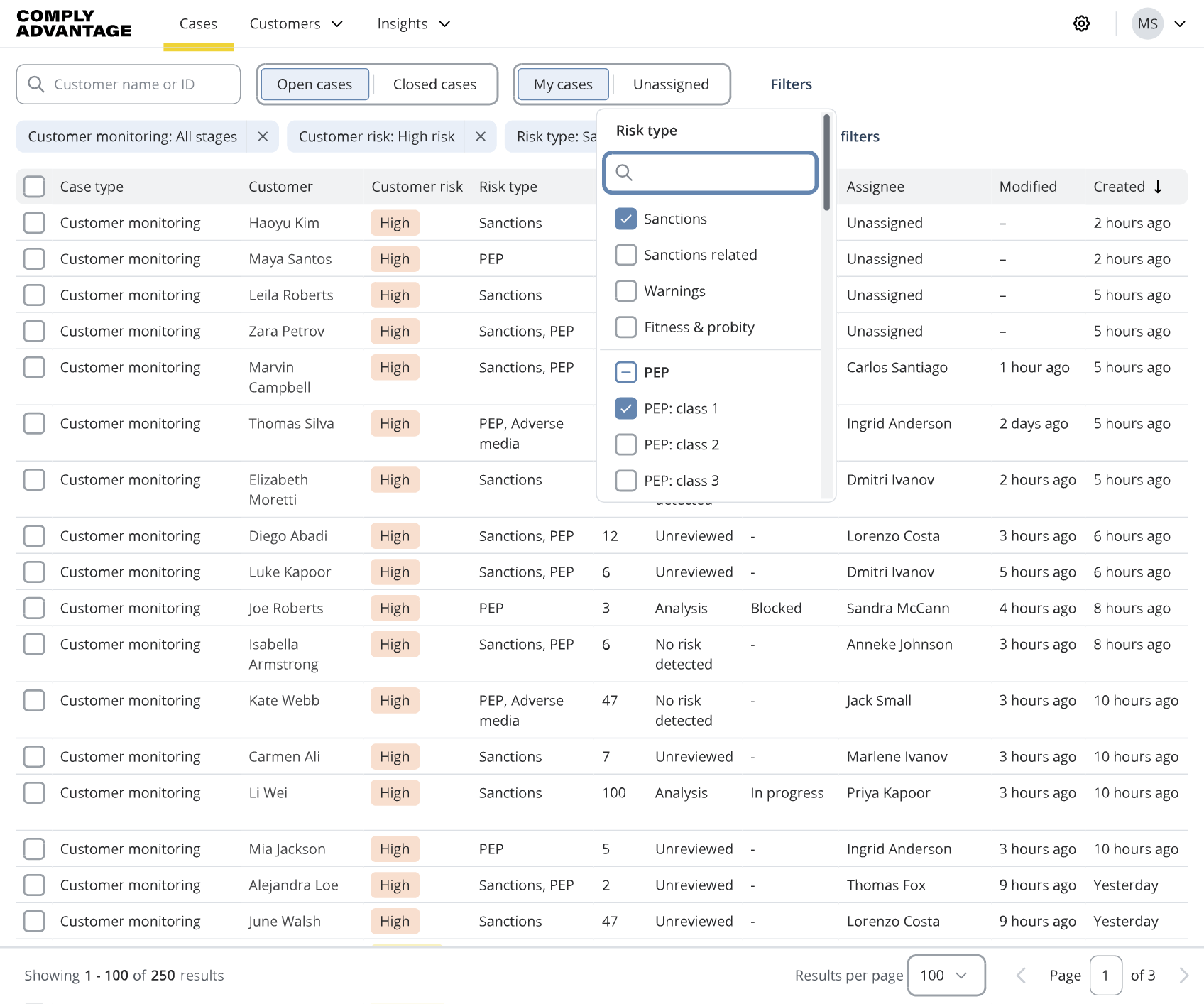

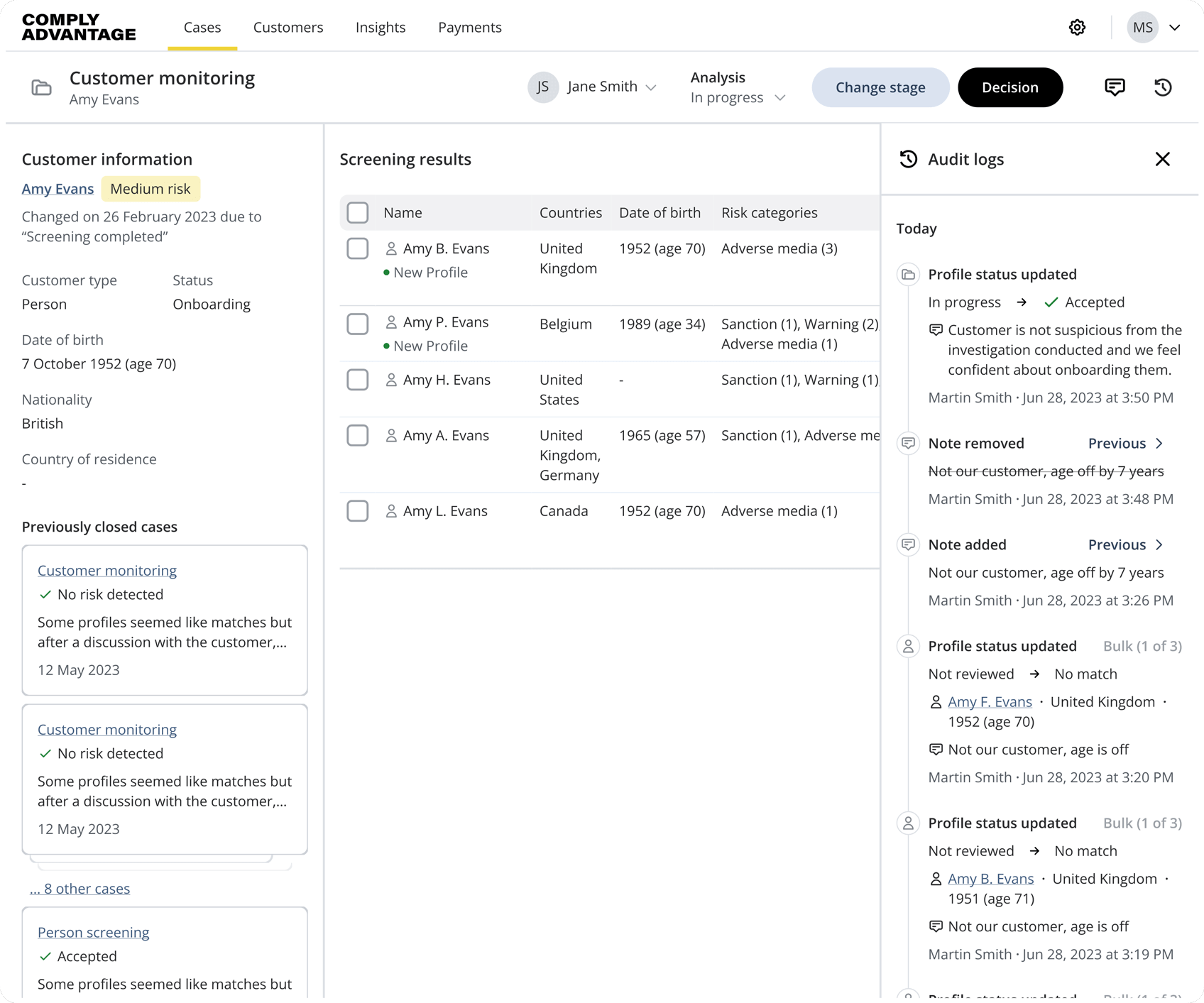

Team Leaders

Implement risk-based team workload management.

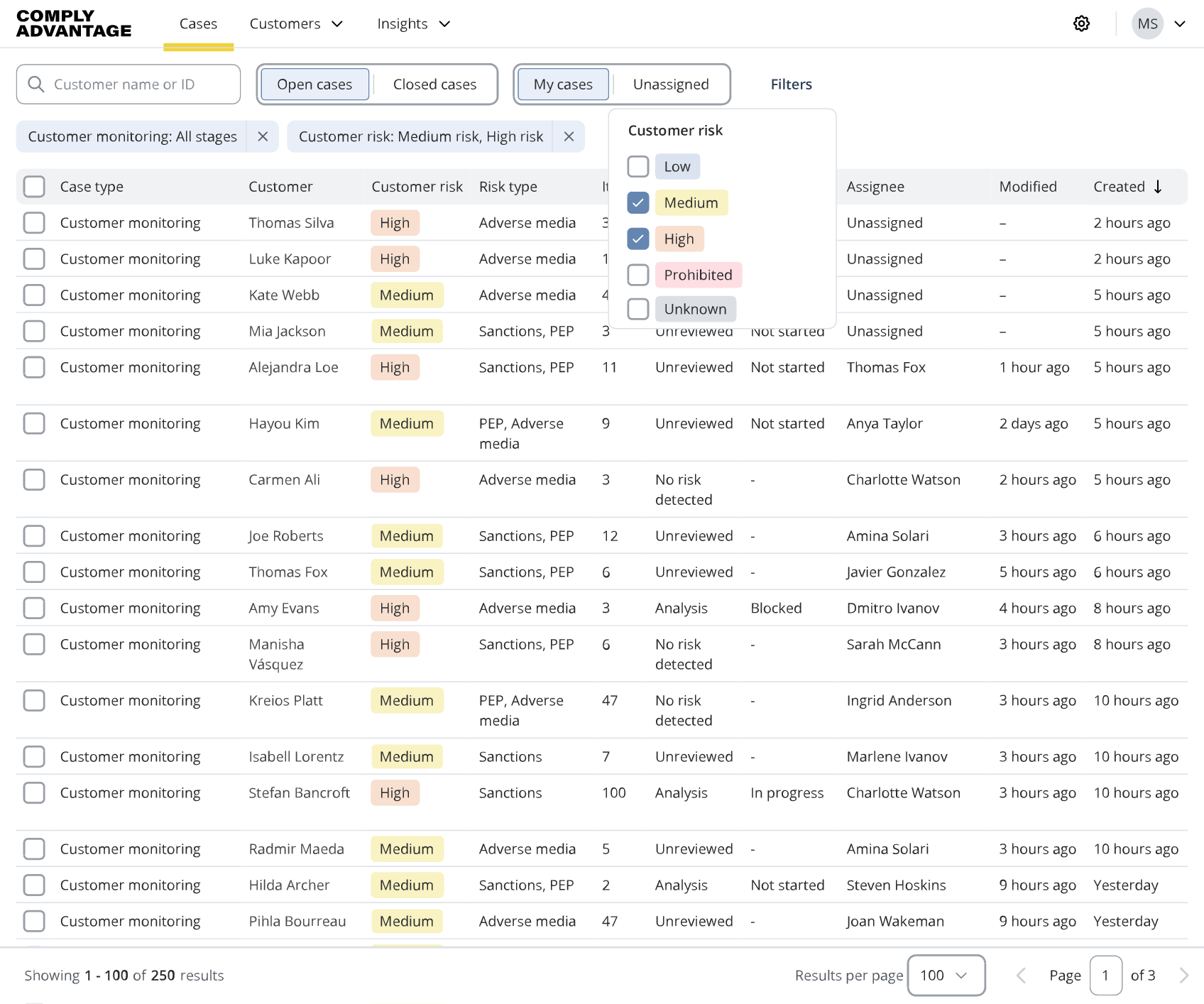

- Streamline workloads by assigning the highest risk cases first to analysts.

- Minimize false positives by tuning monitoring configurations.

- Uncover emerging trends within risk sources, like products used and customer locations.

Swipe to scroll the full image

Got it

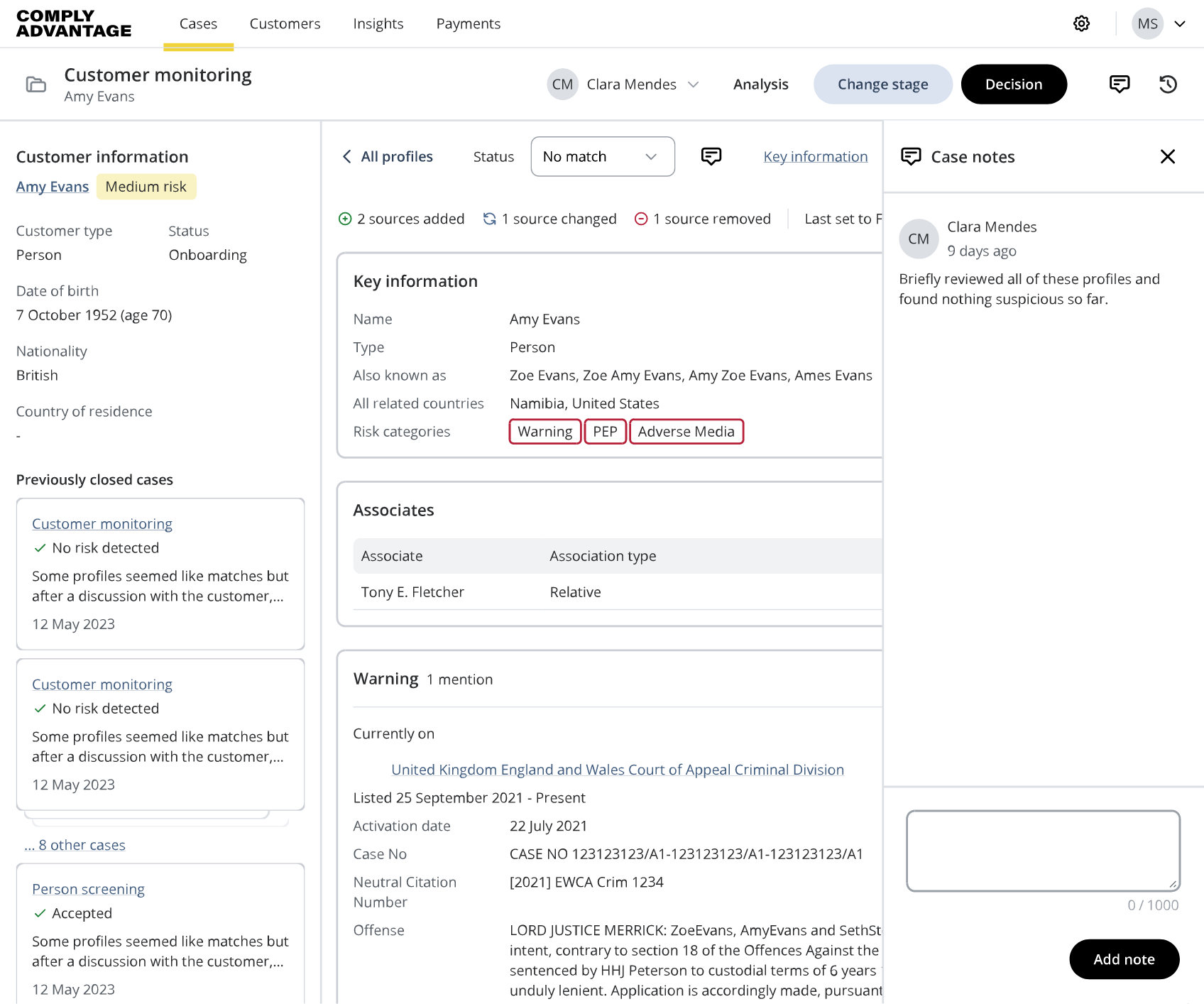

Compliance Analysts

Efficiently process monitoring cases.

-

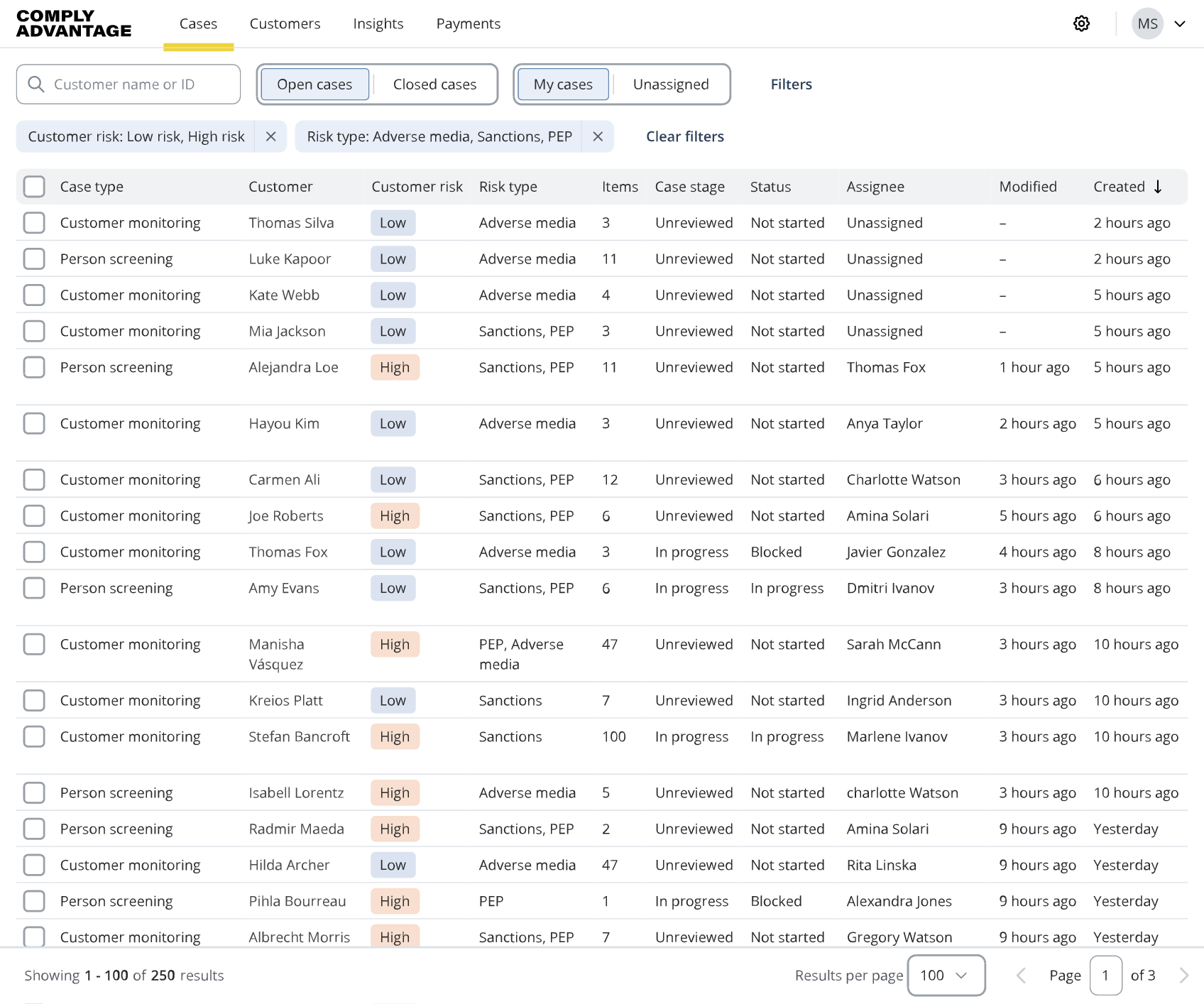

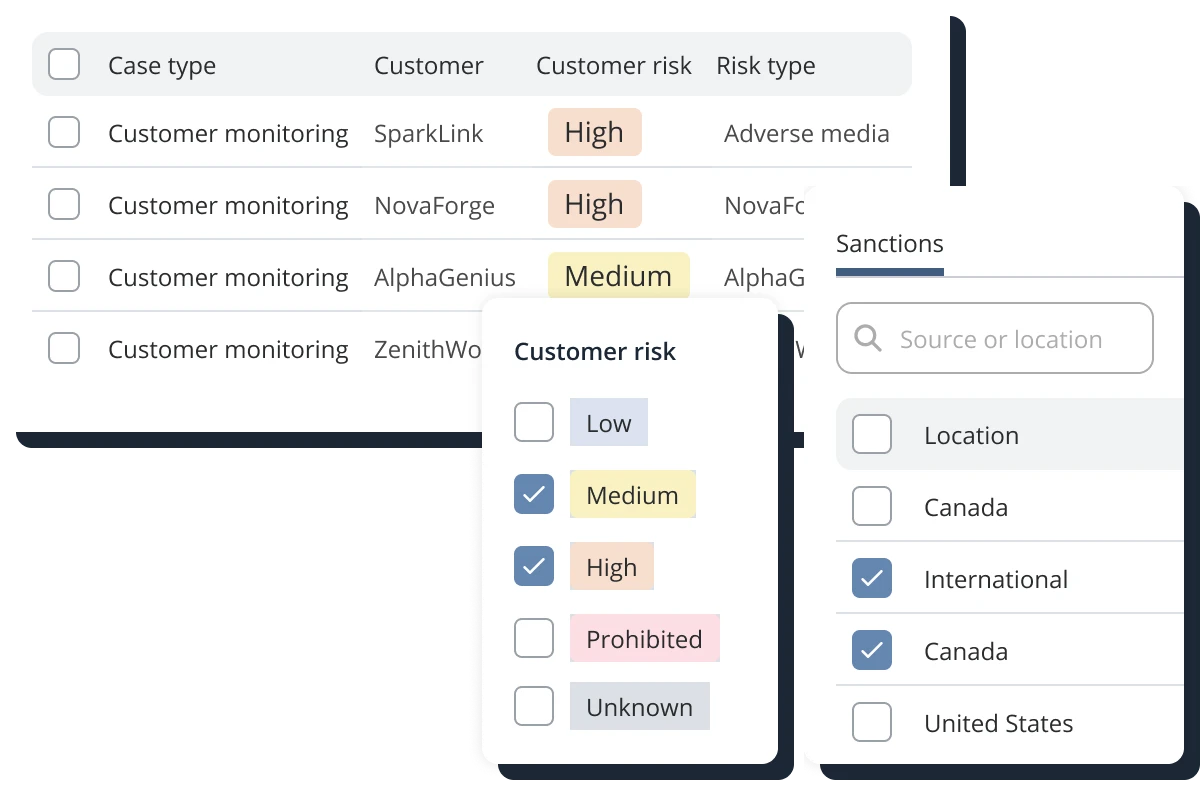

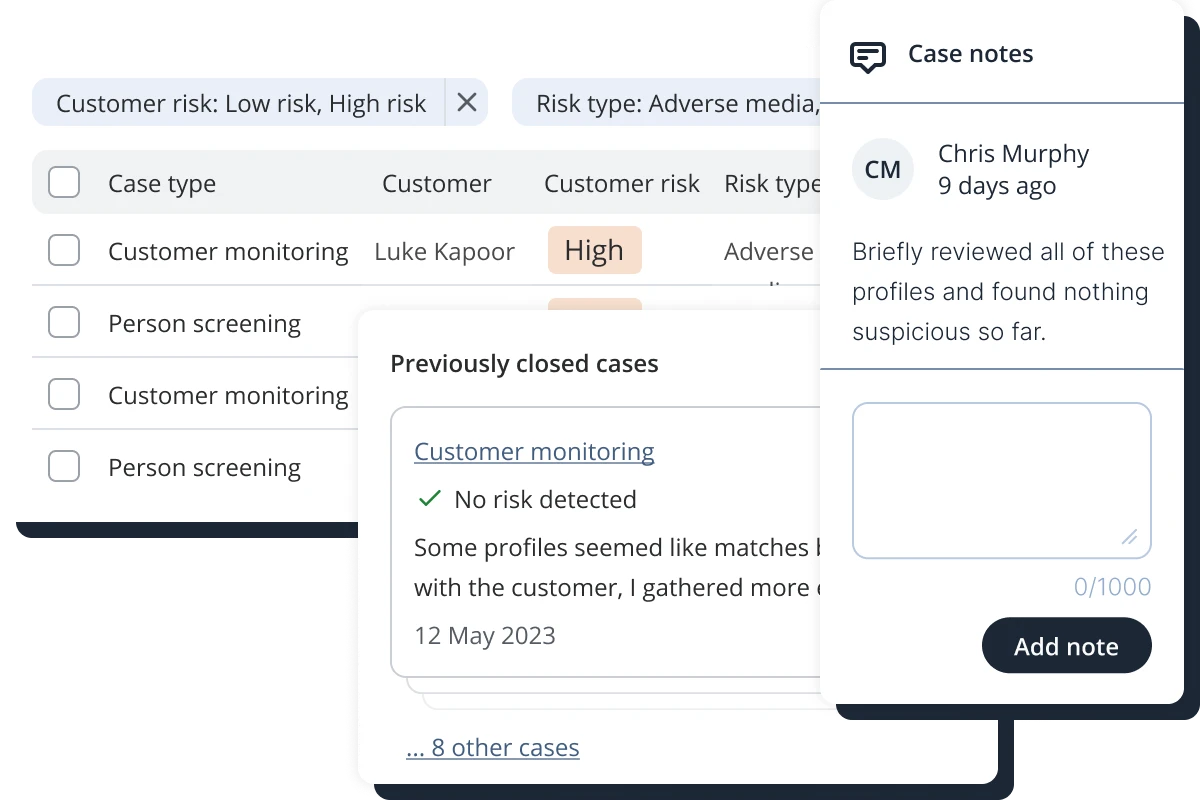

- Prioritize alerts by filtering cases by risk level and type.

- Identify evolving customer risks through an intuitive interface.

- Easily access full screening and decision history for customers and cases.

Swipe to scroll the full image

Got itEfficiencies in monitoring you can replicate

Reduction in false positive rates

Reduction in false positive rates

Improvement in account-opening efficiency

Increase in remediation speed

Frequently asked questions

You have complete control. You can choose to apply identical configurations for both screening and monitoring your customers or customize them individually. Our solution provides extensive configuration options, allowing you to align your screening and monitoring processes with your risk policies effectively.

Absolutely. You can configure the solution accordingly. Whether you use our system or another for transaction monitoring, you can establish workflows seamlessly. Ensure compatibility with API or webhooks for third-party or in-house solutions so that you can automate this.

Yes. Our solution monitors both individuals and businesses. You can tailor screening configurations based on entity types.

Our solution comes with a host of capabilities that are aimed at reducing false positives right from the start. For example, its alert muting feature empowers users to mute profiles identified as false positives, effectively eliminating their recurrence in ongoing monitoring alerts. By doing so, you can significantly reduce unnecessary alerts and alleviate the burden of continuously reviewing profiles already identified as false positives.

How we use AI to fight financial crime

At ComplyAdvantage, AI powers every stage of the financial crime risk management lifecycle, from onboarding and ongoing monitoring to remediation and reporting. Discover how our multi-layered, AI-driven approach boosts accuracy, reduces friction, and helps compliance teams move faster with confidence.

Learn moreStarter Plan

Category-leading AML solutions

Our customers and financial services analysts all rate us as a category leader quarter after quarter.