Transaction Monitoring

Monitor transactions for AML risk

Use rules & ML algorithms to identify and prioritize alerts alongside ID clustering & graph analysis. Scalable to billions of transactions.

Proven value for businesses

Transaction Monitoring from ComplyAdvantage is an AI-driven solution that helps firms detect financial crime with advanced insights on hidden risk and custom thresholds.

By intelligently identifying complex and evolving suspicious patterns, it achieves up to 70% fewer false positives and boosts operational efficiency, freeing teams to focus on genuine threats and critical investigations.

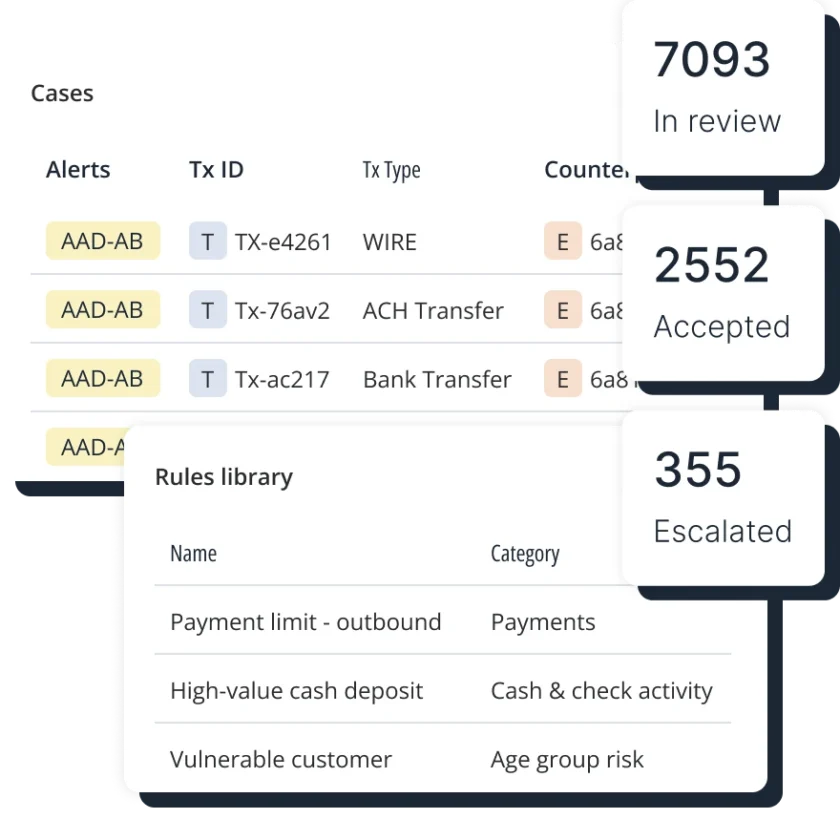

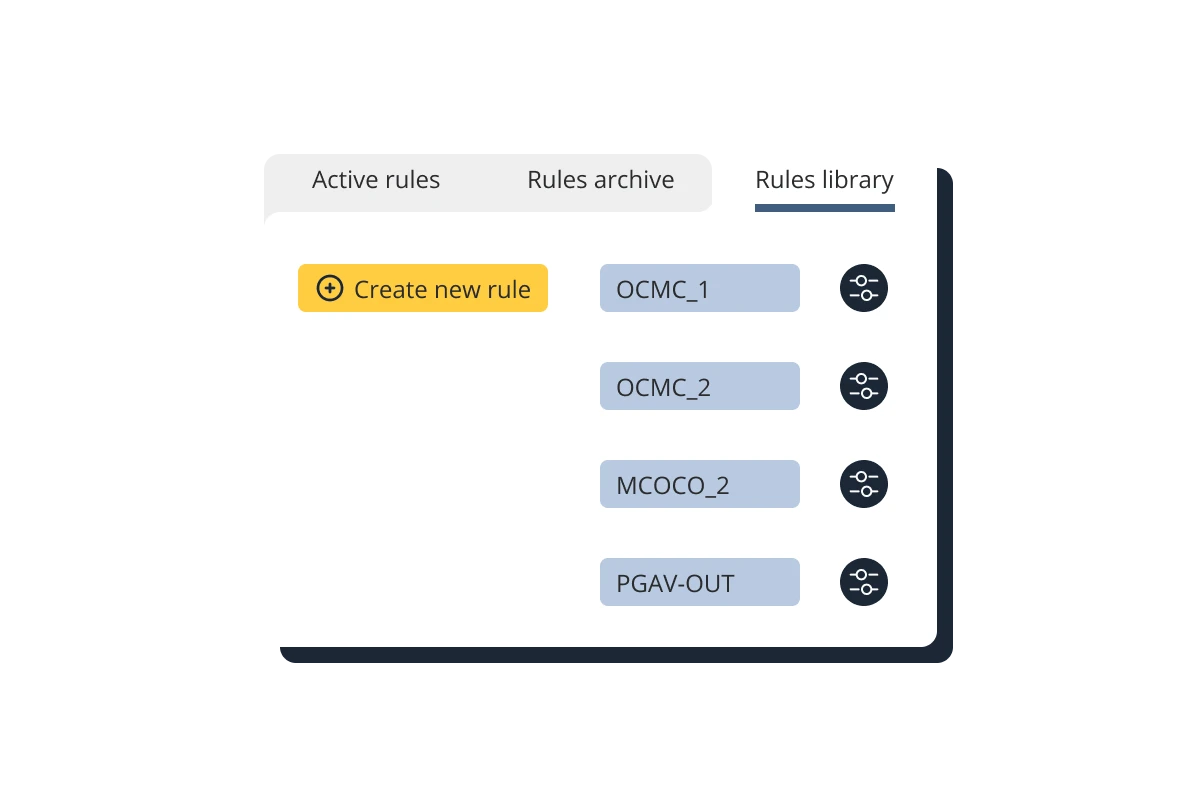

Easy to use

Use expert-built rules, customize them to your thresholds, or build your own from scratch.

- Try and test new rules safely and easily before going live

- Drive down false positives by tailoring your scenarios quickly in response to new business risks

- Segment customers based on your risk appetite and apply different thresholds and rules for different client segments.

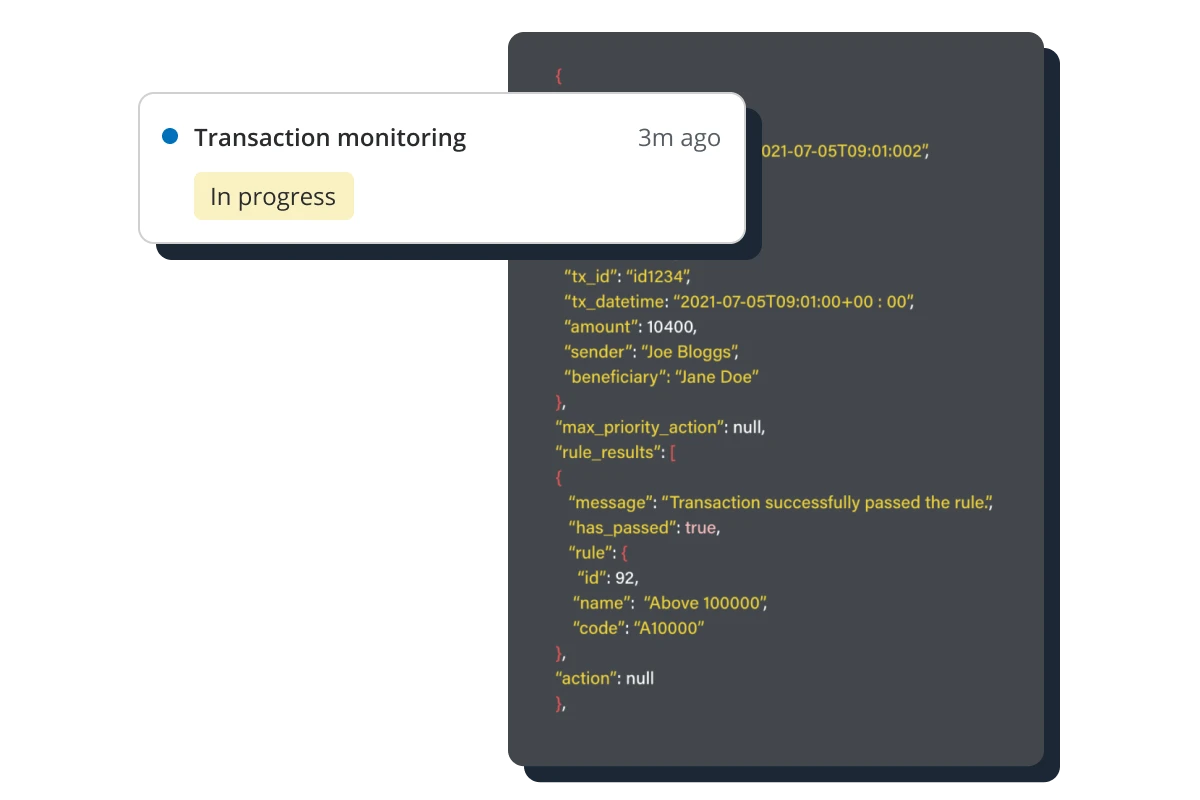

Integrate efficiently

Easily integrate via RESTful API.

- Explore hundreds of out-of-the-box scenarios and models.

- Identify underperforming rules in real-time with advanced analytics.

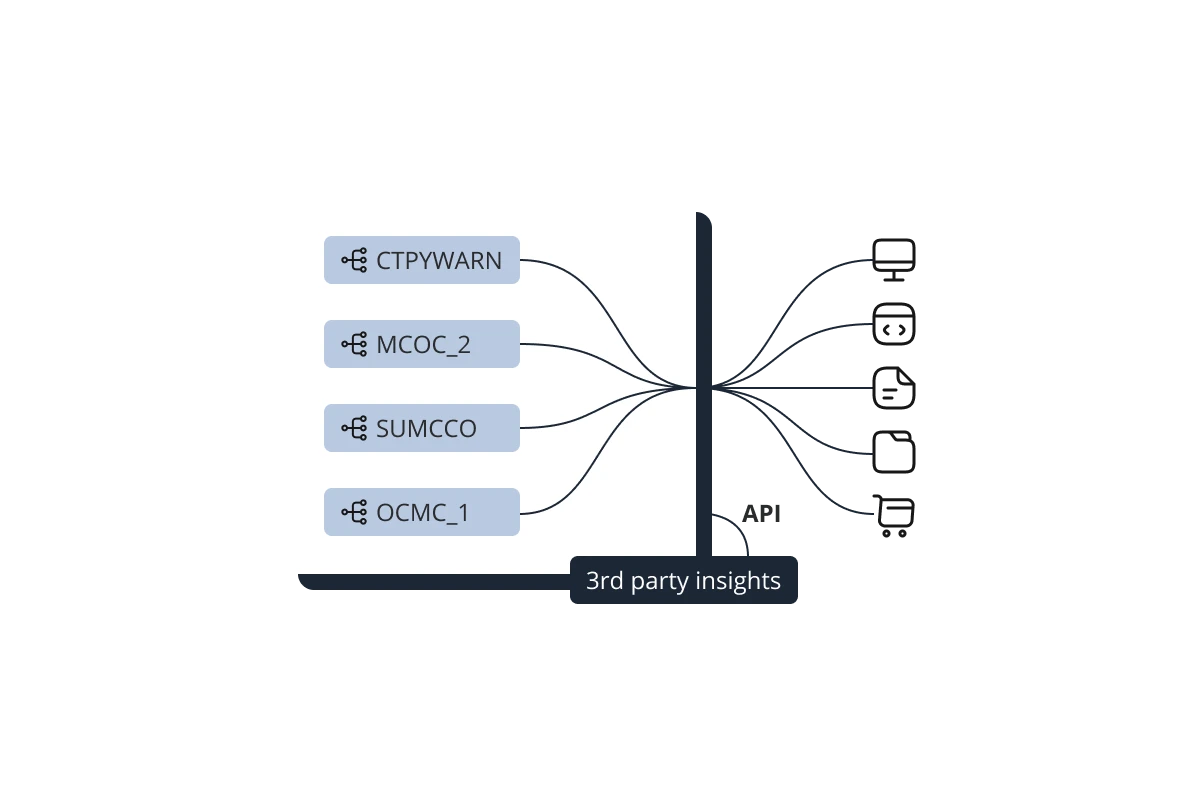

Monitor all transactions in one place

Integrate any data point with any rule.

- Opt for our proprietary insights or synthesize them with your own.

- Incorporate third-party risk insights.

- Implement your customer risk scoring seamlessly with API integrations.

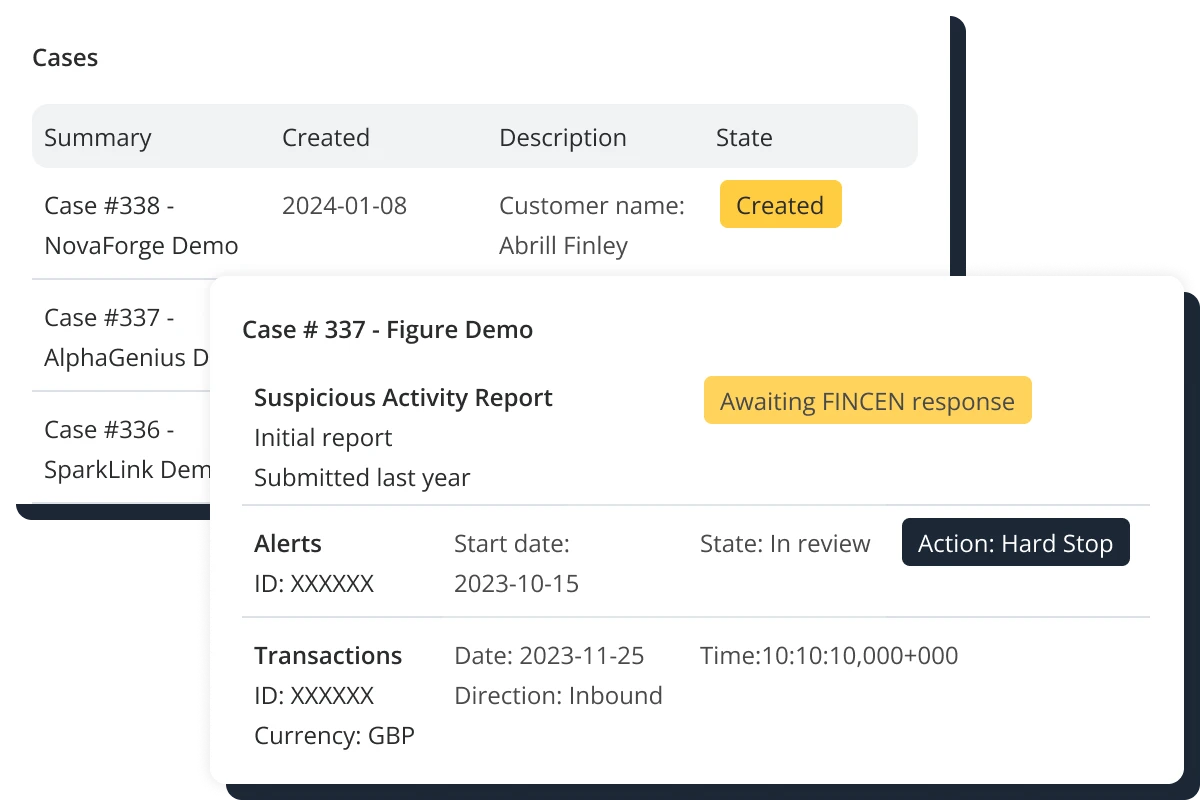

Manage cases intuitively

Reduce your team’s operational overheads by prioritizing suspicious activity alerts.

- Optimized layout to allow teams to investigate quickly by accessing information for faster decision-making.

- Efficiently investigate alerts and cases, drill down on related entities, add notes and attachments — all with a comprehensive audit trail.

- Empower investigators to focus on the highest priority, SAR-worthy alerts.

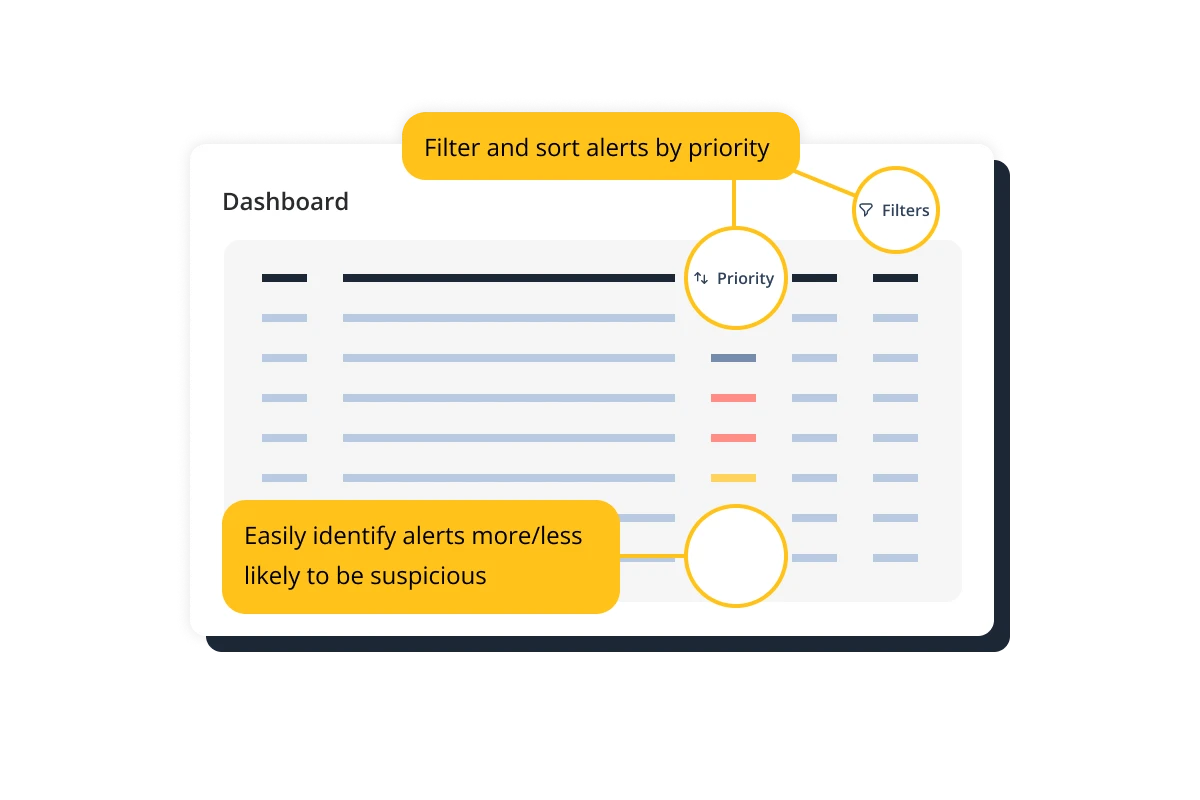

Prioritize work efficiently with explainable Smart Alerts

Delegate grouped alerts automatically based on risk levels and action accordingly.

- Bulk remediate low-priority alerts to significantly reduce false positives and improve backlogs and workflow.

- Tailor rules based on AI-generated priorities to adapt to new threats and business outcomes.

Insights to drive business decisions

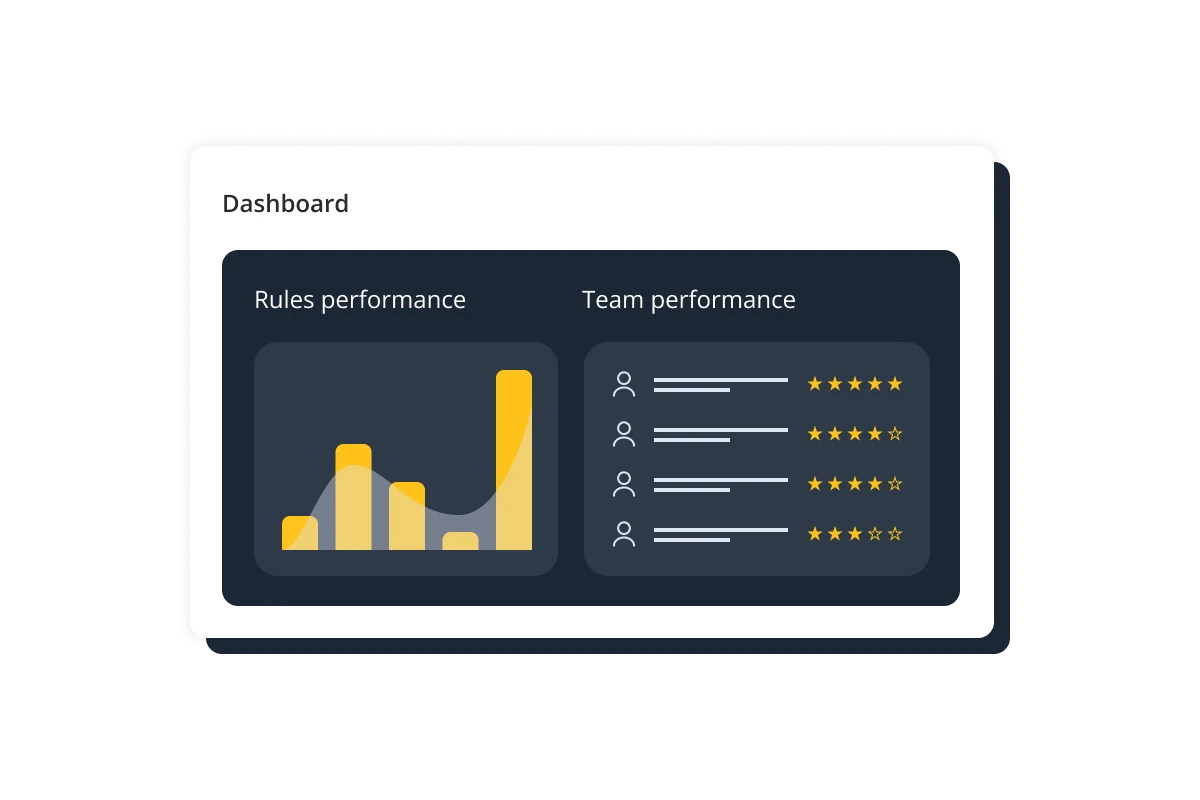

Dashboard view of valuable insights.

- Explains everything from rule performance to team performance.

- Helps manage the team.

- Empowers you to make informed decisions regarding changes to rule thresholds.

Screening efficiencies you can measure

Reduction in false positives, helping teams focus on real financial crime risk.

Less time spent building and updating risk scenarios.

Billions of transactions monitored with sub-second response times.

From onboarding to go-live for enterprise deployment.

Transaction Monitoring FAQs

The ComplyAdvantage API enables you to integrate your systems with our services to automate many of the functions available through the web user interface. Our API follows the REST convention and accepts and returns JSON data. View our API docs.

The transaction monitoring solution uses an advanced rules-based system to evaluate the AML/CTF risk of a transaction in real-time. These rules include:

- Simple rules: Rules that perform a check on the data within a transaction

- Aggregate Rules: Rules that track activity over multiple transactions (e.g., velocity rules)

- Behavioral Rules: Rules that compare with past activity (e.g., average transaction amount)

- Risk Pattern Rules: Rules that cross-reference activity against a known AML/CTF risk pattern

These rules are created and deployed during the implementation of your solution as this allows you to concentrate on the areas that will benefit your business the most (i.e., resolution of cases).

It is possible to select and export transaction data as a CSV file to use outside the ComplyAdvantage platform as needed. This contains all input data as well as additional output such as rule and alert information from the system.

Rules are completely customizable. Our transaction monitoring system can run on any data that you provide to us (data that is captured within a transaction). This not only allows the engine to detect suspicious scenarios specific to your financial institution but also allows the tool to speak in your language, using your own variables, codes, definitions, etc., that are unique to you.

Various factors will impact how you set your thresholds, including effective customer segmentation, statistical analysis, and – crucially – tuning. ComplyAdvantage’s implementation and success teams will review your data alongside their industry expertise to recommend changes over time.

How we use AI to fight financial crime

At ComplyAdvantage, AI powers every stage of the financial crime risk management lifecycle, from onboarding and ongoing monitoring to remediation and reporting. Discover how our multi-layered, AI-driven approach boosts accuracy, reduces friction, and helps compliance teams move faster with confidence.

Learn moreStarter Plan

Category-leading AML solutions

Our customers and financial services analysts all rate us as a category leader quarter after quarter.