Financial Crime Risk Intelligence

Precision-engineered data for AI-driven risk intelligence

Worldwide reach ensures comprehensive financial crime tracking. Explainability and data lineage empower audits with traceable data history.

Boost financial crime prevention with our AI-powered data & intelligence layers

Leading global financial crime database powered by AI and verified by experts, working hand-in-hand with specially developed entity resolution models and our cutting-edge search technology. This powerful combination offers exceptional efficiency in identifying and mitigating risks.

Data excellence: AI-enhanced & expert-validated

- Proprietary mix of sanctions, watchlists, fitness, probity, PEPs, RCAs, and adverse media—AI-driven and expert-verified for accuracy.

- Global industry-leading coverage fused with a steadfast dedication to data integrity.

- Leading the industry in update speed, delivering consistently fresh data.

- Exceeds enterprise-grade standards for data reliability and comprehensiveness.

Intelligence at its core: Tailored for financial crime prevention

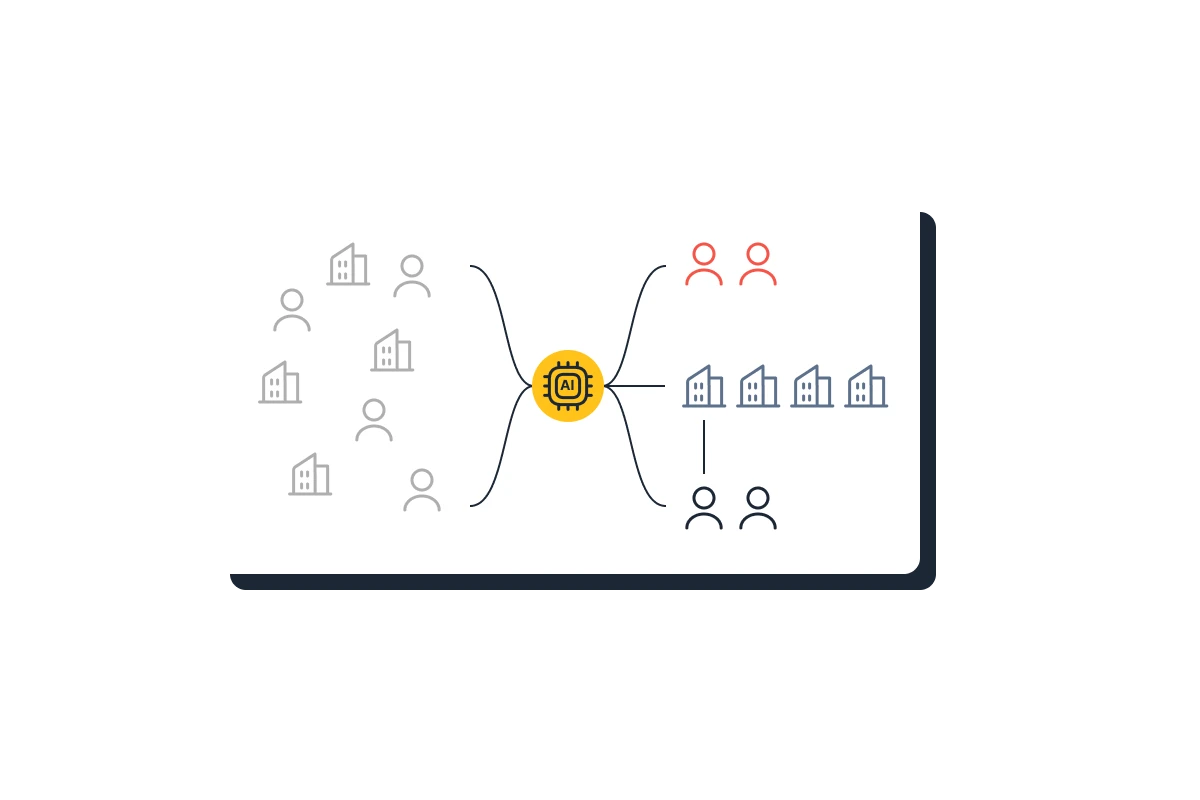

- AI-powered entity resolution engines are optimized for our exclusive data set and financial crime compliance scenarios.

- Innovative AI-based search capabilities significantly reduce false positives while capturing critical information, ensuring you never miss essential signals.

Financial Crime Risk Intelligence FAQs

Each of our consolidated risky entity profiles undergoes immediate updates upon receiving new relevant information, ensuring unparalleled timeliness in risk mitigation.

ComplyAdvantage sets the industry pace for sanctions data updates, with all affected entity profiles swiftly refreshed and made accessible to our clients within minutes of a sanction list update announcement by any jurisdiction.

Our relentless mining of tens of thousands of watchlists, media, and reference data sources ensures comprehensive coverage of risks by association, safeguarding against indirect sanctions evasion and identifying PEP relatives and close associates with unparalleled accuracy. Our mapping to the EU and FATF predicate crimes (and the FinCEN national priorities) is market-leading.

Entity resolution ML models need constant monitoring and improvement to ensure they are still reflective of ever-changing real-world data. Compared to other providers who may depend on external entity resolution engines or old-school rules-based linking, ComplyAdvantage has built a custom-made model for our proprietary data. This model is constantly evolving to stay in sync with the real-world data.

ComplyAdvantage’s award-winning machine learning model employs advanced algorithms to comprehend and assess the global distribution of names and other identifiers, optimizing true matches while minimizing erroneous, false matches. We also apply many options for narrowing name screening using detailed customer information as additional matching criteria.

Absolutely. ComplyAdvantage is one of the few vendors offering a comprehensive solution to meet a wide range of fincrime and compliance needs.

ComplyAdvantage Mesh is an industry-leading and trusted SaaS-based risk intelligence platform that unites global intelligence to beat financial crime. It offers cutting-edge technology for customer risk scoring and customer screening and monitoring.

Mesh comes packed with advanced case management, risk scoring, audit history, enterprise-level security and resilience, and more – all seamlessly tuned to complement our proprietary data. Upcoming features will include payment screening, transaction monitoring, and beyond.

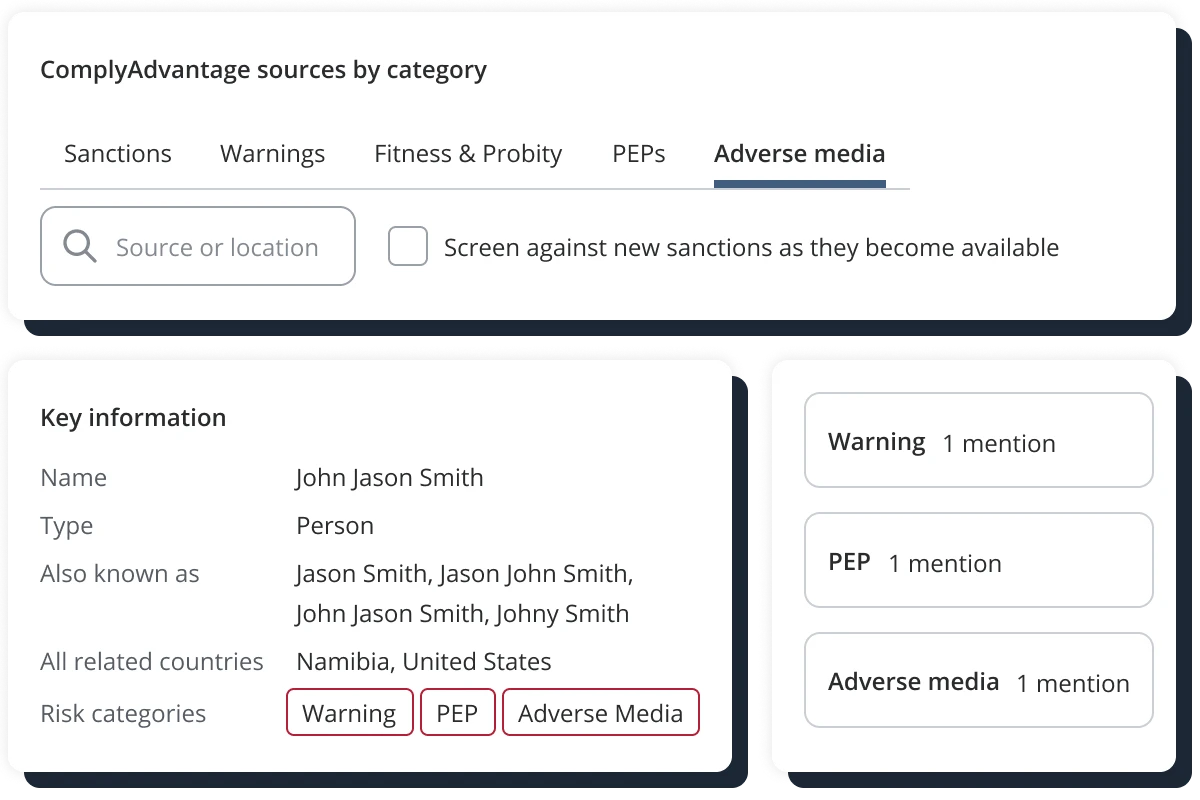

ComplyAdvantage data accelerates remediation processes by providing rich, detailed profiles that succinctly summarize all pertinent information about every individual, company, vessel, and aircraft. This enables quicker dismissal of false positives and more confident confirmation of true positives.

Furthermore, ComplyAdvantage consolidates data from tens of thousands of global sources into a single standard data schema, facilitating seamless API integrations and empowering advanced auto-remediation measures.

ComplyAdvantage leads the fincrime and compliance data market. We offer an unparalleled array of proprietary data, encompassing sanctions, watchlists, fitness & probity, PEPs, RCAs, and adverse media, ensuring comprehensive coverage for all compliance needs.

How we use AI to fight financial crime

At ComplyAdvantage, AI powers every stage of the financial crime risk management lifecycle, from onboarding and ongoing monitoring to remediation and reporting. Discover how our multi-layered, AI-driven approach boosts accuracy, reduces friction, and helps compliance teams move faster with confidence.

Learn moreStarter Plan

Category-leading AML solutions

Our customers and financial services analysts all rate us as a category leader quarter after quarter.