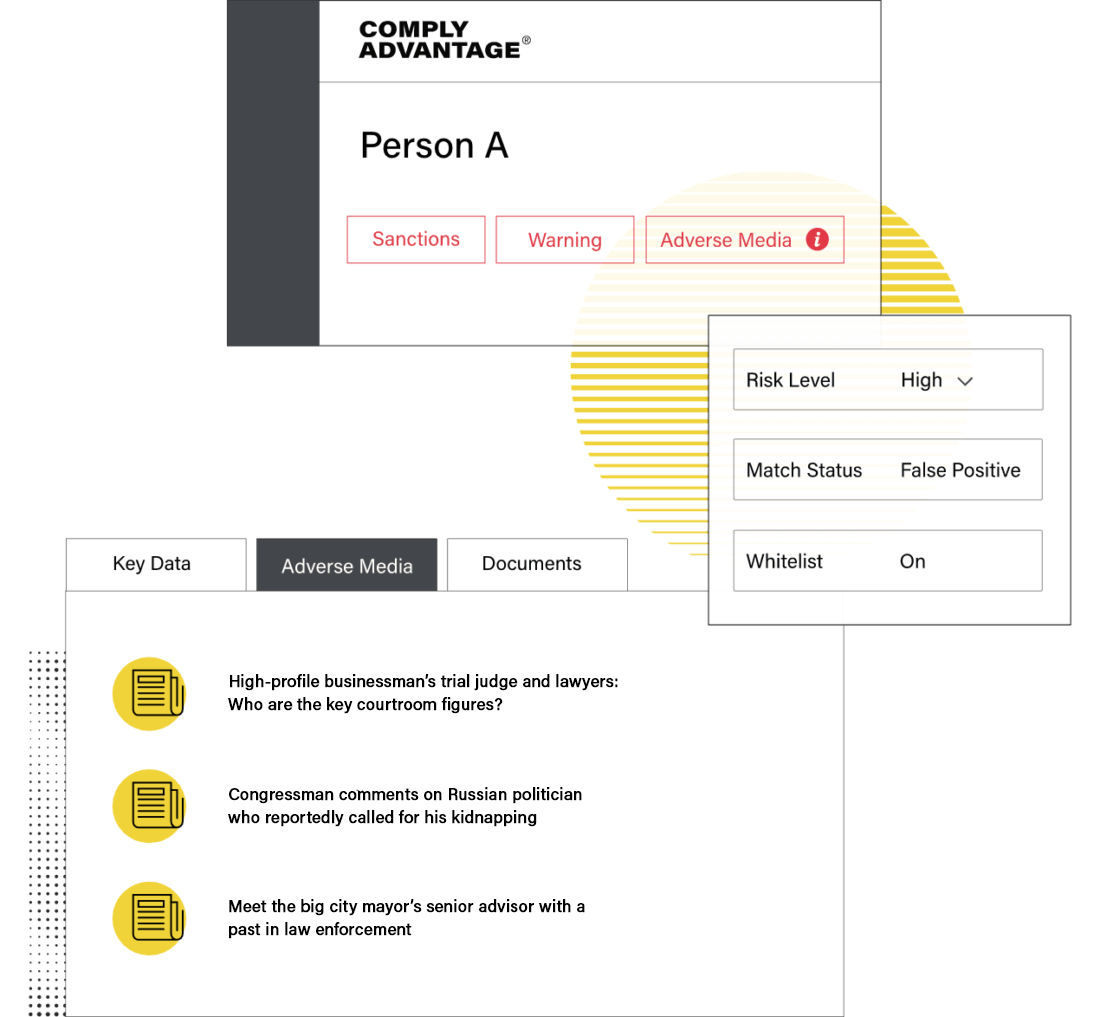

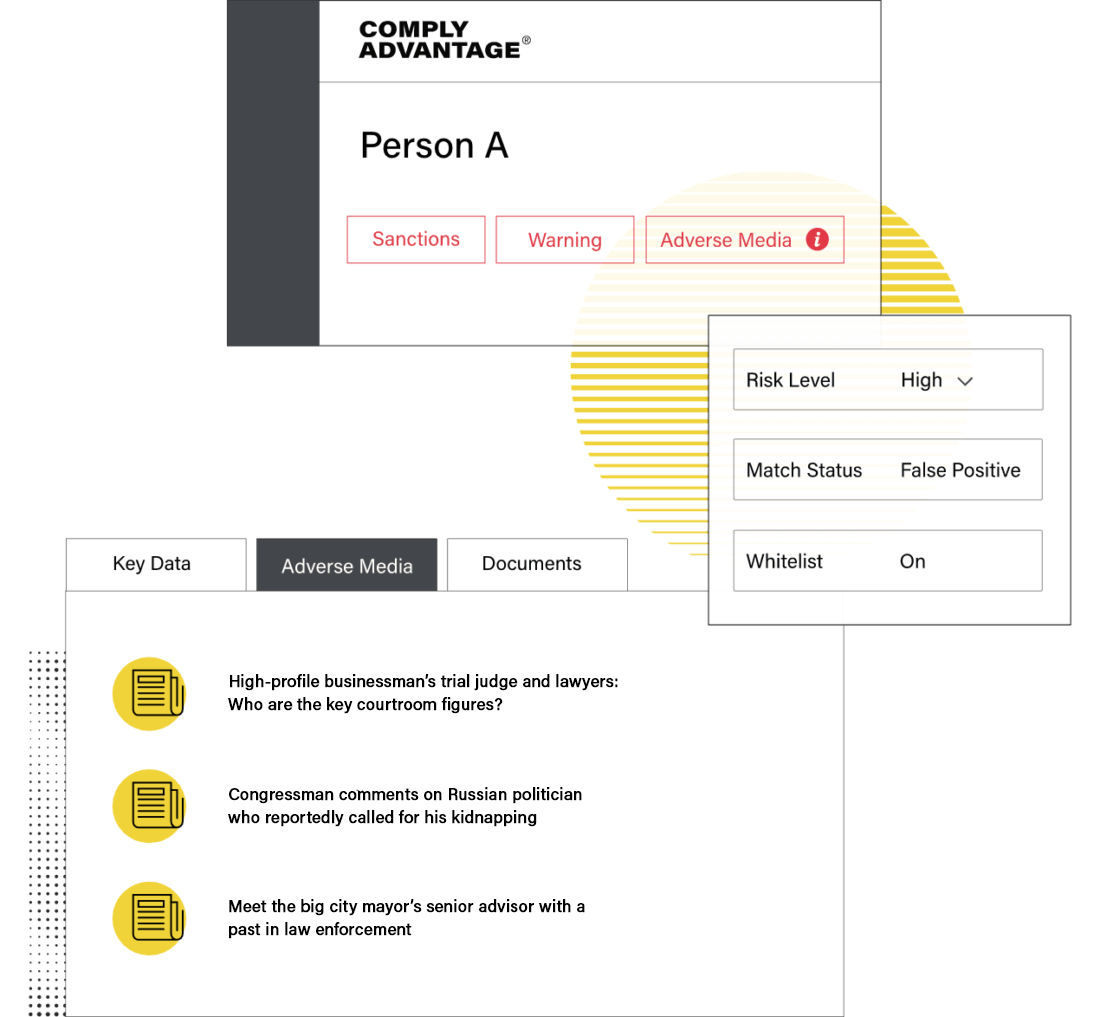

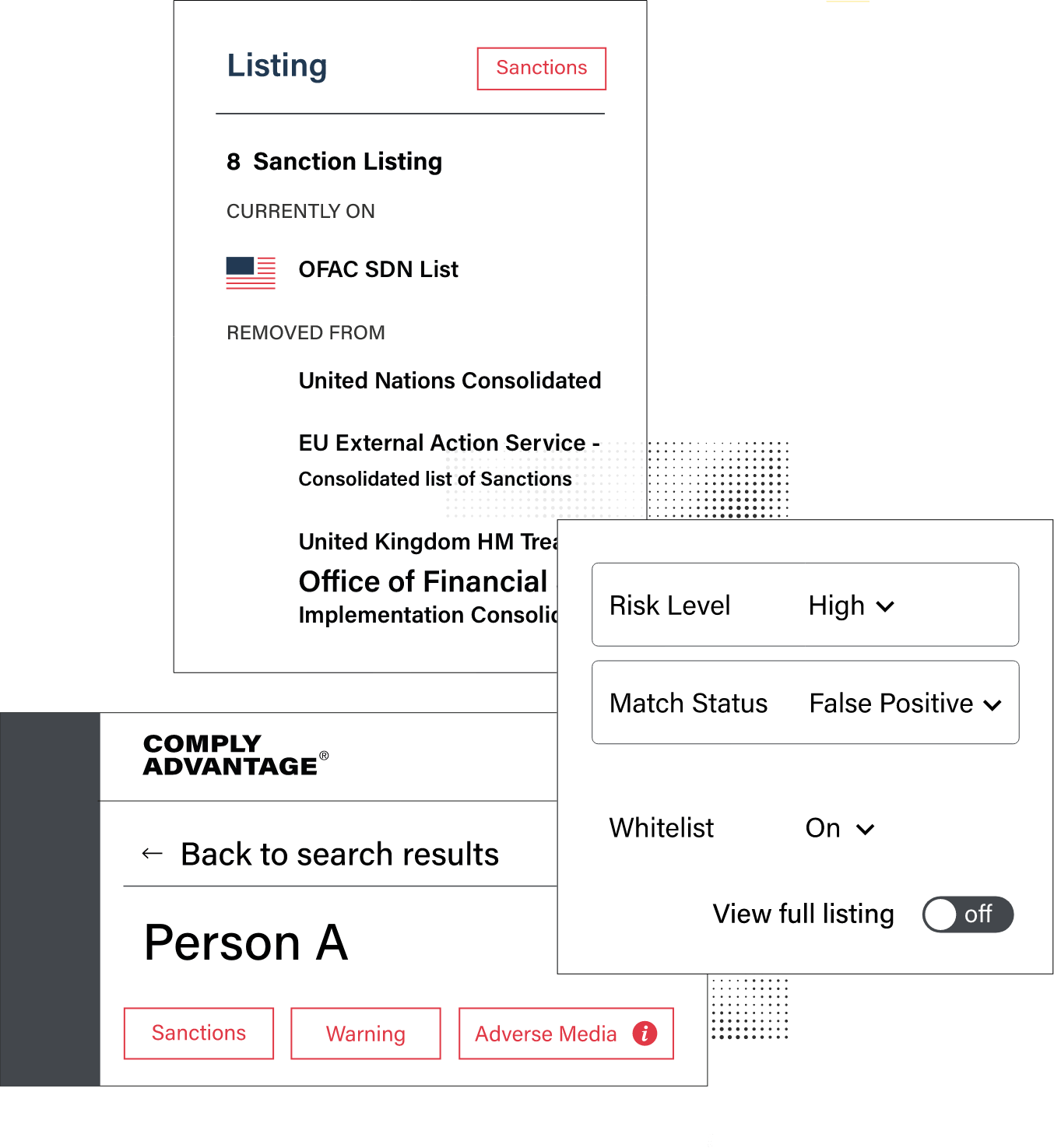

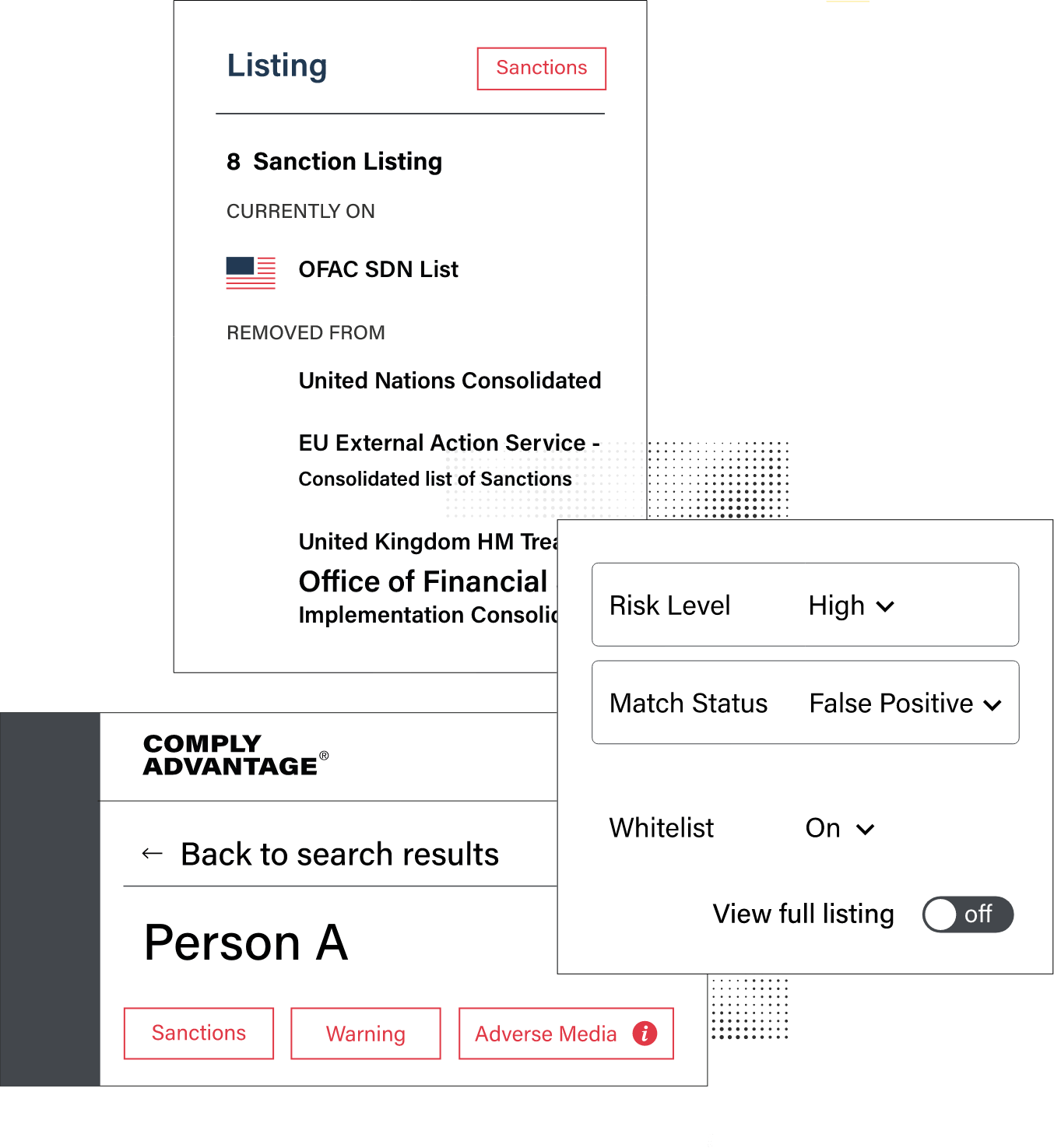

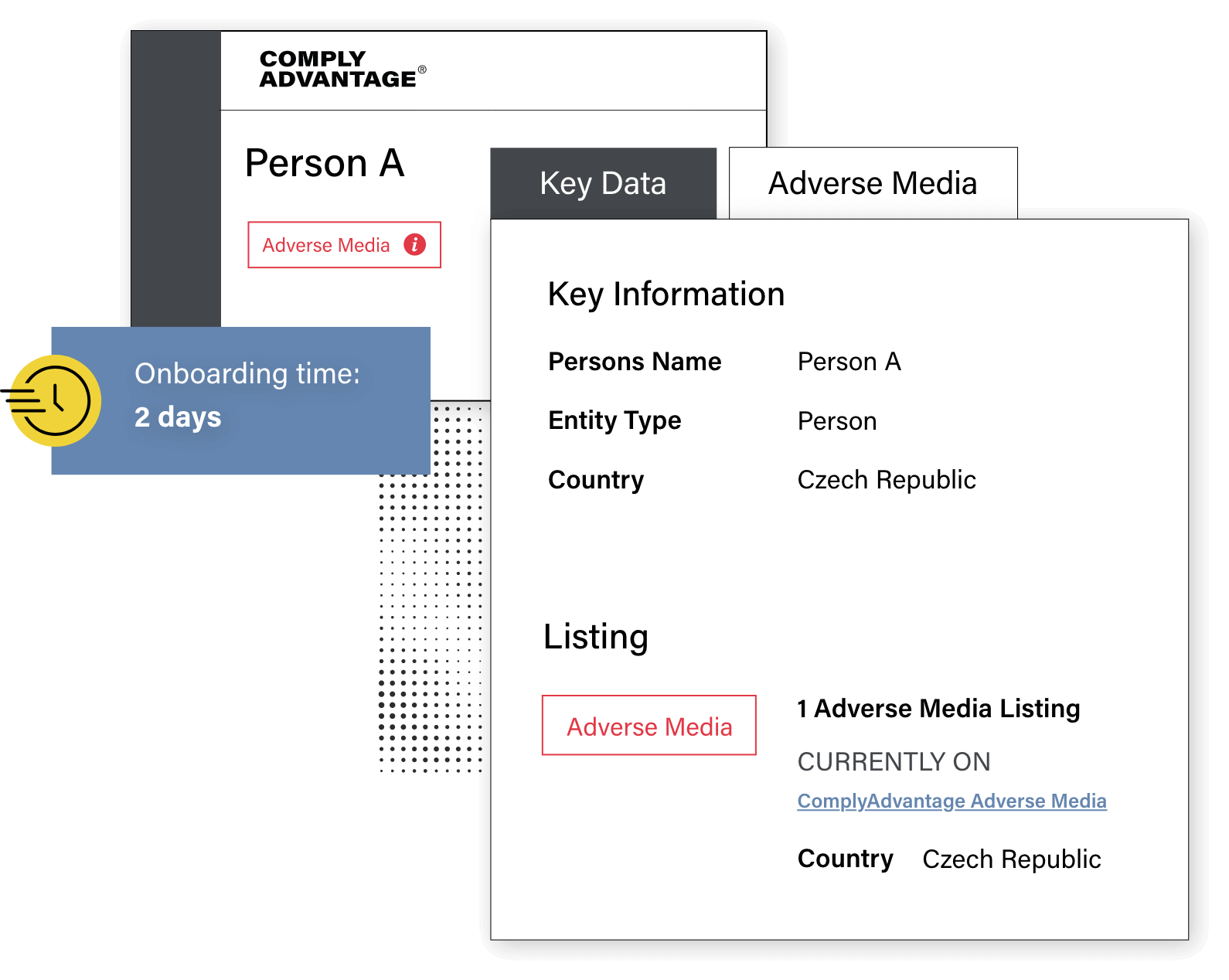

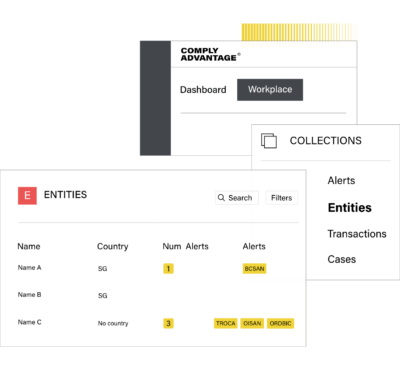

Screen against structured entity and individual profiles, not endless articles.

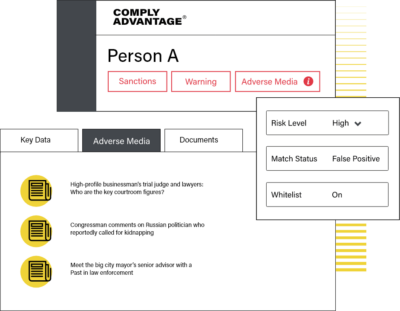

Select specific source lists curated by financial crime experts.

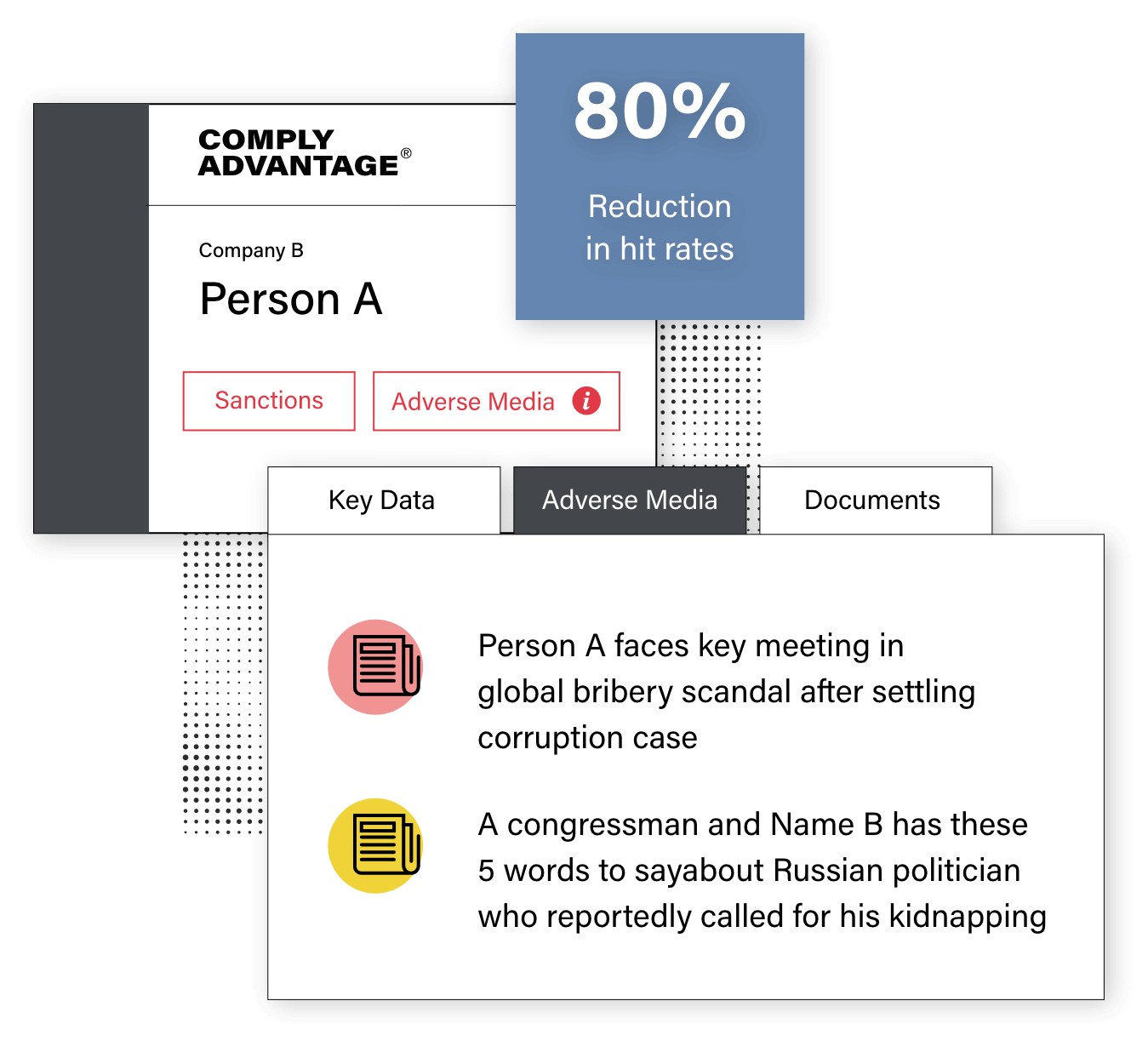

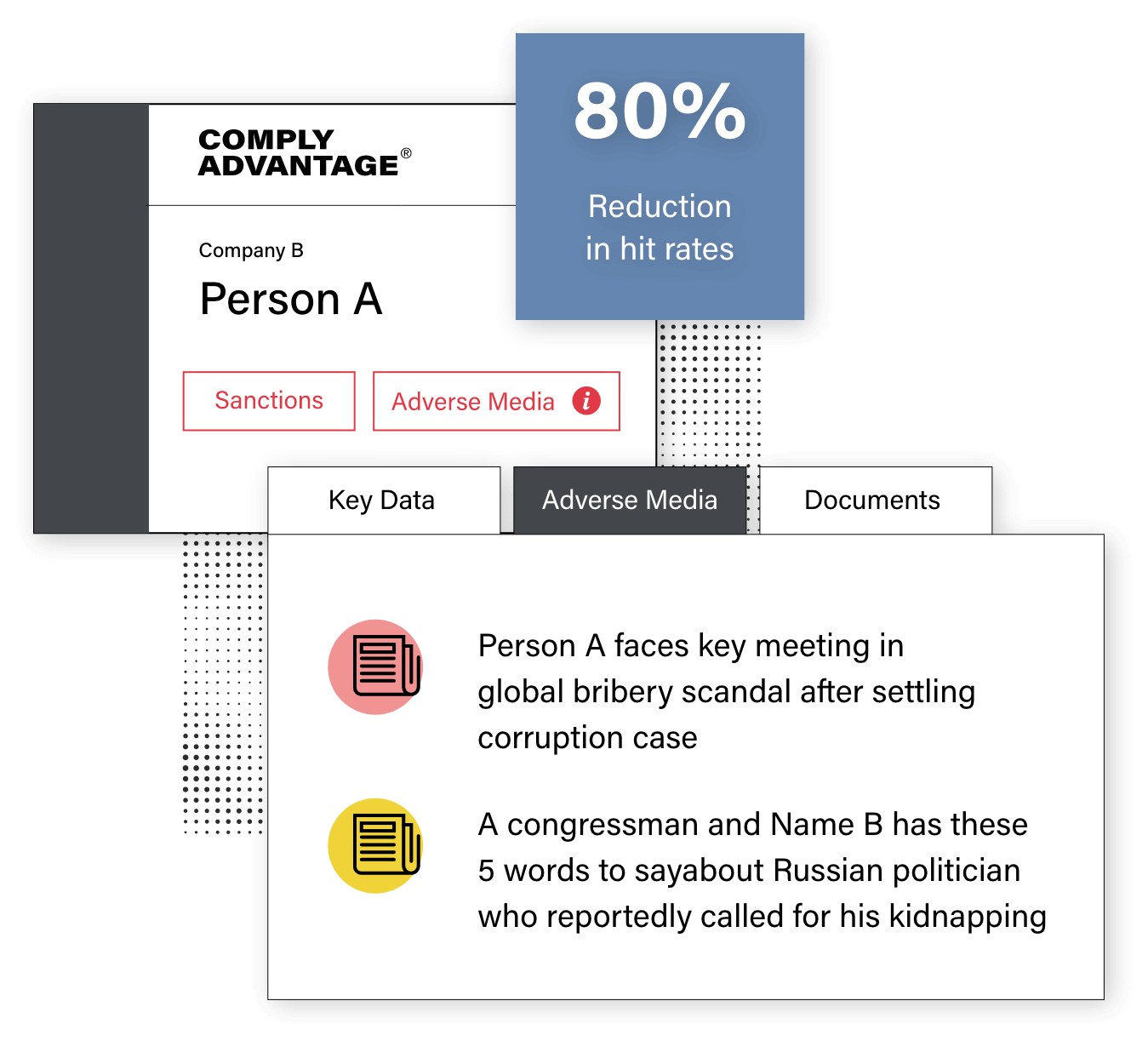

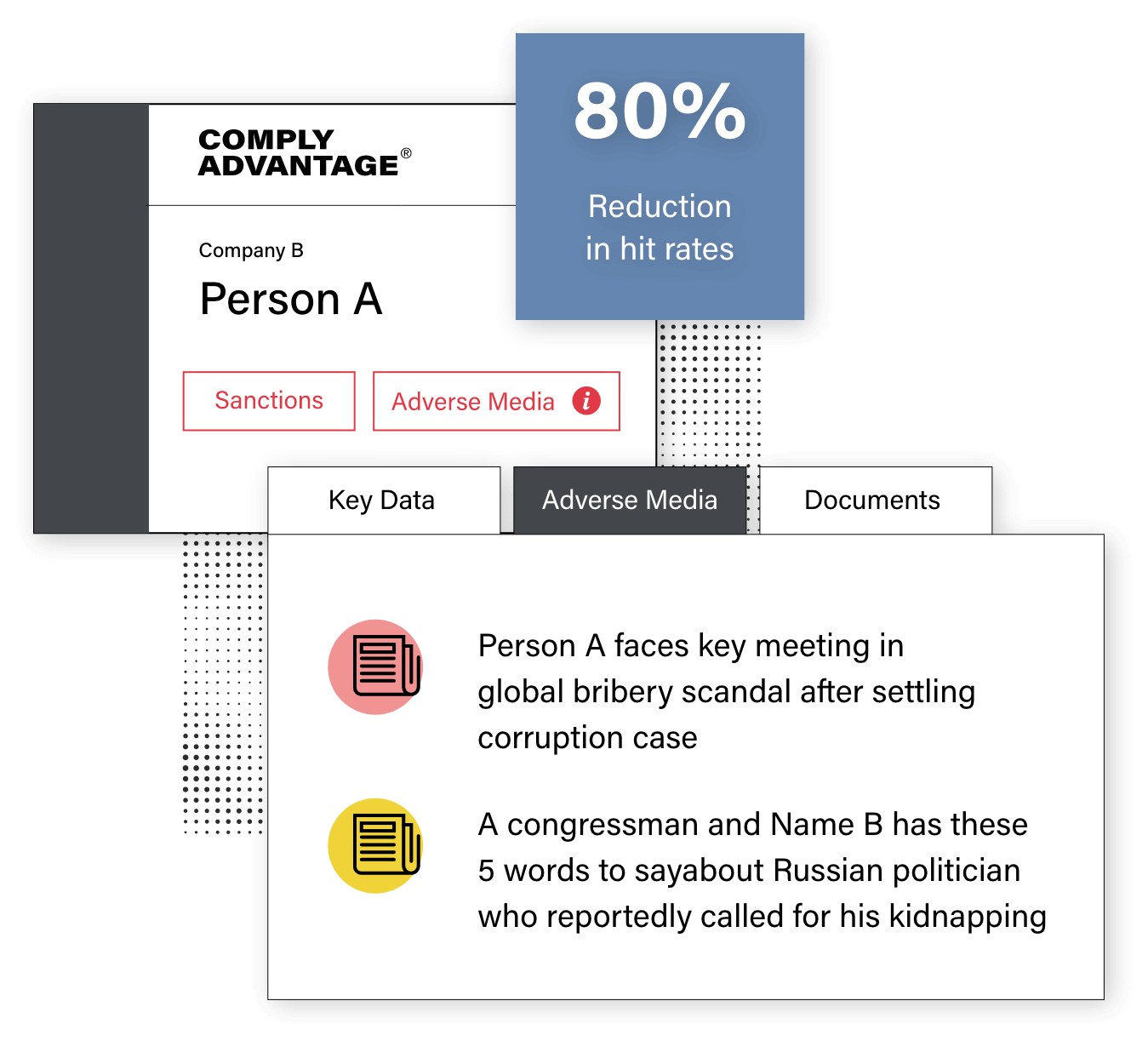

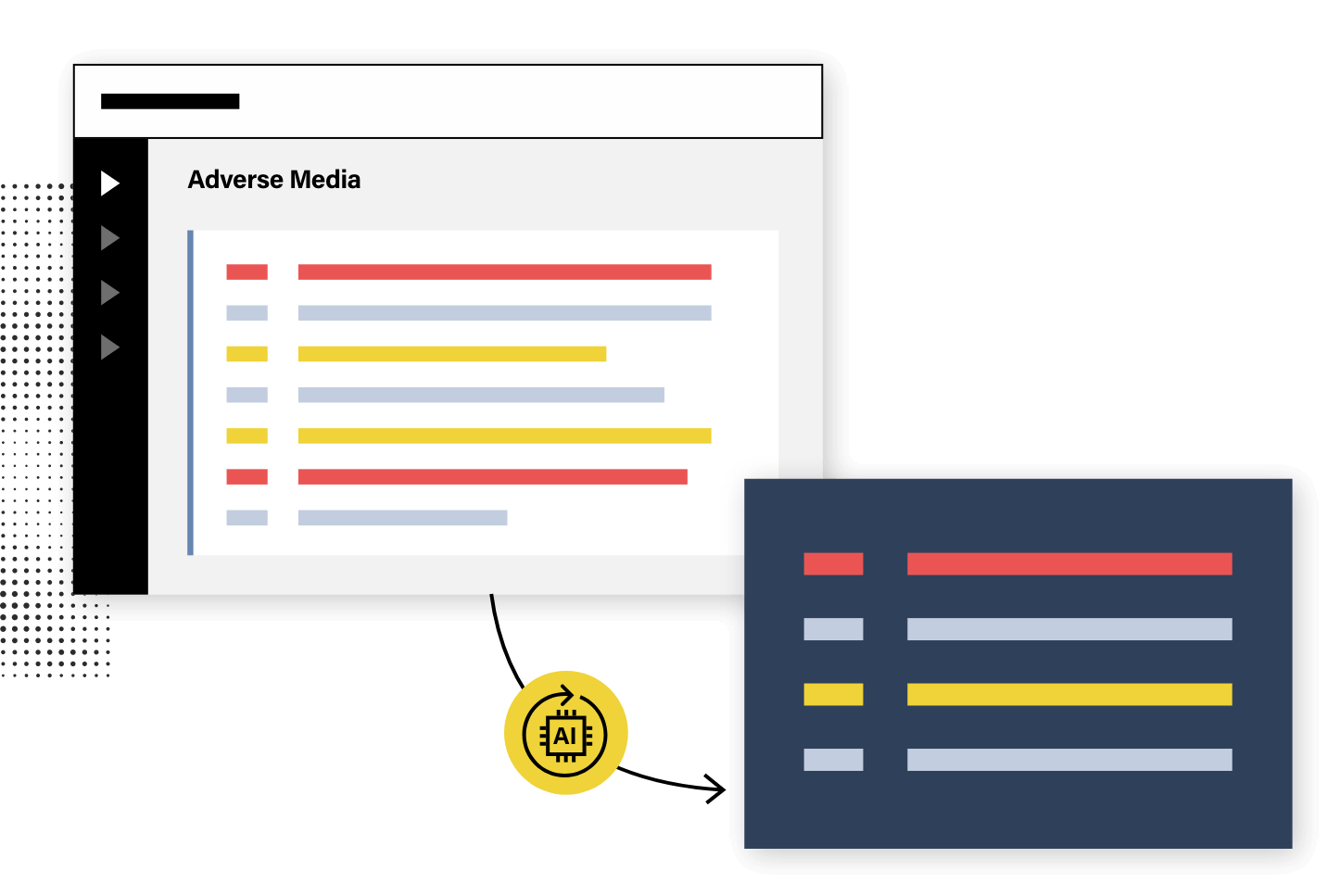

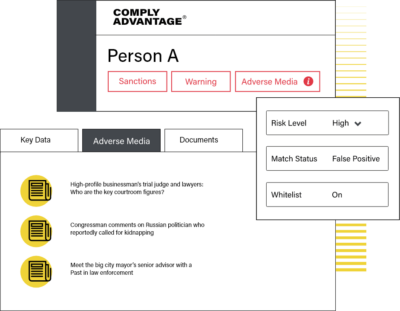

Use a contextual machine learning approach to filter out non-adverse media hits.

Benefit from an AML/CFT taxonomy that’s aligned with regulatory guidance.

Monitor transactions and events in real-time for fraud using out-of-the-box rules library and advanced AI.

Discover our Fraud Detection Solutions

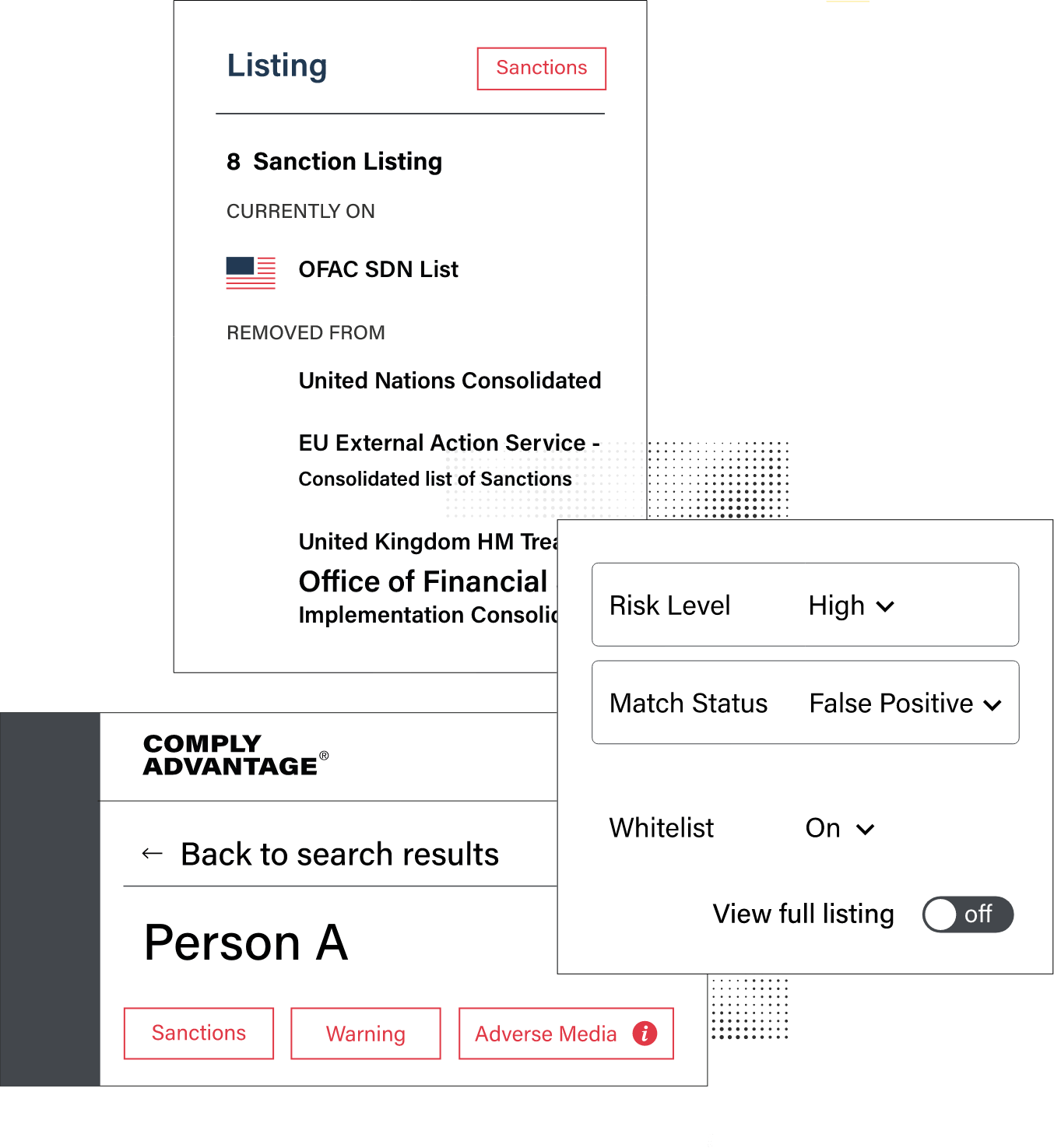

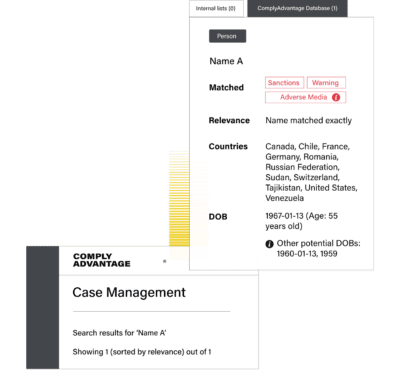

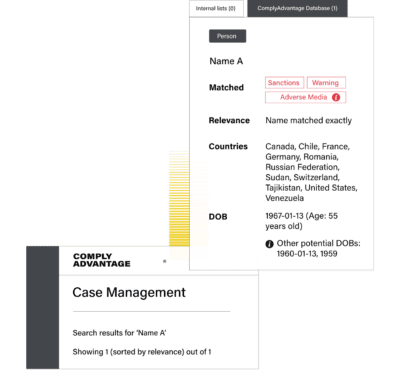

Protect your organization with a robust watchlists and sanctions screening tool that offers real-time insights into your clients’ risk statuses.

Screen for Sanctions

Understand the risk of companies, associated directors and shareholders via a single API.

Discover our KYB Solutions

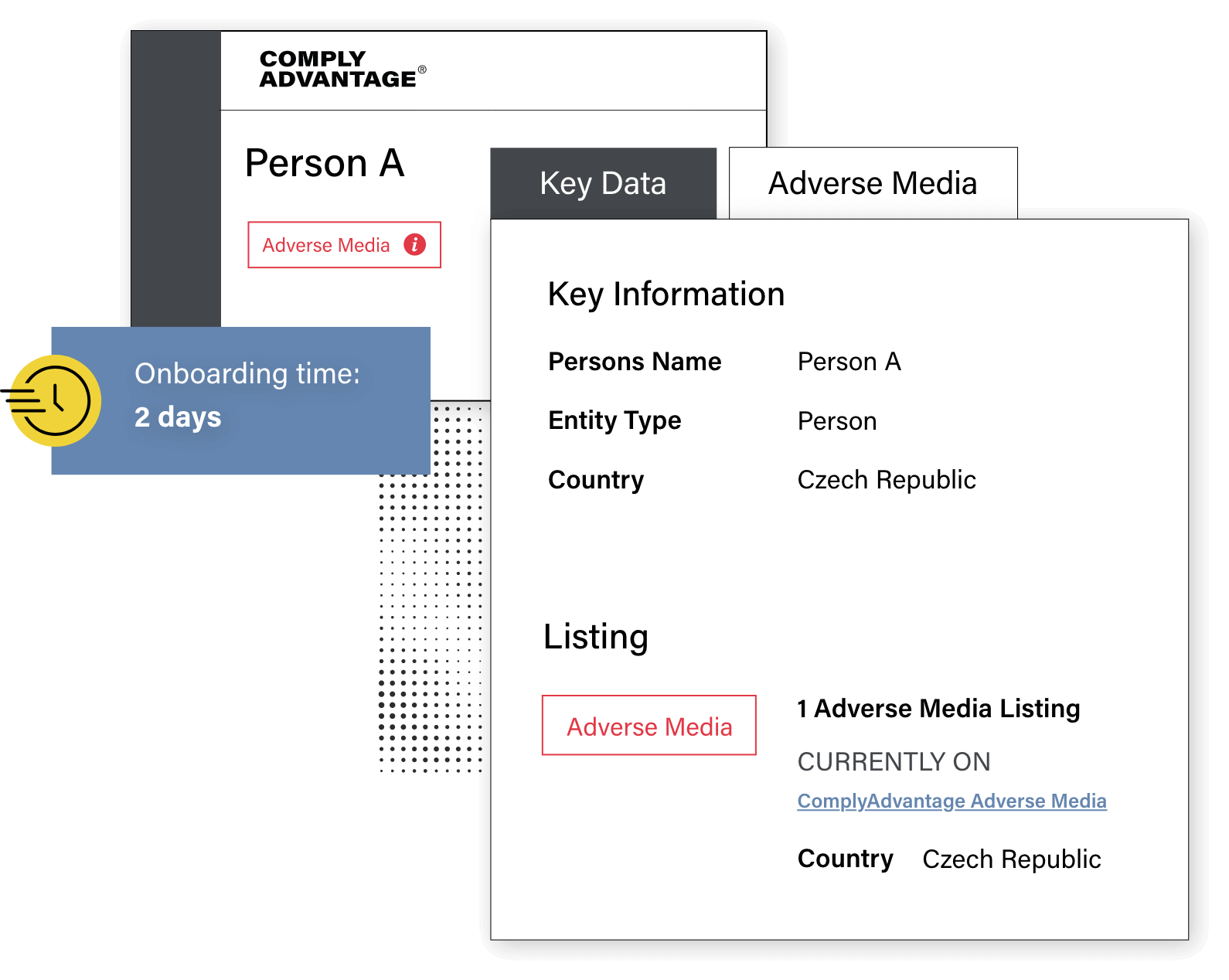

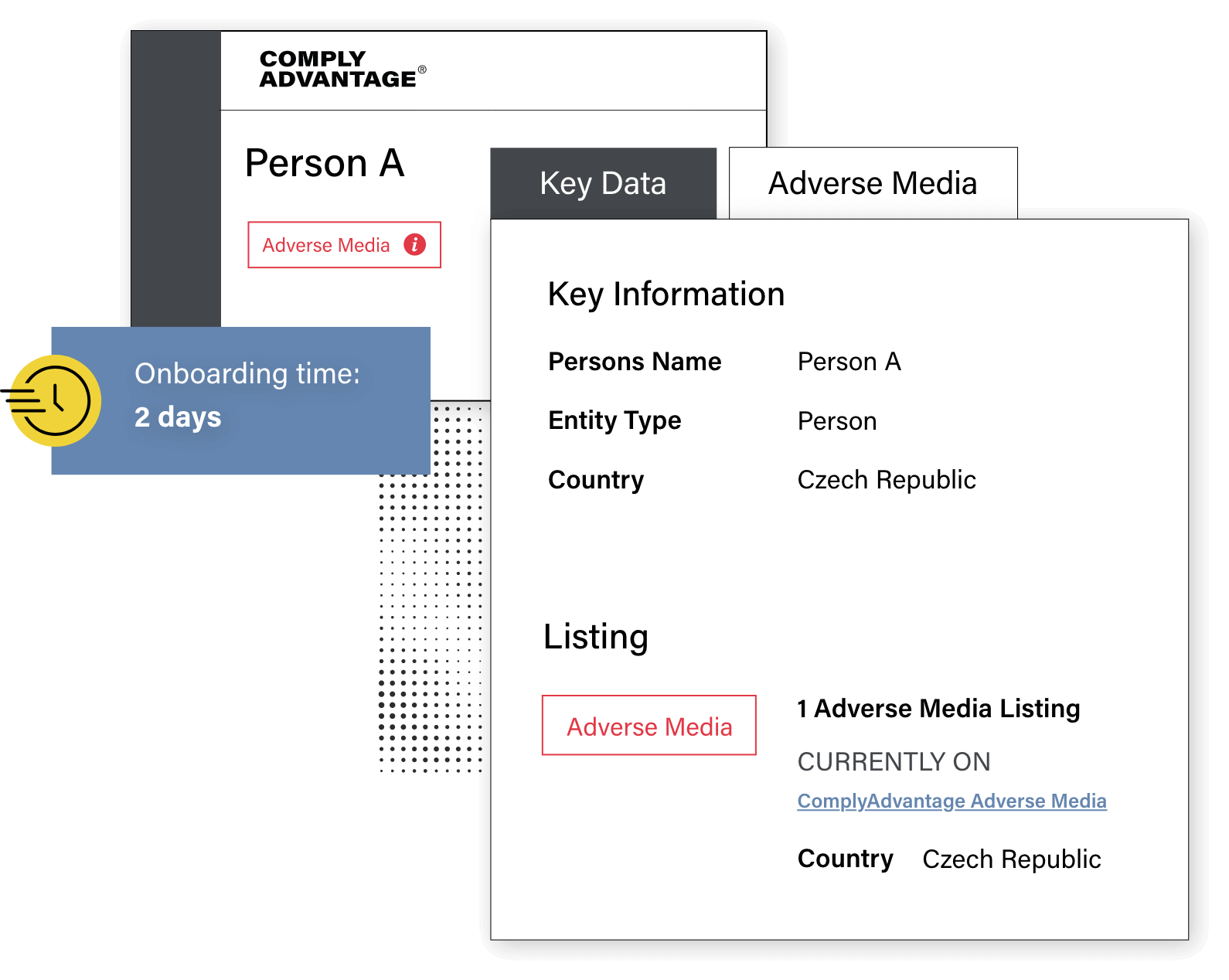

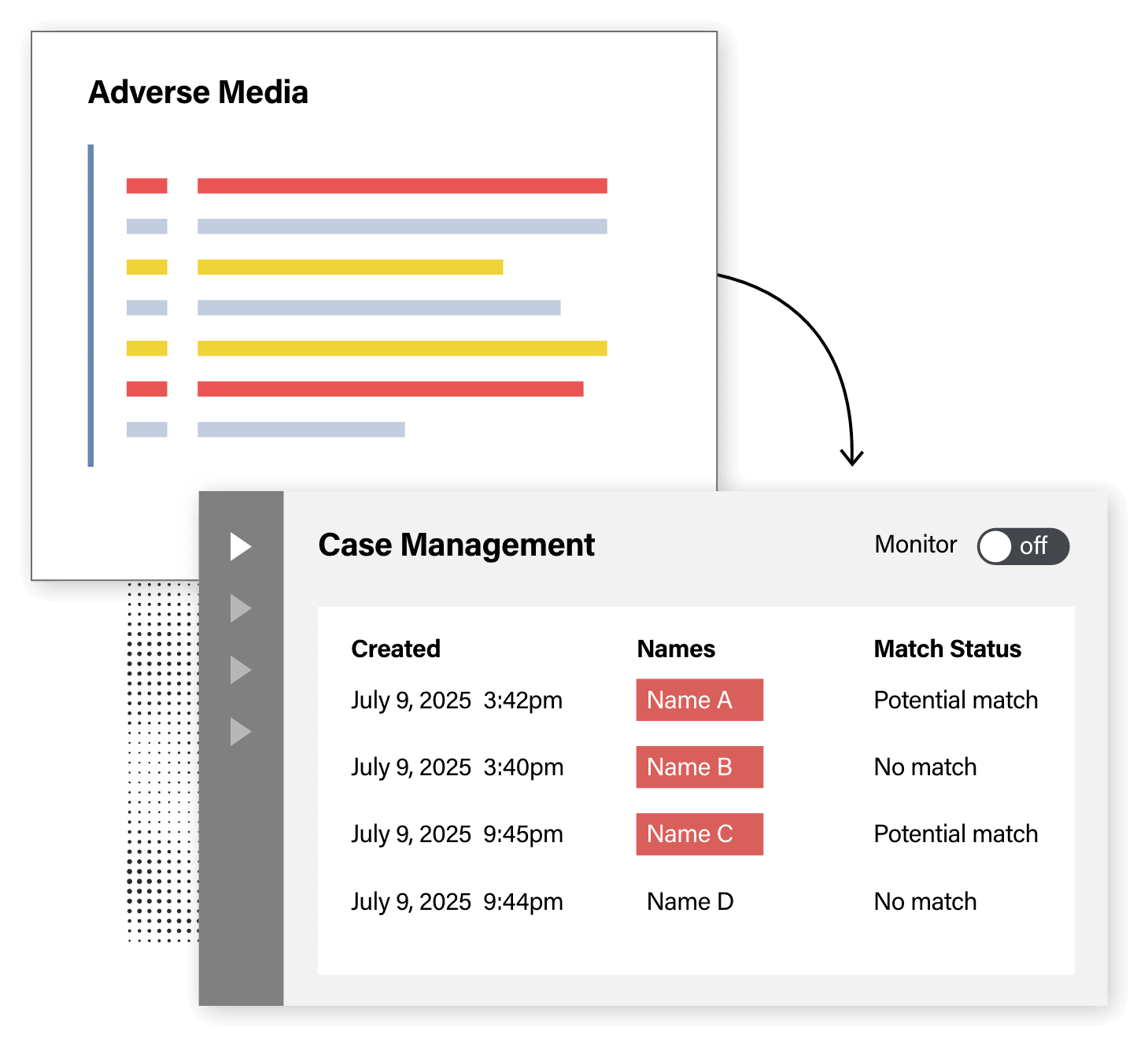

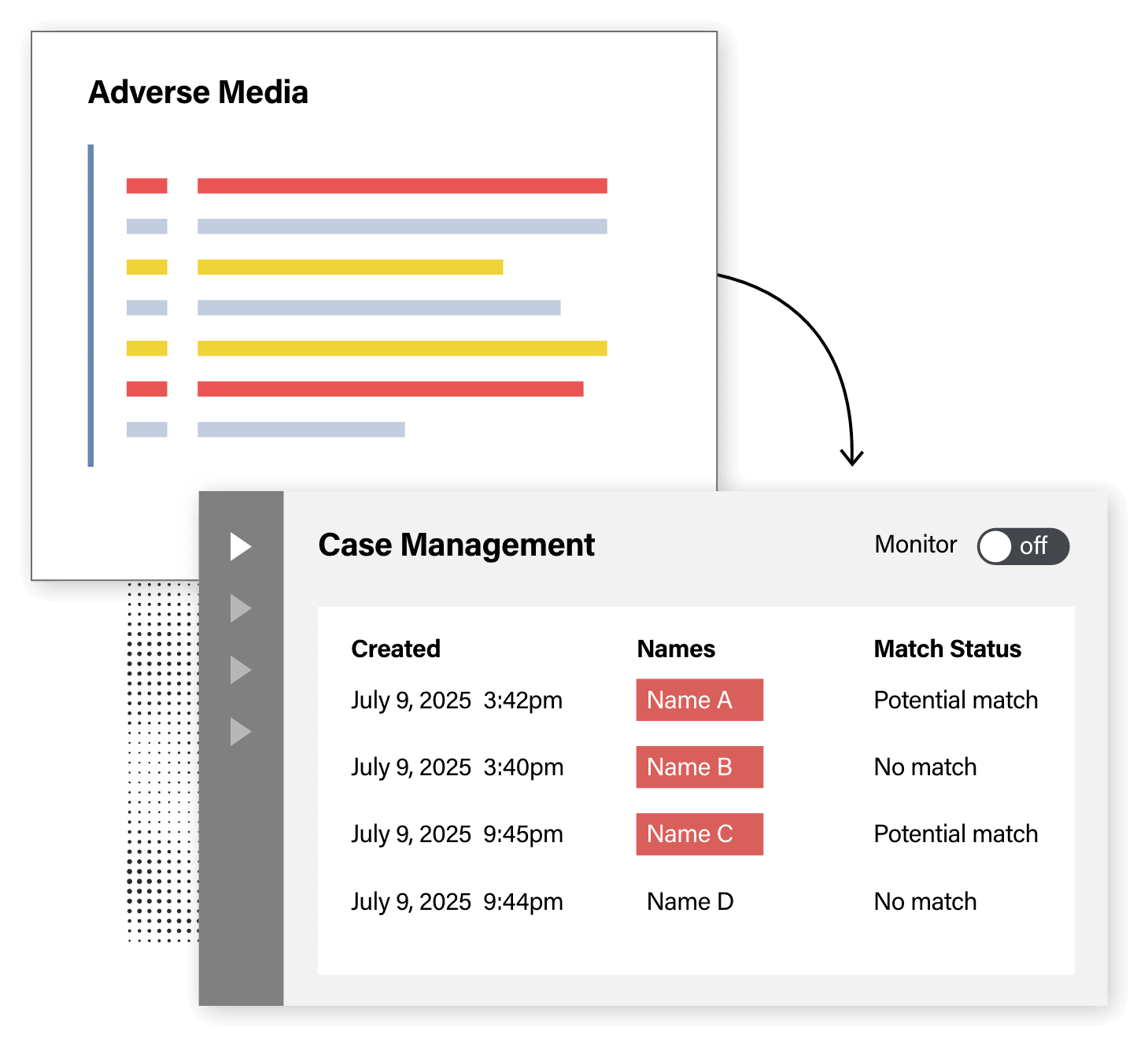

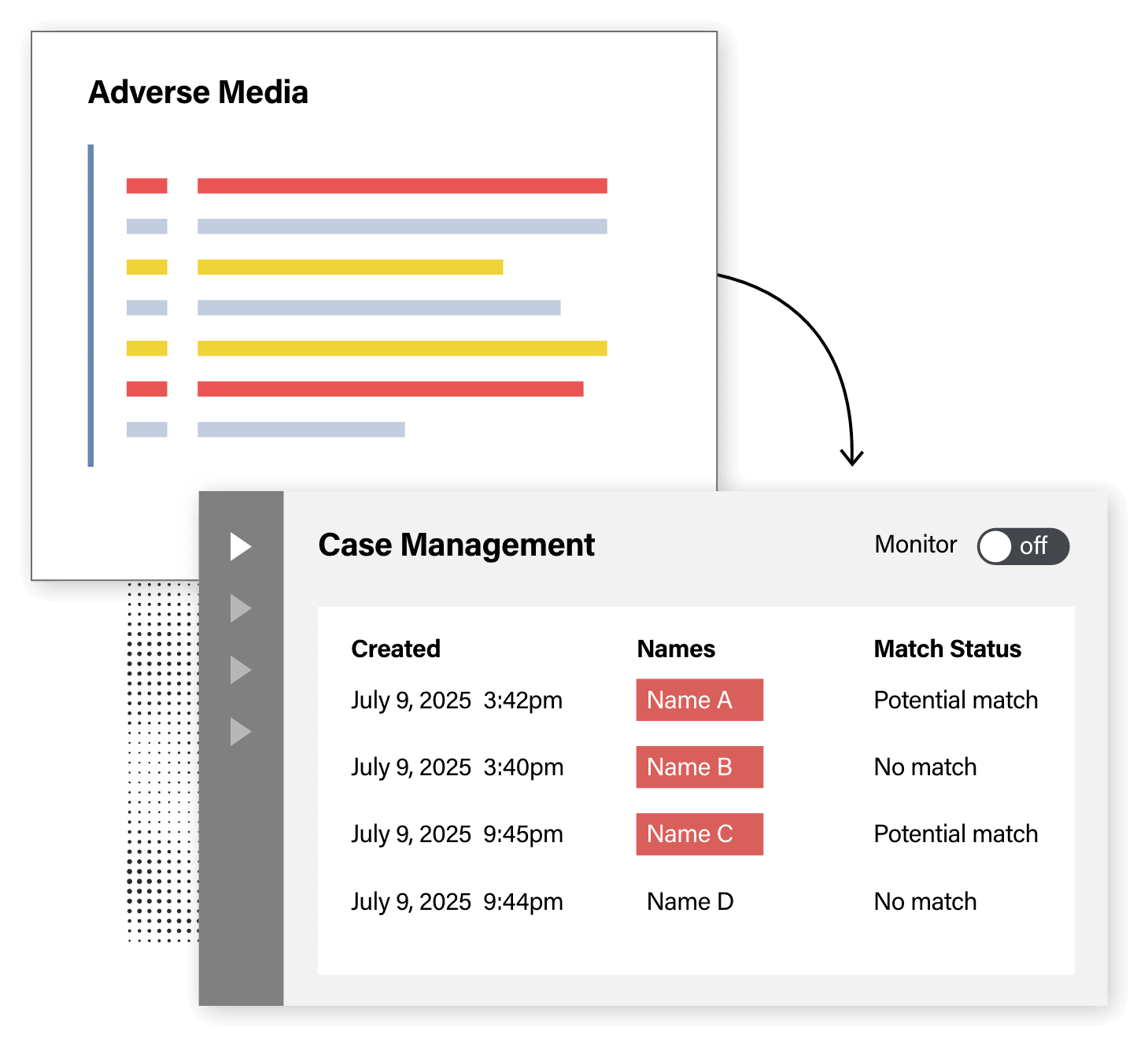

Easily integrate our adverse media tool into your existing systems and send data in your preferred format via our industry-leading REST API. We combine our API with a set of webhooks, which allows two-way data transfer between our application and your back office systems so you can manage your workflow, all from one window.

Our adverse media tool currently screens against 11k+ verified national, regional, and local media sources across 200+ countries.

Keyword filtering adverse media tools only capture and analyze data from a select number of media sources, which don’t necessarily provide the whole picture. AI-driven solutions fill these gaps by automatically assigning negative news information to profiles matching real-world entities. In addition to minimizing human error and false positives, AI-driven screening can reduce alert remediation time and increase operational efficiency.

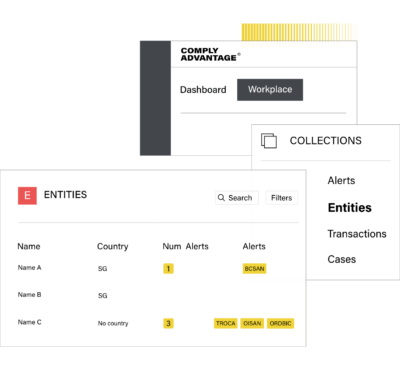

See how 1000+ leading companies are screening against the world’s only real-time risk database of individuals and legal entities.

Request Demo