Payments

Screen payments and onboard customers faster

Speed matters when sending or receiving money. Payments service providers (including remittance, peer-to-peer, and e-wallet services) must be able to process transactions quickly. Only then can they satisfy their customers’ rising expectations.

Whenever money moves, there’s a risk of money laundering, though. Payment providers also need to have robust onboarding and transaction screening processes. Having too many false positives or relying on manual processes risks damaging the customer experience.

Now, using artificial intelligence, it’s possible to screen customers and transactions in real time. Our solutions enable you to comprehensively identify risk at speed.

Why ComplyAdvantage?

Integrate seamlessly

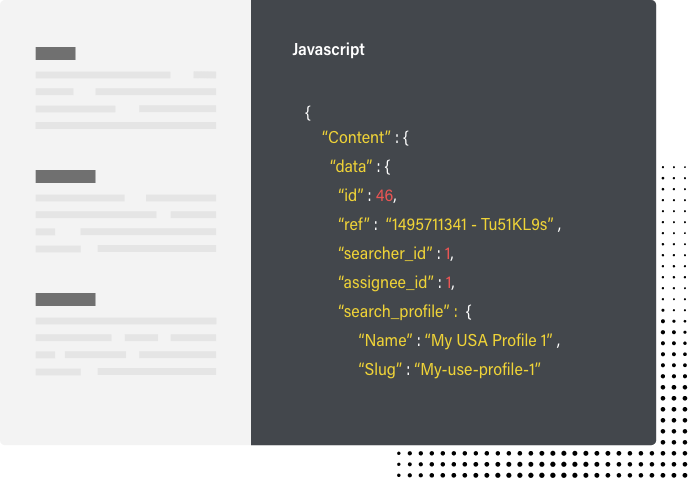

Enable straight-through processing of payments. Our two-way RESTful API issues alerts in real-time when suspicious payments are detected.

Highest level of security and risk mitigation

We are ISO 27001 certified across all our systems and locations, and deliver industry-leading uptime.

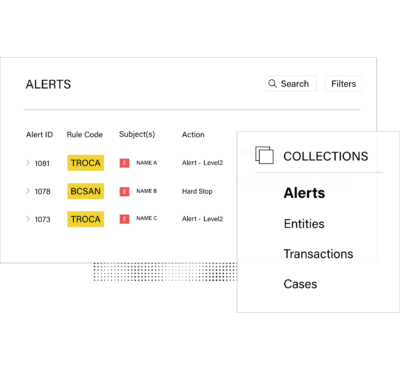

Reduce false alarms

Segment payments and risk scenarios according to your own risk-based approach. Use AI instead of manual intervention to identify real risks.