Company Screening

Enhance risk management by quickly evaluating the risk profiles of company entities.

- Automatically indicates hits, screening for sanctions, regulatory and law enforcement, and negative media content.

- Continually monitors business customers for compliance with regulatory and internal requirements.

Proven value for business & compliance teams

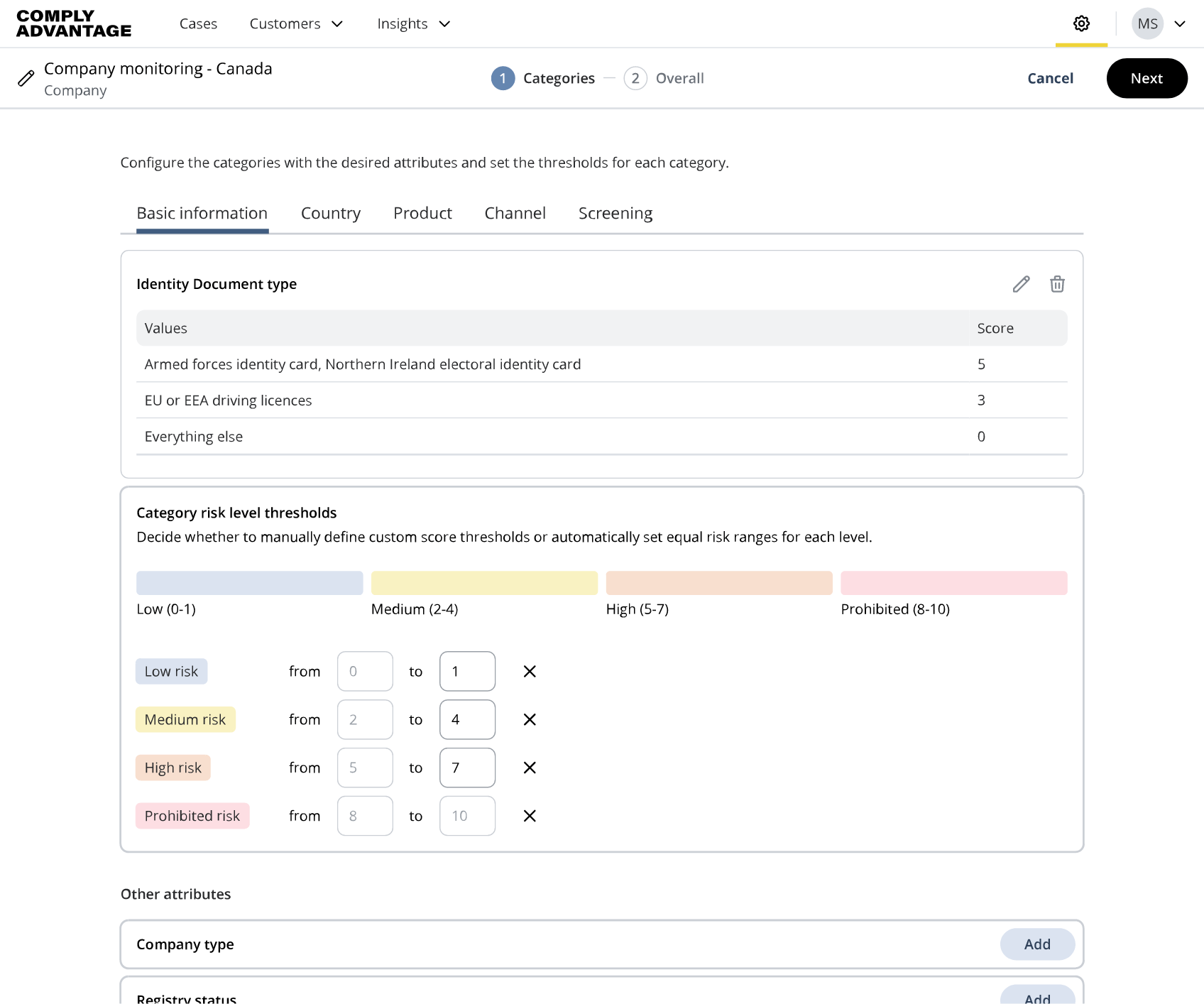

Mesh Company Screening is a configurable screening solution, created to fortify businesses against financial crimes while facilitating compliance and boosting growth.

By simultaneously mitigating client, reputational, and regulatory risks, it empowers the adoption of a targeted, risk-based approach to customer screening.

Compliance Officers & MLROs

Deploy a state-of-the-art B2B onboarding & monitoring program.

- Configure company screening and monitoring to reflect your risk policy including risk scoring.

- Ensure compliance & financial crime teams are audit-ready.

- Provide teams with market-leading software and risk intelligence.

Team Leaders

Conquer company screening backlogs.

- Gain real-time insights into the team’s company screening workload and performance.

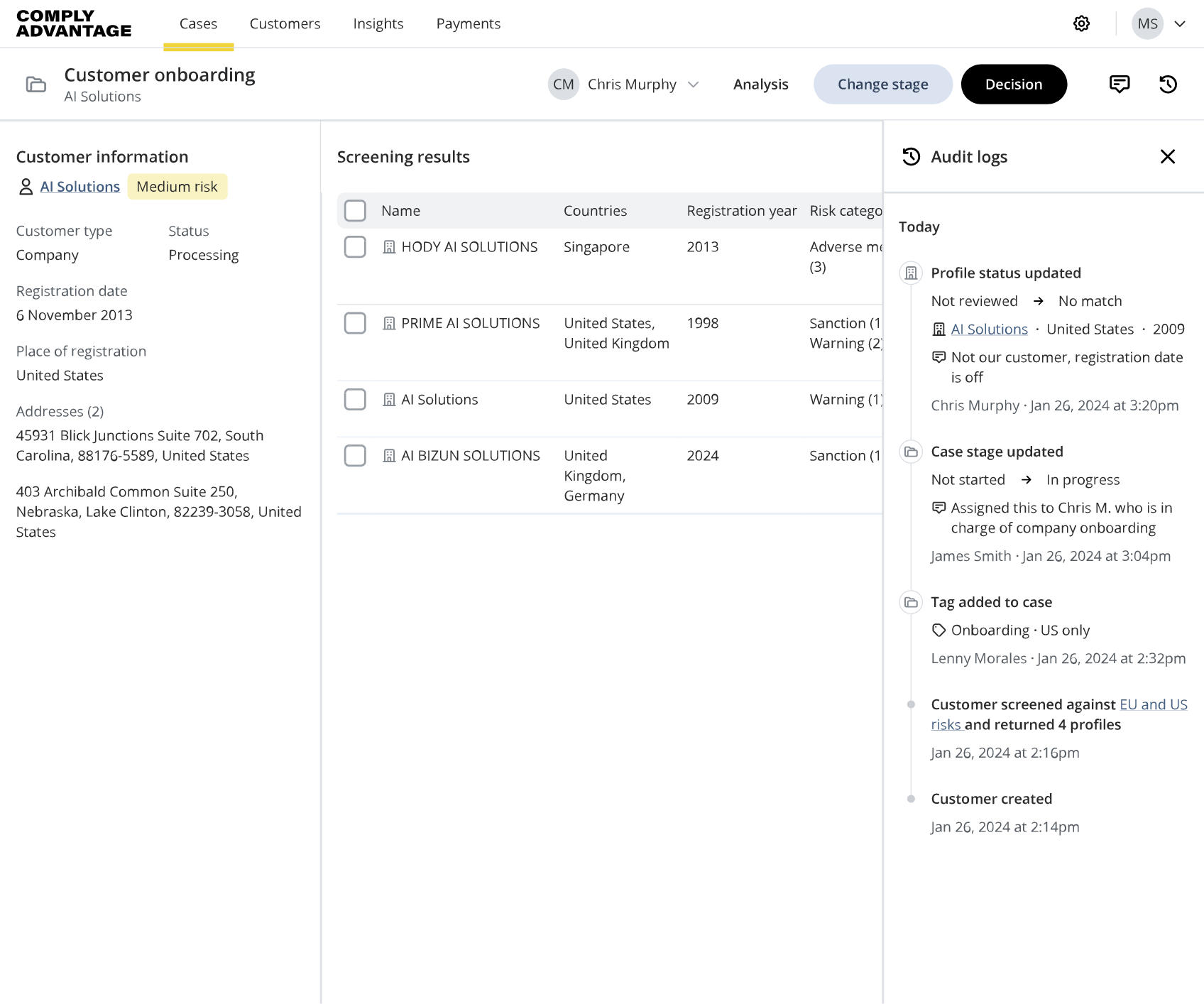

- Benefit from comprehensive audit trails for enhanced quality assurance.

- Empower teams to prioritize high-risk cases efficiently.

Compliance Analysts

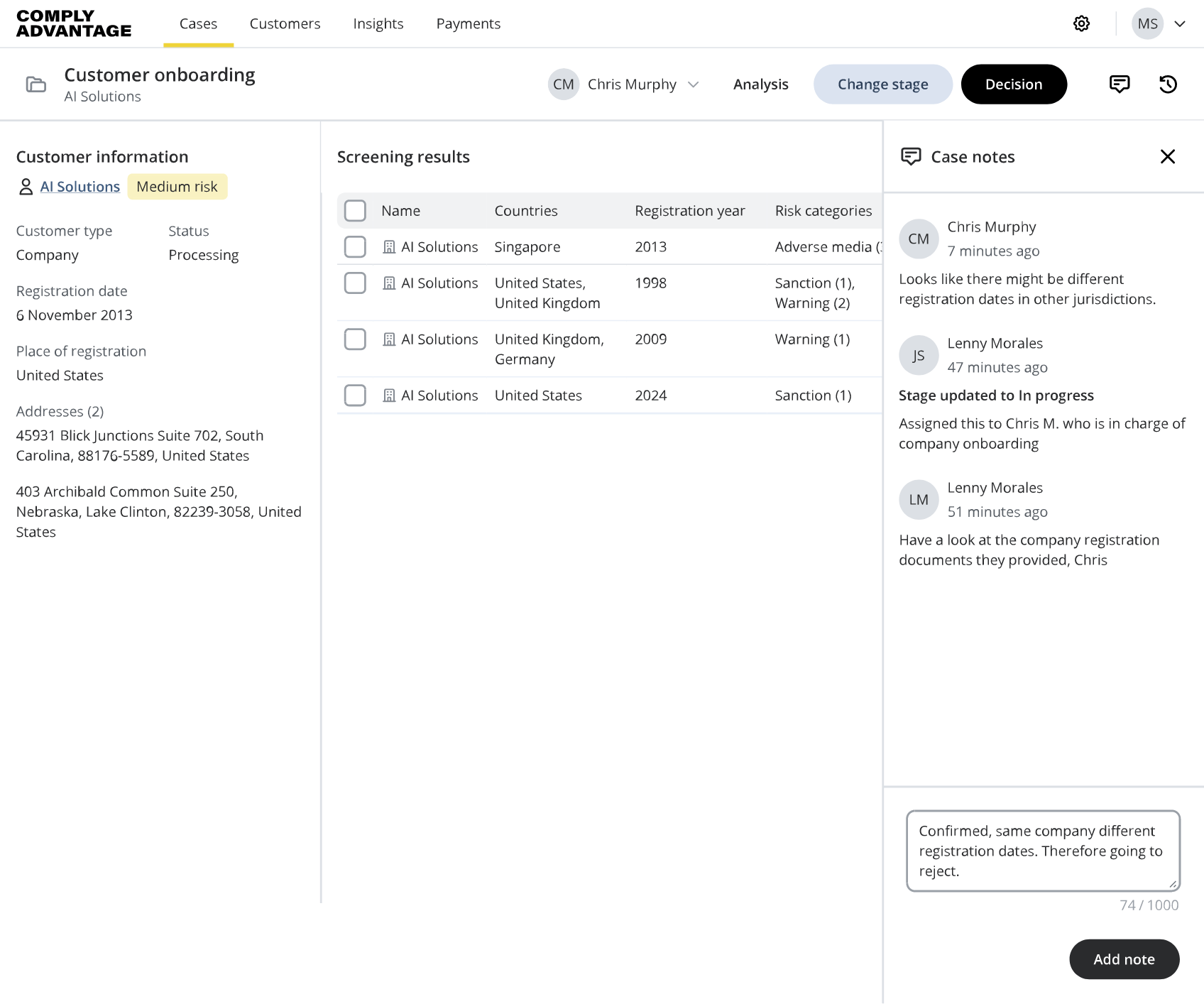

Remediate company onboarding cases easily and effectively.

- View all key business information on a single screen.

- Capture observations to defend screening decisions confidently.

- Hand over repetitive and low-value manual tasks to automation.

Tangible value delivered right from the start

Reduction in false positive rates

Reduction in false positive rates

Reduction in false positives

![]()

![]()

Improvement in account-opening efficiency

Starter Plan ($99/month)

- Run up to 100 checks each month

- Screening & monitoring included

Premium Plan (Custom price)

- Over 100 searches per month

- Tailored package for your business

Frequently asked questions

We provide in-depth, reliable, and actionable proprietary risk data. This includes sanctions, fitness & probity, watchlists, adverse media, and enforcement data.

Yes. The Company Screening solution is a versatile module within our Mesh platform. It gives you total flexibility to swiftly add or remove AML data sources to screen or monitor against. Without having to rely on a developer, you can easily specify that you want to screen businesses only against the adverse media database. And in future, if you want to add sanctions you can.

Absolutely. You can easily set up a workflow using our API to pass us your data so we can screen the owners – be they persons or businesses – and monitor them if you want. Our 2-way API will also feed back the results within your ecosystem if you prefer, or allow your teams to work on the screening results on our user-friendly case management solution.

Indeed. That API can feed you entities that our solution can screen and monitor against industry-leading real-time AML data.