- No professional service fees

- Webhook functionality

- Built for security and scale

- Migrate existing client base

- 99.9% Uptime

- Trusted by global businesses

- A single, hassle-free integration

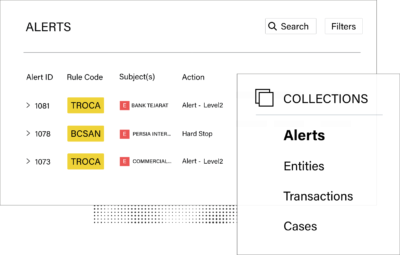

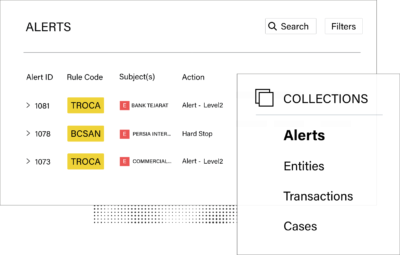

- Optional user interface

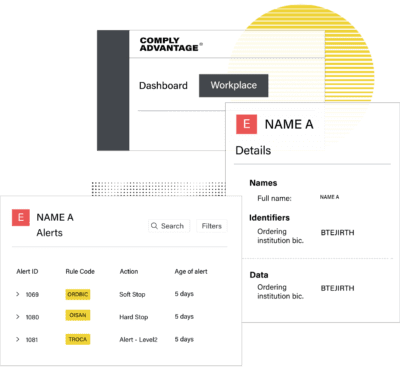

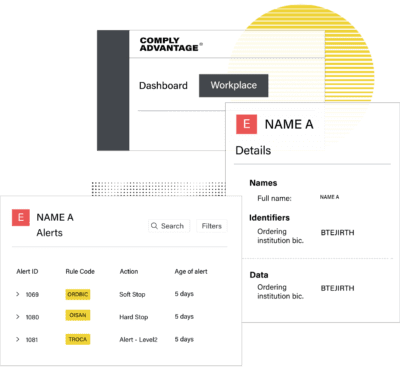

Digitize and automate your FinCrime risk management processes.

Request a Demo

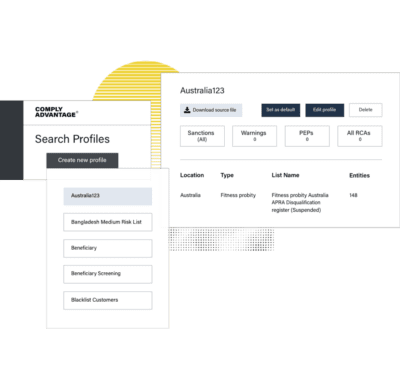

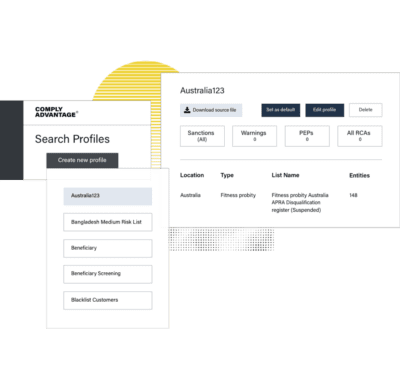

Access our real-time AML risk database of Sanctions and Watchlists, PEPs, and Adverse Media.

Tailor to your risk-based approach and reduce false positives while automating ongoing monitoring.

All our products are built for security and scale with RESTful API integration and an ISO 27001 certification.

Top 5 fraud trends in 2024 and how to mitigate them