Detect fraud efficiently and effectively

reduction in all payment fraud-related losses

Beat fraudsters’ creativity by using ML models that detect a continuously evolving range of fraud attempts.

increase in analyst efficiency

Empower analysts with cutting-edge tools that help make every step of the fraud prevention process fast and low effort.

reduction in false positives

Improve alert rate quality with tailored rules and segmentation.

Explore why leading digital bank Holvi chose ComplyAdvantage for fraud detection

Identify and prevent a range of payment fraud scenarios

Fraud Detection from ComplyAdvantage covers a wide range of continuously evolving payment fraud scenarios.

50+ payment fraud

scenarios covered

Here are just a few examples:

Fraud Detection from ComplyAdvantage stops this fraud using a combination of:

It detects:

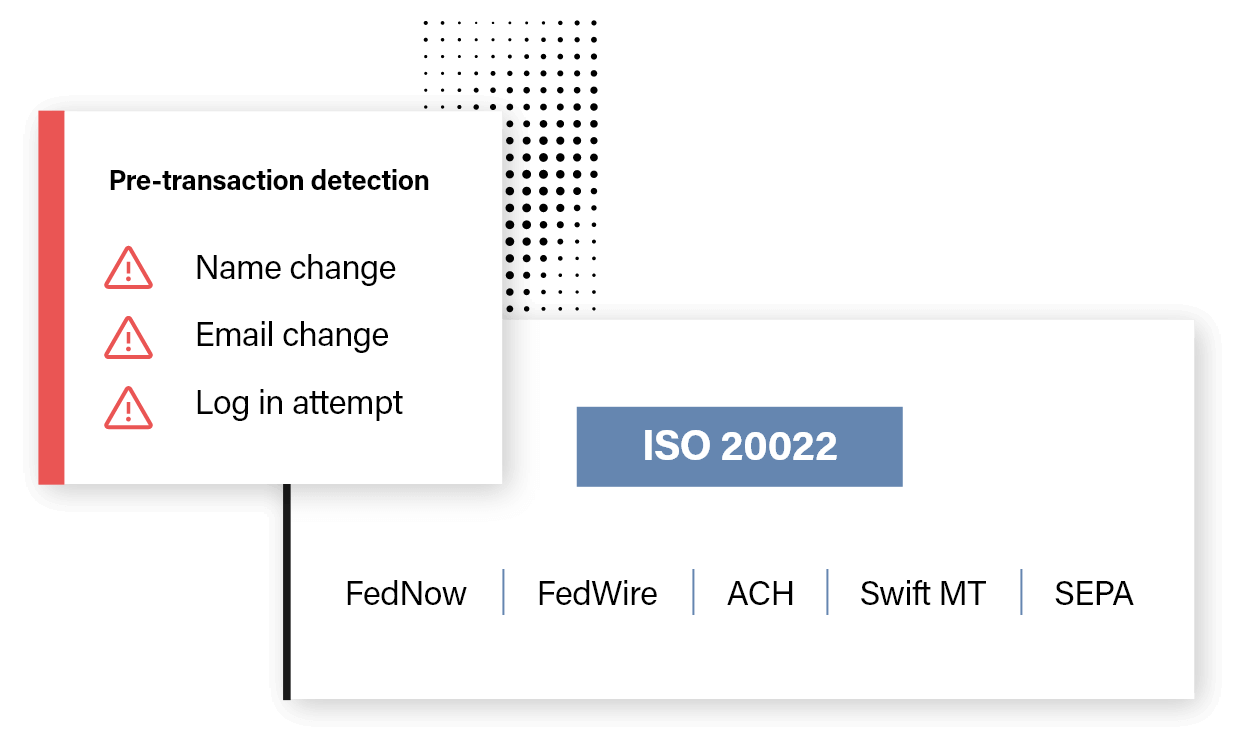

- Changes in behavior, activity from strange and unseen counterparties, and money transfers to high-risk countries or banks

- Changes in behavior following a suspicious event, such as a failed password attempt or a change in address

- Activities at uncommon times to a particular user (such as a user transacting at 4 am)

- Discrepancies between payments reference texts & payment details

Fraud Detection from ComplyAdvantage stops this fraud using a combination of:

It detects:

- Anomalous behavior indicating a vulnerable person has been taken advantage of by a third party

- Discrepancies between payment reference texts & payment details

- Changes in periodic behavior indicative of invoice fraud, such as a change in a bank account number on a typical payment

- Synthetic identities or mule accounts used to hide the destination of the funds

Fraud Detection from ComplyAdvantage detects synthetic identity fraud by applying a combination of:

It identifies networks of accounts that are acting in tandem, both from a behavioral and a personal data perspective. It gives you dual protection, catching both:

Fraud Detection from ComplyAdvantage stops this fraud using a combination of:

Using these techniques, our solution can detect:

- Merchants fraudulently representing themselves as another type of business - for example, a casino claiming to be a restaurant

- Merchants with significant refunds and chargebacks compared to others or previous activity from the same merchant

- Businesses with similar patterns to others you have offboarded

- Companies taking lines of credit with an anomalous “bust-out” pattern

Fraud Detection from ComplyAdvantage stops this fraud using a combination of:

Using these techniques, our solution can detect:

- Customers that process large amounts of refunds or chargebacks, either at a total level or in comparison to their peer group

- Anomalous patterns of refunds or chargebacks indicative of fraud

With our pre-built scenarios and ML techniques, our solution can detect individual cases of credit card fraud, and identify networks of stolen information across accounts that may slip through traditional systems.

Using these techniques, our solution can detect:

- Test transactions followed by anomalous activity for a customer or their peer group

- Overall changes in behavior by customers indicating fraud

- Clustered networks of stolen information used in tandem by fraudsters through similar behavior and details

Leading financial institutions trust ComplyAdvantage for fraud detection

Preventing fraud with ComplyAdvantage: Top four benefits

One of the most powerful ML models

Unmatched speed to value

Fraud scenarios covered across all payment rails

Leader in financial crime risk data & detection technology

Read the story“The flexibility to build custom scenarios was important for us. Many vendors do not have the same level of flexibility.”

~ Blanca Rojas, Transaction Risk Manager, RealPage

(Real estate software and data analytics)

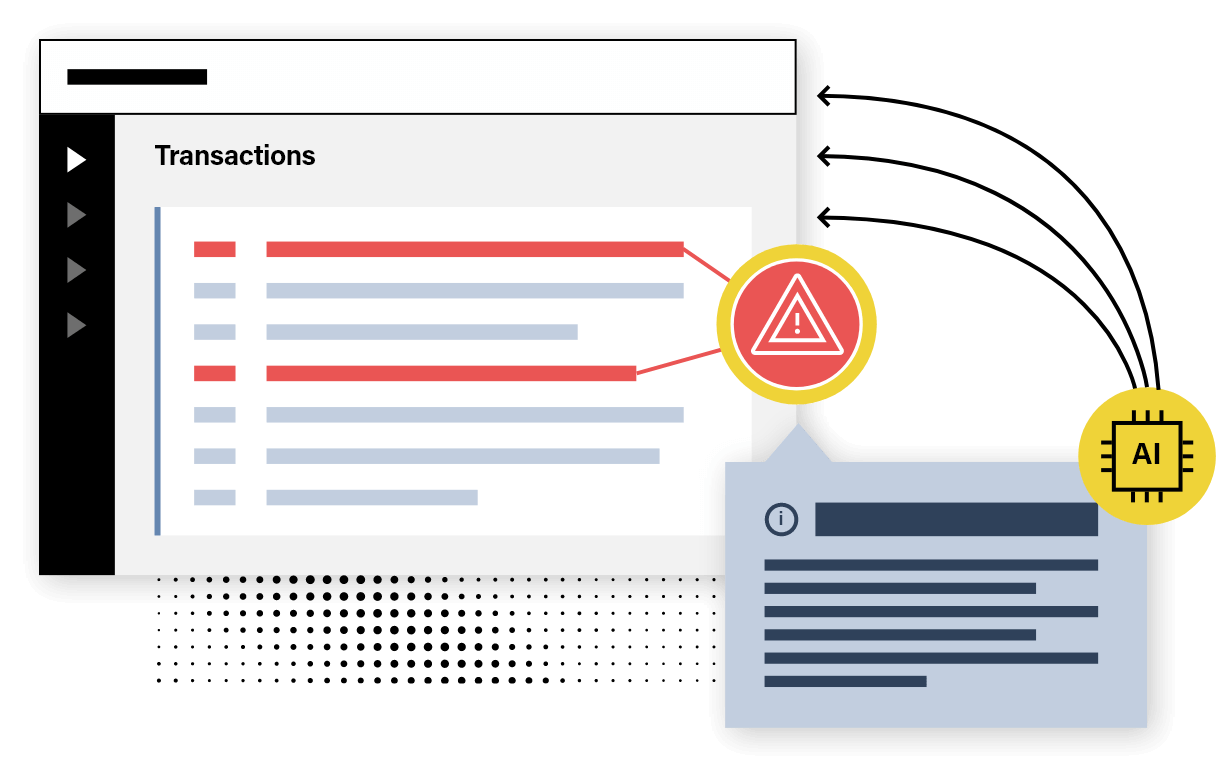

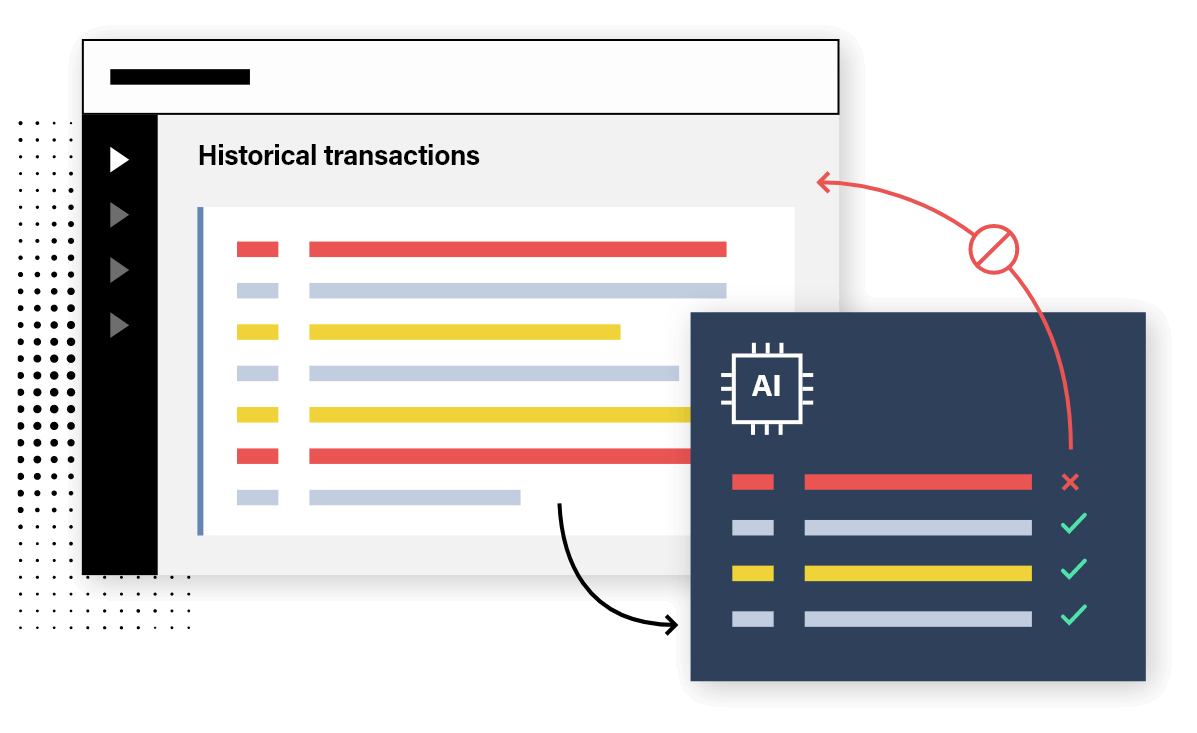

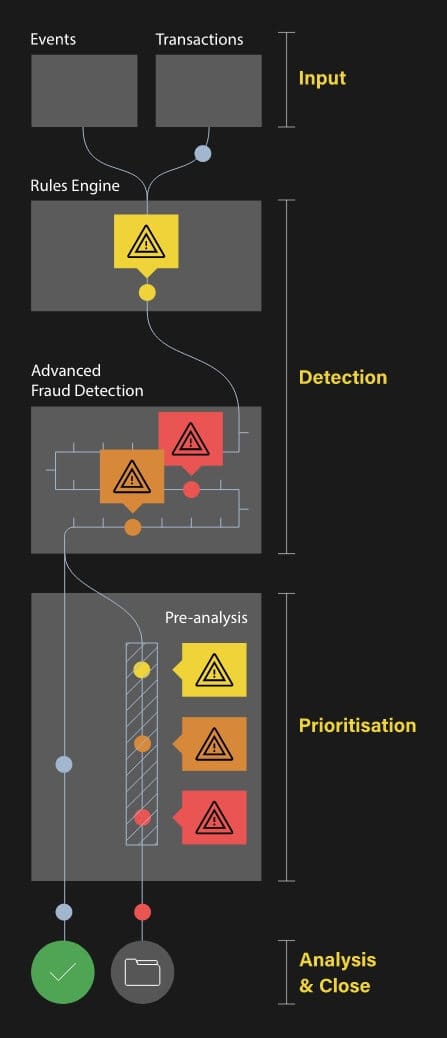

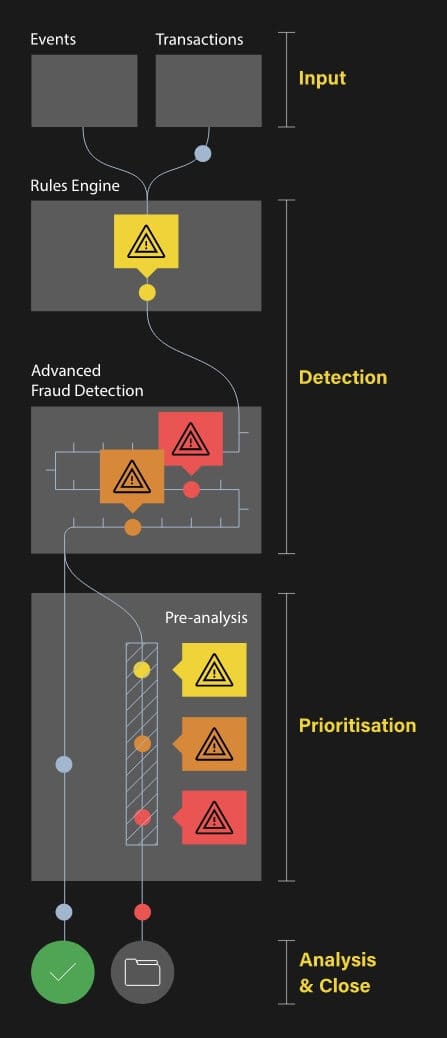

How the ComplyAdvantage fraud detection solution works

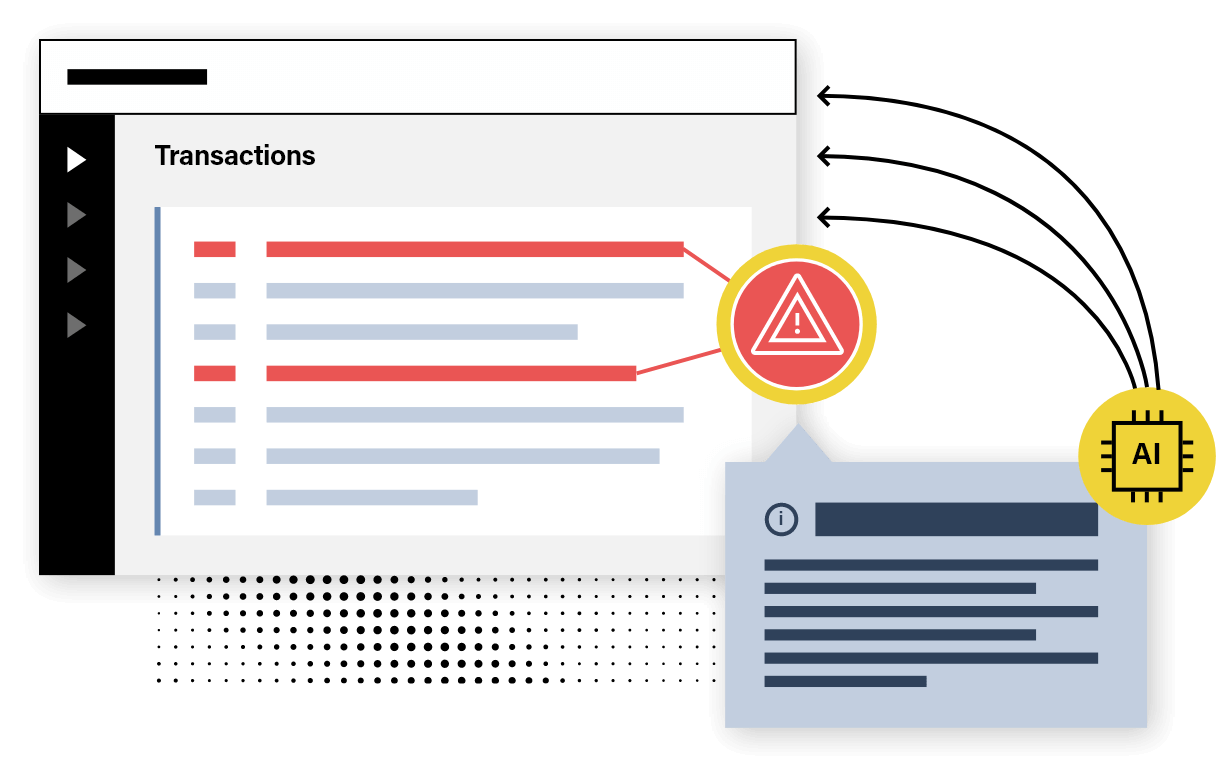

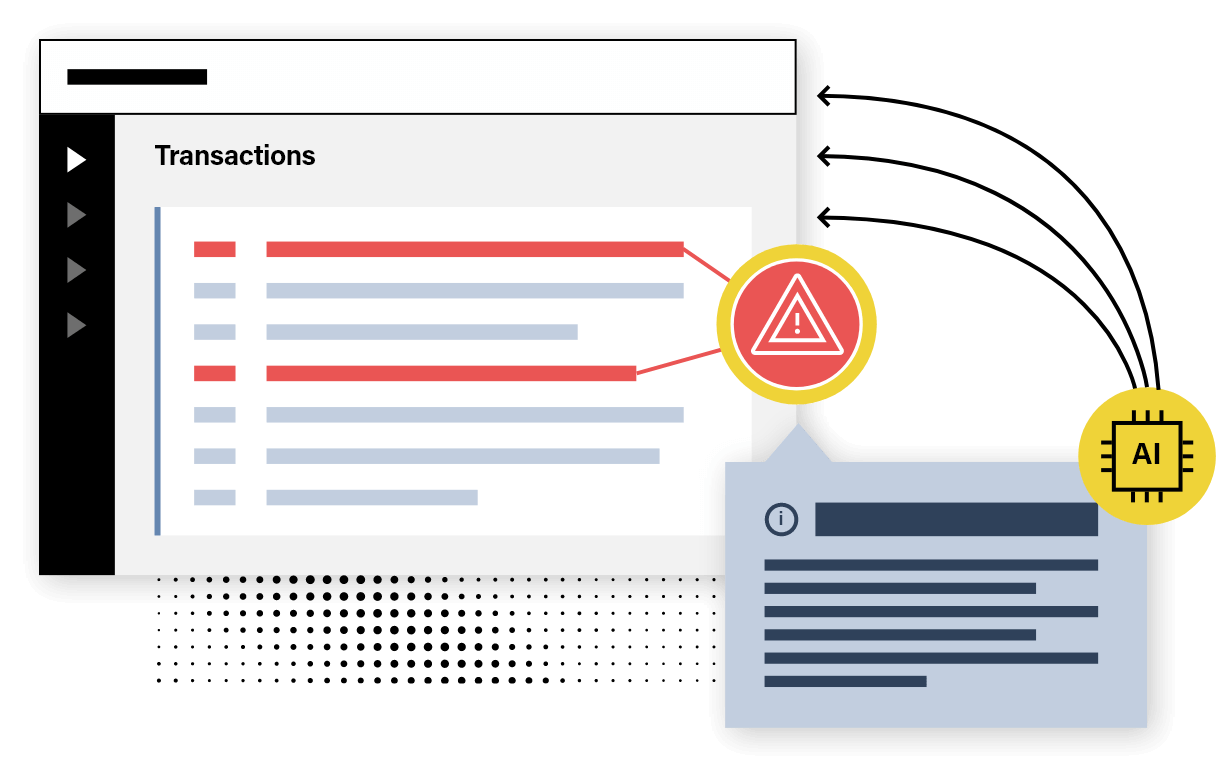

Powered by AI

Powered by AI

How much could Fraud Detection save your firm? Explore our ROI calculator

Explore our related financial crime risk detection solutions

Transaction Monitoring

Powered by AI, our transaction monitoring solution offers a no-code, self-serve rules builder and can be scaled to billions of transactions.

Discover Transaction Monitoring

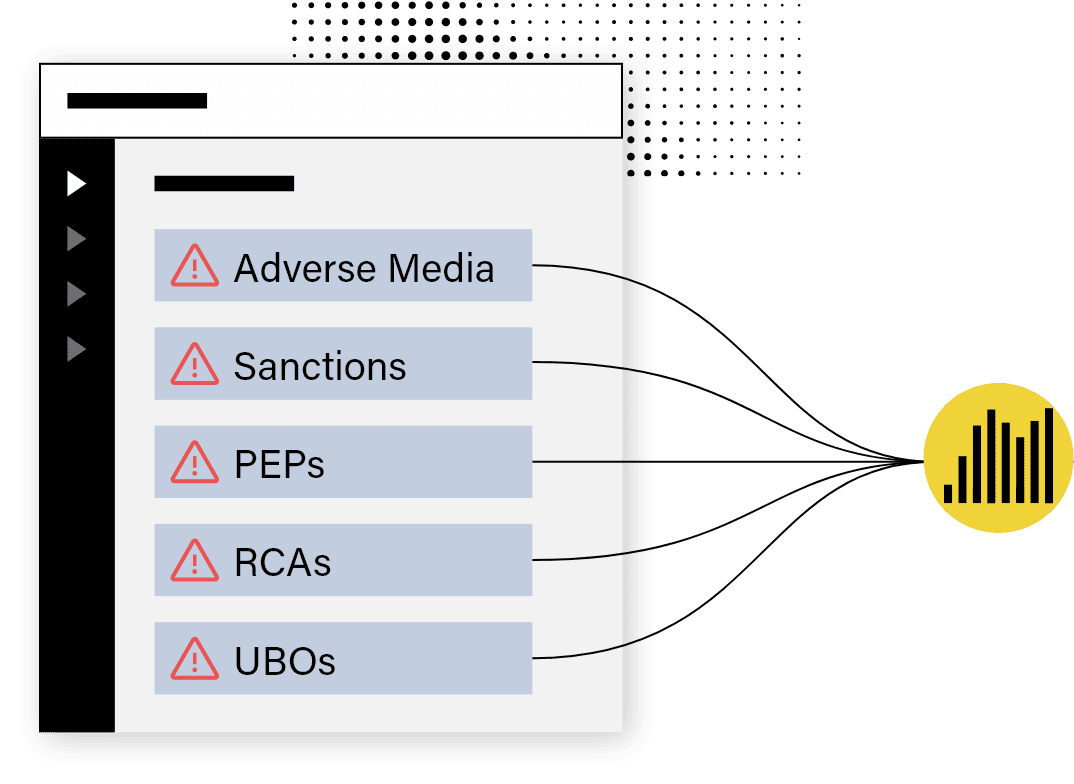

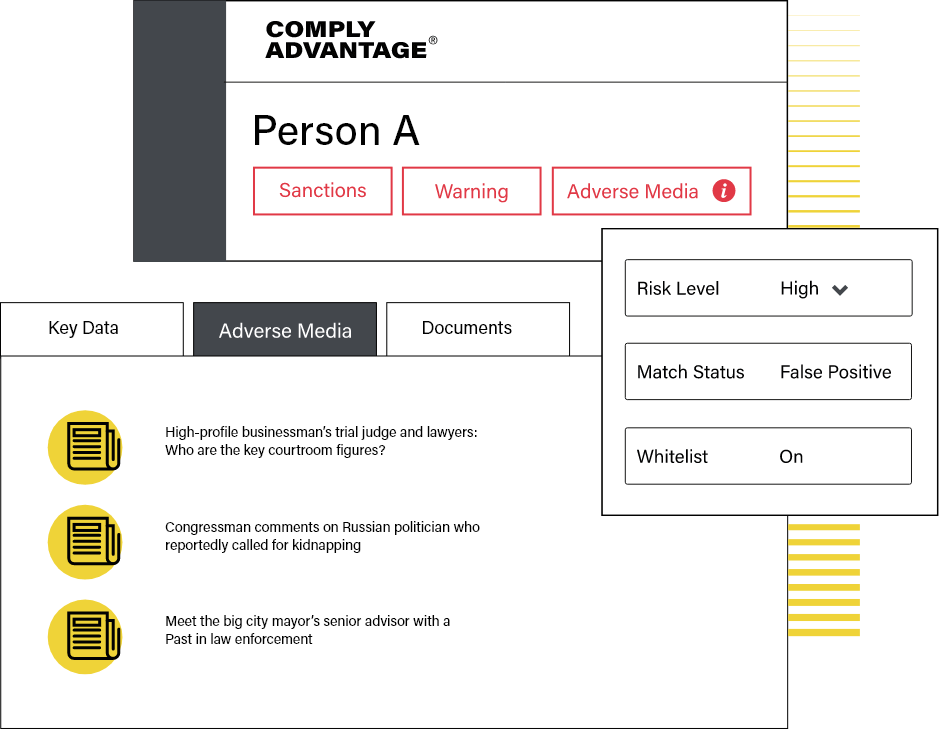

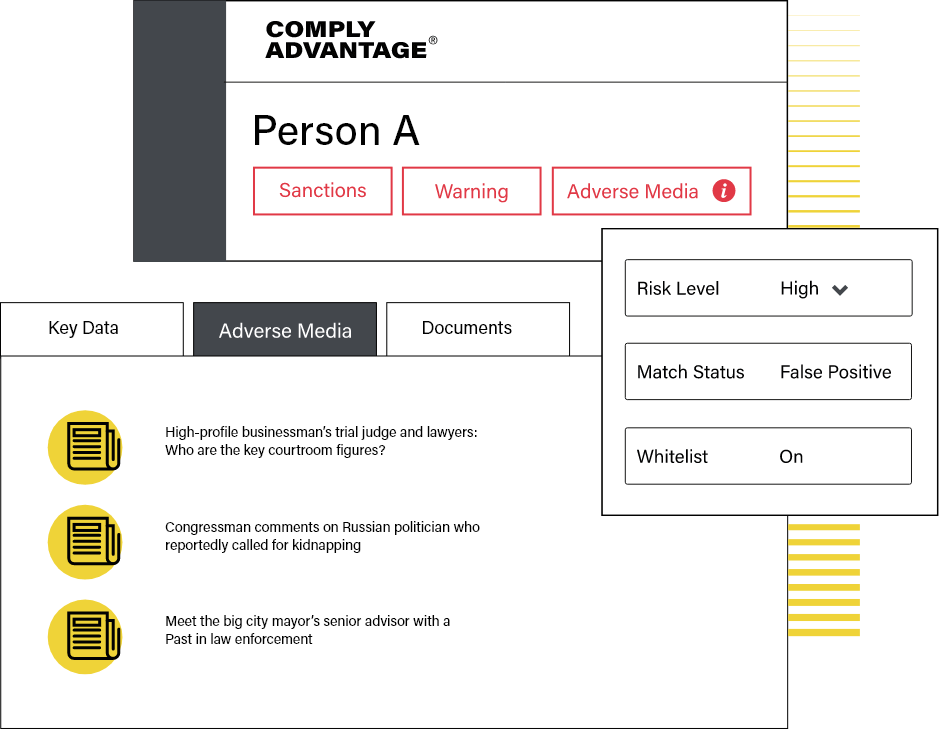

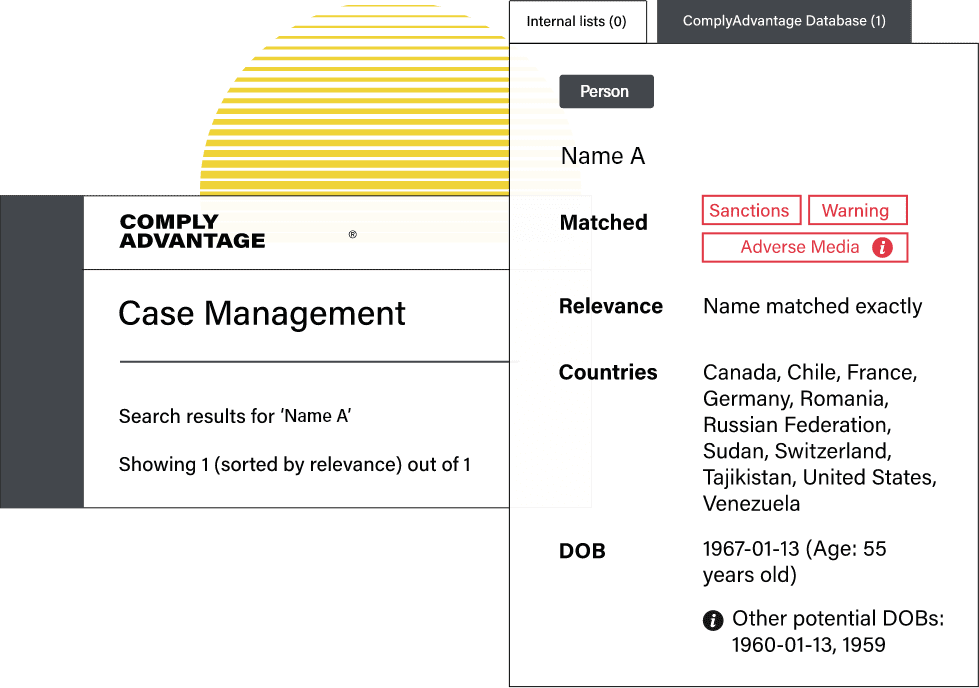

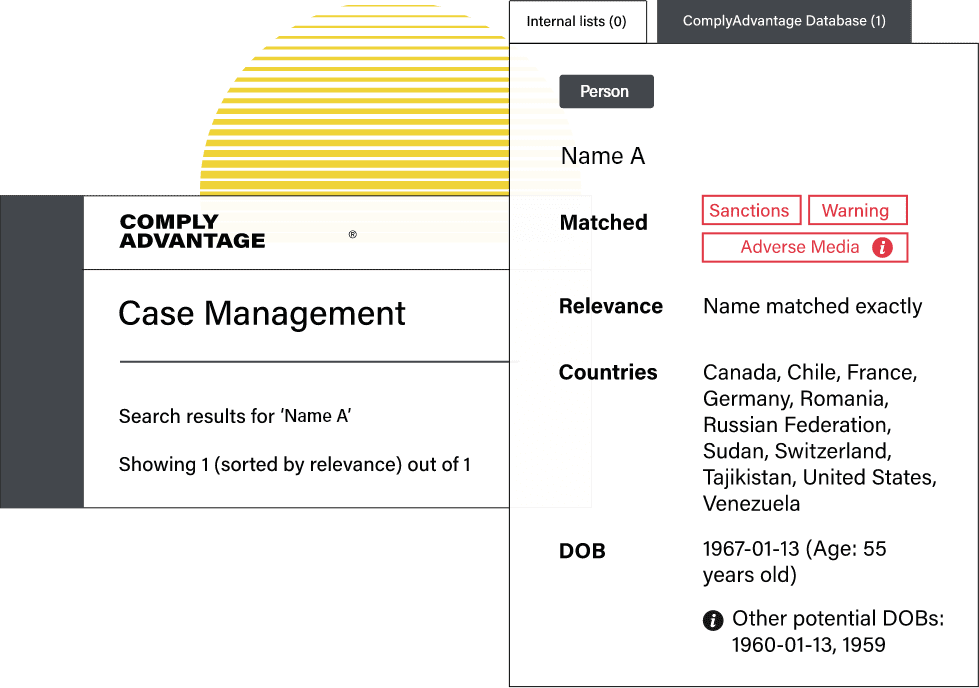

Customer Onboarding and Screening

Automate customer onboarding and monitoring with a real-time AML risk database and an effective KYC solution.

Discover Customer Onboarding and Screening

Adverse Media Screening

Cut through the noise and analyze true adverse media context at scale with our robust adverse media screening software.

Discover Adverse Media Screening

Get started with ComplyAdvantage today

Request a demo to see how our fraud detection capabilities can help you see the unseen.

Get a Demo