Cryptocurrency

Reduce risks with real-time screening and automated monitoring

Crypto companies must have robust AML processes. They must verify the identity of every sender and beneficiary, to ensure there are no illegal activities, such as money laundering or terrorist financing.

Crypto assets, wallets, and exchanges face CFT/AML regulations worldwide. They are considered ‘obliged entities’ under the EU’s 5AMLD directive. That means they must perform customer due diligence (CDD) and submit suspicious activity reports (SARs). The anonymity and high-risk models in cryptocurrency have led to enhanced supervision by auditors and banking partners.

Our AI-driven solutions ensure that crypto companies comply with regulatory expectations across various jurisdictions. We help crypto companies to quickly identify risks before they become threats, and to protect their reputations with banks and customers.

Why ComplyAdvantage?

Screening & Monitoring

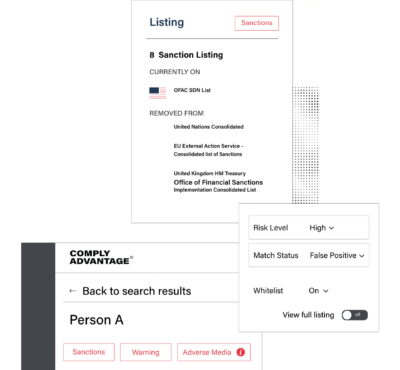

Fast and safe customer onboarding and monitoring

- Screen in real time against sanctions lists, and watchlists, politically exposed persons (PEPs), and adverse media.

- Receive proactive automated alerts when there are changes in status. Alerts are all tailored to your risk-based approach.

- Integrate AML checks seamlessly into your onboarding and monitoring workflow. We offer a highly functional and scalable RESTful API.

Transaction Monitoring

Data-agnostic rules engine to spot suspicious behavior in real time

- Real-time tracking of fund movements. We enable wallets and exchanges to spot suspicious behavior patterns when crypto-assets are transacted into fiat.

- Our API allows easy segmentation of rules by type of currency, location, and transaction volume. It’s all tailored to your risk-based approach.

- Our solution is data-agnostic. Incorporate crypto data such as wallet addresses.