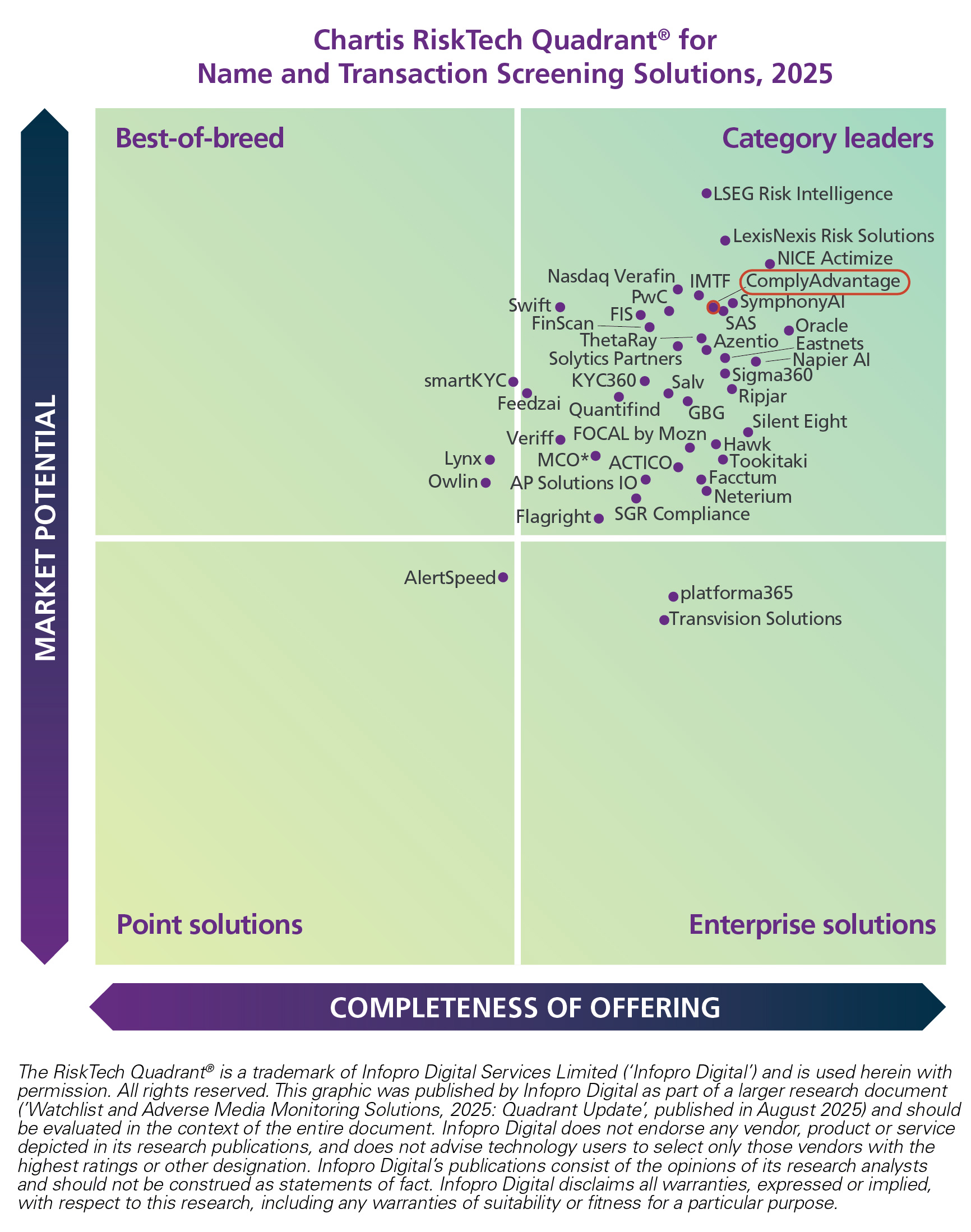

London, UK, 29 August 2025: ComplyAdvantage, a global financial crime risk detection technology provider, has announced it has been named as Category Leader in two Chartis Quadrants for 2025:

- Name & Transaction Screening Solutions.

- Adverse Media Monitoring Solutions.

A specialist advisory firm in risk, compliance, and financial technology, Chartis focuses on supporting financial institutions, investment managers, and insurers.

To be positioned as a Category Leader, Chartis evaluates two primary axes: ‘completeness of offering’ and ‘market potential’. For ‘completeness of offering’, ComplyAdvantage has to demonstrate the breadth and depth of its functionality, data, analytics, and content (completeness of offering), and for ‘market potential’, its market presence, growth prospects, and ability to capture market share.

As firms look to onboard new customers as quickly and efficiently as possible, they have to navigate a global financial crime compliance market that faces unprecedented regulatory pressure.

ComplyAdvantage’s category leader placing in Chartis’ Watchlist and Adverse Media Monitoring quadrants reflects the strength of its proprietary global risk data and AI-driven adverse media capabilities,’ said Phil Mackenzie, Senior Research Principal at Chartis. ‘Its focus on delivering unique datasets at scale and speed has led to a strong and growing position in the compliance landscape as it becomes embedded into more compliance workflows.

Transaction Monitoring from ComplyAdvantage helps firms detect financial crime with AI-driven rules and ML algorithms that identify complex suspicious patterns and hidden risks. By intelligently prioritizing alerts through ID clustering and graph analysis, it achieves up to 70% fewer false positives and boosts operational efficiency, freeing teams to focus on genuine threats and critical investigations.

Meanwhile, ComplyAdvantage Adverse Media tools deliver 7X more comprehensive negative news coverage than competitors using multilingual machine learning models and market-leading NLP technology. By providing expert-curated enriched profiles with contextualized data and unique entity resolution capabilities, they accelerate customer onboarding while reducing false positives, ensuring accurate risk assessment and regulatory compliance across global markets.

ENDS

For additional information, please contact:

Sarah Cameron

ComplyAdvantage

[email protected]

About ComplyAdvantage

Our mission is to empower every business to eliminate financial crime. By harnessing AI, a unified platform, and an extensive partner ecosystem, we help customers turn compliance into a catalyst for growth, operational strength, and enduring regulatory trust.

More than 3,000 enterprises across 75 countries rely on our end-to-end platform and the world’s most comprehensive financial crime risk intelligence. With full-stack agentic automation, we help organizations automate up to 95% of KYC, AML, and sanctions reviews, cut onboarding times by 50%, reduce false positives by 70%, and handle 7x more work with the same staff.

ComplyAdvantage is headquartered in London and has global hubs in New York, Singapore, and Cluj-Napoca. It is backed by Balderton Capital, Index Ventures, Ontario Teachers’ Pension Plan, Goldman Sachs, and Andreessen Horowitz. Learn more about Compliance re-engineered for the agentic era at complyadvantage.com.