Transaction Monitoring

Scale your transaction volumes without scaling your headcount

Break the link between rising transaction volumes and operational costs by deploying agents that auto-remediate 65-85% of false positives. Empower your existing team to outpace complex financial crime using natural language rule creation and sub-second behavioral insights on a unified, hyper-scale platform.

Unified intelligence for high-velocity detection across many risk types

Transaction Monitoring on Mesh unifies detection across every risk – from money laundering and fraud to human trafficking – within one AI-native engine.

By combining smart noise filtering with automated workflows, routine alerts are resolved instantly to optimize straight-through processing and reduce customer friction, achieving up to 82% fewer false positives.

Detection grounded in intelligence

Merge high-speed automation with complete regulatory transparency.

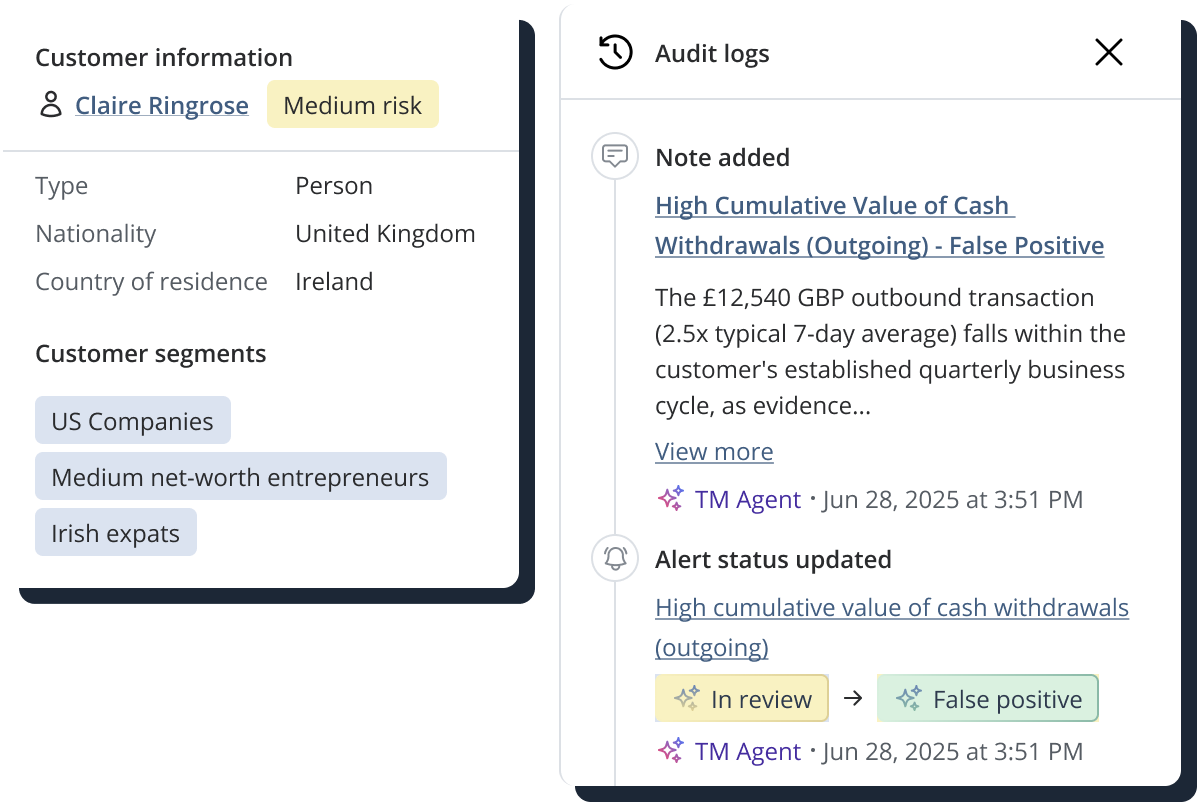

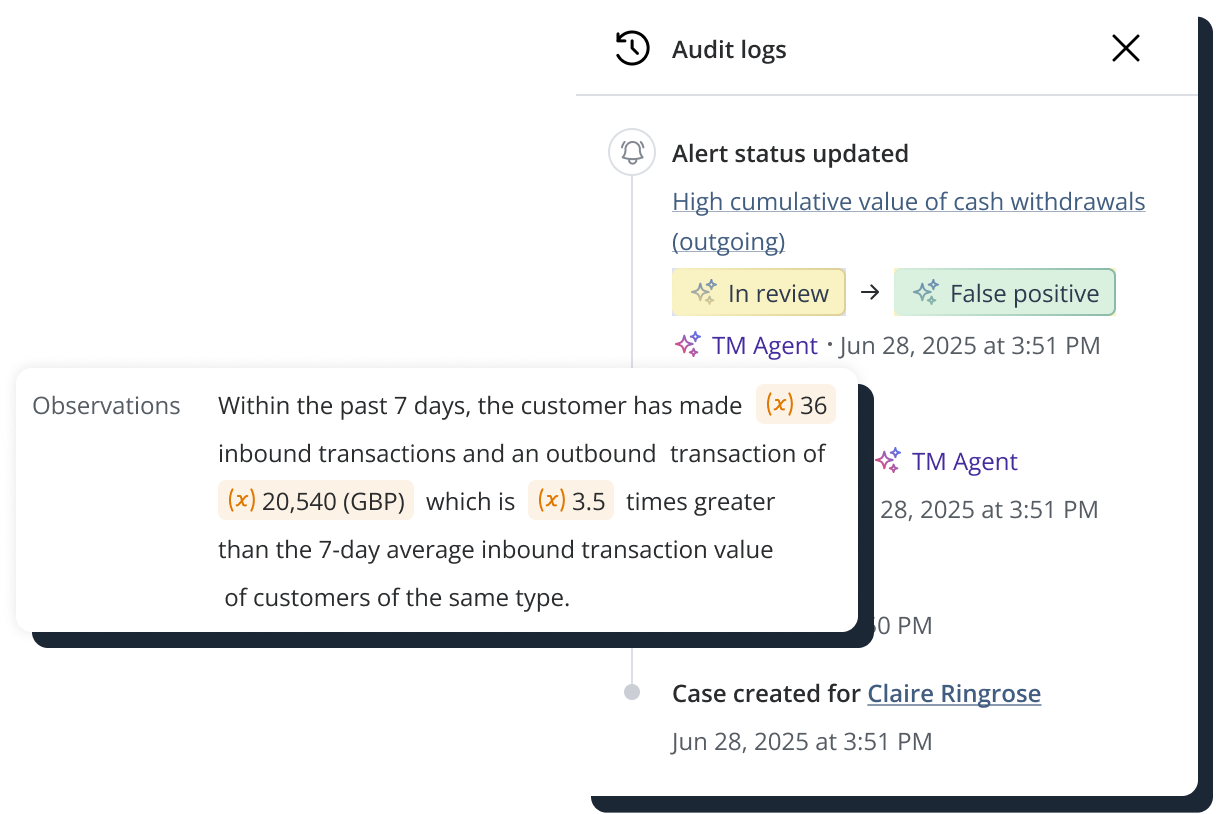

- Agentic-driven risk analysis: Resolve 65-85% of false positives using our decision chain – a smart workflow that connects our detection engine, AI agents, and your analysts in one seamless process.

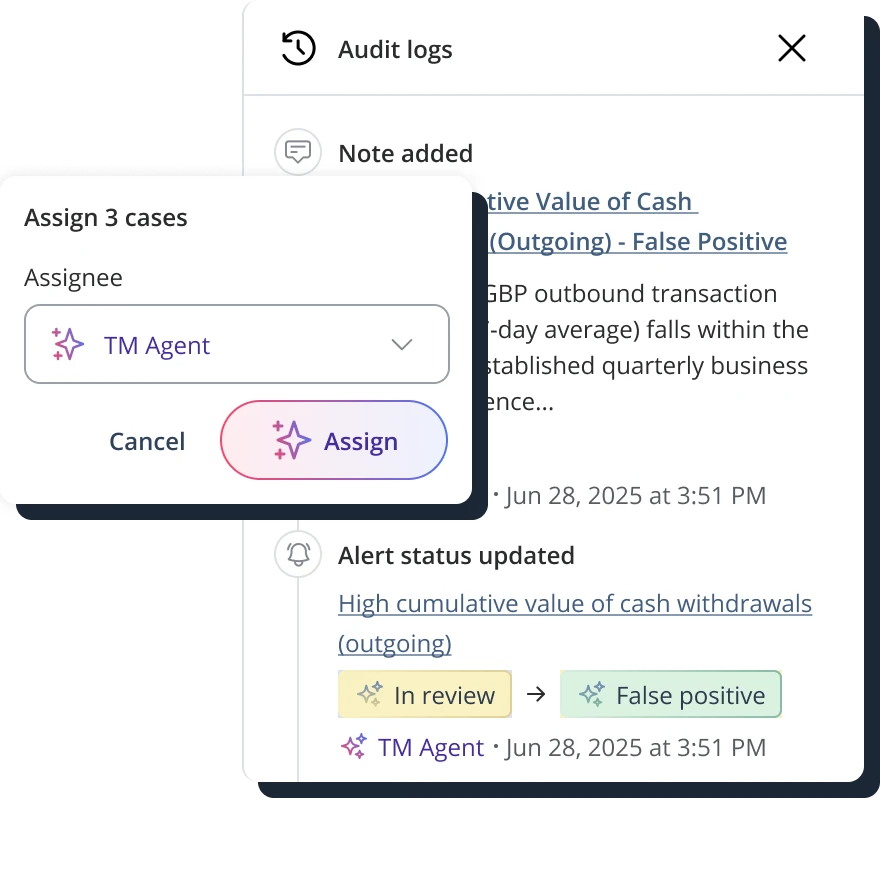

- Full explainability: Every decision is backed by clear, natural language reasoning in the audit trail for total regulatory confidence.

- Proven governance: Our AI framework includes proactive bias management and independent validation for defensible outcomes.

- Domain expertise: Models are built by financial crime experts, ensuring AI logic is grounded in real-world risk typologies.

Self-serve configuration at your fingertips

Deploy new detection scenarios in minutes, not months.

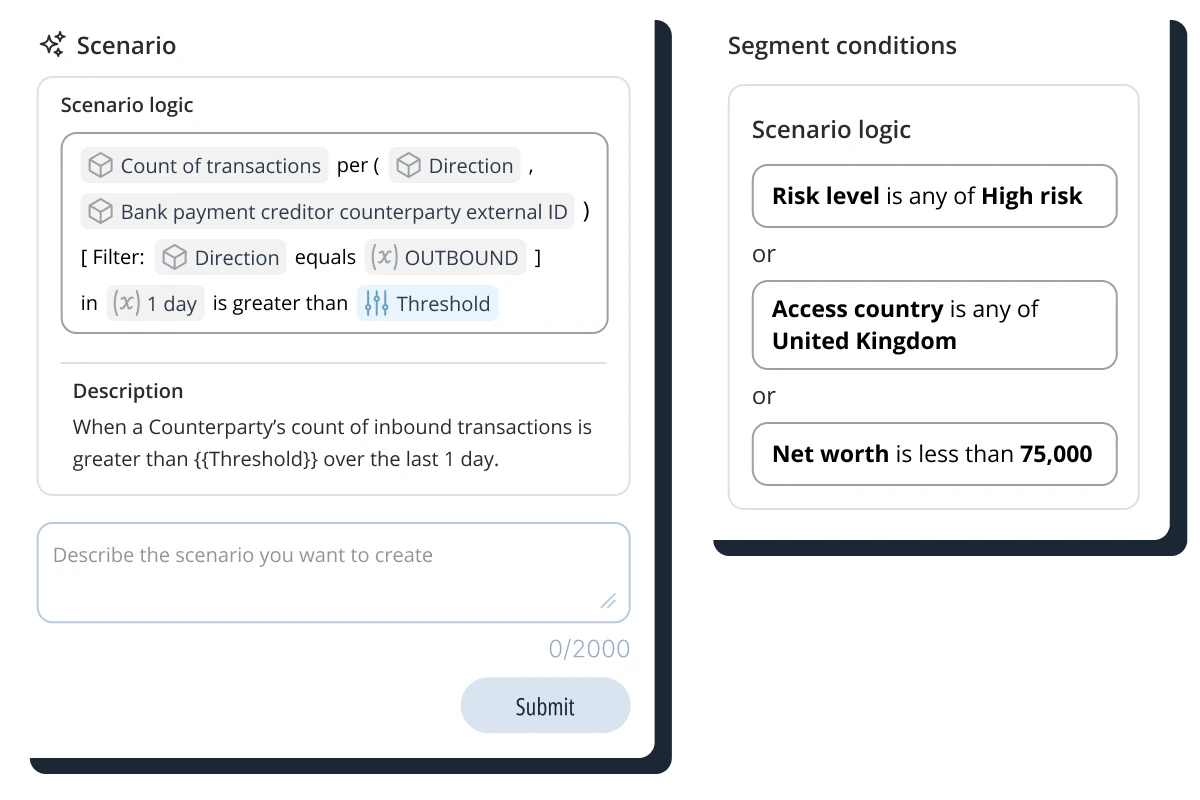

- Natural language rules: Build robust monitoring scenarios as easily as describing them. Designed specifically for compliance professionals, our engine turns your risk-management expertise into precise, executable code with zero manual programming.

- Intelligent segmentation: Group customers by multiple attributes and risk levels without needing technical or developer support.

- Dynamic thresholds: Fine-tune parameters and priorities to match shifting patterns in customer behaviour.

- Sandbox testing: Validate new rules safely in a sandbox environment to see the impact on alert volumes before going live.

Configurable case management and compliance workflows

Streamline operations with smart workflows that scale with your business

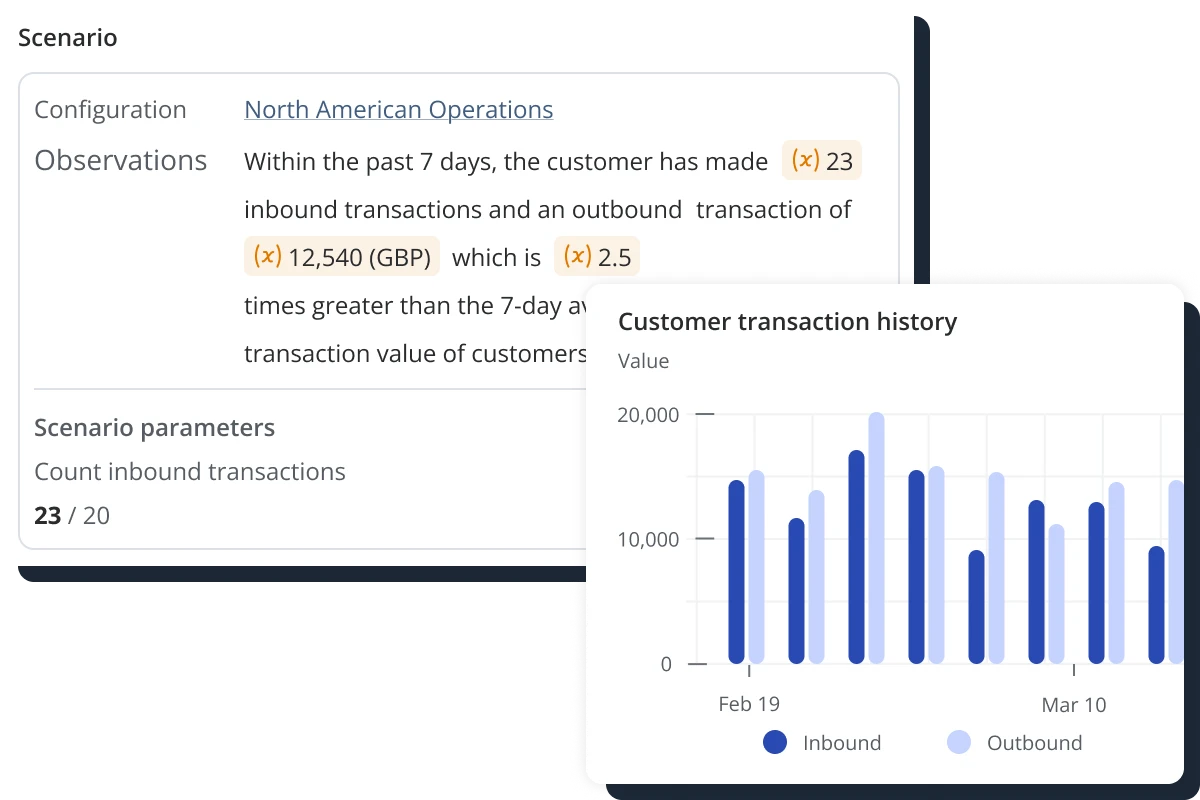

- Comprehensive context: View transaction history, related entities, and risk evolution in a single, unified interface.

- Flexible configuration: Align rule thresholds and alert priorities with your specific risk appetite.

- Customizable workflows: Tailor up to eight review and decision stages to mirror your internal team structures.

- Regulatory readiness: Built-in support for global reporting – including SAR, CTR, and FINTRAC STR and EFT reports – ensures seamless filing and comprehensive audit capabilities.

Actionable insights for continuous improvement

Refine your strategy with real-time performance analytics.

- Rule performance: Track hit rates and false positive trends for every scenario to eliminate underperforming detection scenarios.

- Team productivity: Monitor analyst efficiency, case progression, and agentic remediation impact in one dashboard.

- Trend analysis: Gain deep visibility into transaction patterns and evolving risk behaviours.

- Data-driven optimization: Quantify the business impact of your compliance improvements and ROI.

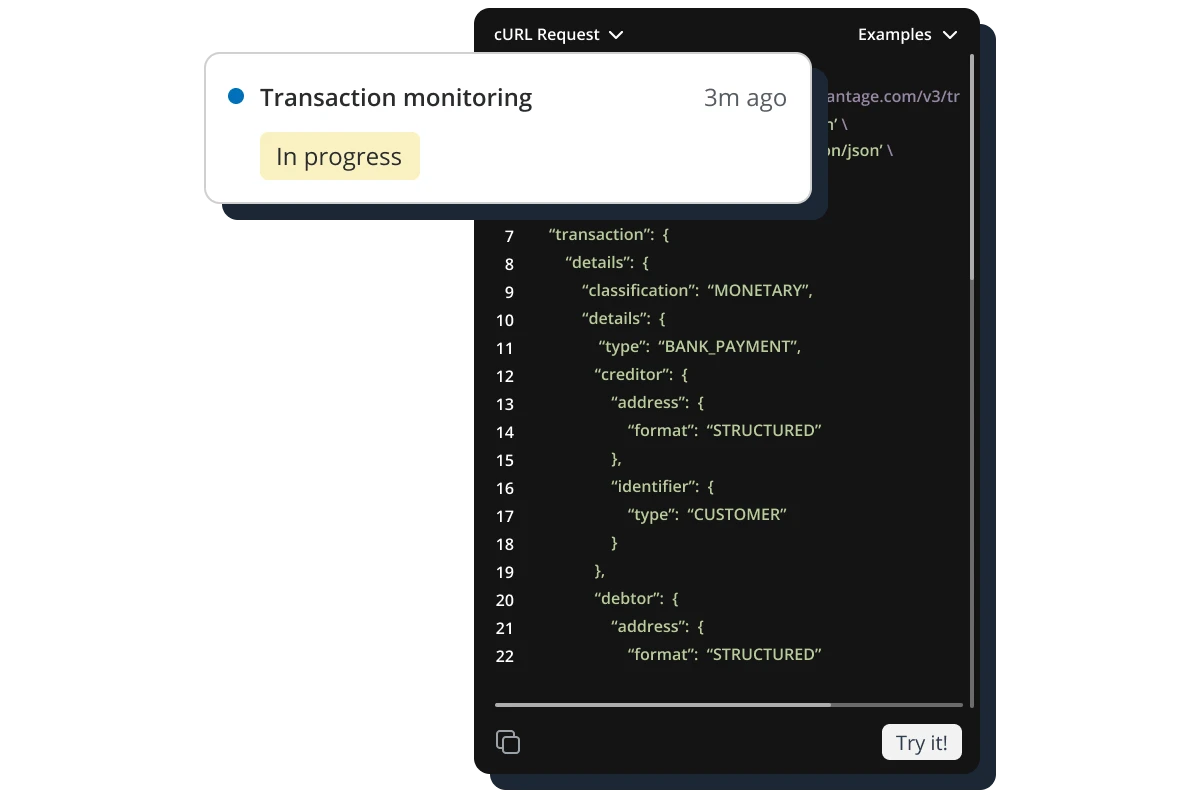

API-first architecture for enterprise scale

A resilient foundation built for rapid deployment and flexible control.

- Flexible integration: Access our full capabilities through our intuitive web interface or integrate directly into your ecosystem via a robust REST API.

- Rapid implementation: Deploy and maintain your system quickly with management interfaces designed for non-technical users, removing the need for specialist developer support.

- Hyper-scale performance: Process billions of transactions with sub-second latency and <20ms aggregation speeds on a foundation that supports continuous customer lifecycle management.

- Gold-standard security: ISO27001 and SOC2 Type II-compliant infrastructure with encryption and immutable audit trails by default.

Screening efficiencies you can measure

Reduction in false positives, helping teams focus on real financial crime risk.

Of alerts resolved autonomously by agents, enabling your team to scale without increasing headcount.

Daily messages processed on a unified platform built for hyper-scale and sub-second latency.

Billions of transactions monitored with sub-second response times.

Transaction Monitoring FAQs

The ComplyAdvantage API enables you to integrate your systems with our services to automate many of the functions available through the web user interface. Our API follows the REST convention and accepts and returns JSON data. View our API docs.

The transaction monitoring solution uses an advanced rules-based system to evaluate the AML/CTF risk of a transaction in real-time. These rules include:

- Simple rules: Rules that perform a check on the data within a transaction

- Aggregate Rules: Rules that track activity over multiple transactions (e.g., velocity rules)

- Behavioral Rules: Rules that compare with past activity (e.g., average transaction amount)

- Risk Pattern Rules: Rules that cross-reference activity against a known AML/CTF risk pattern

These rules are created and deployed during the implementation of your solution as this allows you to concentrate on the areas that will benefit your business the most (i.e., resolution of cases).

It is possible to select and export transaction data as a CSV file to use outside the ComplyAdvantage platform as needed. This contains all input data as well as additional output such as rule and alert information from the system.

Rules are completely customizable. Our transaction monitoring system can run on any data that you provide to us (data that is captured within a transaction). This not only allows the engine to detect suspicious scenarios specific to your financial institution but also allows the tool to speak in your language, using your own variables, codes, definitions, etc., that are unique to you.

Various factors will impact how you set your thresholds, including effective customer segmentation, statistical analysis, and – crucially – tuning. ComplyAdvantage’s implementation and success teams will review your data alongside their industry expertise to recommend changes over time.

The decision chain is our end-to-end workflow that manages an alert from the moment it is detected to its final resolution. It seamlessly connects our high-speed detection engine with AI agents and human analysts. In this chain, AI agents autonomously resolve 65-85% of routine false positives, while complex, high-risk patterns are instantly escalated to your expert team with full natural language reasoning and a transparent audit trail.

Ready to transform your transaction monitoring?

Move beyond legacy systems that create bottlenecks and false positives. Experience AI-native transaction monitoring that scales with your business growth while ensuring regulatory confidence.

Get a demoCategory-leading AML solutions

Our customers and financial services analysts all rate us as a category leader quarter after quarter.