Adverse Media

Streamline onboarding and ongoing customer monitoring

Onboard your customers quickly with confidence. Cut out noise with always-on global negative news monitoring and name commonness matching.

Accelerate onboarding and boost due diligence with always-on adverse media

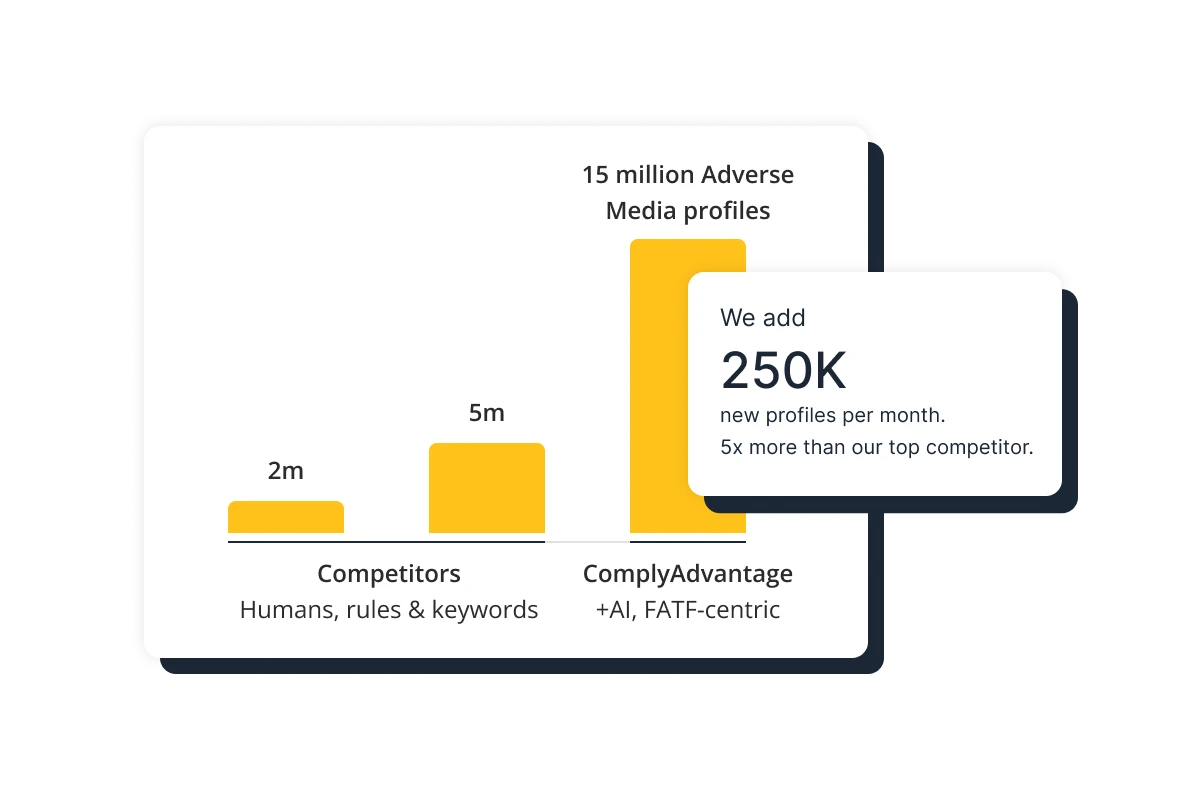

Effortlessly identify threats detected by multilingual machine learning models so your business can navigate with certainty. Build accurate counterparty profiles with a clear view of risks.

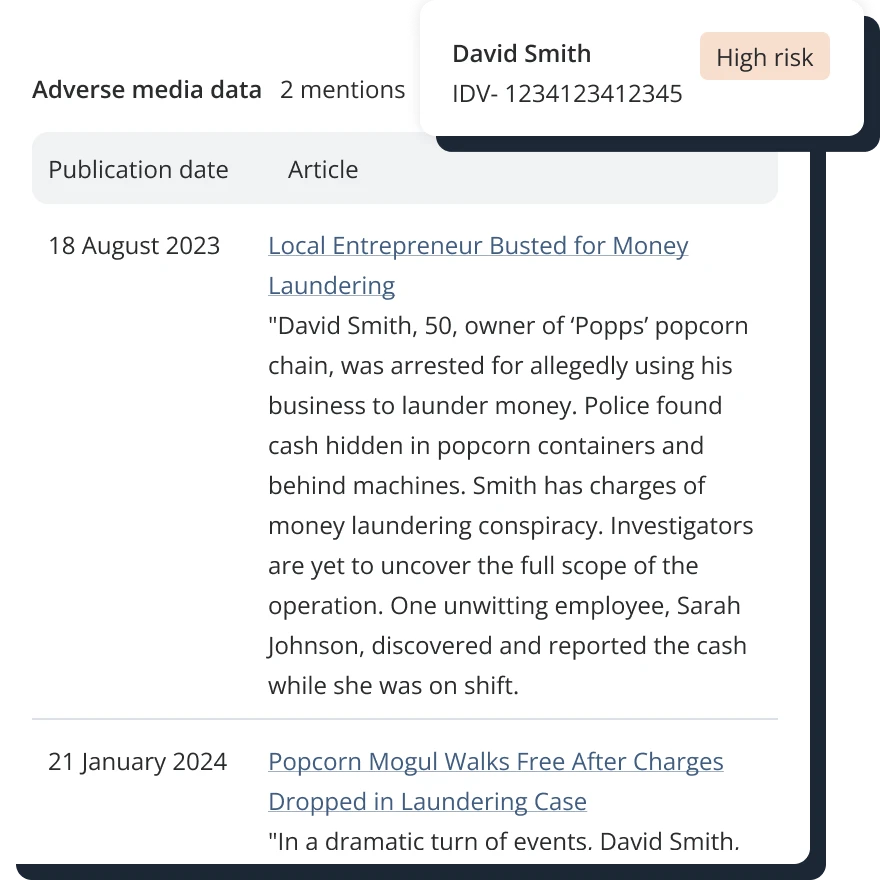

Access comprehensive, market-leading negative news coverage

- Get 7X more adverse media than the next best supplier; Every month, we add 5X more new profiles than the top supplier.

- Configure and optimize for high-volume, enterprise-ready operations with enhanced explainability.

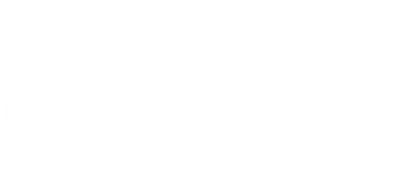

- Access expert-curated enriched profiles with insightful context – such as images, date of birth, location, and media articles with easy-to-read snippets.

Revolutionize your adverse media search and matching with gold-standard remediation decisions

- Ensure accuracy and surface hidden risks with unique entity resolution capabilities.

- Facilitate richer API integrations and faster remediations with a single consolidated view of risk.

- Make quicker decisions by filtering out irrelevant hits with contextualized data.

Continuously-evolving trusted global adverse media database

- Market-leading NLP models tackle the inefficiencies created by a keyword-based approach.

- Process adverse media in the native language using deep learning technology, curated and reviewed by financial crime experts.

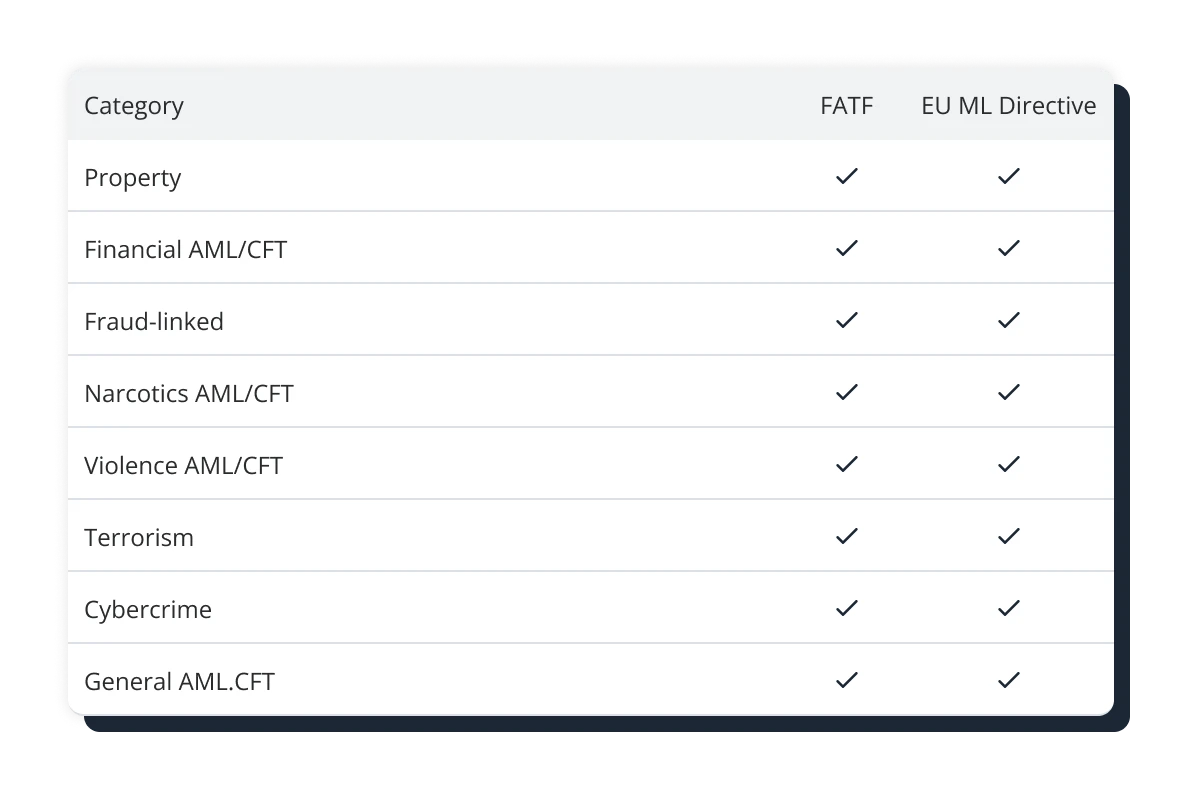

- Align with regulatory standards and uncover connections to predicate offenses with cutting-edge data-gathering technology.

Adverse Media FAQs

ComplyAdvantage’s adverse media solution looks at tens of millions of articles from sources, including international news websites, regional and local news sites, government websites, court judgments, and specialist blogs. These sites cover the globe and are processed by our machine learning models in multiple languages.

For a new source to be added to our adverse media coverage it must satisfy our internal assessment criteria, which include:

- The source should publish negative news articles that would help our clients identify risks related to financial crime.

- The source should not be found to propagate false information, conspiracies or satire.

- The source must publish its own material and not rely on syndicated content.

ComplyAdvantage periodically reviews the sources covered by our adverse media screening solution, to remove or rectify any sources which have closed down, merged or rebranded. New credible sources are added based on targeted improvements or feedback from our active client base of hundreds of financial companies.

Our adverse media data currently screens against over 11,000 verified national, regional, and local media sources across 200+ countries and territories.

Our adverse media data is updated every day, ensuring you have access to the latest information.

How we use AI to fight financial crime

At ComplyAdvantage, AI powers every stage of the financial crime risk management lifecycle, from onboarding and ongoing monitoring to remediation and reporting. Discover how our multi-layered, AI-driven approach boosts accuracy, reduces friction, and helps compliance teams move faster with confidence.

Learn moreStarter Plan

Category-leading AML solutions

Our customers and financial services analysts all rate us as a category leader quarter after quarter.