AML Transaction Screening

Screen all elements of a transaction for sanctions risk and hold payments in-flight until checks are complete.

We selected ComplyAdvantage as they share the same vision as us to use ‘compliance as a competitive advantage’, and they support our mission to develop dynamic rules tuned to specific inherent vulnerability scenarios, ultimately providing a better customer service while keeping the bad guys out of our global payments infrastructure. It’s great to know that we have a risk management solution designed to keep pace with our rapidly growing business demands.

AML Transaction Screening

Screen all elements of a transaction for sanctions risk and hold payments in-flight until checks are complete.

Speak to an AML specialist about your compliance needs

Monitor Hundreds of Connected Sanctions Lists Simultaneously

Effectively identify sanctions risk in all parts of the payment message including unregulated free reference text, by screening against a consolidated, near real-time database.

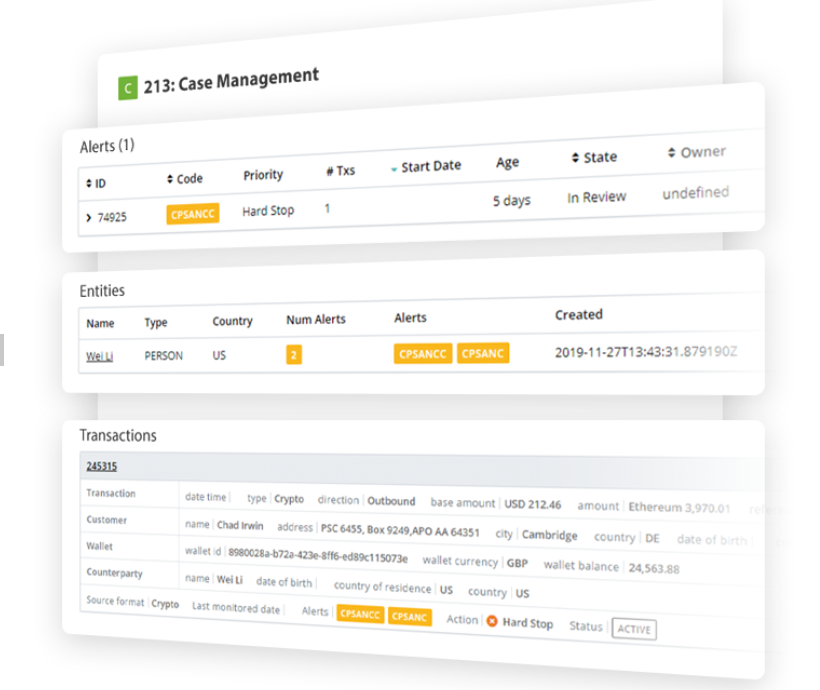

Faster Remediation, Fewer Alerts

All your transaction-based risks in one place. Review activity, manage alerts and meet the requirements of regulators, banking partners and auditors with a user-friendly interface and electronic audit trail.