Early Stage Start-Ups

Get award-winning AML and KYC tools for free

We’re helping early-stage start-ups to achieve the highest compliance standards. Our ComplyLaunch™ program gives start-ups free access to our AML and KYC solutions. Spaces are limited.

Apply Today.

Value to the customers

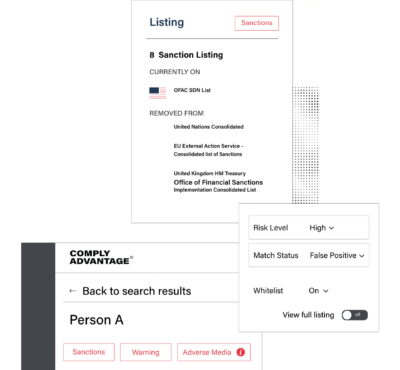

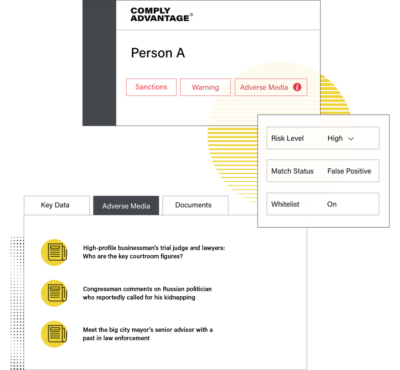

Award-winning data

Screen 5000 names for sanctions, politically exposed persons (PEPs), and relatives and close associates.

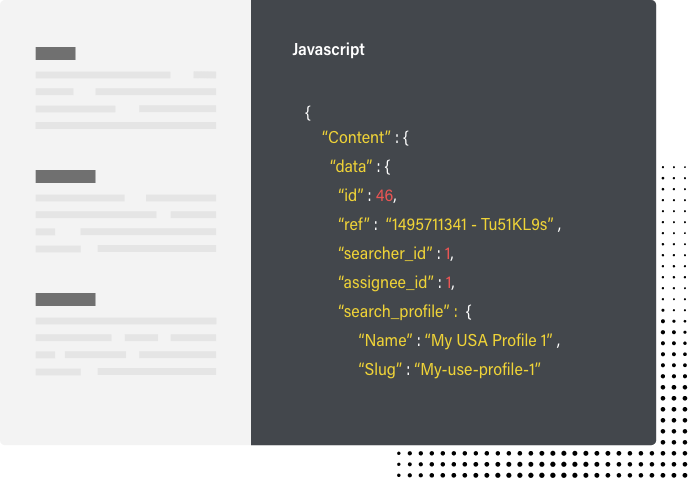

Seamless integration with your workflows

Our plug-and-play solutions are configurable and available in UI or API form, so they easily slot into your existing processes.

Automatic risk monitoring with alerts

Protect your business 24/7 with alerts if there are relevant changes in risk status. Integrate with a single API call.

Scale and security

Grow with confidence. All our products are built for scale and security, with RESTful APIs and ISO 27001 certification.