ComplyAdvantage Mesh

A single, AI-driven financial crime platform

A cloud-based compliance platform, ComplyAdvantage Mesh combines industry-leading AML risk intelligence with actionable risk signals to screen customers and monitor their behavior in near real time.

Manage financial crime risk on a single platform

ComplyAdvantage Mesh is an industry-leading and trusted SaaS-based risk intelligence platform that unites global intelligence to beat financial crime.

Differentiated by insights

ComplyAdvantage’s proprietary risk database powers its Mesh platform, delivering depth, reliability, and actionability across many data sources.

Enterprise-ready fincrime risk intelligence platform, enabling lower TCO

Explainable AI continuously trained on analyst decisions unlocking regulatory trust

Real-time fincrime risk intelligence layer

Highly configurable fincrime risk model

AI-powered search based on resolved profiles

Our sole focus is financial crime risk management

The powerful capabilities of Mesh

The platform centralizes exceptional capabilities usually duplicated across different segments of a financial crime program. It also helps build and seamlessly scale a truly integrated risk function that intelligently detects and enables prompt action in the most effective and efficient manner.

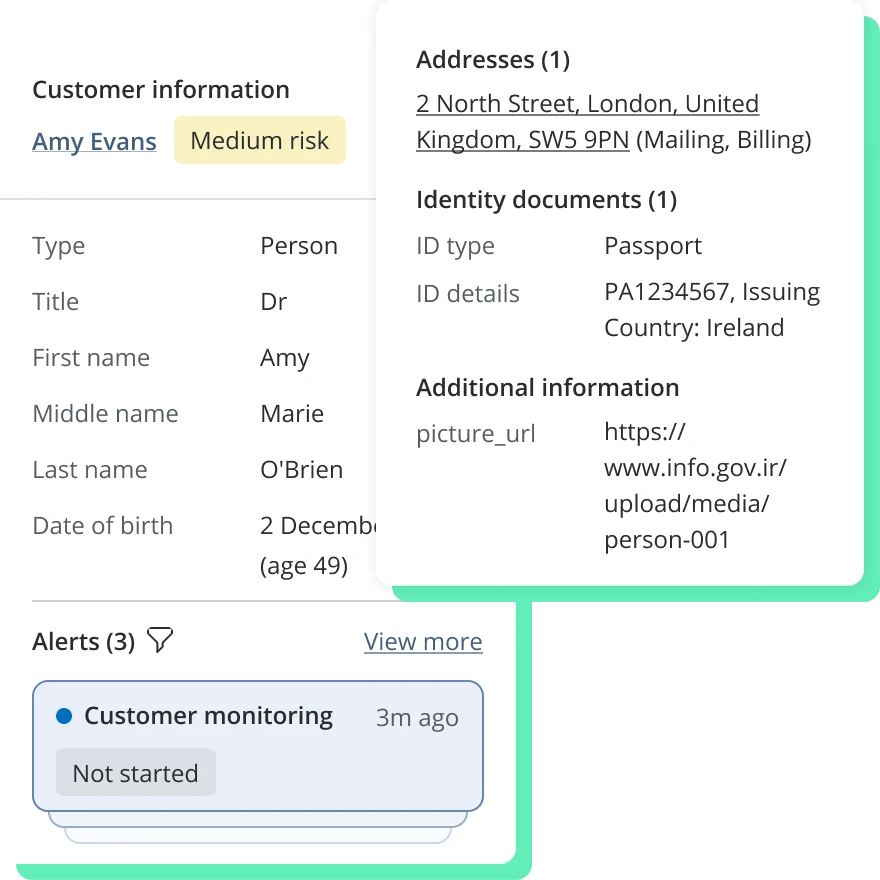

Case management

Efficiently manage alert reviews and investigations within the platform. Collaborate across teams and maintain a full audit trail, capturing when and why decisions are made.

- Streamline tasks with crucial information on one screen.

- Prioritize the highest-risk cases first.

- Access a comprehensive audit trail.

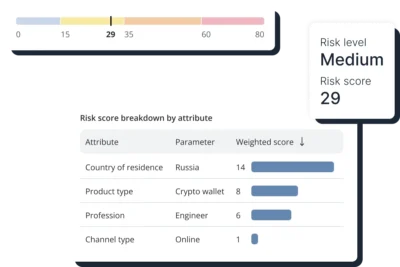

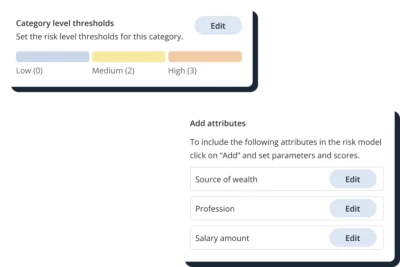

Risk scoring

Develop a data-driven understanding of every person or company.

- Automated risk scoring across customer and events.

- Fully configurable and dynamically updated customer risk scores and levels.

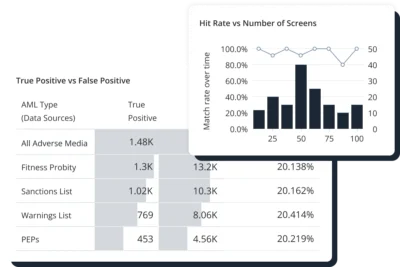

Insights

Gain visibility into key risk and performance metrics through interactive dashboards providing an overview of the compliance program’s effectiveness.

- Pre-configured business metric dashboards.

- Improve operational performance by monitoring customer and usage data in a single platform.

- Slice and download risk data by AML type, country, and customer risk level.

Security

ComplyAdvantage maintains comprehensive compliance certifications and attestations with bank-grade online security to ensure your data is managed and stored securely.

- SOC 2 Type II certified.

- ISO 27001 certification.

- GDPR aligned.

- Encryption at rest and in transit.

- Configurable role-based permissions.

Integration

Designed to be integrated lightning-fast with flexibility.

- Leverage APIs alongside existing platforms and processes.

- Real-time API, batch, and SFTP options.

- Development experience team to assist with best practices.

How we use AI to fight financial crime

At ComplyAdvantage, AI powers every stage of the financial crime risk management lifecycle, from onboarding and ongoing monitoring to remediation and reporting. Discover how our multi-layered, AI-driven approach boosts accuracy, reduces friction, and helps compliance teams move faster with confidence.

Learn moreCategory-leading AML solutions

Our customers and financial services analysts all rate us as a category leader quarter after quarter.