A Guide to AML for Australian FinTechs

Uncover the core compliance responsibilities that arise from Australia’s AML/CTF regime and how FinTechs should respond using a risk-based approach.

Download the guideAs a long-term member of the Financial Action Task Force (FATF), Australia’s anti-money laundering and combatting the financing of terrorism (AML/CFT) regulatory framework seeks to align with the recommendations laid out by the agency.

These recommendations require governments to:

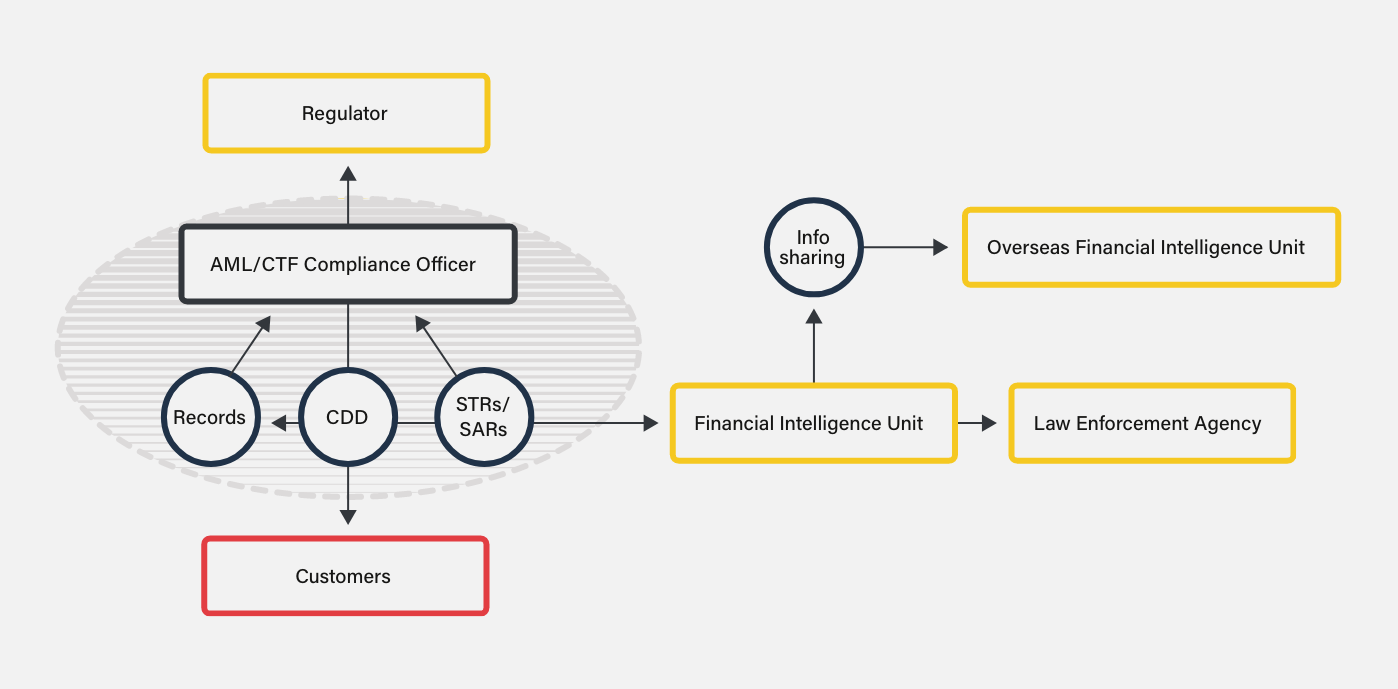

Commonly, this creates an AML/CTF ecosystem shown in a simplified form in the diagram below.

Australia’s AML regulations were initially implemented as a direct response to two Royal Commissions that exposed the relationship between money laundering, fraud, major tax evasion, and organized crime in the 1980s. The Costigan and Stewart Royal Commissions identified the need for legislative strategies to address these growing issues, which led to Australia’s primary AML legislation, the Financial Transaction Reports Act 1988 (FTR Act).

Australia’s FTR Act now operates alongside the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF Act), establishing the country’s compliance framework alongside:

However, in light of the FATF’s Mutual Evaluation Report (MER) of Australia in April 2015, the country’s AML/CFT framework is currently undergoing a long-term overhaul. According to the MER, Australia’s approach:

As part of the reform process, a statutory review by the Australian Attorney General made various recommendations, which have subsequently become known as “Tranche 1.5” and “Tranche 2.” The AML/CTF and Other Legislation Amendment Act 2020 and the AML/CTF Increased Transparency Bill have also been proposed to provide more scope for information sharing around suspicious activity and between the public and private sectors and introduce a Beneficial Ownership (BO) registry.

Uncover the core compliance responsibilities that arise from Australia’s AML/CTF regime and how FinTechs should respond using a risk-based approach.

Download the guideOriginally published 15 September 2022, updated 16 September 2022

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).