How to Combine Talent and Tech to Build an Efficient AML Compliance Function

Download the report to explore how firms can optimize their investments in technology and talent across their fraud and AML programs.

Download Your CopyThe fourth Financial Action Task Force (FATF) plenary under the two-year Singapore Presidency of T. Raja Kumar took place at the FATF headquarters in Paris on October 25-27, 2023.

We’ve summarized the key developments – read on or click below to jump to a particular section:

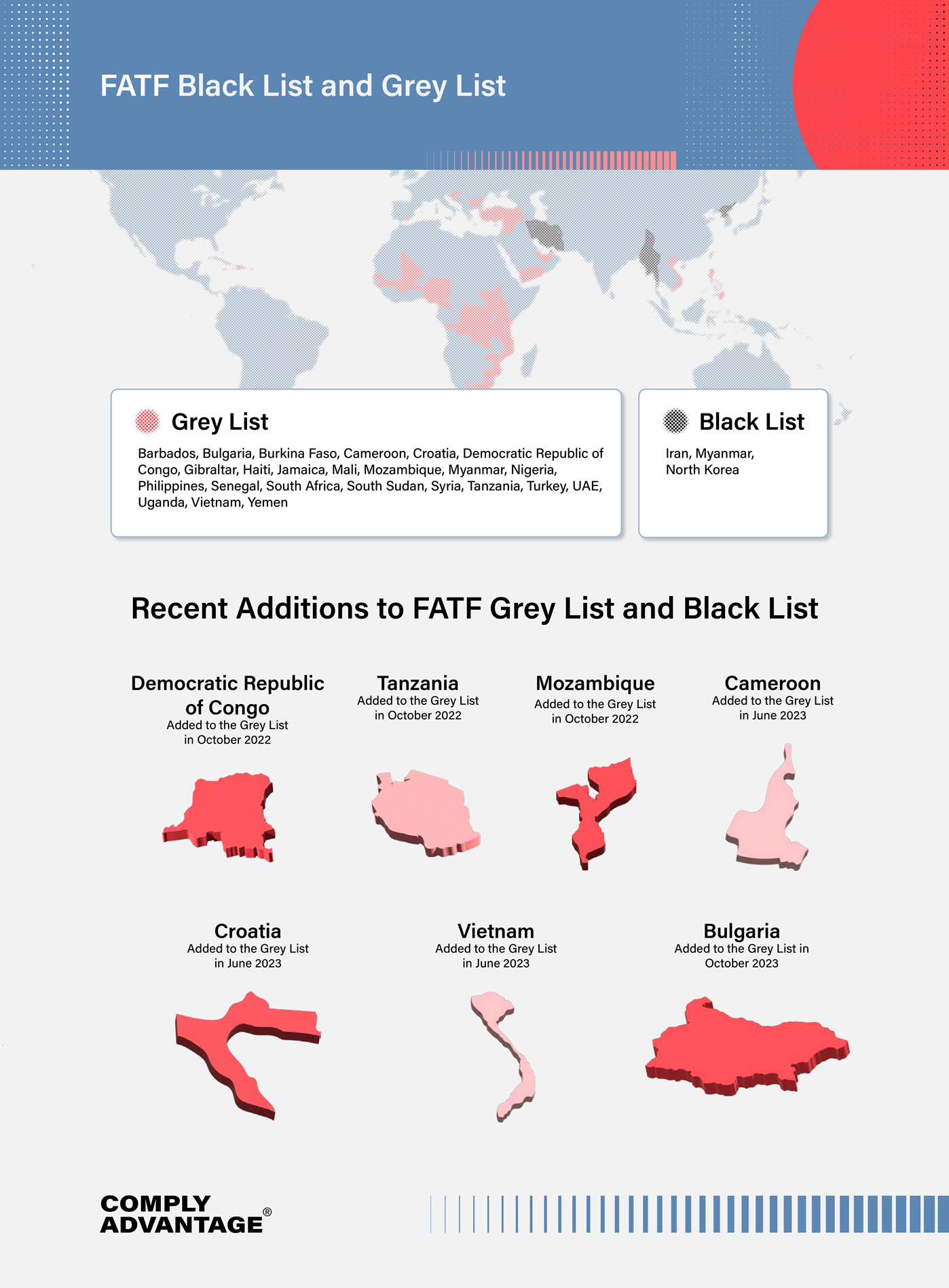

At the plenary, the FATF noted that Bulgaria had made progress on recommendations listed in its 2022 mutual evaluation report (MER) to improve international cooperation. However, the watchdog highlighted several areas of Bulgaria’s AML/CFT regime that required strengthening, leading to the country being subject to increased monitoring and a ten-point action plan. Standouts include:

Bulgaria’s addition to the grey list follows a season of high-profile cases involving the misuse of EU funds by Bulgarian politicians, the implementation of Magnitsky sanctions on corrupt Bulgarian officials by the Office of Foreign Assets Control (OFAC), and a multi-billion dollar cryptocurrency pyramid scheme. Firms operating in Bulgaria may choose to conduct a thorough risk assessment to consider various factors, including:

In February 2020, Albania was added to the grey list and subjected to increased monitoring by the FATF due to deficiencies in its AML/CFT regime. The FATF recommended actions including:

Since 2020, Albania made commendable efforts to improve its AML/CFT framework, resulting in a significant increase in money laundering cases prosecuted, especially those involving foreign criminal proceeds laundered in Albania. As a result, Albania has been removed from the grey list.

In February 2021, the Cayman Islands was added to the grey list due to deficiencies related to “sanctions on financial institutions for anti-money laundering breaches” and a lack of “up-to-date beneficial ownership information.” While the Cayman Islands’ Technical Compliance assessment in 2021 rated the jurisdiction as compliant or largely compliant with 39 out of the 40 FATF Recommendations, the evaluation also outlined 63 action points aimed at improving overall effectiveness.

At the October 2023 plenary, the FATF highlighted the Cayman Islands’ substantial progress in enhancing the effectiveness of its AML/CFT framework, particularly in proportionately applying sanctions, resulting in the watchdog removing it from the grey list.

In its 2019 MER, multiple deficiencies in Jordan’s AML/CFT framework were identified, including:

While the country amended its anti-terror and money laundering law in June 2021, it came into effect after the FATF’s deadline, contributing to the body’s decision to subject Jordan to increased monitoring in October 2021.

However, at the FATF’s October 2023 plenary, the watchdog highlighted the progress made by the country in addressing these deficiencies, leading to its removal from the grey list.

Panama was originally added to the grey list in 2014 but removed in 2016 after amending its laws to address the deficiencies in its money laundering framework, including laws targeting designated non-financial businesses and professions (DNFBPs). However, the country found itself back on the grey list in 2019 when it failed to adopt key pieces of legislation, including criminalizing tax fraud and making tax crime a predicate offense for money laundering. Panama made significant efforts to address these deficiencies, leading to the FATF removing it from the grey list in October 2023.

The FATF also welcomed Indonesia as its 40th member, placing the country on equal footing with other G20 countries and improving international trust in Indonesia’s financial integrity. Ivan Yustiavandana, Head of the Indonesian Financial Transaction Reports and Analysis Center (PPATK), said this membership will increase Indonesia’s economic credibility and positive perception of its financial system, which will influence economic growth through investment.

Discussions also centered around the Russian Federation’s suspended membership, which still remains in effect.

The FATF also discussed multiple strategic initiatives ranging from improving asset recovery and BOI information to helping public and private sector entities better identify potential terrorist financing activity via crowdfunding.

Echoing Kumar’s objectives presented at the June 2022 plenary, the FATF highlighted its aim to prioritize asset recovery to tackle money laundering and terrorist financing. Globally, countries recover only a fraction of the assets generated by criminal activity, fueling further criminal activity. The FATF has previously led efforts to strengthen legal and operational frameworks for asset recovery, including introducing non-conviction-based confiscation regimes. The revised standards aim to bring about a cultural shift to make asset recovery a core component of crime prevention. The FATF will adjust its assessment methodology to account for the changes in recommendations, and the updated Recommendations will be published in November 2023.

The FATF also announced that it has analyzed the Asset Recovery Inter-Agency Network (ARIN) model – international or regional networks that unite law enforcement and judicial practitioners who work towards tracing, freezing, seizing, and confiscating assets. In an upcoming report, the watchdog said it would outline recommendations for closer collaboration with ARINs to help investigators and prosecutors follow the money and recover assets in transnational crime cases. This report will also be published in November 2023.

As part of the FATF’s focus on protecting NPOs from terrorist financing abuse, the watchdog revised one of its recommendations. The revisions clarify that recommendation eight only applies to NPOs that fall within the FATF definition. Countries must identify the types of organizations within the definition and assess their risks. The revised recommendation aims to prevent undue disruption or discouragement of legitimate charitable activities. Countries in the global network will be assessed against these revised standards without disrupting legitimate charitable activities. The updated recommendations will be published in November.

The FATF also updated its best practices paper to reflect the changes made to Recommendation 8 and help stakeholders implement the revised requirements more effectively. The paper serves as a guide for the non-profit sector, protecting NPOs from terrorist financing abuse without hindering legitimate charitable activities. With the revisions, the FATF has made its standards clearer and more aligned with the risk-based approach (RBA). The best practices paper will be published in November.

Kumar also announced the release of a new report (published on October 31) that analyzes how terrorists exploit crowdfunding platforms. It discusses the challenges faced in detecting and preventing terrorist financing in the crowdfunding ecosystem, citing the complexity of crowdfunding operations, the use of anonymizing techniques, and the lack of expertise within the industry to detect suspicious activity.

The report suggests good practices such as:

It also provides a list of risk indicators that can help public and private sector entities, as well as the general public, identify potential attempts at terrorist financing activity via crowdfunding. Some of these risk indicators include:

In partnership with the Egmont Group and INTERPOL, the FATF also identified strategies to combat cyber-enabled fraud, including:

A report highlighting these strategies and risk indicators will be published in November.

Citizenship and residency by investment (CBI/RBI) programs are initiatives that grant citizenship or residency to foreign investors. Although they stimulate economic growth, they also come with significant risks of money laundering, fraud, and other misuse. A joint project by the FATF and the Organisation for Economic Co-operation and Development (OECD) highlights how criminals can exploit CBI programs and proposes measures to manage these risks. Due to be published in November, the report will emphasize the importance of multi-layered due diligence and clearly define the roles and responsibilities of all parties involved in RBI/CBI programs to detect fraudulent activities.

During the plenary, the FATF amended the methodology for upcoming mutual evaluations that guide assessment teams in determining the effective implementation of updated beneficial ownership and transparency requirements.

The revised methodology will be published in November. The watchdog also announced the development of updated risk-based guidance on beneficial ownership and transparency of legal arrangements to help stakeholders assess and mitigate money laundering and terrorist financing risks. The plenary agreed to release the revised guidance for public consultation and expects to finalize this work during its February 2024 session.

Finally, the FATF approved Brazil’s MER for compliance with AML/CFT and counter-proliferation financing measures. According to the watchdog’s review, Brazil has shown improvement since the last assessment in 2010, with strong international cooperation, risk assessment, and policy coordination. However, cooperation and coordination between certain authorities were noted as still requiring improvement, and the prosecution of money laundering needs enhancement. A report on the subject will be published by December after completing the quality and consistency review.

The next FATF plenary is due to take place in February 2024.

Previous plenary coverage from ComplyAdvantage can be found here:

Download the report to explore how firms can optimize their investments in technology and talent across their fraud and AML programs.

Download Your CopyOriginally published 01 November 2023, updated 12 February 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).