The European Union (EU) is embarking on its most significant financial crime legislative reform in over a decade, with its new Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) legislative package is set to reshape compliance across the bloc.

The impact of these regulations on how financial institutions identify and manage politically exposed persons (PEPs) is profound. This article breaks down the context for this regulatory update, the key changes to PEP definitions and requirements, and how ComplyAdvantage can help you proactively address your PEP risks and ensure your compliance framework remains robust.

What is the purpose of the EU Single Rulebook?

For years, the EU’s AML/CFT framework was primarily based on the Anti-Money Laundering Directives (AMLD). These directives required each EU member state to transpose the rules into their own national law, inevitably leading to fragmented interpretation, varied implementation dates, and regulatory loopholes.

The new legislative package, which includes Regulation (EU) 2024/1624 (the Anti-Money Laundering Regulation or AMLR), fundamentally changes this approach. It aims to create a unified, robust, and watertight defense against financial crime across the entire EU.

Key elements of the package are:

- Regulatory harmonization: The AMLR establishes a Single Rulebook – a uniform set of rules that apply directly across all 27 member states without the need for national transposition. This mandates consistency and eliminates much of the jurisdictional arbitrage that existed previously.

- A new AML regulator: The package establishes the Anti-Money Laundering Authority (AMLA), headquartered in Frankfurt. AMLA will be the EU’s central supervisor, ensuring consistency and direct enforcement for the highest-risk financial institutions.

- Implementation timeline: The AMLR is scheduled to apply from July 10, 2027. While this may seem distant, the scale of change requires immediate preparation and data remediation.

What are the changes to PEP regulations?

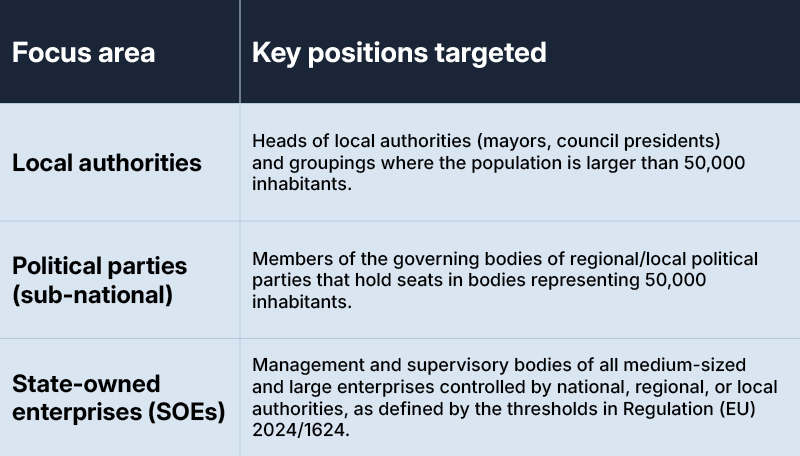

The AMLR harmonizes the prominent public functions that qualify an individual as a PEP. The new definition expands coverage significantly, with two major categories requiring immediate attention from regulated entities: sub-national and local officials, and state-owned enterprises (SOEs).

Extended coverage for sub-national and local officials

The AMLR explicitly introduces new thresholds for local and regional PEPs, ensuring greater scrutiny of officials who manage significant public funds and contracts.

The new definition now explicitly includes:

- Heads of local authorities, including groupings of municipalities and metropolitan regions, with at least 50,000 inhabitants.

- Heads of regional authorities (e.g. governors or presidents of regions).

- Members of the governing bodies of political parties that hold seats in national, regional, or local executive or legislative bodies representing constituencies of at least 50,000 inhabitants.

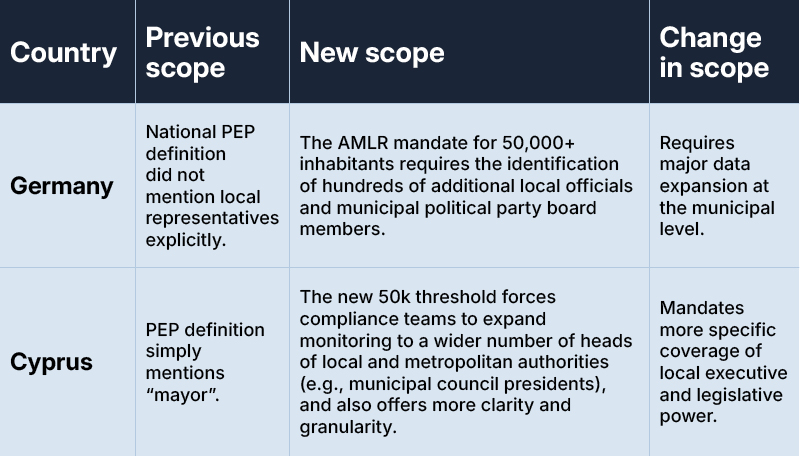

This table demonstrates some examples of the impact of the new regulation on existing national PEP definitions:

Broadened definition of state-owned enterprises (SOEs)

The regulation also expands the scope of who qualifies as a PEP in the context of state-controlled entities.

The focus is now on members of the administrative, management or supervisory bodies of enterprises that qualify as medium-sized or large undertakings (based on specific EU accounting thresholds) where those enterprises are controlled by the state, or by regional authorities.

This shift means that entities that might not have been traditionally viewed as high-risk SOEs – but are large enough to meet the financial criteria – will now trigger PEP status for their management and supervisory boards. Specifically, enterprises controlled by regional or local authorities must meet at least two of the following thresholds (as defined by Regulation (EU) 2024/1624) to qualify as medium-sized, or exceed at least two of them to qualify as a large undertaking:

- 250 employees on average.

- €40 million net turnover.

- €20 million balance sheet total.

This requires a granular assessment of both the control relationship and the size of the entity.

How ComplyAdvantage is addressing these changes

Our mission is to ensure your compliance program stays ahead of regulatory change. We have been actively mapping the requirements of Regulation (EU) 2024/1624 against our existing EU PEP database coverage and have invested resources to understand how the new PEP requirements map against existing national legislation for all EU countries.

We are executing a focused, multi-year roadmap, extending until 2027, to fully integrate the new EU PEP requirements into our screening data. By mapping these specific jurisdictional gaps and implementing targeted data collection for the new 50k threshold and the expanded SOE definitions, we will ensure our clients will be fully compliant before the regulation comes into force on July 10, 2027.

This is a regulatory and technical shift requiring strategic planning, and our team is here to support you in building real-time, highly accurate PEP screening capabilities as part of a robust AML compliance framework.

An easier way to manage PEP red flags

Enhance your PEP coverage at scale with more accurate data, deeper insights, and automated workflows.

Get a demoOriginally published 11 December 2025, updated 12 January 2026

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2026 IVXS UK Limited (trading as ComplyAdvantage).