Improve Your Operational Efficiency with ComplyAdvantage

Book a meeting with our team to find out more about how our AML and fraud detection solutions can help your business make smarter decisions about its financial crime risks - fast.

Request demoE-money institution (EMI) Payset offers diverse payment solutions, from multi-currency accounts and B2B wallets to currency exchanges and – soon – debit cards. Established in 2018, the company aims to bring financial services up to speed with modern business requirements by mitigating the challenges associated with cross-border transactions and currency exchange.

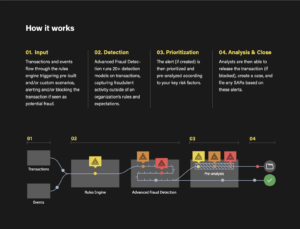

To combat evolving threats associated with the various sectors Payset serves, the company needed a transaction monitoring solution to evaluate risks associated with a client’s account and specific transactions. Additionally, the solution would need to perform pattern-level analysis across a range of data sets and timelines simultaneously and be able to immediately suspend all movement of funds on a client account as required.

“To better identify suspicious activity and understand the complete flow of illicit funds, we required a solution that would allow us to view and assess previously unseen connections between different accounts. We also wanted the ability to instantly ‘blacklist’ specific counterparties and their external bank accounts to prevent them from being used in future transactions by the same and other clients.”

– Adam Mackulin, Head of Compliance & MLRO at Payset

After partnering with ComplyAdvantage, Payset’s in-house development team collaborated with their appointed implementation manager to integrate the company’s data into its new transaction monitoring platform seamlessly. Following this, Payset was able to utilize ComplyAdvantage’s sandbox environment, where real-life transaction monitoring data could be screened to ensure any proposed changes were effective before altering the configuration of the live platform. Once live, Payset’s dedicated customer success manager provides ongoing expert guidance, ensuring compliance operations are aligned with wider business goals.

In addition to the quick and efficient implementation process, Payset partnered with ComplyAdvantage due to its wide-ranging transaction monitoring rules library. The compliance team could deploy these individually and collectively within the company’s designated customer risk segments, meaning Payset can now take more of a risk-based approach in its analysis of transaction monitoring data.

“The friendly and accommodating technical support team is another reason we partnered with ComplyAdvantage. Our dedicated account manager has taken the time to really understand our business and what we are trying to achieve. They always go above and beyond in responding quickly and effectively to any queries or issues we may have.”

– Adam Mackulin, Head of Compliance & MLRO at Payset

With ComplyAdvantage’s Fraud Detection solution, Payset is now able to more effectively handle scenarios that pose a particular threat in light of the company’s offerings and the sectors it serves. These include:

Mackulin also noted the solution’s capability to detect transactions inconsistent with a customer’s risk profile, stated business model, and flow of funds presented during the onboarding stage. By implementing ComplyAdvantage’s advanced behavioral analytics, Payset can detect unexplained and inconsistent account activity and map out associations between multiple client accounts and counterparties.

With ComplyAdvantage, Payset has experienced an improvement in the efficiency and effectiveness of its compliance team. In keeping with the company’s risk-based approach to compliance, the transaction monitoring alert process has allowed Payset analysts to prioritize and focus on the cases that require the most immediate and detailed attention. “We can now easily identify tasks and assign which ones need to be analyzed live or in retrospect,” said Mackulin.

Additionally, thanks to ComplyAdvantage’s built-in report generation and data analysis tools, Payset can quickly summarize and assess its performance against various metrics. This information is then incorporated into the company’s senior management discussions to inform future strategy and decision-making.

Looking forward, Payset can update its platform in keeping with its ever-evolving transaction monitoring processes and working procedures. As the company’s client numbers and transaction volumes continue to grow, Payset is confident it has invested in a scalable solution and a long-standing partnership that will grow and adapt in tandem.

Book a meeting with our team to find out more about how our AML and fraud detection solutions can help your business make smarter decisions about its financial crime risks - fast.

Request demoOriginally published 22 June 2023, updated 19 April 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).