Integration

API-first integration that empowers businesses to connect core tech stacks seamlessly and securely.

- API-first, modular architecture, and a comprehensive API ensure a clean integration with existing operational workflows.

- Developer-centric experience delivered through comprehensive integration guides, and examples.

- Enterprise-ready scale and reliability fit for all mission-critical use cases.

API-first, flexible integration suitable for all tech stacks

ComplyAdvantage offers a choice of integration methods – API, SFTP, or via our web interface.

API-first: A comprehensive and modular API

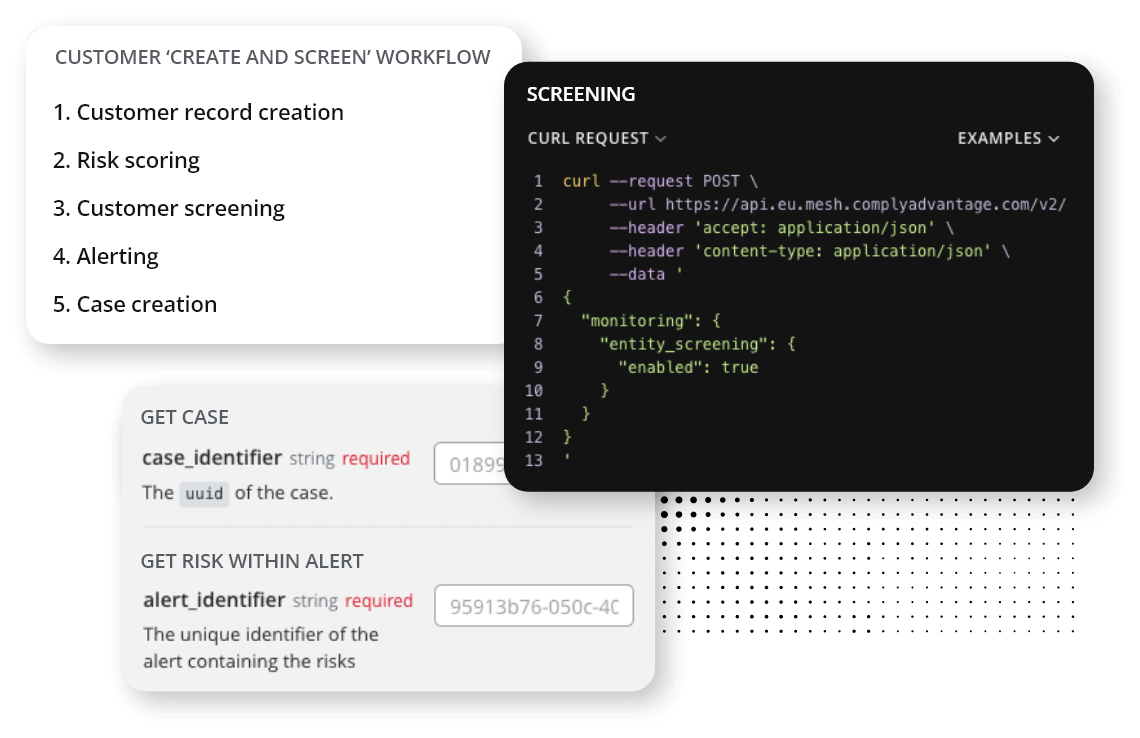

- Avoid high-risk big bang migrations. Our modular and granular REST API allows ComplyAdvantage Mesh to operate as your complete compliance stack or as a component within your wider compliance ecosystem.

- Integrate ComplyAdvantage Mesh with your payments or core banking platforms however you need. A range of integration mechanisms, including real-time synchronous API, asynchronous webhook-enabled flows, and batch upload, including SFTP, make this possible.

- Easily extract your compliance data for downstream processes and reporting.

Developer-centric: All the resources you need in a single place

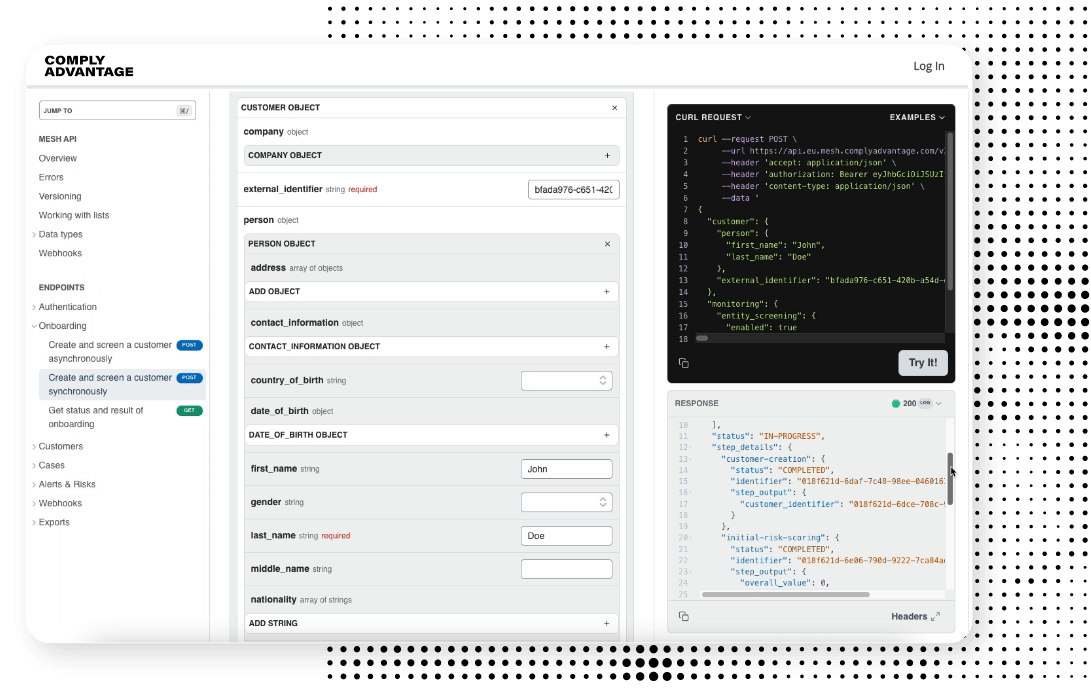

- Get started quickly using comprehensive and interactive API documentation.

- Build upon reference integrations suited to your use case and download code examples directly from our documentation in the language of your choice.

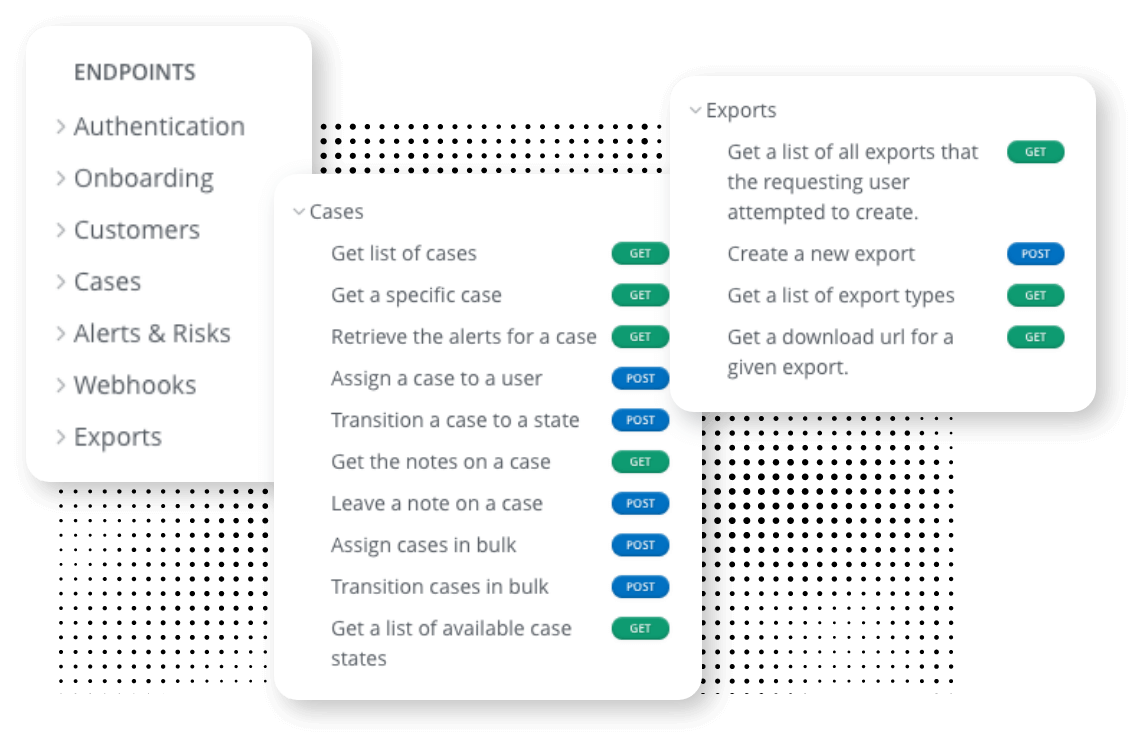

- RESTful endpoints following standard conventions.

Enterprise-grade integration: Scale and reliability fit for all mission-critical use cases

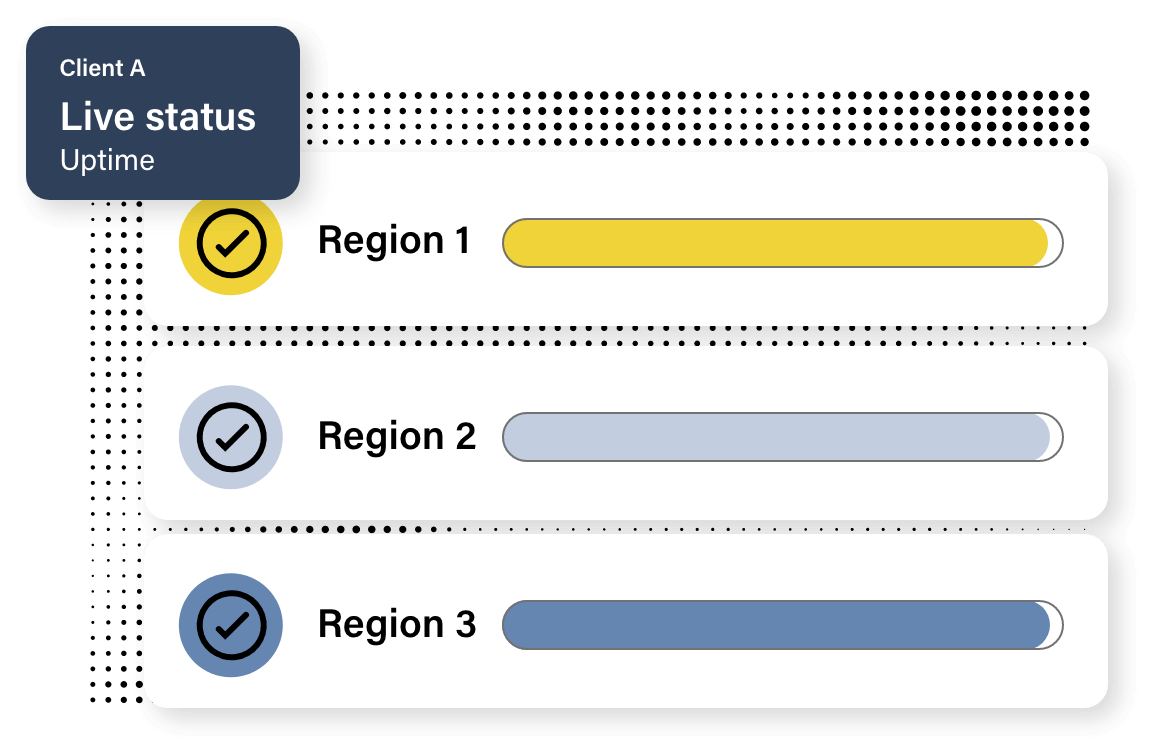

- Leverage a scalable, highly available, secure API that empowers some of the world’s largest enterprises.

- Ensure business continuity for mission-critical use cases with the high availability offered by ComplyAdvantage Mesh.

- Accelerate your payment network with real-time, low-latency integration pathways.

ComplyAdvantage Mesh API allows you to automate a range of case management activities. These include accessing a list of cases, pulling a specific case, retrieving case alerts, assigning cases, transitioning cases in bulk, and a lot more. Refer to the ‘Cases’ section under ‘Endpoints’ in the API documentation.

Yes. ComplyAdvantage Mesh API allows you to edit screening configurations via the API.

The ComplyAdvantage Mesh API is a REST API that follows the OpenAPI specification. This means it offers a standardized interface, making integration with your systems easier.

ComplyAdvantage Mesh’s API-first architecture delivers unparalleled flexibility. Every feature within the platform is accessible via our robust API, enabling seamless integration across diverse use cases, from real-time payment flows to high-volume customer screening. Additionally, ComplyAdvantage Mesh’s webhook support ensures real-time notifications and updates, streamlining integration with your existing systems and workflows.

ComplyAdvantage Mesh prioritizes security and ease of use. It employs OAuth2, an industry-standard protocol, for robust API authentication. Additionally, Mesh integrates with your company’s Single-Sign-On (SSO) system for streamlined user access and offers Multi-Factor Authentication (MFA) as an extra layer of protection.