Customer Screening

Accelerate growth with real-time risk intelligence and agentic automation

Transform compliance into a competitive advantage. Onboard customers faster and reduce false positives with AI-powered entity resolution and global risk data that scales with your business without scaling costs.

Full-stack agentic efficiency that transforms compliance operations

Customer Screening on Mesh combines AI-enhanced risk intelligence, flexible screening parameters, and real-time updates, giving you the power to identify risks without compromising the customer onboarding experience.

AI is built into every layer of our platform, from enriched data ingestion to dynamic risk scoring. Agentic capabilities automate remediation, so your team spends less time clearing noise and more time tackling true threats.

Lightning-fast data intelligence with global coverage

Protect your business with the market’s fastest risk updates, powered by our own global intelligence.

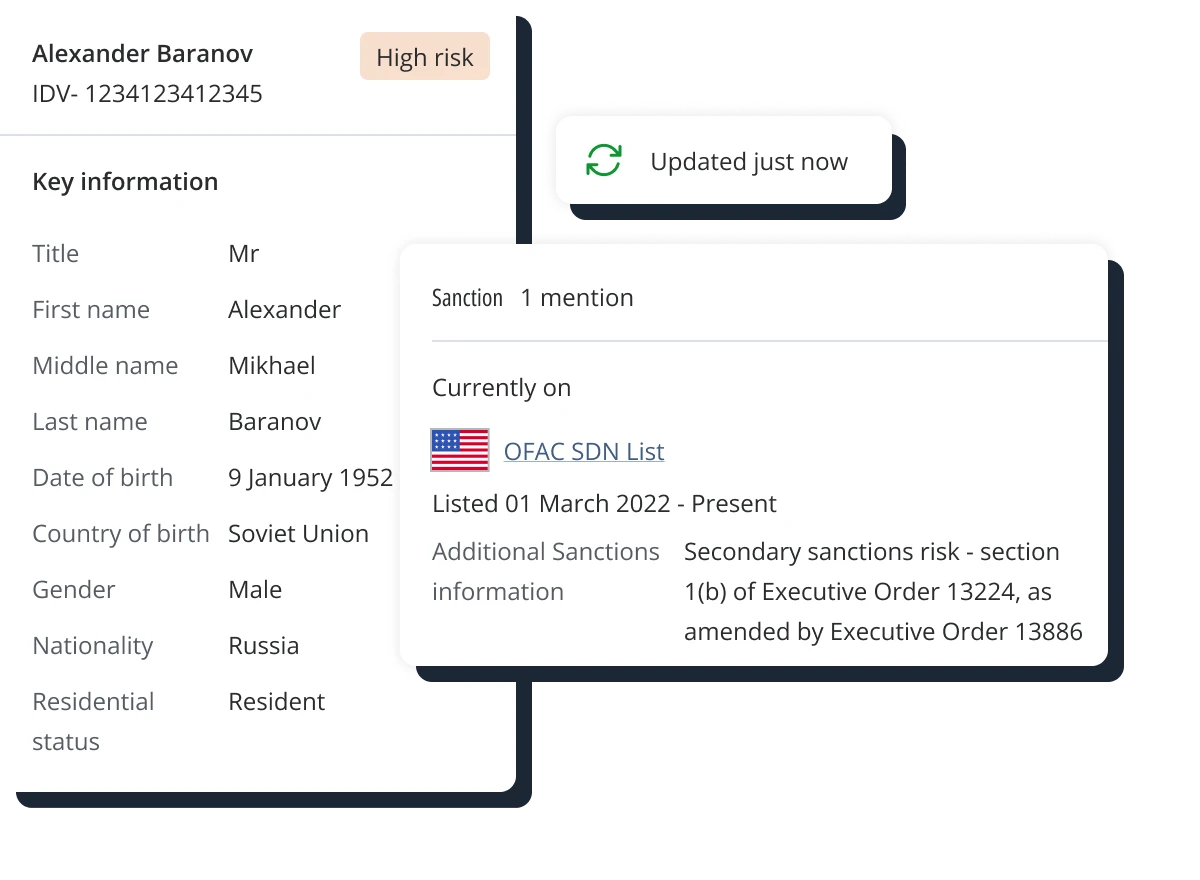

- Sanctions updates in minutes: Changes to global sanctions lists are available within minutes vs. days for competitors, ensuring you never miss a critical regulatory change.

- Daily PEP monitoring: Maintain continuous visibility with real-time tracking of political exposure changes across global databases.

- Real-time adverse media: 10M+ pages processed daily using deep learning to build comprehensive risk profiles that uncover hidden threats.

- Intelligent entity resolution: Automatically connect fragmented identity data across multiple jurisdictions and systems to reveal the true risk behind every customer.

- Single-source data integrity: By controlling the entire ingestion and enrichment process, we ensure data is categorized to meet specific jurisdictional regulatory needs, not just broad categories, and flexes with you as you grow.

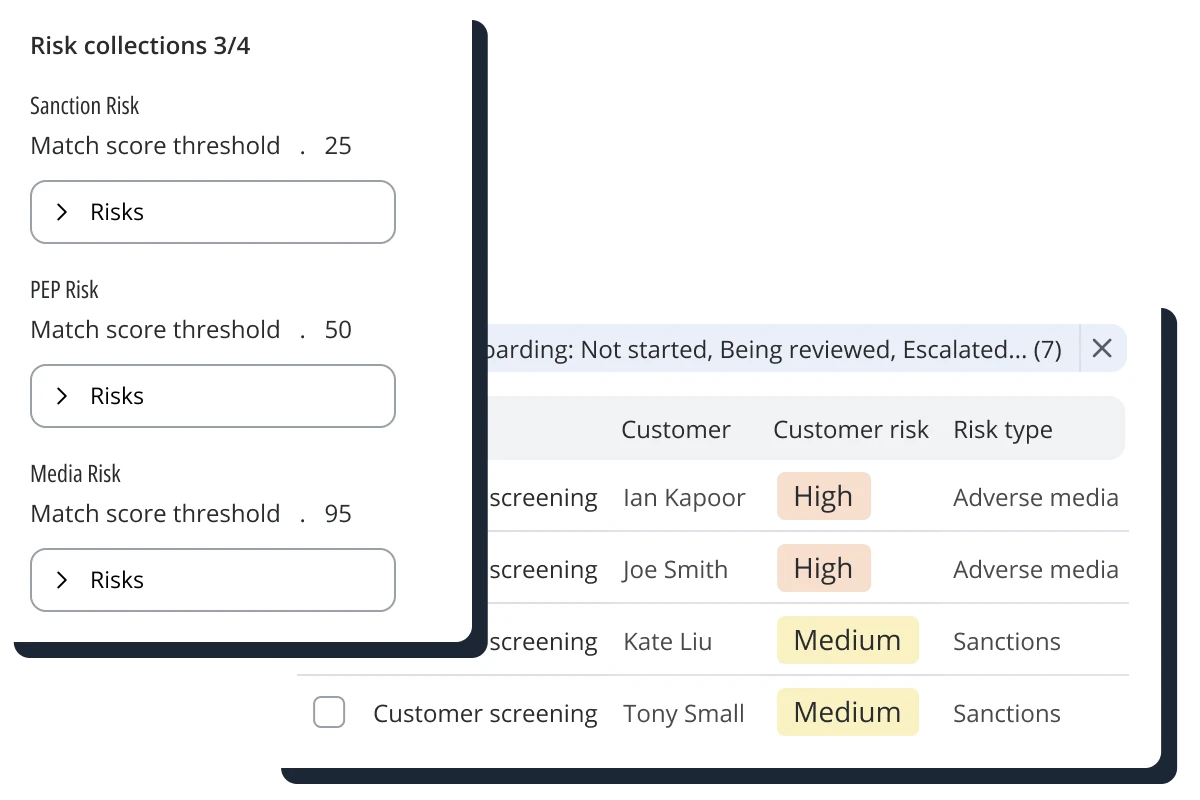

Flexible screening configurations that match your risk policies

Maximize efficiency with dynamic risk models and full customization.

- Risk-based parameters: Set screening thresholds tailored to customer segments, geography, or business lines.

- Custom screening logic: Define which sources apply to different entity types or onboarding scenarios.

- Transparent methodology: Clear breakdowns of risk score components for audit trails and regulatory confidence.

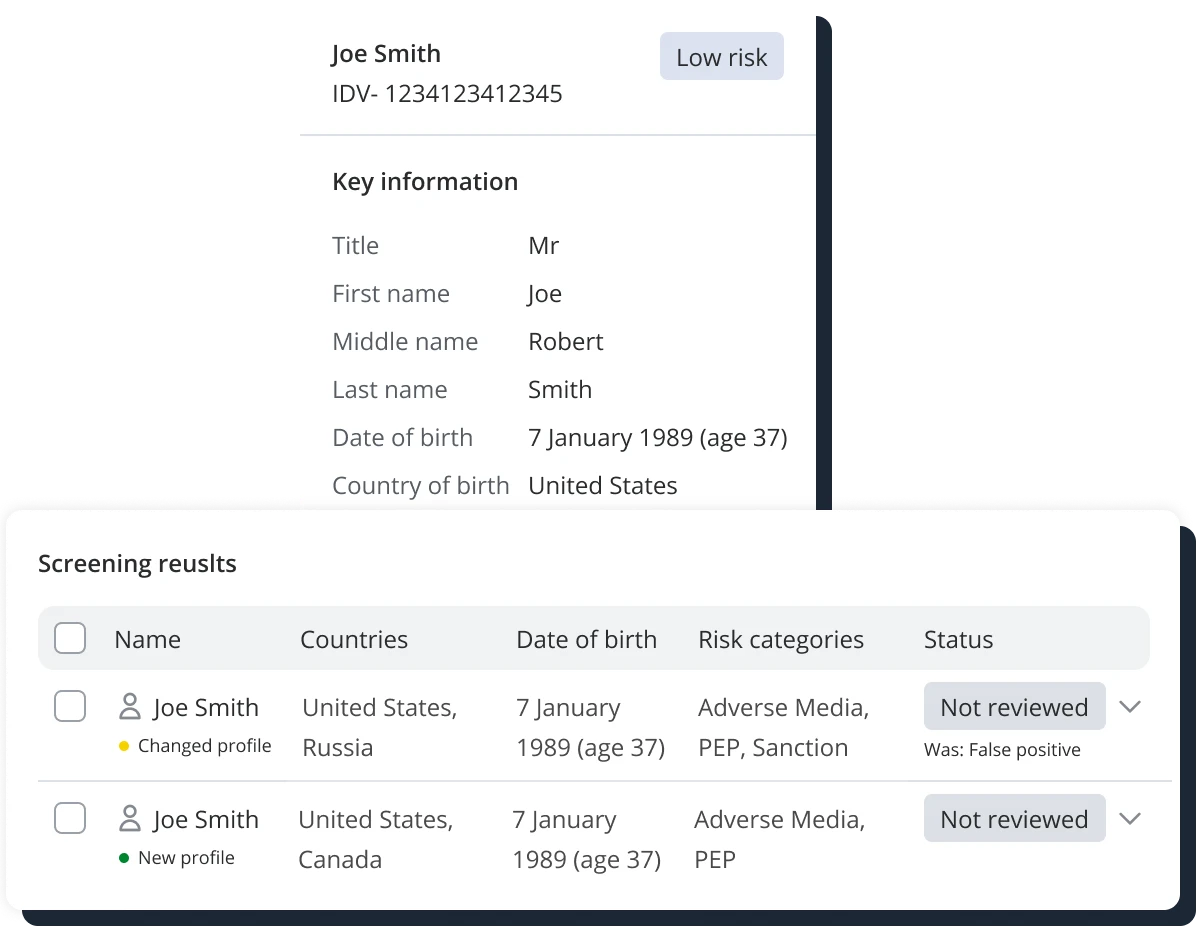

Customer-centric case workflows for efficient investigations

Gain regulatory confidence through complete data lineage.

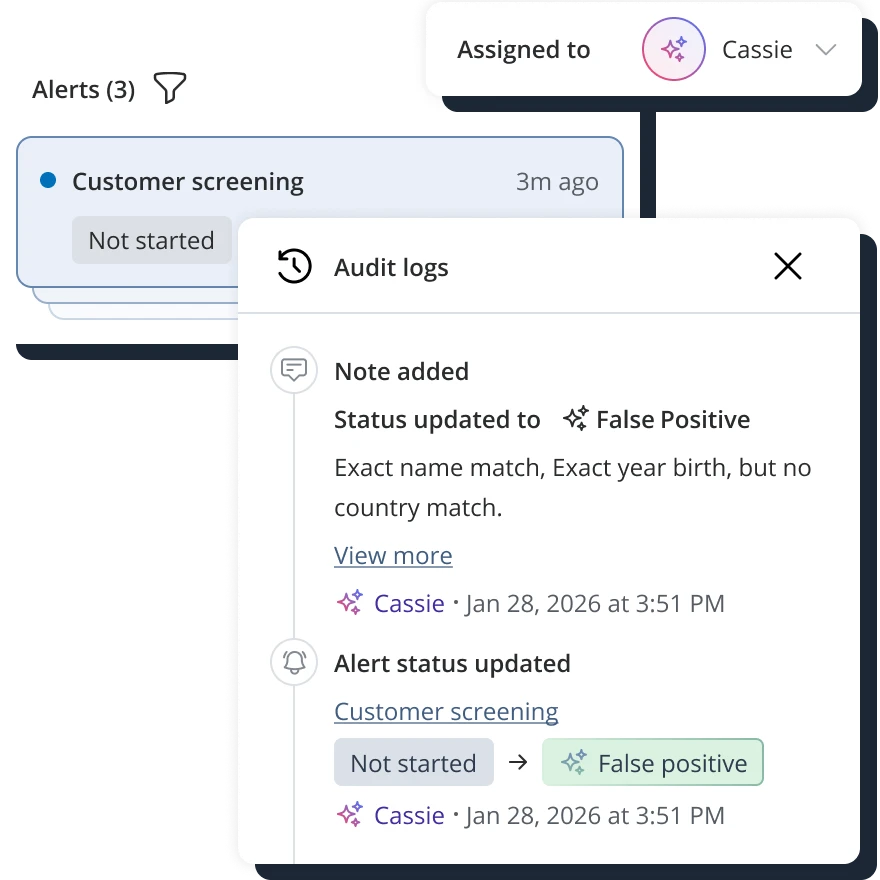

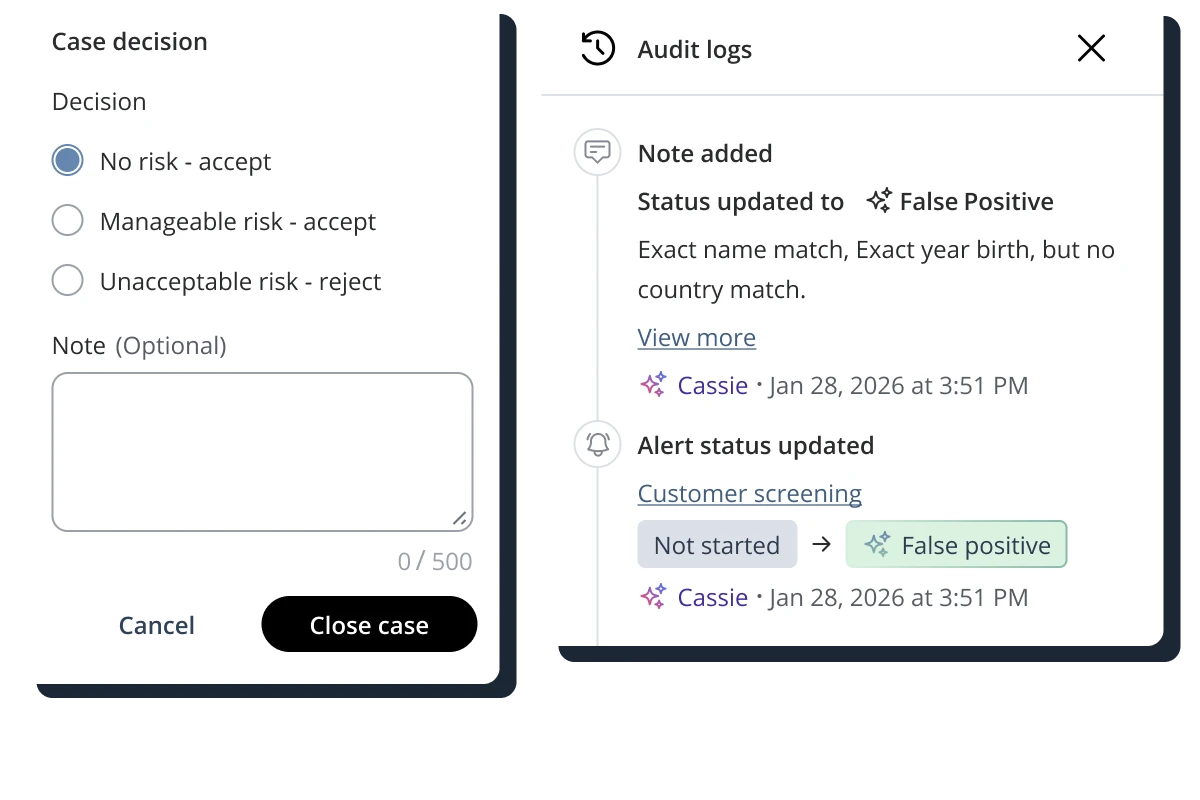

- Full auditability: Unlike human-collated or fragmented data, our platform provides a comprehensive audit trail from data sourcing to alert generation, ensuring every automated decision is defensible to examiners.

- Comprehensive risk visibility: Sanctions hits, PEP matches, adverse media findings, and ongoing monitoring alerts in one interface.

- Risk-based case routing: Automatically prioritize high-exposure cases and route low-risk alerts for bulk processing.

- Clear investigation workflows: Step-by-step case progression with decision checkpoints and approval hierarchies.

Ongoing monitoring that scales with customer growth

Manage the long-tail of global risk as you enter new markets

- Comprehensive risk visibility: Our architecture captures diverse, specialized data sources that legacy players miss, ensuring your risk coverage remains comprehensive as you scale transaction volumes.

- Dynamic risk ratings: Customer risk scores update automatically as new information emerges.

- Comprehensive monitoring: Track changes across sanctions, PEP status, adverse media, and more.

- Reporting automation: Generate standardized reports for examiner requests with complete screening history and decisions.

- Performance analytics: Analyze screening effectiveness, investigate false positive trends, and optimize risk detection parameters.

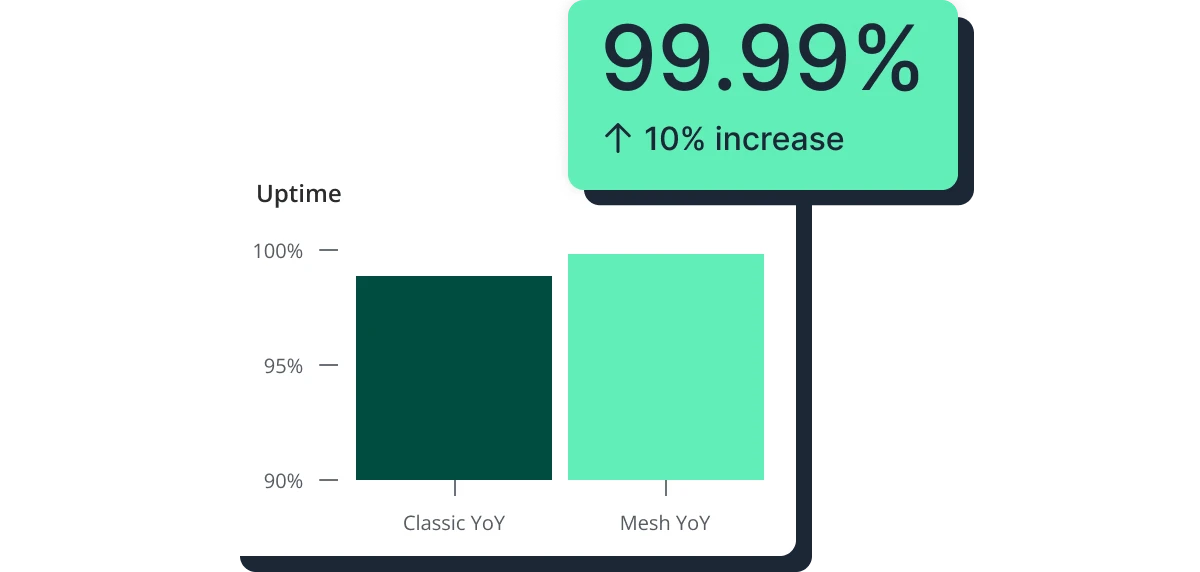

Enterprise-grade platform architecture for global operations

Integrate multi-cloud infrastructure designed for screening at scale.

- Integration without friction: We provide API-first flexibility to suit your business. Whether using our real-time API, batch processing, or SFTP, you can integrate our intelligence into your preferred workflows and automate risk management across the entire customer lifecycle.

- Real-time screening capability: Support fast onboarding flows and seamless customer experiences.

- ISO27001-certified and SOC2 Type II-compliant: Enterprise-grade security with encryption at rest and in transit.

- Massive scalability: Handle millions of annual screenings with consistent performance.

Screening efficiencies you can measure

Improvement in account-opening efficiency through streamlined screening and case workflows.

Faster customer onboarding times with real-time screening and intelligent case prioritization.

More screening work handled with existing compliance staff through auto-remediation and workflow optimization.

Annual customer screenings conducted across our global platform infrastructure.

Customer Screening FAQs

We provide in-depth, reliable, and actionable proprietary risk data. This includes sanctions, PEPs, RCAs, watchlists, adverse media, and enforcement data.

We leverage thousands of sources contributing to our comprehensive global coverage, including OFAC, UN, HMT, EU, DFAT, and many more. Lists are crawled from around the world, with 14 languages supported.

You can assign and unassign cases in bulk. You can also make decisions on several cases in a single go. In addition, you can benefit from a wide range of case filtering options, including case owners, case types and stages, case creation date, level of customer risk, and risk type.

Using the insights section, select your date range and access a host of dashboards covering:

- Team performance

- Cases per risk level

- The number of screenings completed

- The number of hits produced

- Hit rate

- Average number of profiles per hit

You can also adjust the frequency by selecting options ranging from daily, weekly, and yearly.

Our platform ensures comprehensive coverage by mapping all data to a proprietary predicate crime taxonomy. We ingest information directly from source – including sanctions, PEPs, and over 8 million daily news articles – which our LLM-powered pipeline automatically classifies into 34 specific risk subcategories. This “glass-box” approach moves beyond simple name-matching to identify complex typologies like fraud or narcotics trafficking, providing full transparency and ensuring your screening remains aligned with global regulatory requirements.

Ready to eliminate screening bottlenecks and reduce compliance costs?

Experience comprehensive screening that reduces false positives, accelerates customer onboarding, and builds regulatory confidence – all while scaling seamlessly with business growth.

Get a demoStarter Plan

Category-leading AML solutions

Our customers and financial services analysts all rate us as a category leader quarter after quarter.