Financial crime risk applications

Streamline risk management across the customer lifecycle with a unified suite of AI-native applications and data

Consolidate your screening, monitoring, and investigation workflows into a single interface powered by industry-leading, proprietary risk intelligence.

Spot sophisticated and constantly evolving threats and take action with total confidence

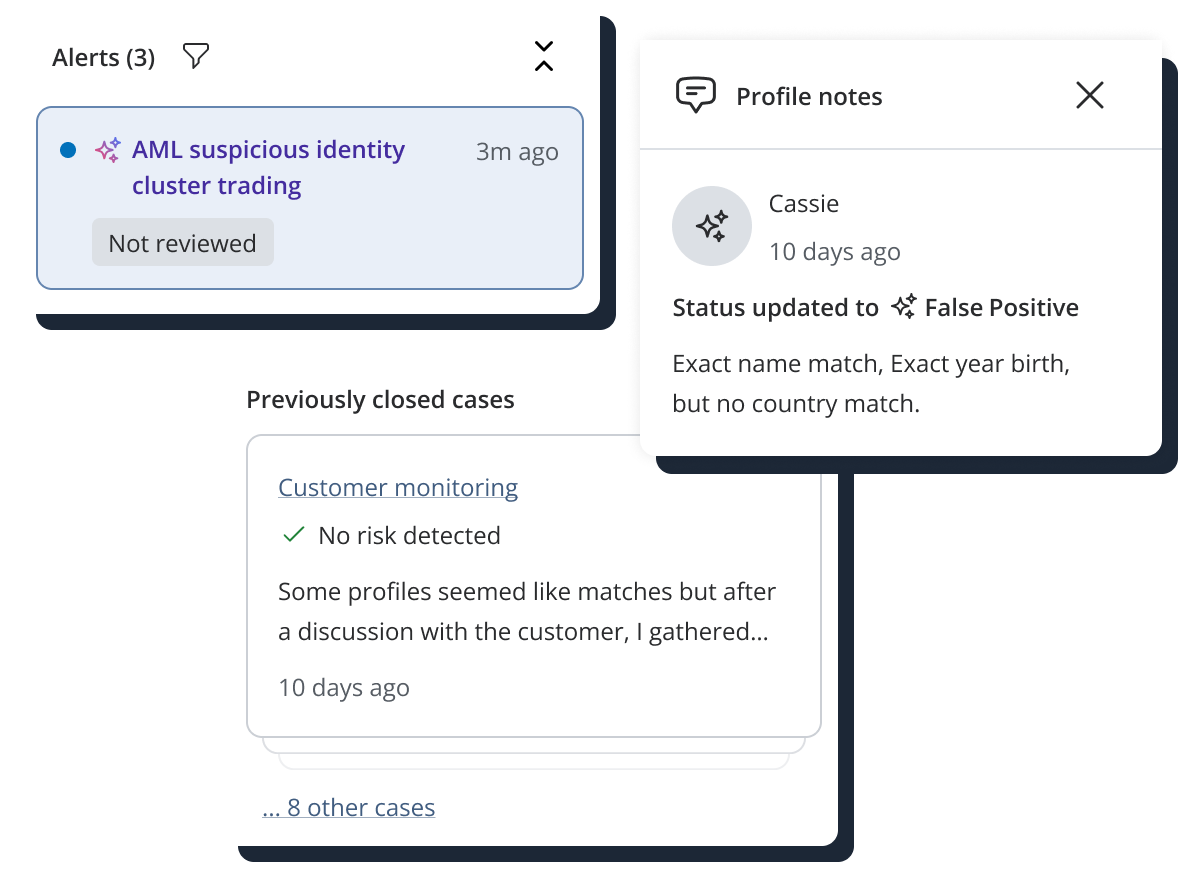

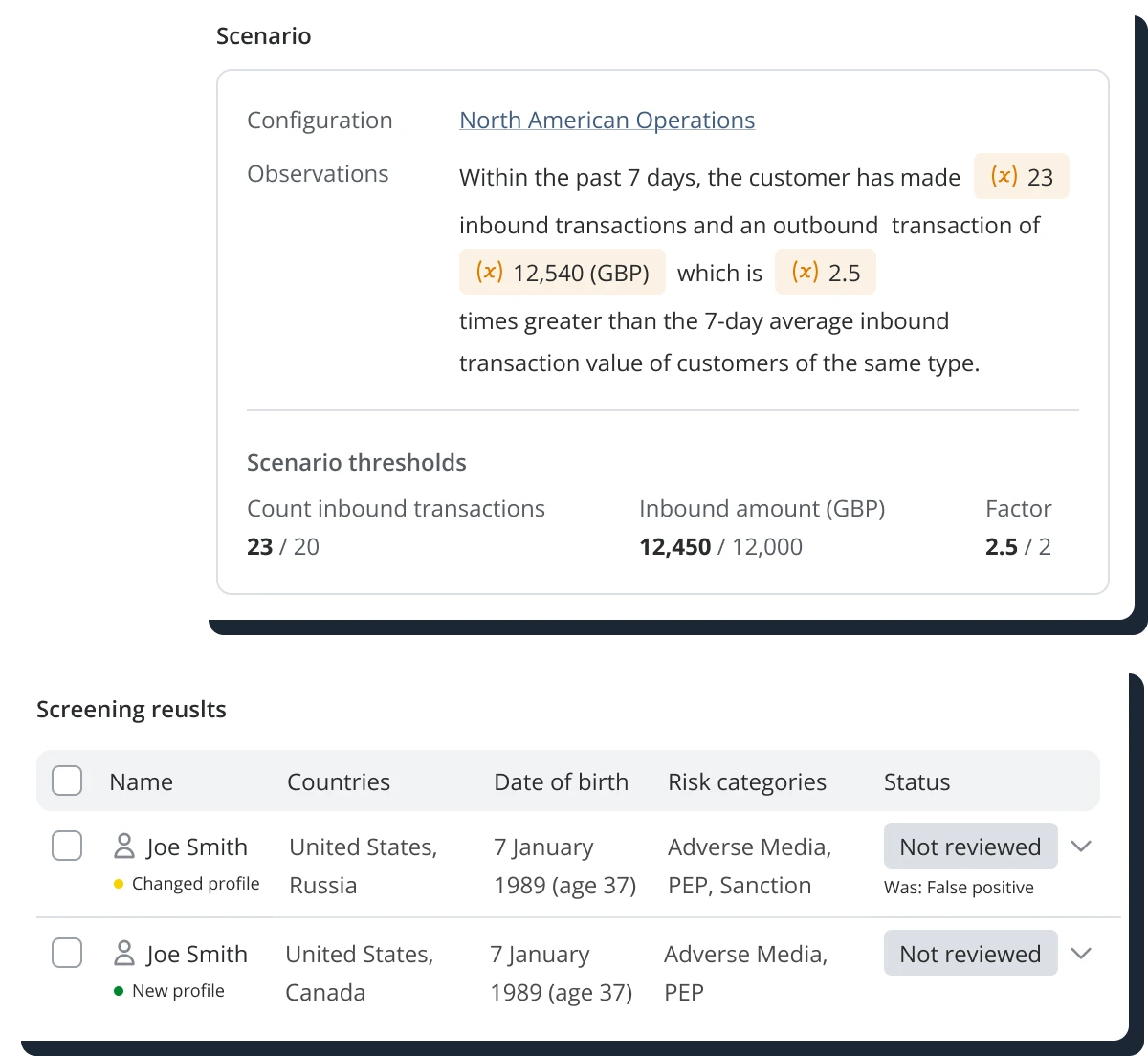

Give your team the full picture by connecting all your risk management processes in one place. Our applications work together on a shared foundation of proprietary, real-time intelligence – all connected to an AI-native case management system that uses agentic workflows to automate reporting, audit trails, and insights.

Spot constantly evolving threats and take action with total confidence

Built-in real-time, proprietary risk intelligence

Keep your risk management in sync with a rapidly changing global landscape.

- Achieve true real-time detection: Identify global risk changes in under 40 seconds, ensuring your screening and monitoring applications are always acting on the latest available information.

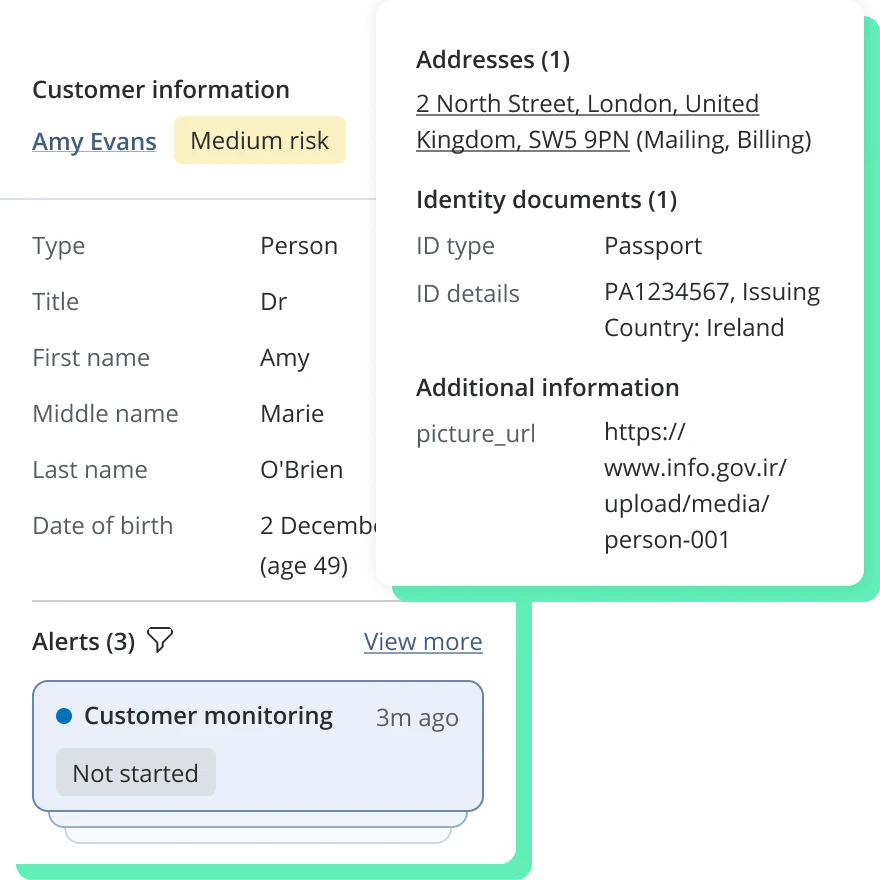

- Make high-confidence decisions: Access the primary source data and specific context behind every risk flag directly within the application interface, eliminating the need for manual external research.

- Reduce your total cost of ownership: Simplify your vendor stack and eliminate the need for third-party data contracts by using applications with world-class risk intelligence already built in.

- Maintain total data integrity: Benefit from a system where the intelligence engine and the application are natively integrated, removing the risk of data-mapping errors or synchronization delays.

- Demonstrate proactive compliance: Provide regulators with an unbroken audit trail that proves your applications leverage verifiable, live intelligence to protect your business.

Applications connected to a central case management hub

Accelerate case resolution through a unified workspace that automates reporting, audit trails, and insights.

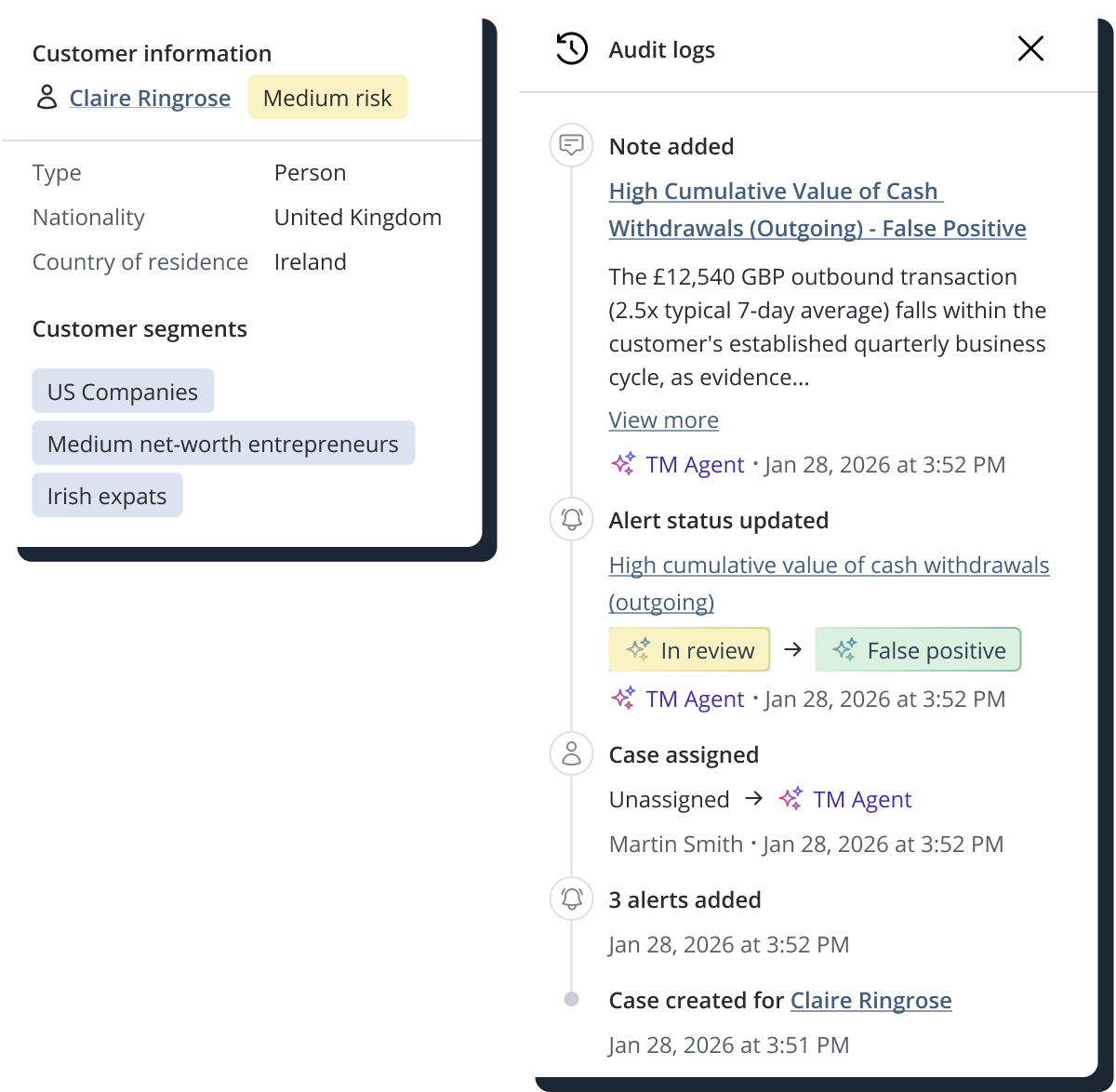

- Automate your regulatory reporting: Eliminate the manual burden of documentation with agentic workflows that pre-draft SARs and risk narratives based on data captured across your screening and monitoring apps.

- Generate instant audit trails: Ensure every investigation is regulator-ready with a system that automatically logs every action, data point, and decision in a transparent, chronological record.

- Extract immediate AML insights: Move beyond simple flags with an AI-native workspace that synthesizes complex risk profiles and transaction patterns into clear, actionable summaries for your team.

- Unify your risk management lifecycle: Bridge the gap between detection and resolution by aggregating risk signals from every application into a single interface, ensuring a consistent and holistic view of the customer.

- Drive operational velocity: Focus your analysts on high-stakes decision-making by allowing the AI-native workspace to automate the repetitive evidence-gathering and administrative tasks that typically create bottlenecks.

An API-first architecture for ultimate flexibility

Deploy modular applications that integrate seamlessly into your existing technology stack.

- Embed compliance into your customer journey: Place screening and monitoring triggers directly into your own onboarding or payment flows, making risk management a native, invisible part of your user experience.

- React instantly to risk changes: Use real-time notifications that allow your systems to receive updates the moment a customer’s risk status changes, enabling immediate automated actions.

- Customize your risk logic: Move away from “black box” solutions with modular applications that allow you to tune detection settings to your specific business needs without a complex overhaul.

- Scale effortlessly as you grow: Support increasing volumes and expansion into new markets with cloud-native infrastructure designed for high-growth environments.

- Keep your systems in perfect sync: Maintain a continuous, two-way flow of information between your core platform and our applications, ensuring your customer records are always up to date.

Tangible benefits seen by our customers

Improvement in account-opening efficiency through streamlined screening and case workflows.

Reduction in false positives, helping teams focus on real financial crime risk.

More screening work handled with existing compliance staff through auto-remediation and workflow optimization.

Annual customer screenings conducted across our global platform infrastructure.

Frequently asked questions

Most risk applications rely on third-party data “resellers,” which can result in a 24- to 48-hour delay between a real-world event and an alert. Because our applications are fueled by our own real-time intelligence engine, they can identify and alert you to global risk changes in under 40 seconds. This removes the data lag and ensures your team is always acting on the most current information available.

Unlike traditional AI, which simply flags potential matches, agentic AI in our risk applications actively performs the tasks a human analyst would typically do manually. It gathers evidence, synthesizes complex risk data into concise summaries, and pre-drafts regulatory reports (like SARs). This allows your team to move straight to the final decision-making phase, reducing manual effort by up to 80%.

Yes. We avoid “black box” solutions by giving you total control over your risk appetite. Through our unified interface or via API, you can tune detection settings and filtering logic to align with your specific business needs and regulatory requirements. This ensures the applications remain highly effective for your unique customer base while significantly reducing unnecessary false positives.

No. Our suite is designed with a modular, API-first architecture, meaning you can plug in individual applications – like Customer Screening or Transaction Monitoring – directly into your existing technology stack. Whether you want to enhance a specific part of your workflow or deploy the full end-to-end suite, our tools are built to integrate seamlessly without requiring a “rip and replace” of your core infrastructure.

While our applications are modular and can be used independently, the full-stack approach provides a multiplier effect for your compliance team. By using the integrated suite, you ensure that data flows seamlessly from detection to resolution without manual handovers or data-mapping gaps. This unified ecosystem allows the AI to learn from your team’s decisions across the entire customer lifecycle, resulting in higher accuracy, a single source of truth for your audit trails, and a significantly lower total cost of ownership.

Ready to streamline risk management across the customer lifecycle?

Consolidate your screening, monitoring, and investigation workflows into a single interface powered by industry-leading, proprietary risk intelligence.

Get a demoStarter Plan

Category-leading AML solutions

Our customers and financial services analysts all rate us as a category leader quarter after quarter.