Banks

Accelerate onboarding while reducing risk

Today’s customers expect rapid onboarding. Whether you are a digital bank, retail bank, or enterprise bank, you will have felt the pressure. It’s hard to deliver a great customer experience, though, if your screening process flags a lot of false positives.

At the same time, banks must be confident they are identifying all relevant risks, including those that are not in sanctions and watchlists. Manual searches and keyword-based approaches are slow and cannot provide the full picture.

We have the answer. Our AI-driven solutions enable suspicious entities and activities to be identified in real time. You can onboard faster, cut your costs, and reduce your risk exposure.

Why ComplyAdvantage?

Automate at scale

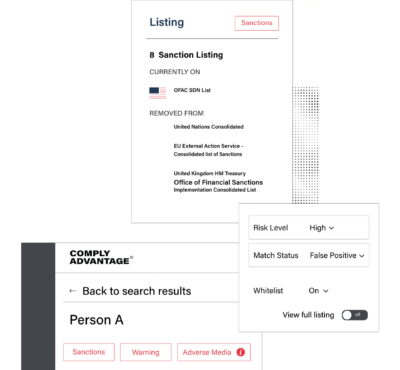

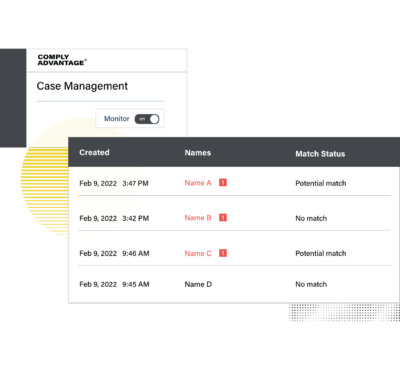

Adopt different search profiles for high and low-risk customers. Whitelist customers that don’t pose a risk to reduce false positives and speed up transactions.

Tailor Screening to Your Risk-based Approach

Use the API to configure thresholds, search strings, or any other relevant information. Tailor the data sources used for your searches.

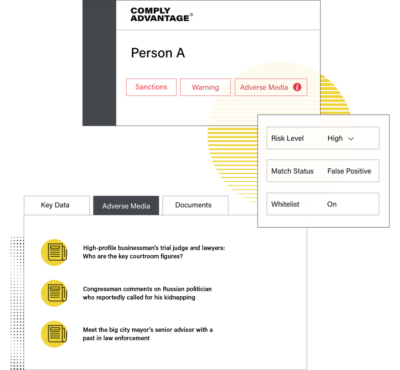

Screen Against Adverse Media

Identify adverse media across millions of articles, using artificial intelligence. All profiles are accurately labelled with FATF-aligned categorization to reduce false positives.