PEPs & RCAs

Daily updates to PEP data and election changes

Identify emerging risks fast with daily, global, Politically Exposed Persons (PEPs) screening updates. Demand more from your PEP data with our industry-leading coverage and quality.

Transformational approach to PEP & RCA data, screening & remediation

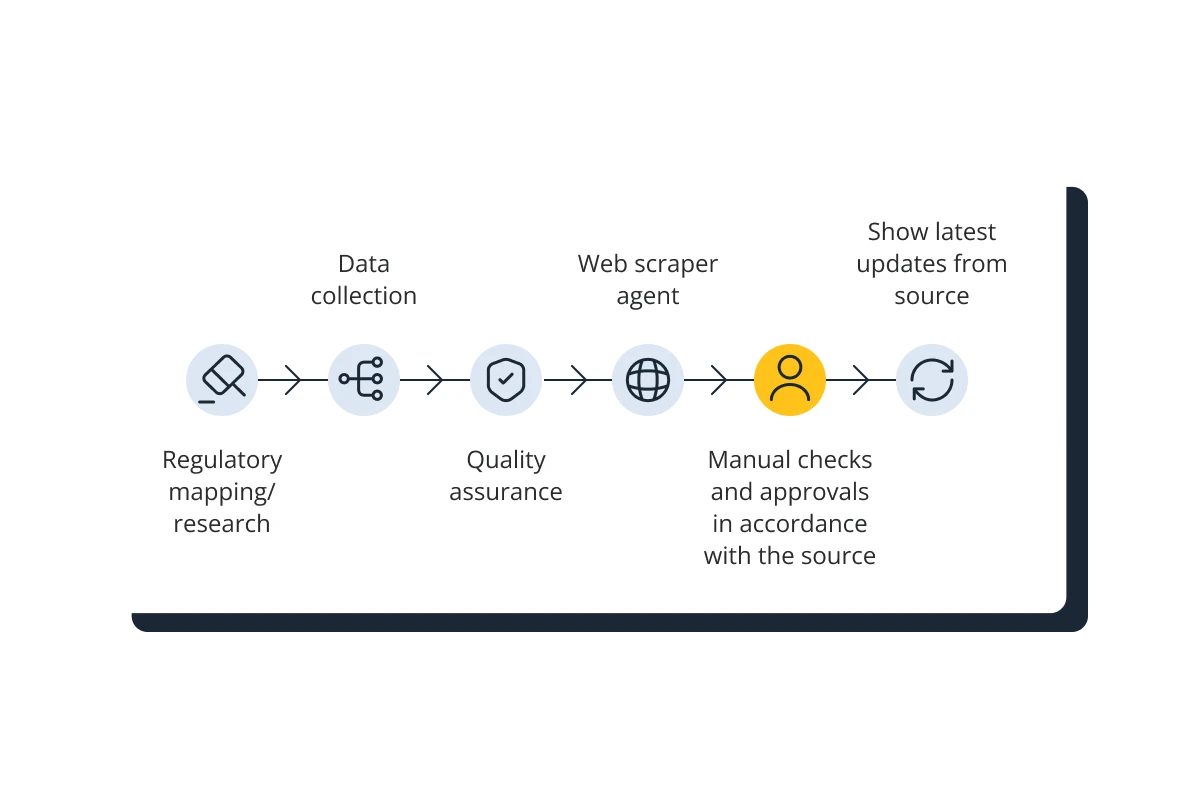

Benefit from up-to-the-minute AI-assisted PEP data collection, curated by experts. Stay ahead of regulatory demands while seamlessly aligning with local jurisdictional requirements.

Uncover the true PEP risk when screening customers by leveraging our knowledge graph of PEPs, and their Relatives & Close Associates (RCAs). A robust feedback loop helps you benefit from gold-standard remediation decisions made by thousands of financial crime teams.

Maximize compliance efficiency with real-time PEP coverage

-

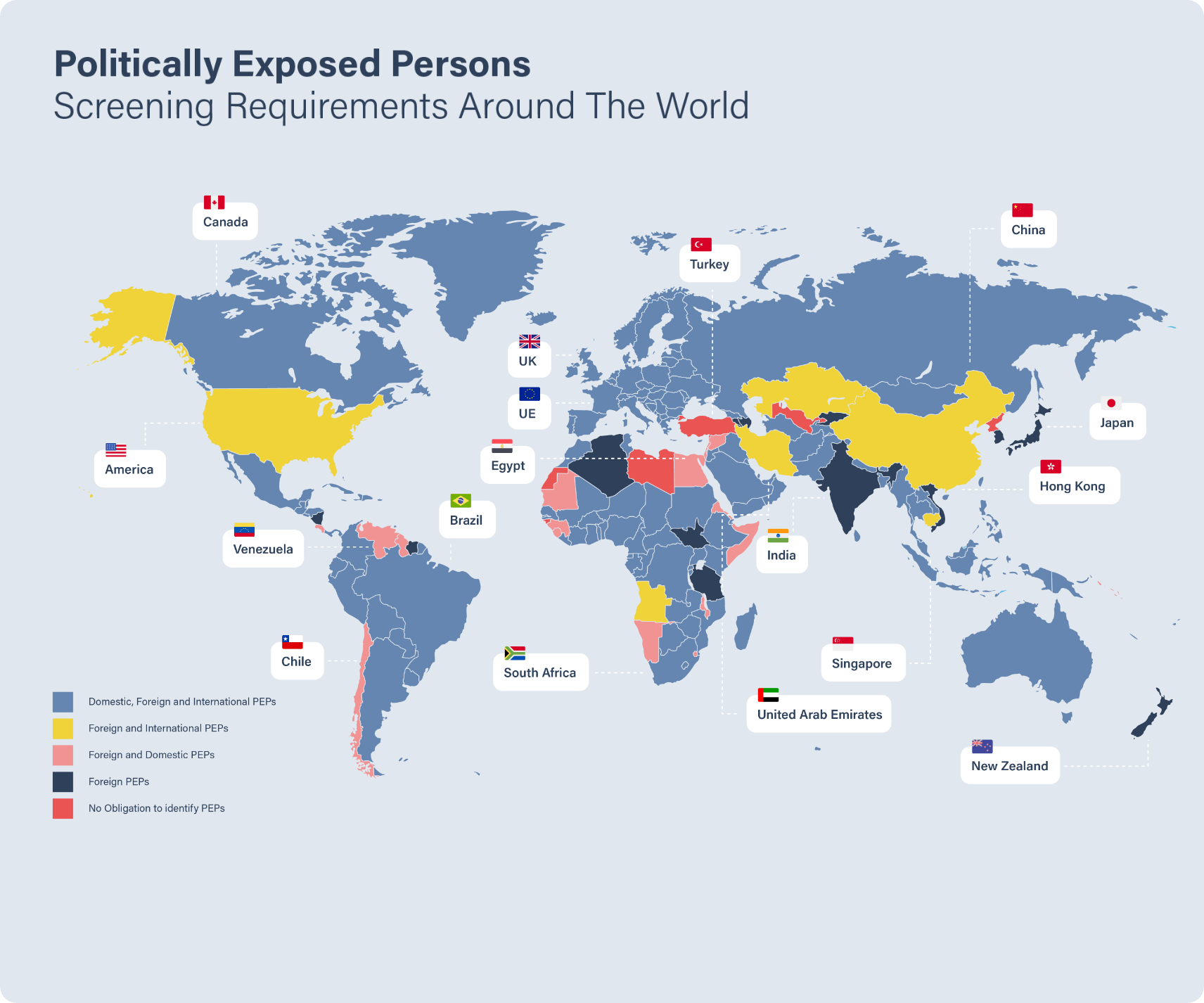

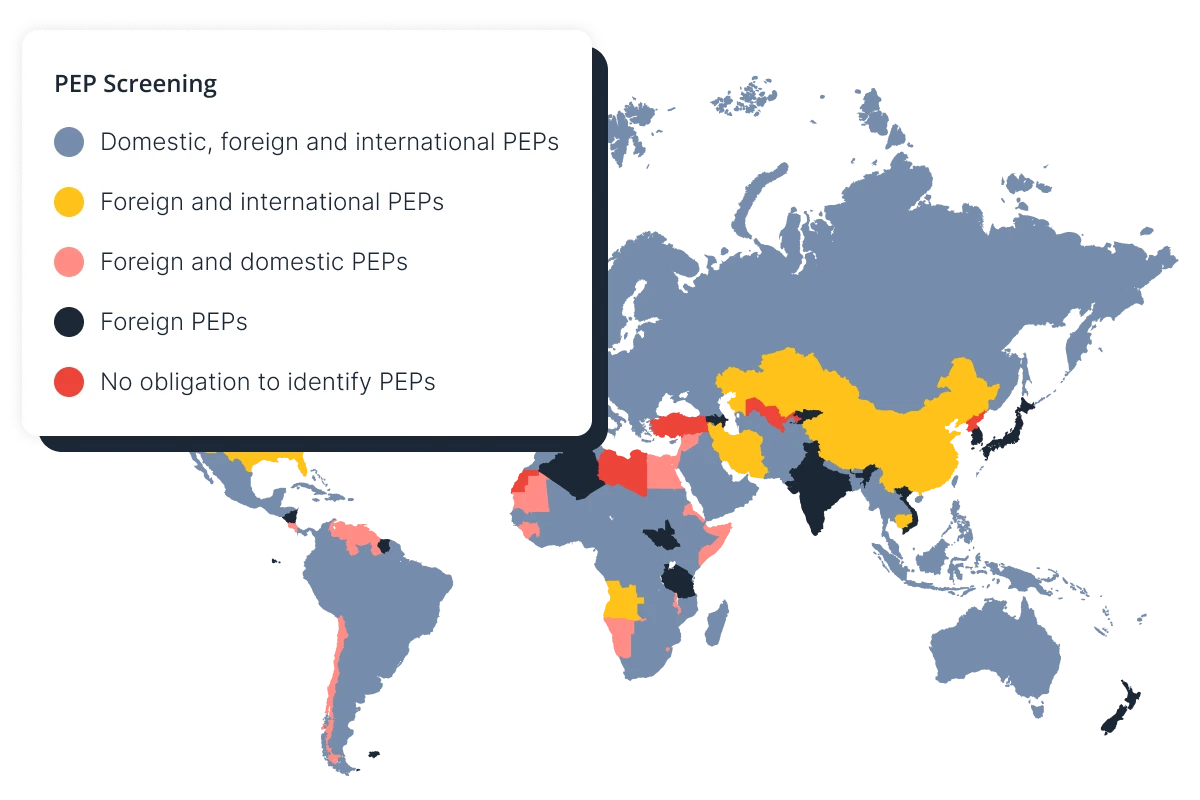

- Avoid unnecessary noise by using global PEP coverage that is finely tuned to specific jurisdictional requirements.

- The only data & screening provider that improves with every remediation decision with our data feedback loop.

- Benefit from large-scale AI-automated data collection and manual quality control for unparalleled accuracy.

Swipe to scroll the full image

Got it

Implement a risk-driven approach with deep PEP search configurability & smarter matching

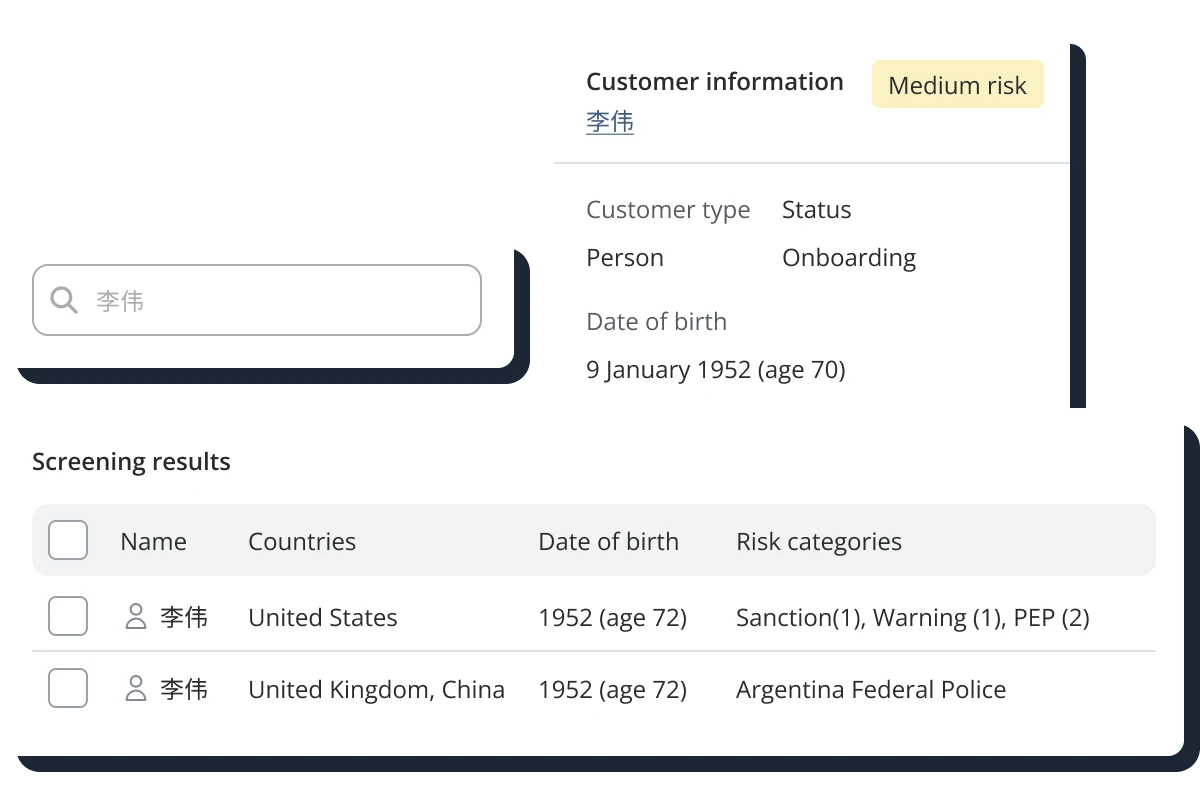

- Achieve unmatched precision in identifying PEPs with our linguistic identity matching, expertly handling the intricacies of naming conventions, aliases / AKAs, non-Latin names, etc.

- Deploy geographically tailored solutions with our highly configurable platform, designed to meet the unique needs of large enterprises.

Make confident decisions with data curated by top-tier analysts

- Trust in our 12-eye review process that ensures impeccable assurance every step of the way.

- Rely on our expert team’s thorough research and selection of pertinent institutions and PEP positions for relevant insights.

PEPs & RCAs FAQs

ComplyAdvantage sources PEPs and RCAs from official sources, including government websites and databases, and proprietary databases.

We have defined 4 classes of PEP which are aligned with FATF guidelines and allow our clients to grow internationally with confidence.

PEP CLASS 1

- Heads of state

- Members of the national executive

- Members of the national legislatures

- Senior military and law enforcement officials

- Senior officials of national agencies

- Board members of central banks

- Senior judiciary officials (national level)

- Top-ranking officials of political parties

PEP CLASS 2

- Board members of International Organizations (HIOs) &

- International Sports Federations

- Ambassadors, high commissioners, and other top diplomatic positions

- Members of the regional executive

- Members of the regional legislatures

- Senior judiciary officials (regional level)

PEP CLASS 3

- Senior management and board of directors of state-owned businesses and organizations.

PEP CLASS 4

- Mayors and members of local government (sub-regional level).

Many regulations and best practice guidelines indicate that PEPs are entities that not only currently hold relevant positions but also have left office. ComplyAdvantage takes a similar approach. Therefore, our database also includes PEP entities previously holding one of the above positions.

Additionally, family members and close associates of PEPs are considered PEPs and can be risk-ranked.

Yes. The FATF recommendations also apply to relatives and close associates of prominent entities, as these are also viewed as potential sources of risk.

ComplyAdvantage considers the following categories of relationships:

- Direct family members – e.g. spouse, partner, siblings, children

- Indirect family members – e.g. in-laws, grandchildren

- Close associates – e.g. business relationships, organizational ties, financial dependencies, publicly known social connections

If an entity belongs to any of the above categories, it is classed at the same level as the PEP it is associated with unless the family member is a PEP in his/her own right. In such cases, the political position held by the spouse will determine his or her classification.

Yes. Using ComplyAdvantage Mesh, you can advance your customer screening with a powerful and flexible “fuzzy matching” search capability that allows you to optimize for the reduction of false positives in line with your risk-based approach.

Our screening configuration allows you to apply varying fuzziness levels to your searches across our PEP, Adverse Media, Sanctions, and Warning data.

Our search algorithm accounts for all the major sources of mismatch in the name screening industry, such as name derivatives, phonetically similar names, spelling & typos, fuzzy matching, and different name forms.

Our PEP records are updated daily. This includes automated checking of PEP data sources as well as proactive updates triggered by elections or geopolitical events.

RCA data capture is triggered every time a new PEP is identified or updated and when there are new declarations of interest, company filings, etc.

Yes. ComplyAdvantage provides ongoing, automated screening and monitoring capabilities of these under our adverse media and sanctions-based solutions. We continually monitor sanctions lists and produce adverse media and PEP status reports. These tools can help you quickly and efficiently identify a special interest person and/or entity and, therefore, significantly enhance your compliance performance.

Our PEP screening solution is powered by data that spans the entire globe. It includes supranational entities (e.g., international organizations), national officials (e.g., heads of state, members of parliament, senior civil servants), as well as regional and local officials, ruling royal families, and leadership of state-owned enterprises. Tailored to jurisdiction-specific requirements and global recommendations, our data aligns with Financial Action Task Force (FATF) and Wolfsberg Group guidelines, offering a granular classification of PEPs based on position and level of influence. This finely tuned data ensures compliance alignment worldwide.

How we use AI to fight financial crime

At ComplyAdvantage, AI powers every stage of the financial crime risk management lifecycle, from onboarding and ongoing monitoring to remediation and reporting. Discover how our multi-layered, AI-driven approach boosts accuracy, reduces friction, and helps compliance teams move faster with confidence.

Learn moreStarter Plan

Category-leading AML solutions

Our customers and financial services analysts all rate us as a category leader quarter after quarter.