Corporates

Protect your business from fraud and reputational risk

The threat of financial crime is increasing across many industries. Firms such as real estate agents and art dealers could be exploited for money laundering. Oil and gas firms could be targets for corruption. Terrorist financing might pass through import and export services, accountancies, or postal services.

Legal professionals who participate in financial or real estate transactions are often targeted by criminals who will try to layer, integrate, or place illegally obtained funds into their systems.

Risk has increased in the gambling sector as activities have moved online. Gaming platforms can be accessed internationally, and payments and withdrawals are processed at a much faster rate.

Our solutions help companies to better identify entities who are at risk of engaging in money laundering, terrorist financing, corruption, and fraud.

Why ComplyAdvantage?

AML Screening & Monitoring

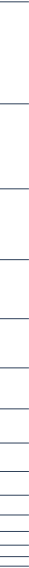

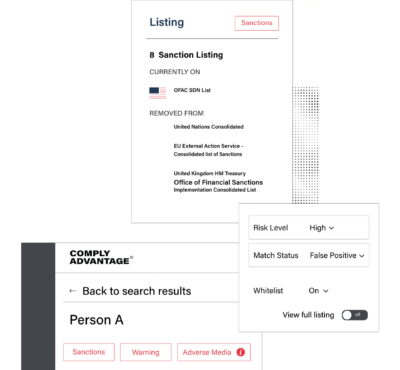

Screen your supplier network, employees, partners, and customers. Uncover hidden risk in real time, avoid financial threats, and safeguard your reputation.

- Receive proactive, automated alerts when a change in entity status is detected.

- Reduce false positives by tailoring the matching parameters to your risk-based approach.

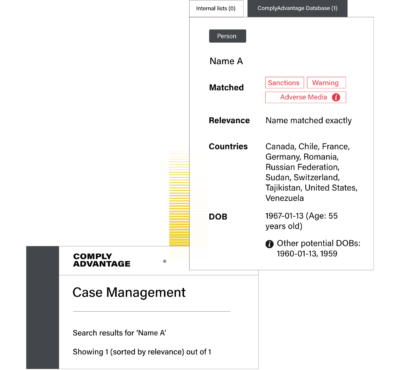

- Integrate our automated onboarding checks and case management into your workflow.

- Quickly spot suspicious patterns. In gambling, for example, identify when players go above their thresholds or make early withdrawals.

Adverse Media

Identify potential risk and safeguard your reputation

- Go beyond sanctions and watchlists. Monitor entities against adverse media to better identify risk of fraud or corruption.

- Be proactive. Get automatic alerts based on your previous searches if an entity’s risk changes.

- Reduce false positives and incorrect hits. Only screen against the categories that are relevant to your business.