For AML software vendors and customers buying RegTech solutions, the quality and capability of the API used to integrate with the platform being purchased is often an afterthought. This can lead to a poor developer experience, lengthy onboarding journeys, and a suboptimal customer experience. Ultimately, a lengthy and frustrating AML integration process can impact a firm’s bottom line.

This blog explores how firms integrate with ComplyAdvantage Mesh, focusing on the improvements to the typical process built into the platform, drawing on more than a decade of experience in financial crime risk management.

This article is part of a series on the capabilities of the ComplyAdvantage Mesh platform. Mesh is designed to provide a 360-degree view of risk in a single platform. Links to the rest of the series are available at the end of this article.

Common AML software integration challenges

Firms we talk to about their integration challenges outline six challenges they experience with traditional vendors:

- The API is an afterthought, meaning onboarding journeys must be built in-house.

- Security is sub-optimal for enterprise-level requirements, causing integrations to be expensive and slow.

- The architecture is monolithic and inflexible. They’re offered an ‘all or nothing’ approach that limits flexibility.

- API documentation is poor, reducing team efficiency and productivity.

- Integration mechanisms are limited.

- Expensive resources must be called in repeatedly, with an imbalance between latency and throughput.

Evaluating a vendor’s AML software integration capabilities: A checklist

With these factors in mind, here’s a checklist of questions we’d recommend asking any vendor when assessing their API:

- How does the API relate to the wider platform architecture? What actions, including administrative tasks, can be completed via the REST API?

- What documentation is in place to help new teams onboard quickly and effectively?

- What integration mechanisms exist – e.g., real-time API, batch, SFTP?

- Can the time taken to integrate be measured in hours vs days? This should include configuring the system to set up new users, screening and monitoring settings, and establishing a risk-scoring model aligned with a risk-based approach.

- Does the integration deliver low latency to support inline onboarding and payment flows?

- Are modular integration options offered? Can a firm integrate with the vendor solution for end-to-end customer risk management or choose individual comments to augment an existing ecosystem, such as selecting screening, risk scoring, or case management modules?

- Are the security and reliability credentials suitable for enterprises? This should include 5 nines reliability alongside core security requirements.

Integrating with the ComplyAdvantage Mesh platform

The ComplyAdvantage Mesh platform has been built to address these AML integration questions. It delivers value to customers in three core ways:

1. Comprehensive

- Avoid high-risk migrations: Our modular and granular REST API allows ComplyAdvantage Mesh to operate as your complete compliance stack or as a component within your broader compliance ecosystem.

- Integrate ComplyAdvantage Mesh with your payments or core banking platforms however you need. A range of integration mechanisms make this possible, including real-time synchronous API, asynchronous webhook-enabled flows, and batch upload, including SFTP.

- Easily extract your compliance data for use in downstream processes and reporting.

2. Developer-centric

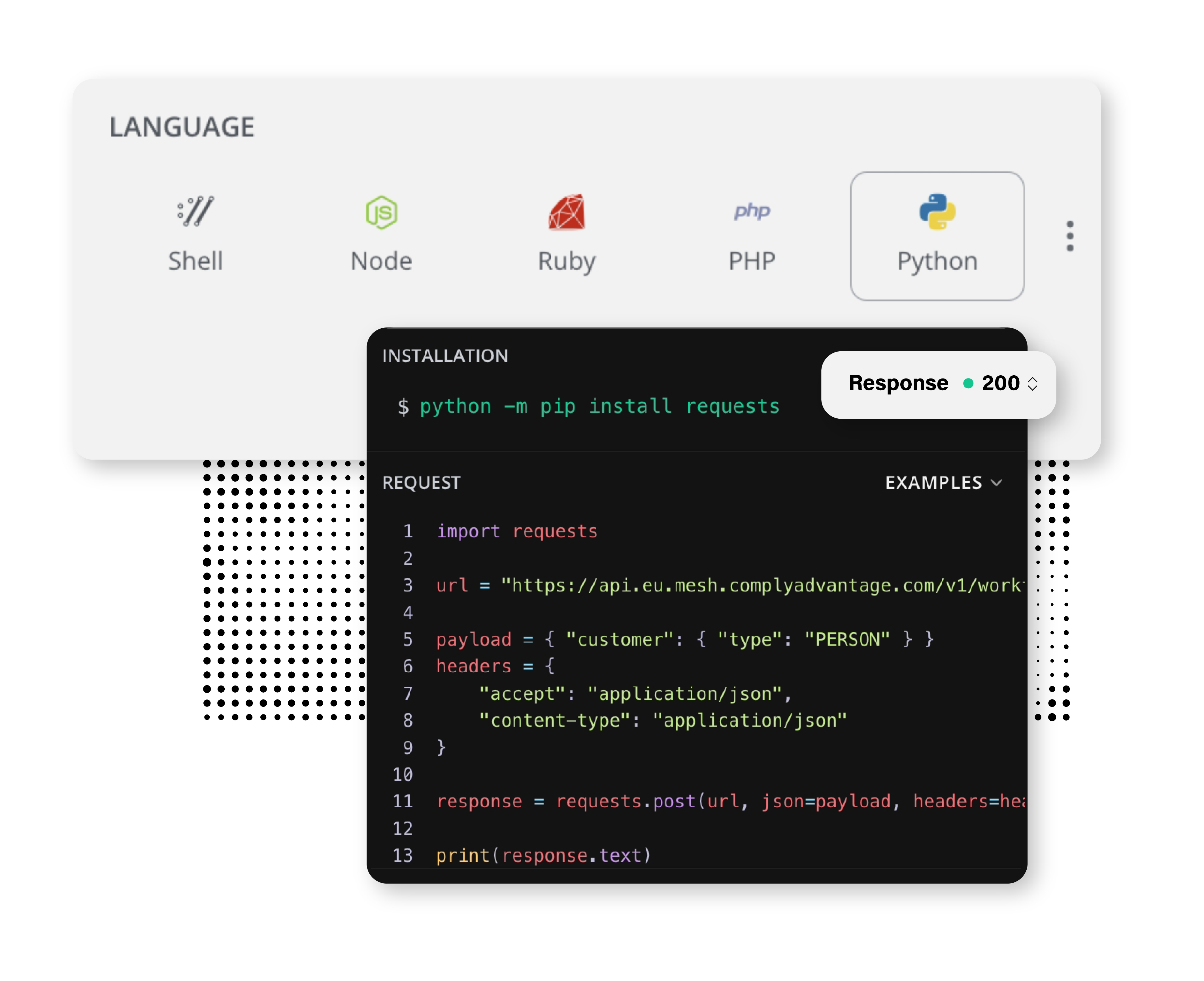

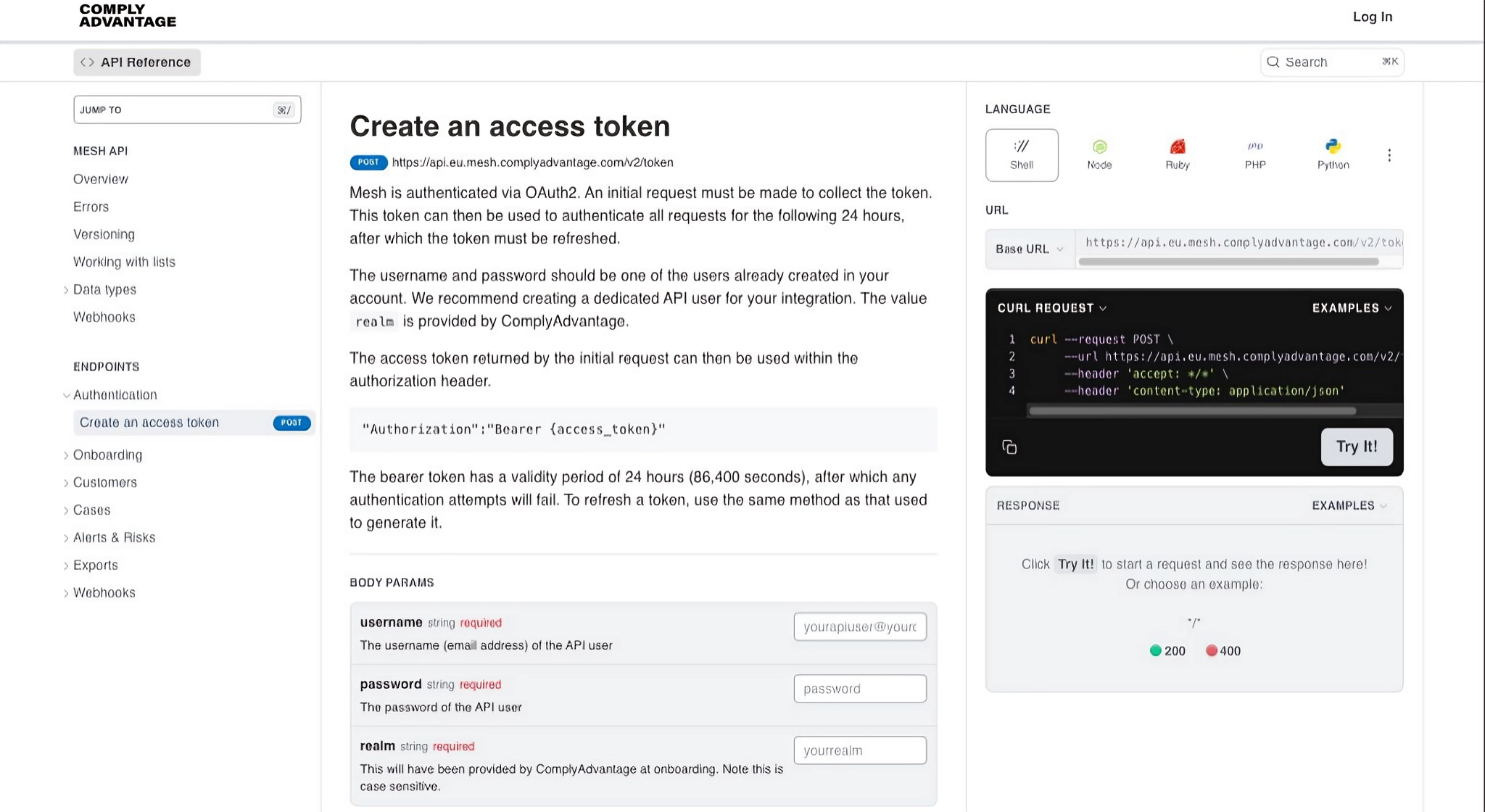

- Every endpoint is documented and explained.

- Rapid integration, testing, and deployment.

- Get started quickly with comprehensive API documentation.

3. Enterprise-ready

- Scalable and secure API.

- Supports business continuity with high availability.

- Real-time, low-latency integration pathways.

Find out more about ComplyAdvantage Mesh by reading the other articles in the series:

Explore how ComplyAdvantage Mesh gives firms a 360-degree view of risk

Find out more about how Mesh combines industry-leading AML risk intelligence with actionable risk signals to screen customers and monitor their behavior in near real-time.

Learn more

Originally published 24 January 2025, updated 27 January 2025