The arrival of instant payment schemes like Single Euro Payments Area (SEPA) Instant Credit Transfers (ICT), and services such as FedNow, is changing the payments landscape. In the EU alone, the instant payments market is expected to grow to €34.2 billion by 2027, according to a report by PYMNTS. Solutions that allow firms to process transactions securely, at scale, and in real-time have never been more important.

Financial institutions (FIs) looking to implement or upgrade their payment screening processes can benefit from the wide range of specialist software solutions available. However, with the wealth of options available, choosing between one solution and another can be difficult.

This article provides guidance on that choice, discussing the nine most important factors firms should consider when choosing their payment screening software.

What is payment screening software?

Payment screening is an essential solution for any payment service provider (PSP) to help them meet their anti-money laundering and countering the financing of terrorism (AML/CFT) obligations. It helps firms detect whether an individual payment carries a risk of money laundering or terrorist financing, allowing them to place the transaction under further review or block it if necessary.

To carry out effective payment screening, firms rely on payment screening software: specialist technology that verifies information relating to a given payment and analyzes it for any sign of AML risks. Selecting the right software is essential for firms to process instant payments at scale while guarding themselves and their customers against financial crime.

Payment screening software works by gathering and validating the necessary information about a payment, before assessing it for any AML/CFT risks and checking it against data relating to sanctions and politically exposed persons (PEPs).

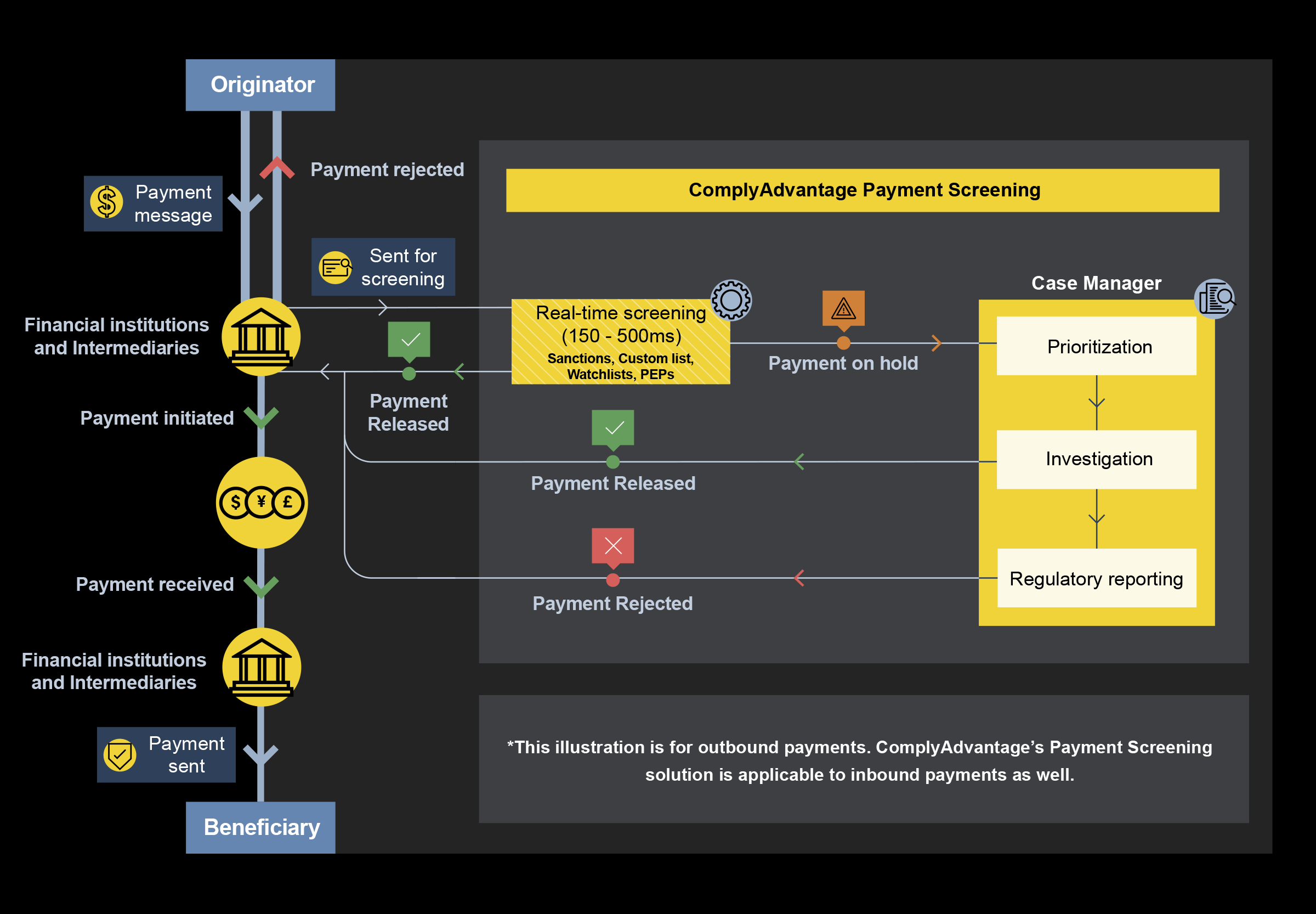

Real-time payments are likely to change the way firms expect to screen – under new SEPA rules, for example, banks and PSPs must screen their customer base for sanctions at least daily, since screening each individual payment would take too long. However, firms will still need to apply payment screening to transactions heading outside SEPA. Firms need a flexible system that allows them to screen payments whenever necessary; while most firms surveyed for our State of Financial Crime 2025 report said they were confident of meeting SEPA requirements, they needed to upgrade their teck stacks and personnel to do so. The diagram below explains how ComplyAdvantage Payment Screening works:

Why is payment screening important for AML?

Payment screening is one of the key tools in any FI’s AML arsenal, helping firms prevent illegitimate transactions from being completed. Given the dominance of instant payments in the contemporary financial landscape, effective payment screening can prevent financial crime in real-time. PSPs across most jurisdictions are subject to AML/CFT regulations designed to ensure firms have measures in place to prevent them from processing funds derived from criminal activity. If firms aren’t sufficiently protected, they risk exposing themselves to crimes such as money laundering, terrorist financing, sanctions evasion, or fraud. If this happens, they can suffer the consequences of regulatory non-compliance, which range from reputational damage to financial and criminal penalties.

9 tips for choosing your payment screening software

1. Understand your business requirements

AML compliance is built around the concept of a risk-based approach: that all compliance programs will look different because firms all have unique needs. This is no different when it comes to payment screening processes and the software used to execute them. Firms should assess each potential solution on its suitability for the payment options they offer and the customers and jurisdictions they serve, all of which affect the data they need for payment screening.

Firms will always have multiple interests to balance: Aside from compliance issues, reputational, operational, and performance considerations will also influence software choices. Customer experience, growth objectives, and workflow optimization will all be factors.

2. Consider your regulatory obligations

While every jurisdiction has its own AML/CFT legislative framework, they typically conform to the Financial Action Task Force (FATF)’s international standards, known as the ‘40 Recommendations’. FIs should consult the regulations they are legally obliged to follow, but generally, they will include these key points.

In addition, PSPs are subject to payments-specific legislation, which mandates them to have payment screening processes in place. Examples include:

- UK payments regulations: The Payment Services Regulations 2017 (PSRs).

- US payments regulations: The Electronic Fund Transfer Act (EFTA).

- EU payments regulations: The revised Payment Services Directive (PSD2).

- Singapore payments regulations: The Payment Services Regulations.

Firms should check that their payment screening software is equipped to comply with these regulations and allows them to access the relevant sanctions lists for their jurisdiction. Regulators will expect firms to explain their choice of software and details on how it helps them achieve compliance requirements.

3. Select a solution that is accurate and efficient

FIs should ensure they understand the specific features of a payment screening solution and check it aligns with their needs. An effective solution will draw on comprehensive, correct, and complete data. Firms should also verify that the solution can accurately screen payments against this information to detect true positives and minimize false ones. For example, matching algorithms can account for variants in spelling or global naming conventions, while FIs should also be able to adjust search parameters to screen only against relevant data.

It’s also important to remember that AML regulations, sanctions lists, and PEP data are all subject to change. This makes customer risk profiles dynamic, not static. FIs should ensure their chosen software gives them access to the latest information, ideally with automated updates that give them new information in near real-time.

The Role of Technology and Talent in Transaction Screening

Based on expert advice and surveys of 600 industry leaders, our guide explains how firms can deliver faster and more effective transaction screening.

Download now4. Make sure the solution integrates seamlessly with your existing systems

Siloed data and systems can greatly hinder compliance processes, compromising the ability of compliance teams to view all the data they need when responding to alerts. If payment screening software can be integrated with an organization’s existing tech stack, then this significant barrier to compliance is removed. Application programming interfaces (APIs), or software that allows two systems to communicate more easily, are the best way of ensuring integration and unburdening firms from siloed data.

5. Test the solution’s usability

Even if a payment screening solution excels on paper at providing technical compliance, this will count for little unless it can be easily used in practice. Firms should check what implementation aids are included – such as guides, FAQs, and other supporting documents – as well as access to ongoing support and troubleshooting from the vendor. The availability of sandboxes, so firms can test out risk models and screening configurations, can further validate the fit between the software and the company.

Firms should look for specific software features indicating a positive user experience. Consolidated data and customer profiles, automated customer and event risk scoring, alert prioritization, and accessible customer and case documentation to help firms establish an audit trail are all good examples.

6. Make sure the solution covers data security and privacy needs

Compliance leaders should prioritize information security when assessing potential solutions, given the volume and sensitivity of the customer data involved in payment screening. Enterprise-wide risk assessments should include data security and privacy issues, and firms should have strategies to resist cyber attacks and ensure maximum business continuity in case one does occur. Any payment screening software a firm adopts should conform to these and not unnecessarily add to a firm’s existing security risks. Firms should also be aware of their privacy obligations under regulations such as GDPR and check with vendors to ensure their solutions can accommodate them.

7. Consider the cost-effectiveness of the solution

Budgets, timelines, and KPIs should all influence how FIs choose their payment screening software. Larger firms willing to invest significant time and resources into the process need to be sure they receive an enterprise-grade AML solution, which lower-cost options are unlikely to provide. For smaller firms with ambitious growth plans, scalability is an especially important consideration. Choosing a solution that works now, only to have to jettison it a year or two down the line, will not prove cost-effective in the long run.

8. Evaluate the vendor’s reputation

Generally, firms have two primary ways to assess a vendor’s reputation. First, they can review client lists and case studies provided by the vendor, which offer evidence of successful outcomes and the vendor’s experience with similar clients. Second, firms can seek external validation of the vendor and its product, which may come from industry research and review platforms, like Chartis or G2, or certifications from standards boards such as ISO.

9. Ask for demos or tests

Successful relationships between software vendors and FIs are built over time. Firms should consider whether off-the-set rulesets or more customized solutions better suit their specific requirements. Vendors should be able to advise firms on specific implementation points and help them refine their use of software for an optimized payment screening process. Demos and sandbox-based testing are good ways to establish a basic fit between product and firm and test it against these criteria. Committing to the wrong payment screening software without trying it out first will prove an expensive mistake for FIs.

Improve efficiency with advanced payment screening solutions

ComplyAdvantage’s Payment Screening solution balances cutting-edge compliance features with enhanced efficiency measures, allowing firms to achieve higher straight-through processing without compromising on risk.

“ComplyAdvantage has not only been able to reduce the number of false positives we see, but also the time we spend on each alert.””

Lukas Andersen, MLRO and Head of Financial Crime Risk, Inpay

FIs looking to process payments securely and instantly at scale can enjoy features such as:

- Processing times of under half a second for 99 percent of payments: With only milliseconds required to complete transactions, ComplyAdvantage payment screening supports any instant payments scheme, including SEPA, FedNow, and Faster Payments.

- System-wide sanctions updates in under an hour: Our technology, enhanced by artificial intelligence (AI), monitors regulators and other authorities directly for updates rather than waiting for delayed official announcements. Our global analyst team oversees data refreshes to ensure only the right updates are made.

- Tailored screening: Firms can screen for any attribute, including names, BIC codes, and countries (including unstructured text fields). They can also apply tailored lists and search fuzziness levels to different payment corridors.

- Fully integrated data, screening, and case management: With flexible, efficient workflows, compliance teams find it easier to review and take action on cases in good time.

Power a no-compromise payment experience

Find out how ComplyAdvantage can help you speed up your payment screening without compromising on risk.

Get a demoOriginally published 08 November 2024, updated 04 July 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2026 IVXS UK Limited (trading as ComplyAdvantage).