Payment Screening

Screen cross-border payments against up-to-date global sanctions intelligence

Support real-time payments with high straight-through processing rates. Detect sanctioned entities in real-time alongside a single consolidated view of payment alerts.

Proven value for businesses

Mesh Payment Screening is a secure web-based solution that screens your incoming and outgoing cross-border financial transactions against up-to-date sanctions intelligence to stay ahead of the latest regulatory requirements.

With a high STP rate, support for any instant payment type and corridor, and real-time major sanctions updates, our solution ensures compliant and hassle-free operations.

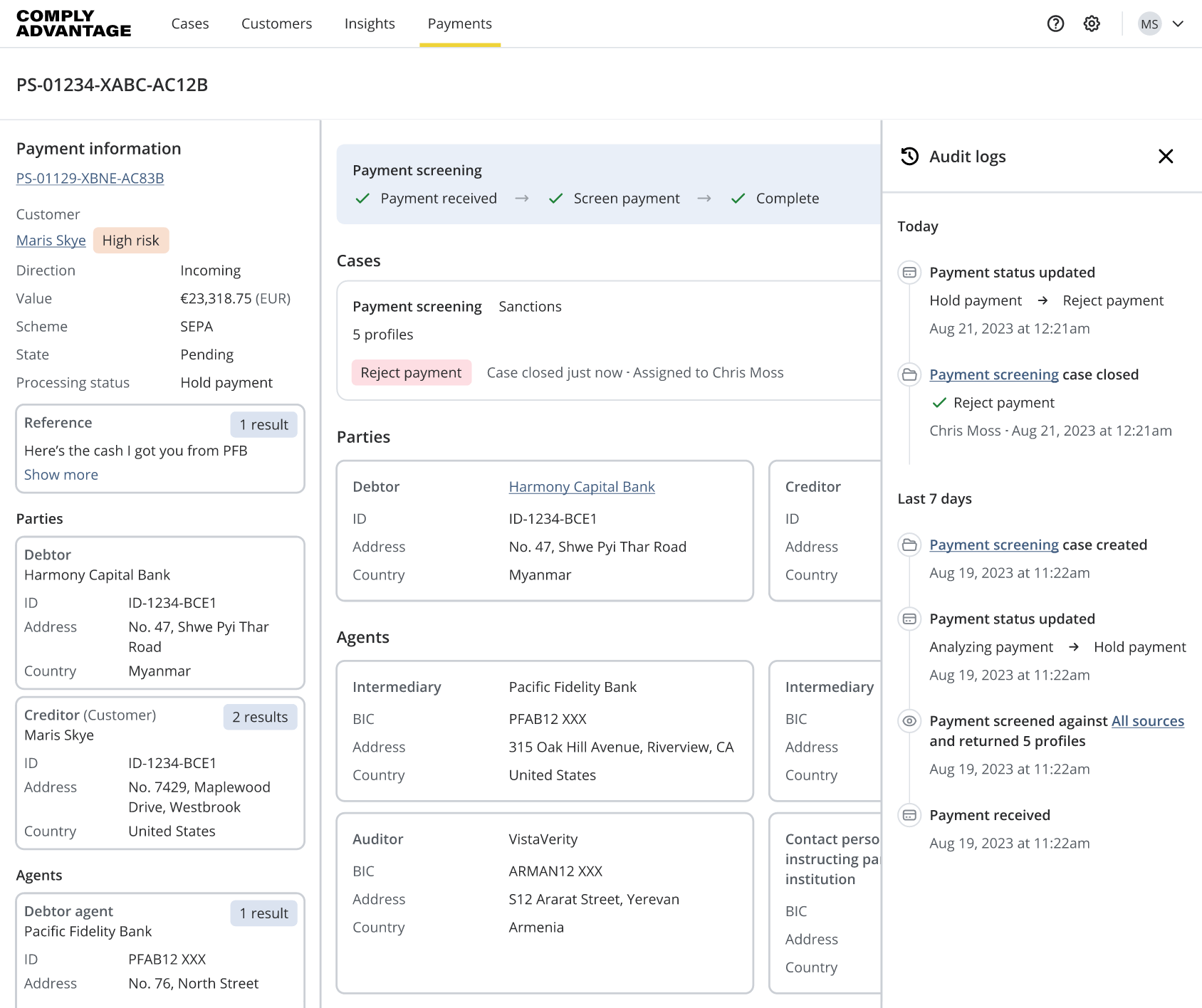

Compliance Officers and MLROs

Adhere to regulatory requirements, support instant payment rails, and minimize false positives.

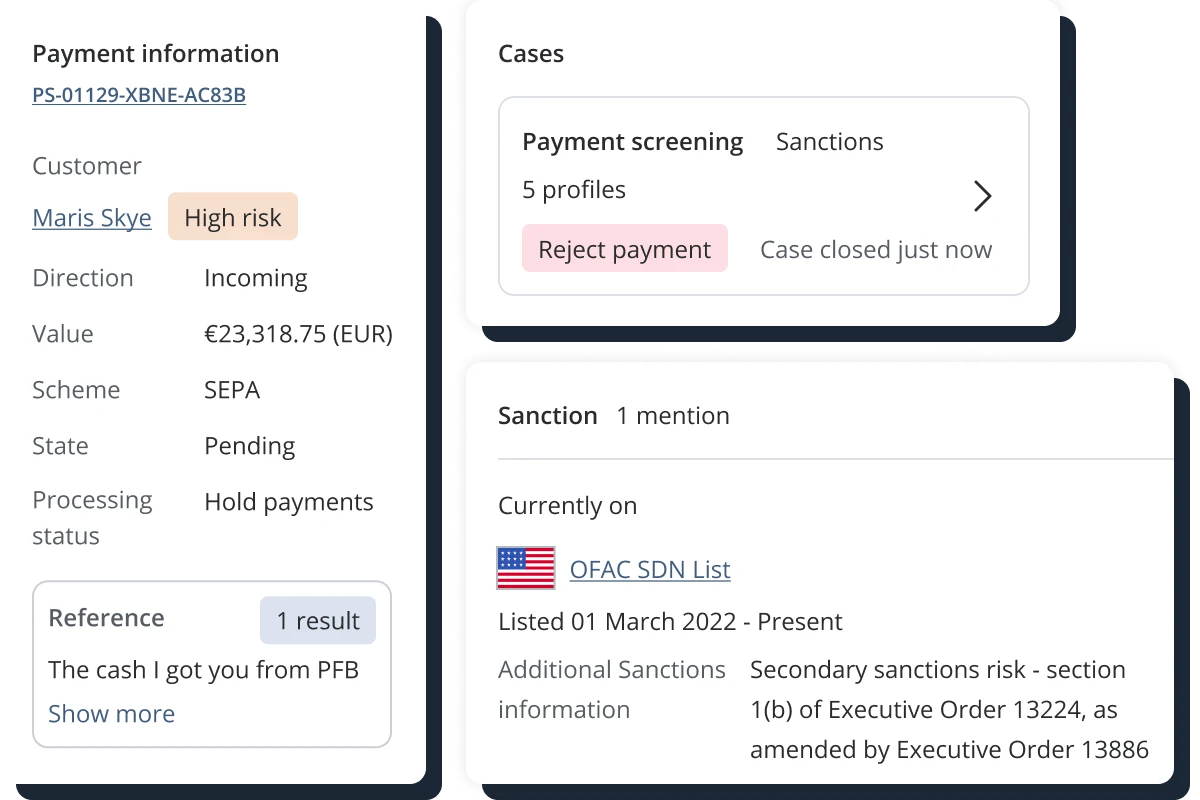

- Reduce the risk of non-compliance with real-time sanctions data intelligence.

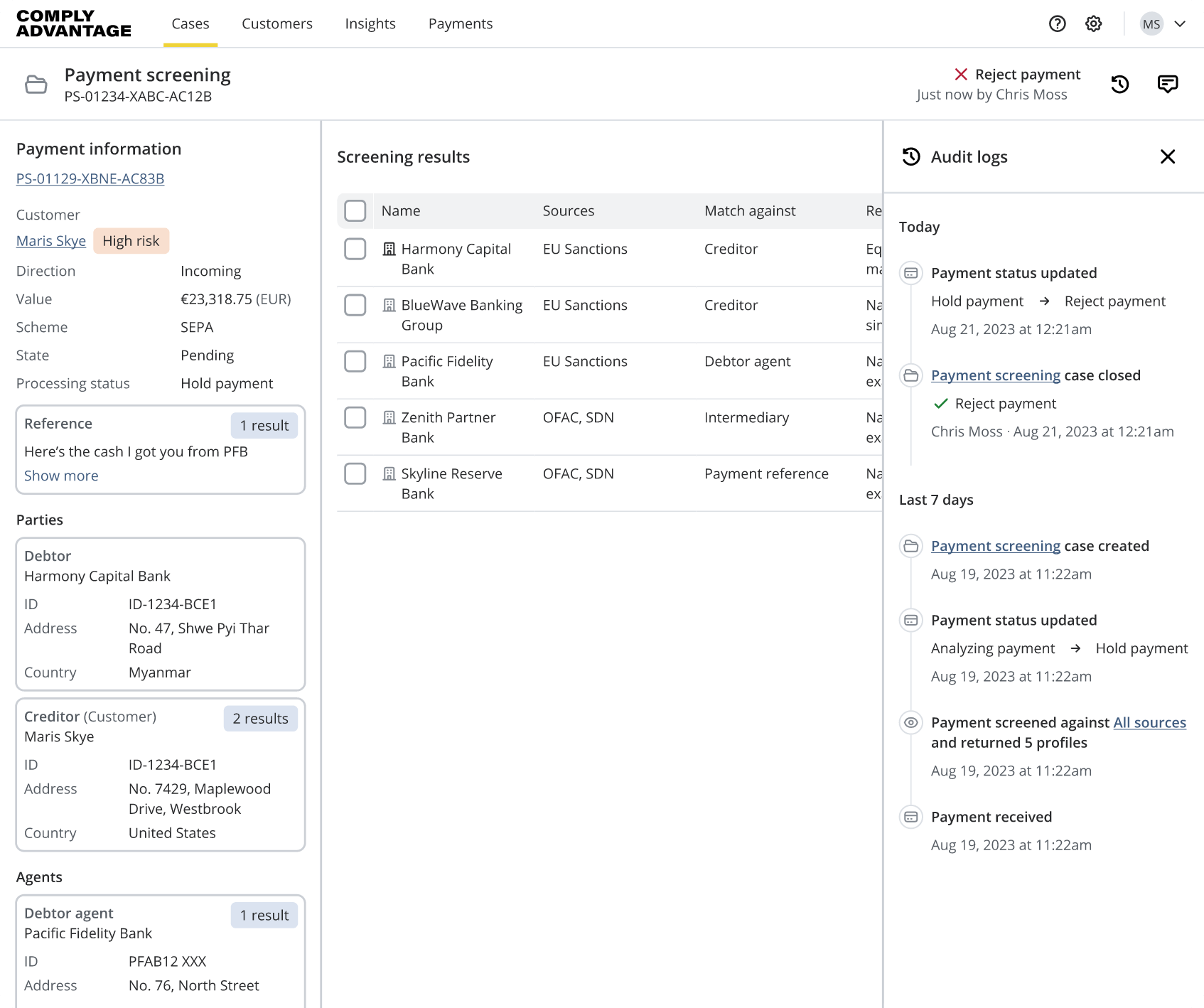

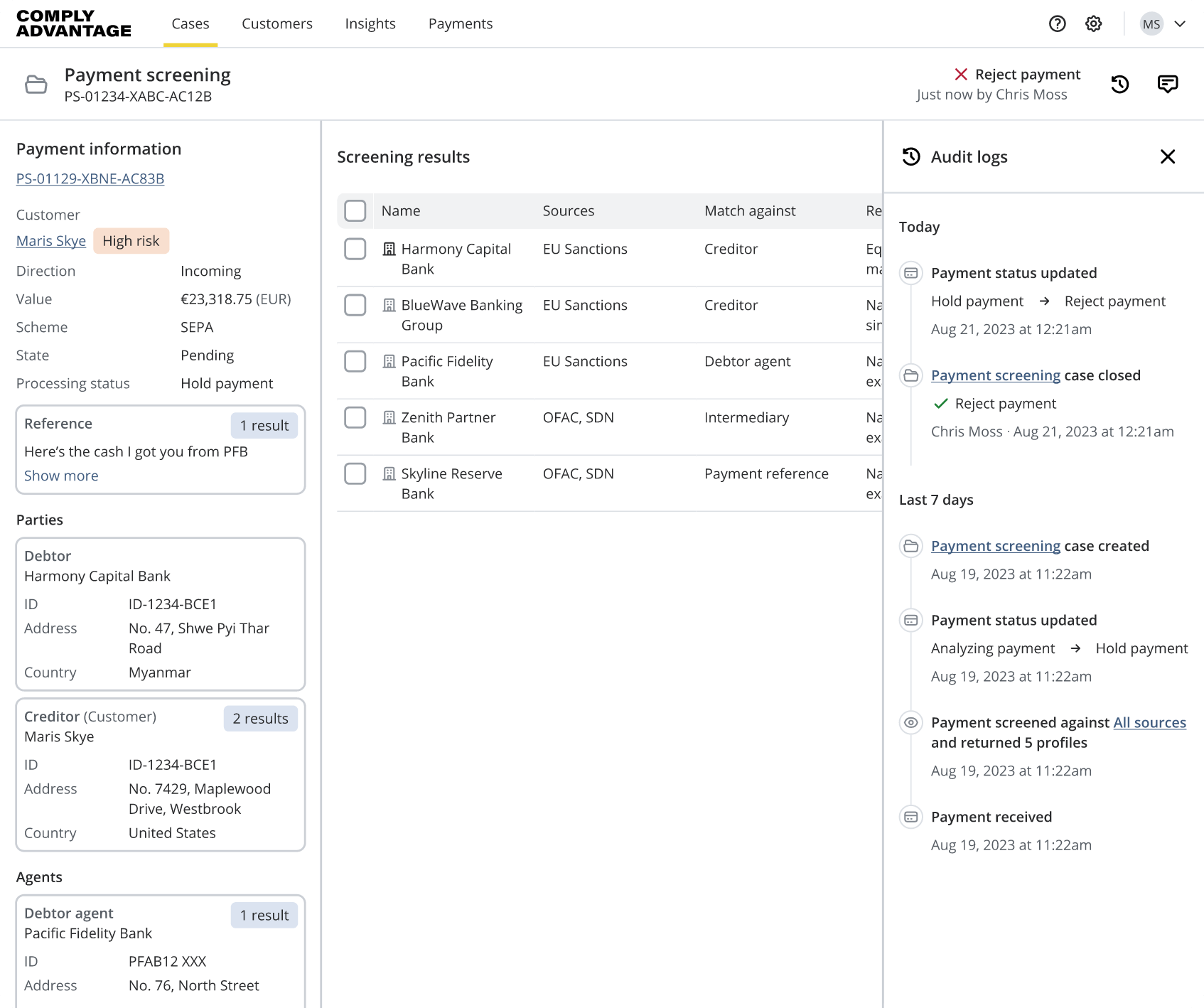

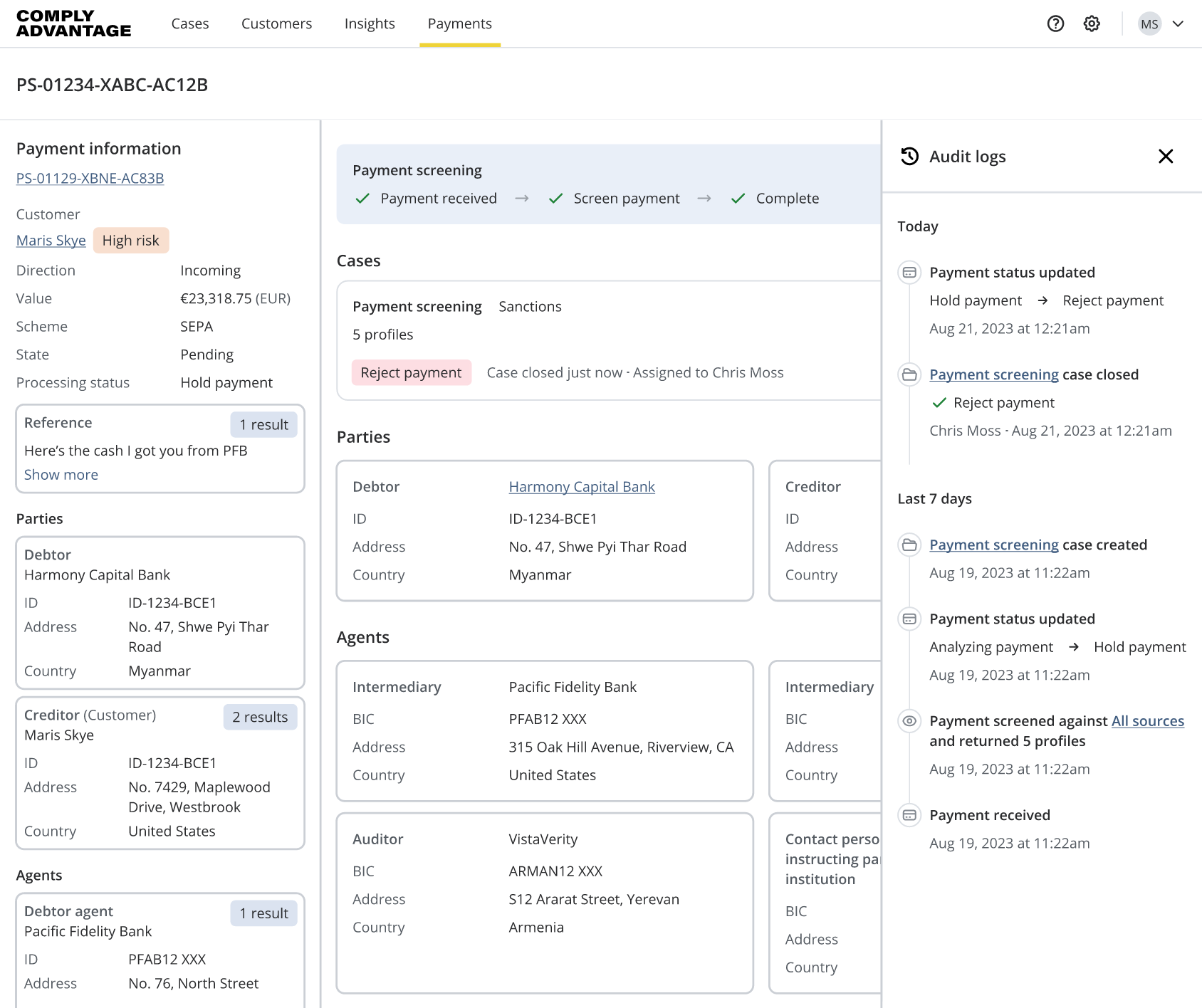

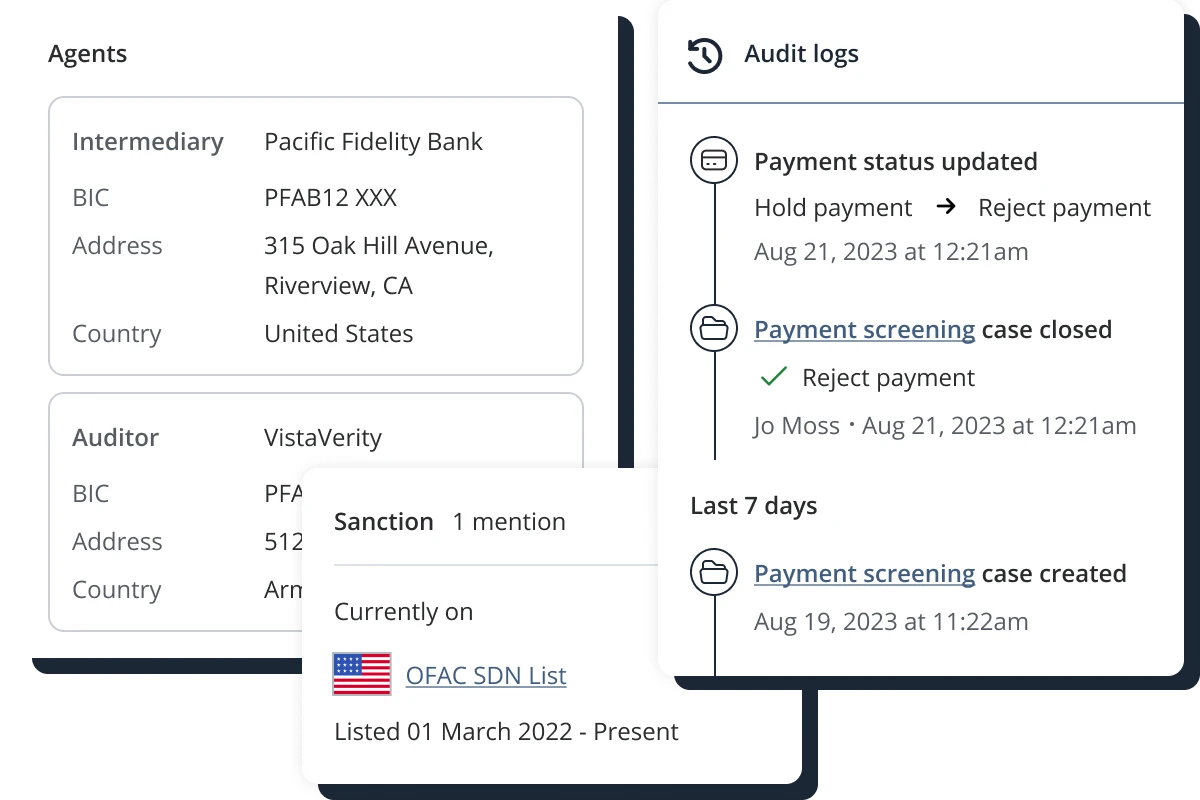

- Comprehensive audit log of payment history and screening of all payment attributes, including names, BIC codes, and unstructured text fields.

- Tailored screening results with flexible configurations, advanced capabilities, and a detailed audit trail that records configuration changes.

Swipe to scroll the full image

Got it

Team Leaders

Ensure accuracy and efficiency of the payments screening process, continuous improvements, and workload assessments.

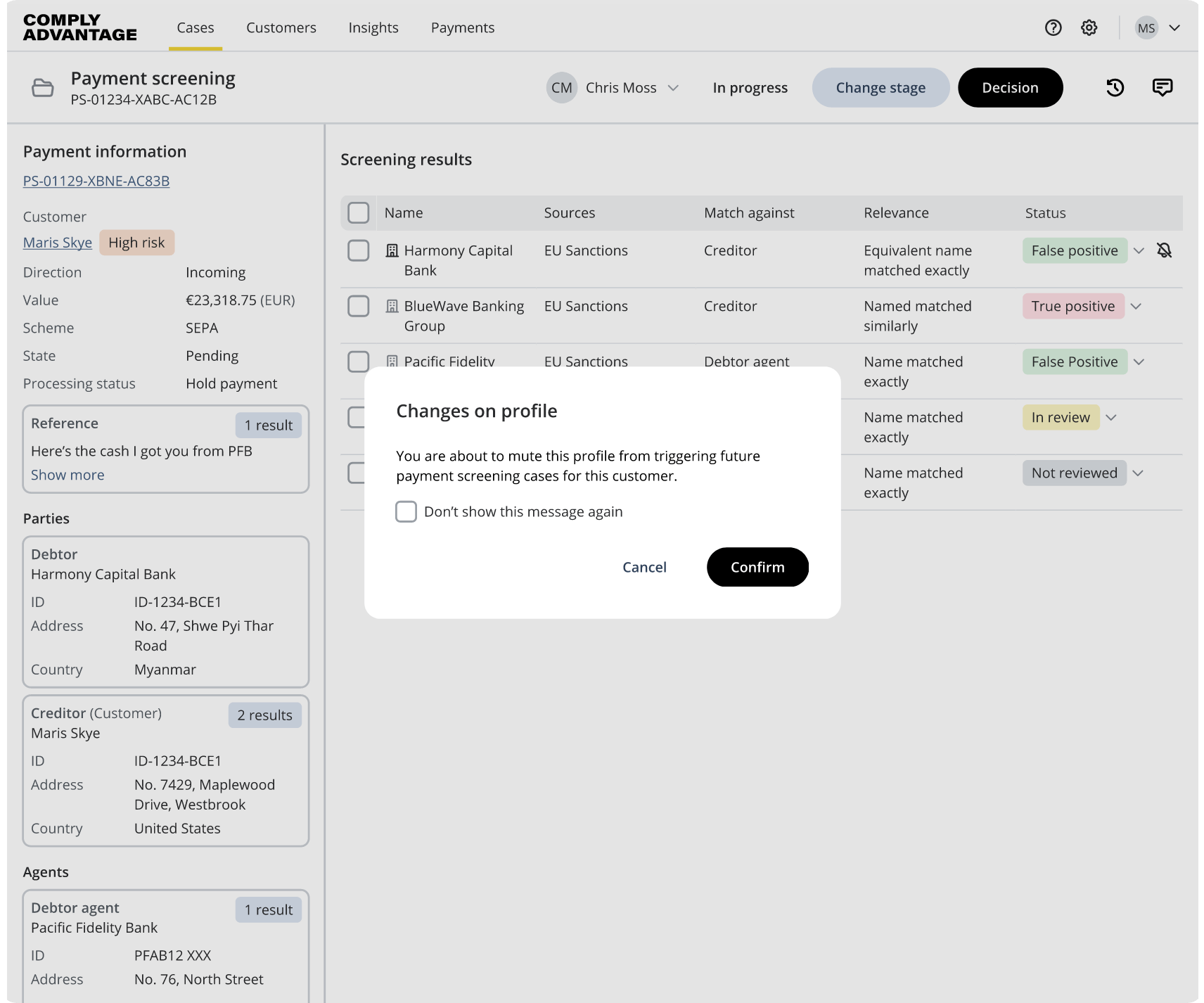

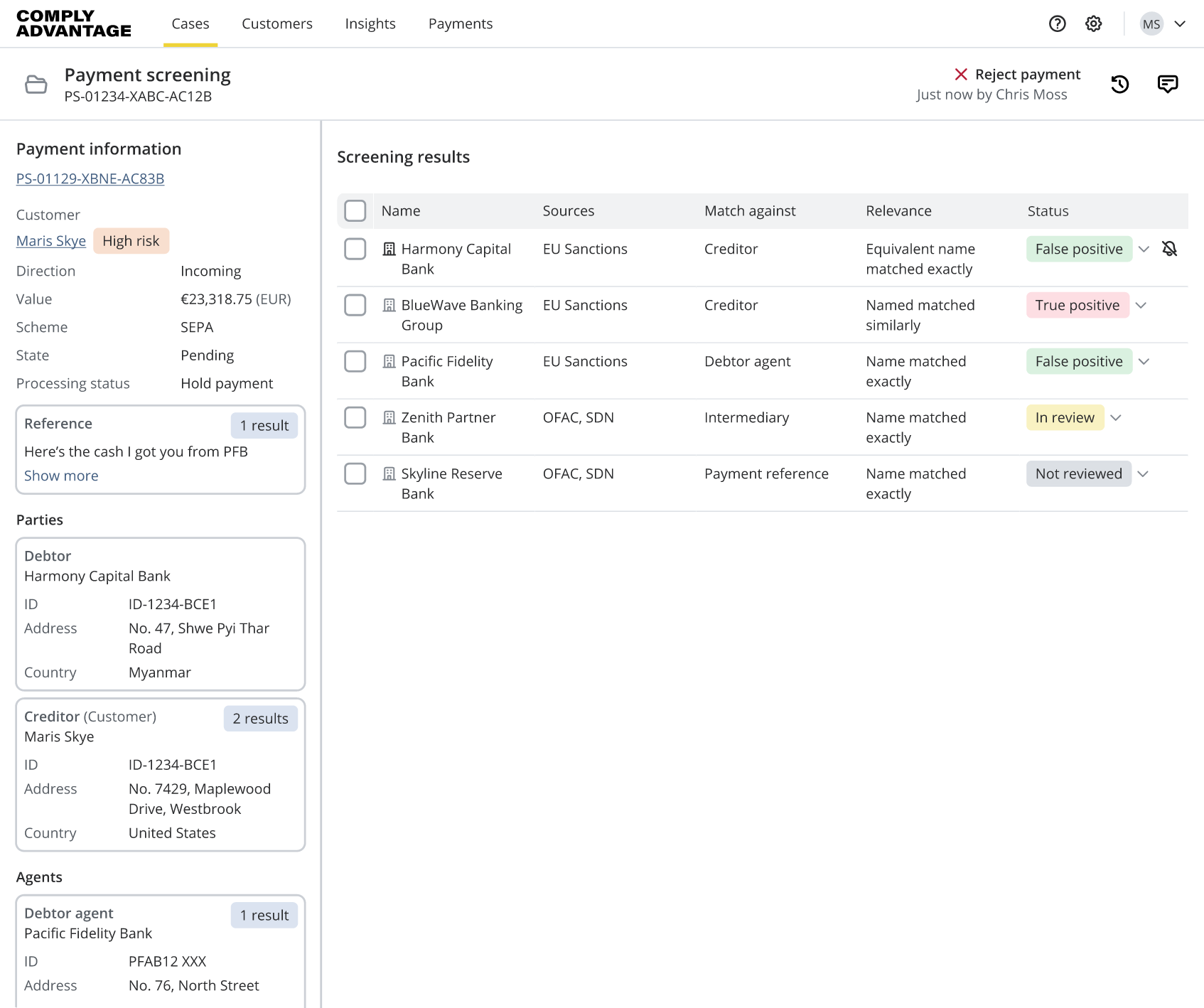

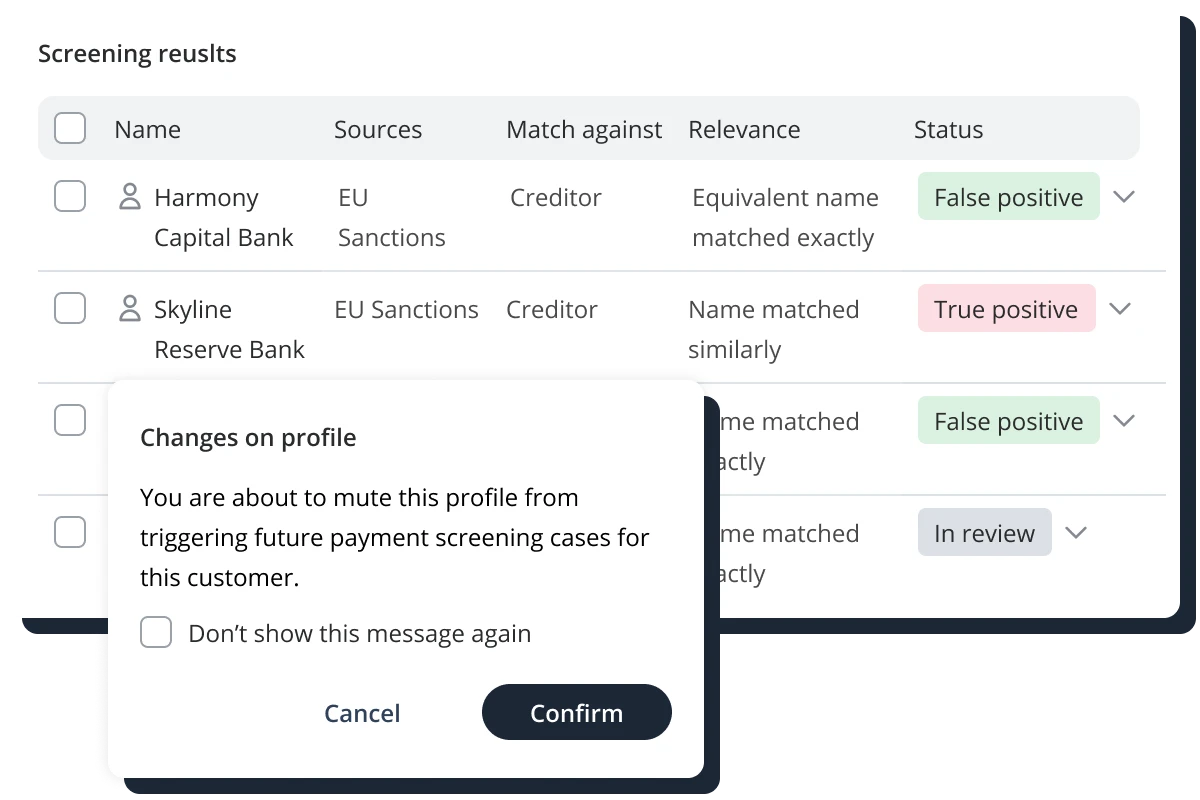

- Make faster, informed decisions with a single consolidated view of alerts with alerts-muting for reduced notifications.

- Keep tab on alerts status, use alert muting to reduce false positives and delays.

- Conduct in-depth case investigations, maintain case notes and audit logs for traceability.

Swipe to scroll the full image

Got it

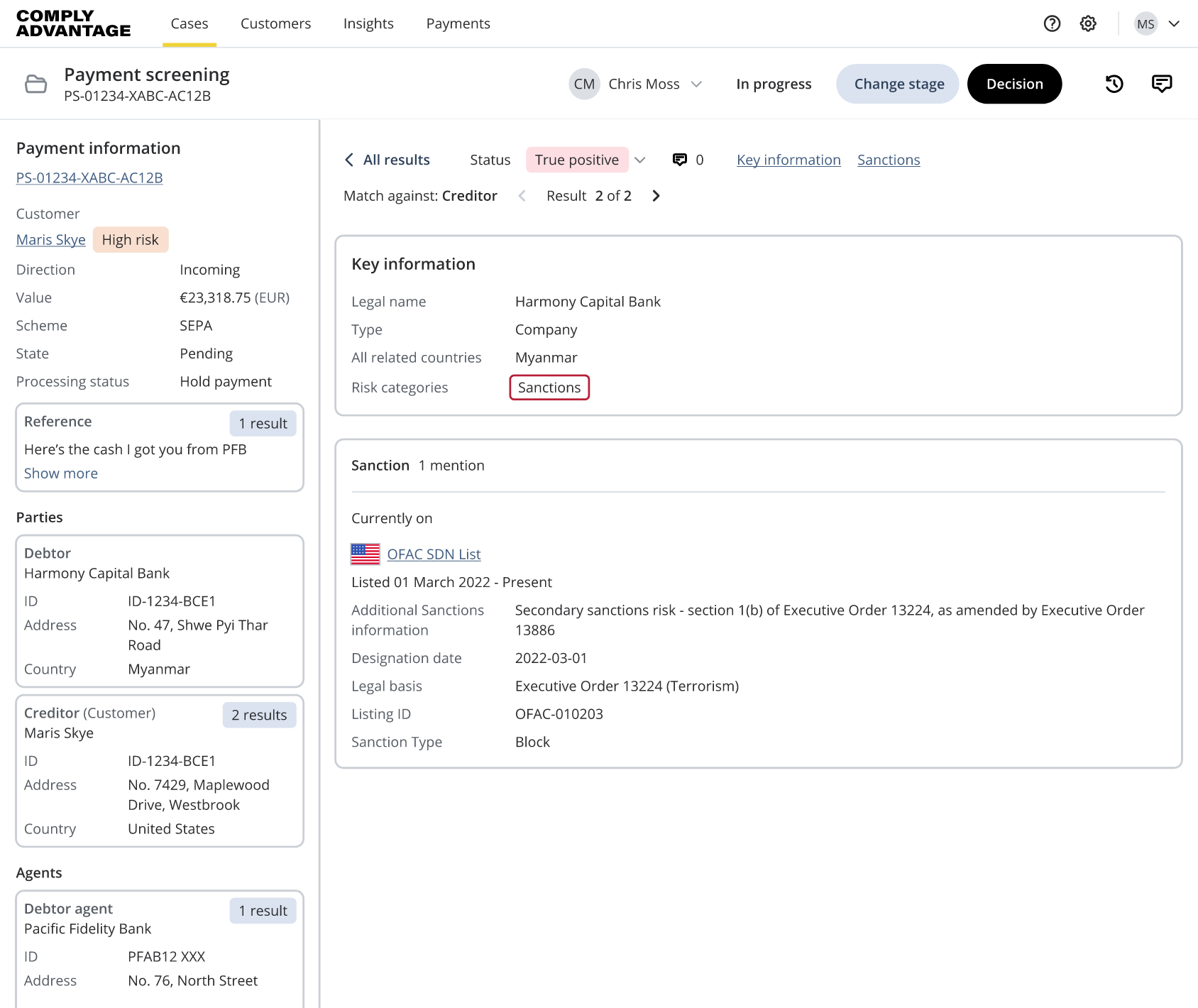

Compliance Analysts

Efficiently and accurately manage all types of alerts against sanctions lists for fast, reliable decision-making.

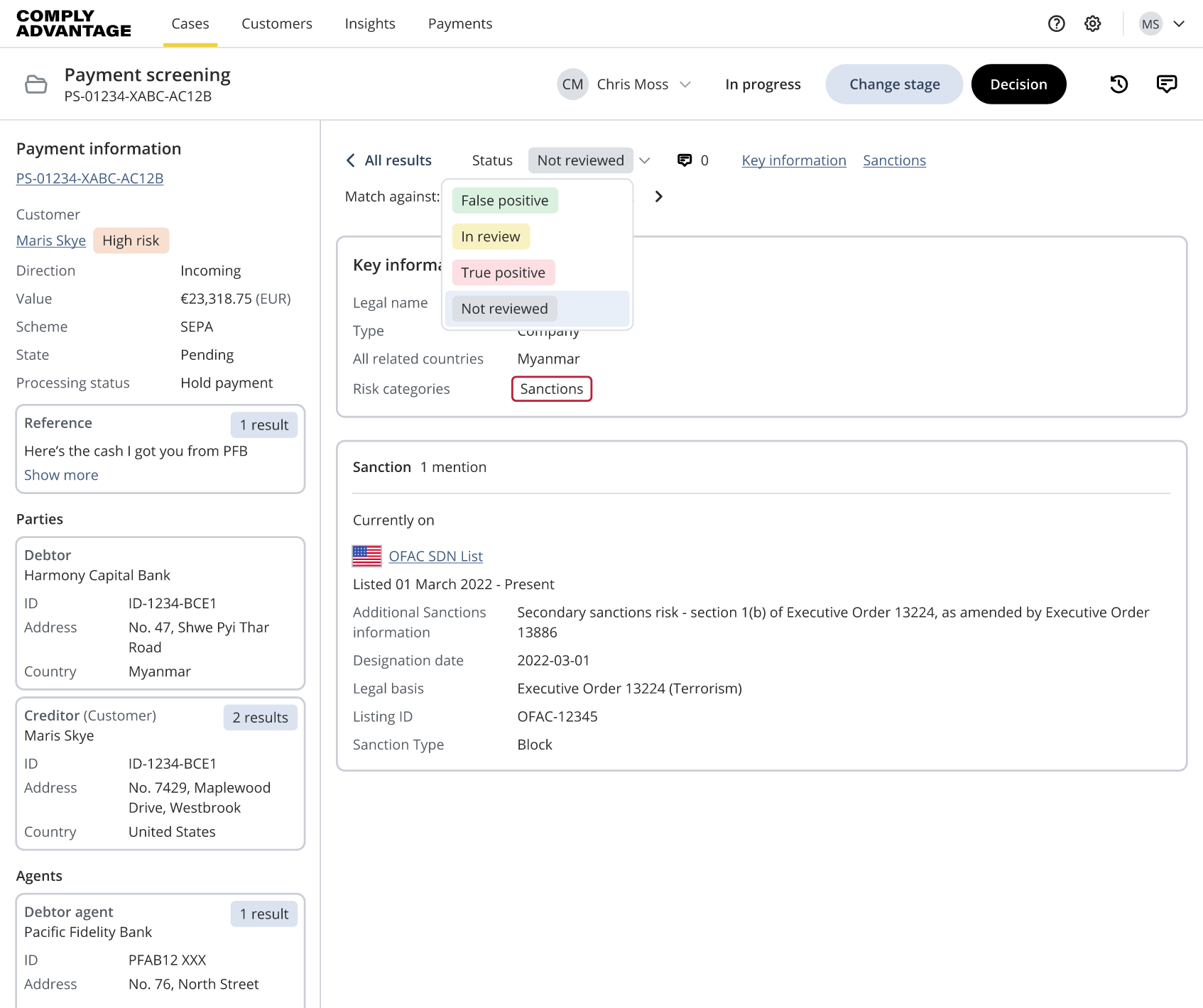

- Analyze alerts quickly and efficiently with rich context on a single screen.

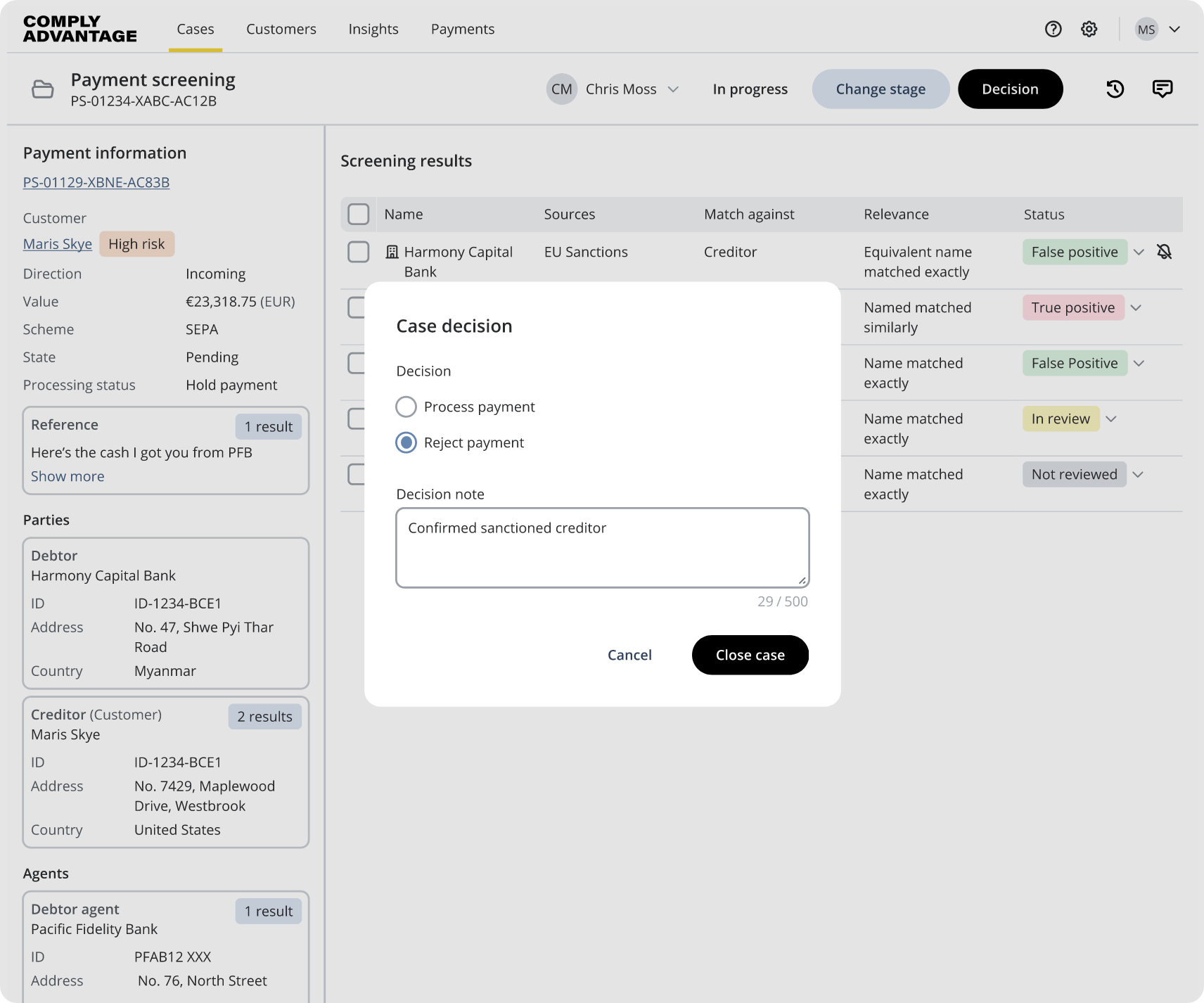

- Review, remediate, and escalate alerts or unusual activity.

- Make informed decisions by documenting the rationale for remediation or escalations.

Swipe to scroll the full image

Got itScreening efficiencies you can measure

Reduction in false positive rates

Reduction in false positive rates

Improvement in account-opening efficiency

Increase in remediation speed

Payment Screening FAQ

SWIFT, Faster payments, Chaps, SEPA, BACS, IMPS, or immediate payment service.

Our global list coverage can be updated as fast as every 15 minutes, with 100% of PEP profiles checked for updates every day. You can detect sanctioned entities within one hour of updates from major lists, including OFAC SDN, OFAC Consolidated, UN Consolidated, EU Consolidated, and HMT. Over 10 million pages are processed daily using deep learning to create accurate adverse profiles.

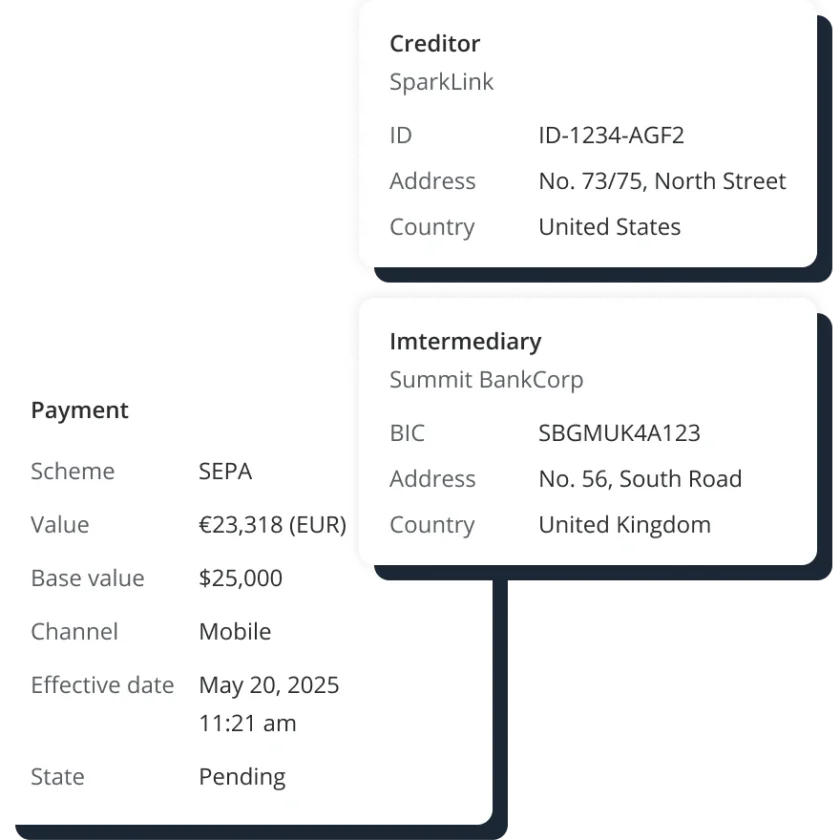

Our solution can screen fields, including counterparty name screening, Customer name screening, Institution name screening, BIC screening, and Reference text screening.

Yes, any number of intermediaries involved in a particular transaction can be configured. Intermediary names can be screened against ComplyAdvantage datasets (Sanctions, Watchlists), and BICs (Banking identifier code), if provided, can be screened against Sanctions.

Custom lists of individuals or legal entities can be configured, and screening can be done against those lists.

Our APIs are easy to integrate and are supported by extensive documentation available through our platform. Clients have been able to implement in as little as 2-4 weeks.

How we use AI to fight financial crime

At ComplyAdvantage, AI powers every stage of the financial crime risk management lifecycle, from onboarding and ongoing monitoring to remediation and reporting. Discover how our multi-layered, AI-driven approach boosts accuracy, reduces friction, and helps compliance teams move faster with confidence.

Learn moreStarter Plan

Category-leading AML solutions

Our customers and financial services analysts all rate us as a category leader quarter after quarter.