WealthTech and Investments

Spot risks before they become threats

High-net-worth clients are high risk. That’s why the cost of customer acquisition is higher in the investment industry than in other financial sectors.

Many firms do not have enough information about the risks of clients’ affiliated entities. That slows onboarding, giving customers a negative experience. Costs and reputational risk increase, too.

At the same time, financial crime is rising and regulators are responding. Investment firms are under pressure to stay on top of many regulations across jurisdictions worldwide.

With our solutions, investment firms can streamline their approach to processes and regulation. Using AI, they can identify risky entities and behaviors before they become threats.

Why ComplyAdvantage?

Screening & Monitoring

Onboard customers quickly, safely, and cost-effectively

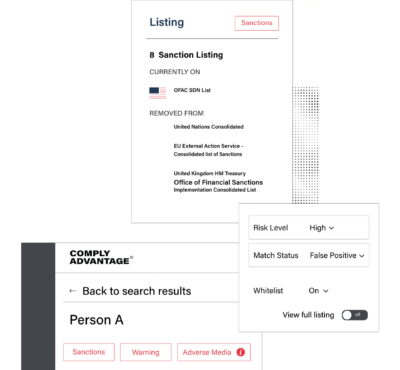

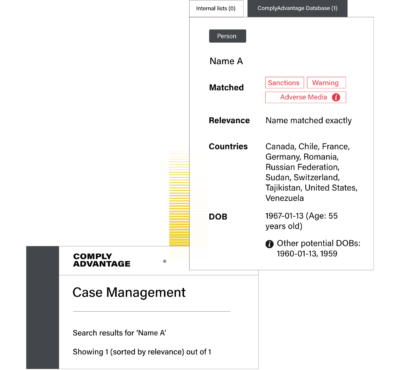

- Screen against the only global dynamic database of sanctions and watchlists.

- Screen in real time against genuine adverse media. Understand the level of political exposure and source of wealth, and identify Politically Exposed Persons (PEPs).

- Reduce the cost of onboarding. Fewer alerts and false positives mean less manual remediation.

- Simplify. Our easy-to-use interface consolidates all insights into a single customer profile.

Adverse Media

Identify potential risks and safeguard your reputation

- Identify adverse media in the entity’s native language. Automatically match it to the entity, so you can monitor changes in risk with speed and accuracy.

- Reduce the noise. Your analysts can focus on the risks that matter to your business.

- React quickly when a client’s risk status changes. Our two-way RESTFul API sends automatic alerts, so your team can act fast to protect your business.