What is the ACPR?

The Autorité de Contrôle Prudentiel et de Résolution (ACPR) is the independent administrative authority in charge of supervising banks and insurance companies in France. Under the authority of the Banque de France, the ACPR is responsible for protecting the French financial system against money laundering and terrorist financing threats by ensuring that financial institutions implement adequate anti-money laundering and the countering of terrorist financing (AML/CFT) measures.

Created in 2010, the ACPR resulted from the merger of the French Banking Commission, the Committee for Credit Card Institutions and Investment Firms (CECEI), and the Mutual Insurance Supervisory Authority (ACAM). Initially known as the Autorité de contrôle prudentiel (ACP), it became the ACPR in 2013 with the implementation of the European Bank Recovery and Resolution Directive (BRRD), which was transposed into French law as Ordinance number 2013-672. The ACPR supervises most of the regulated financial sector.

What does France’s ACPR do?

The ACPR describes its primary missions, which the French Monetary and Financial Code defines in more detail:

- Financial stability: The ACPR exercises ongoing supervision of the French financial system, ensuring that firms comply with financial conduct and reporting rules, including AML/CFT measures. As part of this role, the ACPR issues licenses and authorizations to financial institutions that meet regulatory criteria.

- Customer protection: The ACPR plays a direct role in protecting the customers of financial institutions by conducting on-site audits and inspections to ensure that these institutions have adequate resources and procedures to comply with AML/CFT regulations. The ACPR coordinates its activities through the Joint Unit that it shares with the Autorité des marchés financiers (AMF).

- International representation: In cooperation with the Banque de France, the ACPR must represent France within the EU and on the global stage, including with the Financial Action Task Force (FATF). In this capacity, the ACPR promotes the convergence of international financial standards and best practices.

The ACPR strongly emphasizes compliance with AML/CFT regulations and supports the French Treasury in developing national AML/CFT legislation. The ACPR sends an annual questionnaire to financial institutions to help them define their AML/CFT policy and develop future AML regulations. Using firms’ responses to that questionnaire, the ACPR rates each institution as either low, moderate, high, or very high risk, gauging their AML/CFT response using criteria aligned to those categorizations.

The ACPR regularly publishes normative and informative texts in line with its regulatory function. They include several types, of which the following examples can be noted.

Guidelines

These documents are regularly updated. The most recent versions date from 2021:

- On June 16, the ACPR and the Treasury Department updated their joint guidelines on the implementation of asset-freezing measures. The 2021 revision incorporates the reform in Decree No. 2018-264 of April 9, 2018, and Order No. 2016-1575 of November 24, 2016. In this non-binding guidance, the previous version of which dates back to 2016, the two regulators clarify their expectations regarding compliance with asset-freezing obligations by financial institutions under ACPR supervision.

- On Dec. 16, the regulator issued a guideline regarding identification, verification of identity, and knowledge of customers. This explanatory document aims to specify vigilance standards and best practices for supervised financial institutions. To that end, it addresses the difference between occasional customers and business relationships, and between customer identification and identity verification. It also considers the correct understanding and treatment of beneficial owners and persons acting on behalf of a client.

Supervision Publications

These texts detail banks’ and insurance companies’ regulatory obligations. The regularly updated list can be found on the ACPR website.

AML/CFT Instruction and Reference Texts

The ACPR also provide informative texts dealing with AML/CFT topics. The reference texts contain a variety of national and European regulations. In parallel, the instruction section offers common texts addressed to the insurance and banking sectors, as well as specific information for money changers, digital assets services providers, and other financial institutions. The instruction page was updated in 2022.

The ACPR: Its Current Outlook

In 2022, the FATF published its Mutual Evaluation Report on France. The report highlighted both successes and areas for improvement, with related recommendations. Among the strengths particularly attributed to the ACPR, the FATF noted:

- A broad range of disciplinary sanctions – In the five years between 2015 and 2020, the ACPR imposed 39 sanctions. Its disciplinary measures range from financial penalties to the closure of some institutions.

- Robust understanding of risks – The ACPR demonstrates a solidly grounded approach to anti-money laundering and countering the financing of terrorism. For example, it has established a dedicated AML/CFT team and initiated a platform that assists in its AML/CFT questionnaires. Its supervisory strategy and measures are also sufficiently risk-based.

- Regular and close inter-institutional exchanges – The collaboration between the ACPR, the AMF, and TRACFIN (Traitement du renseignement et action contre les circuits financiers clandestins) also enables the AMF and the ACPR to keep regulated sectors well informed about the risks of money laundering and terrorist financing (ML/TF).

The report also identified several shortcomings to be addressed, including

- Insufficient information on inspections – While the ACPR implements suitable verification measures to ensure that institutions meet their obligations concerning targeted financial sanctions (TFS), the FATF noted a lack of information on the inspections’ frequency and effectiveness.

- Incomplete verification of supervisory or management positions – The ACPR’s fit and proper checks only cover some management titles for financial institutions (FIs). In addition, its definition of “designated effective managers” is inconsistent, varying depending on the type of business.

- Some aspects of supervision are insufficiently based on ML/TF risks – While supervision of French institutions is solidly risk-based, French FIs based abroad do not benefit from such well-informed supervision. The intensity of on-site inspections of FIs did not appear to be sufficiently risk-based, and the ACPR could not cover all at-risk institutions in five years.

ACPR, AMF, and TRACFIN: How do they relate to each other?

Together, the ACPR, the AMF, and TRACFIN work to fight financial crime and protect the financial system in France.

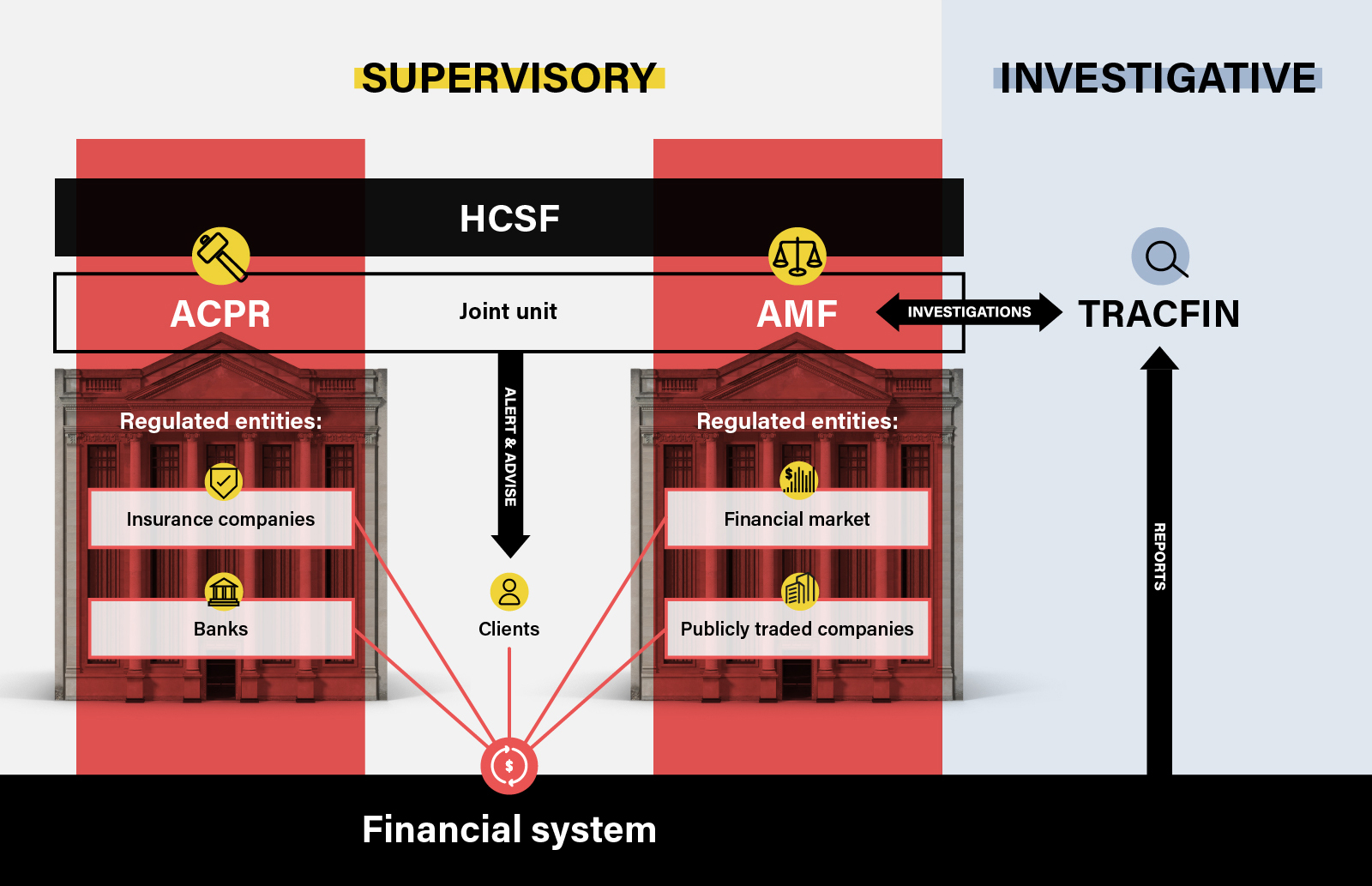

While the ACPR supervises the insurance and banking sectors, the AMF is responsible for the supervision of financial markets. As members of the High Council for Financial Stability (HCSF), both regulatory bodies protect the financial system against economic crises. Together, they also warn and advise clients of the financial system through a joint unit established in 2010.

On the other hand, TRACFIN investigates suspicious transaction reports, communicating its observations to relevant authorities. In this investigative capacity, TRACFIN collaborates with the AMF and the ACPR in fighting financial crime, particularly by exchanging information and collaborating in investigations.

Key Takeaways

Financial institutions under the ACPR’s jurisdiction should consider its current guidelines and ensure that they have based their AML/CFT programs on a current risk assessment. The ACPR’s existing AML/CFT guidelines are on the Banque de France website.

Guide to the new EU AML/CFT framework

Discover how to strengthen AML/CFT programs according to the EU’s new schema.

Access the reportOriginally published 28 April 2020, updated 20 September 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2026 IVXS UK Limited (trading as ComplyAdvantage).