The State of Financial Crime 2024

Stay on top of regional trends and novel criminal techniques so you can protect your business from financial crime.

Download nowThe fifth Financial Action Task Force (FATF) plenary under the two-year Singapore Presidency of T. Raja Kumar took place at the FATF headquarters in Paris on February 21-23, 2024.

We’ve summarized the key developments:

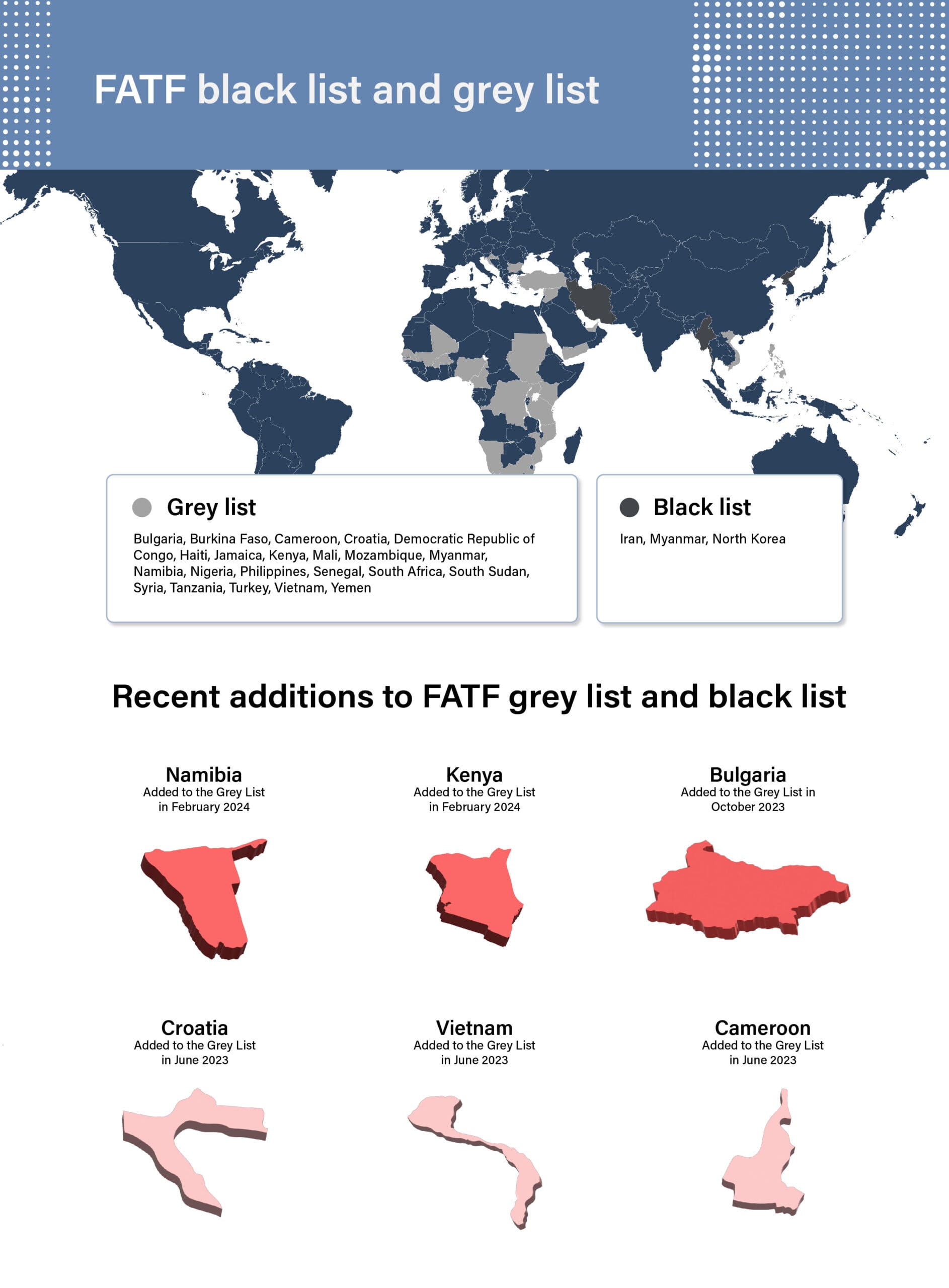

Despite making progress on some recommended actions since September 2022, the FATF has added Kenya to the grey list in light of the country’s need to improve supervision, enhance preventive measures, designate an authority for regulation, and improve the use of financial intelligence.

Since being subject to increased monitoring, Kenya’s national treasury has stated it is fully committed to implementing the action plan of the FATF, stating the move will have only minimal effects on its financial stability. According to a FATF report published in 2022, Kenya is primarily at risk of terrorism financing through money flows from both within and outside its borders. Additionally, the report highlights that cryptocurrencies introduce further risks to the country.

Namibia also committed to strengthening its AML/CFT regime with the help of the FATF and Eastern and Southern Africa Anti-Money Laundering Group (ESAAMLG). Since September 2022, the FATF noted Namibia’s progress in ensuring a common understanding of money laundering, terrorist financing, and proliferation financing risks among key stakeholders. However, the watchdog noted several key areas that required improvement, including:

In contrast with Kenya’s addition to the grey list, Namibia’s Financial Intelligence Centre said that putting Namibia on the grey list could negatively impact the country’s foreign direct investment.

In 2020, Barbados was added to the grey list due to a series of weak AML/CFT measures it had in place, including a lack of risk-based supervision for financial institutions (FIs) and designated non-financial businesses and professions (DNFBPs). After being satisfied with the country’s progress alongside its agreed strategic plan, the FATF removed it from the grey list in February 2024. In particular, the FATF noted Barbados’ improved measures to prevent legal persons and arrangements from being misused for criminal purposes.

The FATF also welcomed Gibraltar’s significant progress in improving its AML/CFT regime, ultimately removing the country from the grey list. While Gibraltar should continue to work with MONEYVAL to sustain its improvements in its AML/CFT system, the FATF specifically highlighted two improvements:

In February 2020, the FATF placed Uganda on its increased monitoring list, which prompted a series of AML reforms, including:

As a result of these reforms, the FATF removed Uganda from the grey list.

Kumar also acknowledged the UAE’s significant progress in enhancing its AML/CFT regime to meet the commitments in its action plan to address the strategic deficiencies identified by the FATF in February 2022.

The UAE achieved this by:

As a result of these improvements, the UAE is no longer subject to the FATF’s increased monitoring process. However, the FATF noted that the UAE should continue to collaborate with the Middle East and North Africa Financial Action Task Force (MENAFATF) to maintain its progress in its AML/CFT system.

Echoing Kumar’s objectives presented at the first plenary under his presidency in June 2022, the FATF discussed multiple strategic initiatives, including improving beneficial ownership transparency and countering illicit finance related to cyber-enabled crime.

The FATF has updated its guidelines on beneficial ownership and transparency of legal arrangements following revisions to recommendation 25, which were adopted in February 2023. The updated guidance aims to help stakeholders assess and mitigate money laundering and terrorist financing risks and complements existing guidance on legal persons.

The FATF’s strengthened standards will aid in identifying corrupt individuals, sanctions evaders, money launderers, and tax evaders who conceal their criminal activities. The guidance will be published at the end of February 2024.

Closing the plenary, Kumar highlighted that many countries have not fully implemented the FATF’s revised recommendation 15. As a result, there are significant loopholes that are being exploited by criminals and terrorists due to the borderless nature of virtual asset activity.

In February 2023, the FATF agreed on a roadmap to strengthen the implementation of the FATF standards on virtual assets and virtual asset service providers. The FATF conducted a stocktake of current implementation levels across the global network and agreed to publish an overview of the steps taken by FATF and FATF-style regional bodies (FSRB) member jurisdictions.

This overview will include the most significant virtual asset activity regarding trading volume and user base, as well as the regulatory and supervisory measures taken to address AML/CFT concerns for virtual asset service providers (VASPs). Kumar explained that this exercise aims to help the FATF network regulate and supervise VASPs for AML/CFT purposes and encourage jurisdictions to implement recommendation 15 fully.

The FATF also proposed amendments to recommendation 16 – which aims to improve the transparency and traceability of transactions – to keep up with the fast development of cross-border payment systems and changing industry standards. These revisions aim to make cross-border payments quicker, cheaper, transparent, and inclusive while ensuring AML/CFT compliance.

Kumar noted that the revisions, which will be released for public consultation, will also ensure that FATF recommendation 16 remains technology-neutral.

In October 2023, the FATF changed recommendation eight to safeguard non-profit organizations (NPOs) from potential terrorist financing abuse. The revisions clarified that the recommendation only applies to NPOs that fall within the FATF definition. At the same time, the FATF updated its best practices to help countries, FIs, and the non-profit sector understand how to protect vulnerable NPOs from abuse for terrorist financing while still allowing legitimate NPO activities to continue.

Following this plenary session, the FATF has agreed to update its assessment methodology for the upcoming round of mutual evaluations. This update will further clarify the obligations to apply risk-based measures to protect NPOs most vulnerable to potential terrorist financing abuse.

Ms. Elisa de Anda Madrazo of Mexico was also appointed as the next President of the FATF for a two-year term. Ms de Anda Madrazo, who served as FATF Vice President from July 2020 to June 2023, will assume her duties on July 1, 2024, a day after the two-year Presidency of Mr. T. Raja Kumar ends.

Following Russia’s invasion of Ukraine in 2022, the FATF issued a statement expanding their previous statement from February 2023. The watchdog noted continued concern over the risks posed by the Russian Federation, including growing economic connectivity with countries subject to FATF countermeasures, proliferation financing, and malicious cyber activities. Due to the severity of these risks, the FATF urged members to continue taking proactive measures to safeguard themselves and the global financial system.

Compliance staff should ensure they are familiar with the outcomes of the February plenary – particularly relating to any upcoming MERs in countries they operate in. Regarding the changes to the grey list, firms must update the risk scores of relevant countries, with appropriate levels of due diligence being administered as required going forward.

Dates related to forthcoming guidance issued by the FATF should also be noted. Such guidance will help shape and inform the future regulatory approach national bodies take.

The next FATF plenary is due to take place in June 2024.

Previous plenary coverage from ComplyAdvantage can be found here:

Stay on top of regional trends and novel criminal techniques so you can protect your business from financial crime.

Download nowOriginally published 23 February 2024, updated 01 July 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).