Take a closer look at ComplyAdvantage’s Sanctions Screening solution.

Find out how ComplyAdvantage is helping financial institutions around the world.

Get a demoSanctions screening software plays a crucial role in the anti-money laundering and counter-terrorist financing (AML/CTF) process. The right technology can improve the customer experience, improve relationships with regulators, and provide a more efficient, scalable operation. The wrong technology slows compliance teams down, agitates customers, and exposes the business to unacceptable degrees of risk.

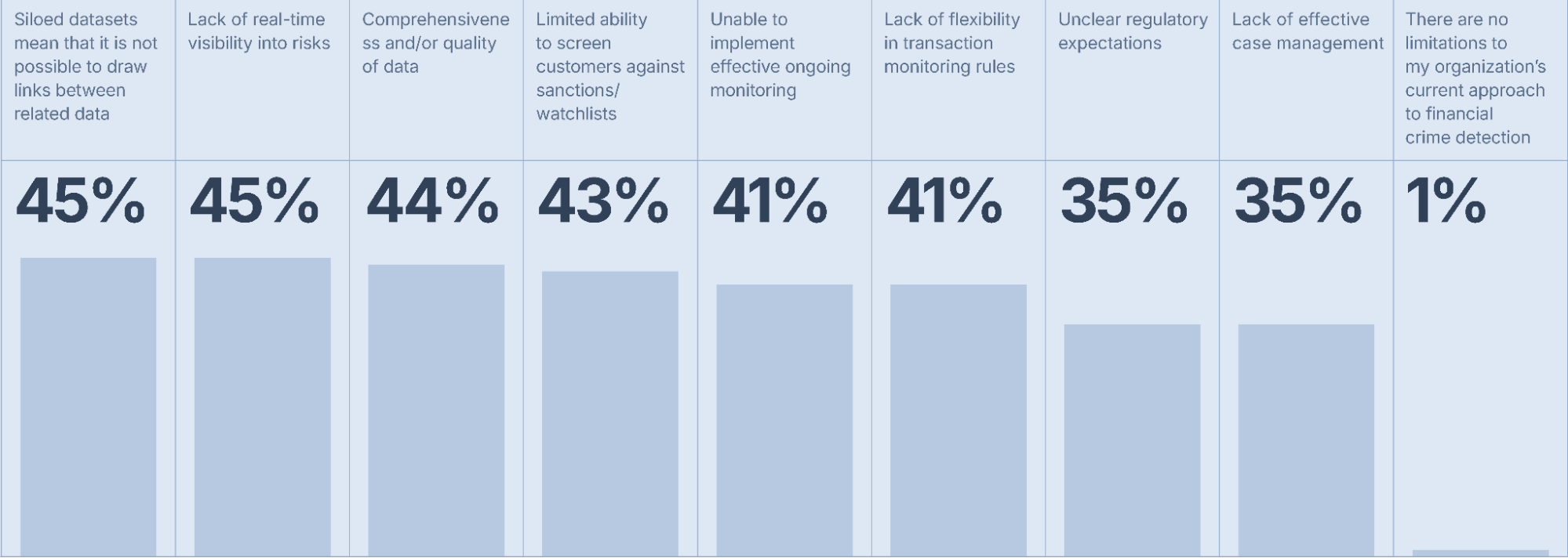

In our State of Financial Crime 2025 survey, 43 percent of firms said the biggest limitation to their financial crime risk detection was an inability to screen customers against sanctions lists and watchlists, underlining the importance of investing in market-leading software solutions.

What are the main limitations to your organization’s current approach to financial crime detection?

This article presents five tips for compliance leaders to consider when selecting the best sanctions screening software for their company.

When evaluating sanctions screening software, a meticulous analysis of its key features will form the cornerstone of a thorough assessment. Among these features, real-time screening is paramount, offering organizations the critical capability to respond promptly to evolving threats. Complementary to this, fuzzy matching functionalities can contribute to the precision and accuracy of the screening process, mitigating the risk of overlooking potential matches. Equally, the software’s ability to manage false positives effectively can directly influence a firm’s operational efficiency and resource allocation, and configurable rules further enhance adaptability, enabling organizations to tailor the screening tool to meet their specific requirements.

However, beyond the technical functionalities, a forward-looking perspective becomes essential. When analyzing the key features of sanctions screening software, organizations should confirm if the solution will serve the roles of all key stakeholders in their financial crime compliance program, including analysts, team leaders, and chief risk officers. Specifically, firms should ask if the solution empowers users to implement role-based access.

Automation, a linchpin for cost-effective compliance, introduces a practical dimension to the evaluation process. Identifying repeatable tasks and assessing the extent to which the solution automates these tasks are pivotal considerations that directly impact overall operational efficiency.

To ensure effective sanctions screening, it is important to determine the vendors’ available data and ensure the software has appropriate data integrations to cover the jurisdictions and territories where a firm operates and provides services. Ideally, firms should prioritize vendors that offer a combination of software and proprietary data. This approach provides several benefits, including the ability to avoid shopping around and maintaining multiple vendor relationships and contracts. For larger financial institutions, the procurement exercise alone can cost hundreds of thousands of dollars.

Another advantage of sourcing both the software and data from a single vendor is that the software and data are closely linked from the start. The software is built to navigate through the data better, send feedback to the data algorithms, and perform other useful functions.

However, it is also crucial to prioritize the quality of data, not just the quantity. Outdated records can contribute to high volumes of false positives, rendering screening against real-time risk much less effective. Rather, firms should consider partnering with a vendor that uses teams of global data experts to review and edit problematic profiles to ensure the AML/CFT data acquired by machine learning algorithms is accurate and up-to-date.

The first stage is understanding the problem that you’re needing to solve. Then you look at, what data do I need to solve that problem? In this case, sanctions risk management. And then make sure that that data is of a sufficient quality and you’ve got all of the relevant data points to solve the underlying problem.

Andrew Davies, Global Head of Regulatory Affairs, ComplyAdvantage

Since non-compliance with sanctions regimes can lead to hefty fines, reputational damage, and legal repercussions, finding a screening solution that aligns with AML regulations will be top-of-mind for compliance teams. A key aspect to look out for when assessing multiple sanctions screening solutions is the software’s ability to access and incorporate updated sanctions lists from reliable sources. These lists, maintained by government agencies and international bodies, include individuals, entities, and countries subject to sanctions or restrictions. By accessing up-to-date lists, the software can help firms stay ahead of regulatory requirements and minimize the risk of inadvertently engaging with sanctioned entities.

In particular, features like automatic updates and alerts for changes in sanctions lists should be prioritized, as they can help enhance compliance efforts and enable proactive risk management.

How vendors implement their clients’ AML programs is critical. A slow implementation process risks undermining the customer experience and delaying the roll-out of new products and services. Poor support over time can become a chronic issue weighing compliance teams down if, for example, the ability to add new rules and capabilities is impacted. But what does ‘good’ look like regarding integration, and what technical aspects should be prioritized?

Finally, it’s important to choose a reliable vendor in the industry to ensure business continuity and increase operational resilience. Securing comprehensive software, good data, and the right price doesn’t guarantee a sustainable relationship with a vendor. The quality of support the vendor is able to offer, if and when a firm needs it, is what underlines this.

Even if assistance isn’t verbally requested, would the vendor still seek to help compliance teams make the most of the solution in improving their efficiency and reducing their risk and cost of compliance? There will be times when unusual reports or a unique screening feature is required. Will they provide the necessary support then (and with a smile)? These are the things that make the vendor-customer relationship a happy one. The best way to check this before becoming a customer is to connect with the vendor’s existing customers.

With ComplyAdvantage, an initial screening search can be completed in as little as five minutes, which is a significant improvement.

Sinclair Coghill, Manager – Compliance and Executive Projects, Hafnia

ComplyAdvantage has been rated by Chartis as the only best-of-breed KYC data provider, which is why thousands of FIs worldwide rely on ComplyAdvantage for a sanctions screening solution. Whether they’re conducting thousands of checks a month or less than a hundred, they benefit from:

Find out how ComplyAdvantage is helping financial institutions around the world.

Get a demoOriginally published 07 May 2024, updated 27 August 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).