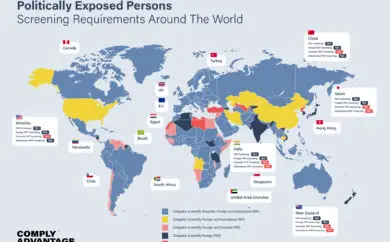

Both industry regulators and the Financial Action Task Force (FATF) consider politically exposed persons (PEPs) to pose a higher risk of corruption and involvement in money laundering and/or terrorist financing. To effectively mitigate the potential risks posed by such activities, […]