Guide to the new EU AML/CFT framework

Discover how to strengthen AML/CFT programs according to the EU’s new schema.

Access the reportThe Autorité de Contrôle Prudentiel et de Résolution (ACPR) is the independent administrative authority in charge of supervising banks and insurance companies in France. Under the authority of the Banque de France, the ACPR is responsible for protecting the French financial system against money laundering and terrorist financing threats by ensuring that financial institutions implement adequate anti-money laundering and the countering of terrorist financing (AML/CFT) measures.

Created in 2010, the ACPR resulted from the merger of the French Banking Commission, the Committee for Credit Card Institutions and Investment Firms (CECEI), and the Mutual Insurance Supervisory Authority (ACAM). Initially known as the Autorité de contrôle prudentiel (ACP), it became the ACPR in 2013 with the implementation of the European Bank Recovery and Resolution Directive (BRRD), which was transposed into French law as Ordinance number 2013-672. The ACPR supervises most of the regulated financial sector.

The ACPR describes its primary missions, which the French Monetary and Financial Code defines in more detail:

The ACPR strongly emphasizes compliance with AML/CFT regulations and supports the French Treasury in developing national AML/CFT legislation. The ACPR sends an annual questionnaire to financial institutions to help them define their AML/CFT policy and develop future AML regulations. Using firms’ responses to that questionnaire, the ACPR rates each institution as either low, moderate, high, or very high risk, gauging their AML/CFT response using criteria aligned to those categorizations.

The ACPR regularly publishes normative and informative texts in line with its regulatory function. They include several types, of which the following examples can be noted.

These documents are regularly updated. The most recent versions date from 2021:

These texts detail banks’ and insurance companies’ regulatory obligations. The regularly updated list can be found on the ACPR website.

The ACPR also provide informative texts dealing with AML/CFT topics. The reference texts contain a variety of national and European regulations. In parallel, the instruction section offers common texts addressed to the insurance and banking sectors, as well as specific information for money changers, digital assets services providers, and other financial institutions. The instruction page was updated in 2022.

In 2022, the FATF published its Mutual Evaluation Report on France. The report highlighted both successes and areas for improvement, with related recommendations. Among the strengths particularly attributed to the ACPR, the FATF noted:

The report also identified several shortcomings to be addressed, including

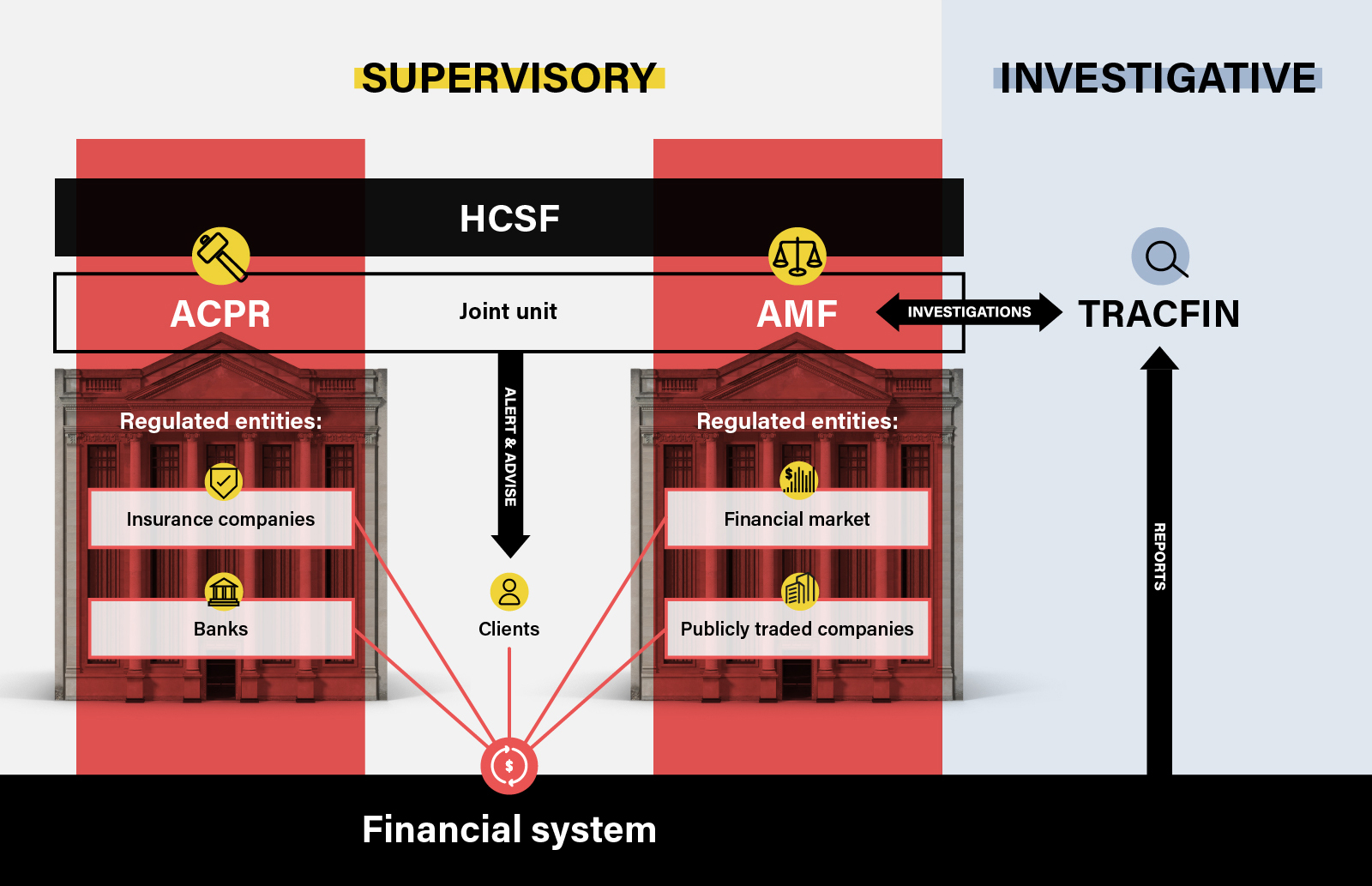

Together, the ACPR, the AMF, and TRACFIN work to fight financial crime and protect the financial system in France.

While the ACPR supervises the insurance and banking sectors, the AMF is responsible for the supervision of financial markets. As members of the High Council for Financial Stability (HCSF), both regulatory bodies protect the financial system against economic crises. Together, they also warn and advise clients of the financial system through a joint unit established in 2010.

On the other hand, TRACFIN investigates suspicious transaction reports, communicating its observations to relevant authorities. In this investigative capacity, TRACFIN collaborates with the AMF and the ACPR in fighting financial crime, particularly by exchanging information and collaborating in investigations.

Financial institutions under the ACPR’s jurisdiction should consider its current guidelines and ensure that they have based their AML/CFT programs on a current risk assessment. The ACPR’s existing AML/CFT guidelines are on the Banque de France website.

Discover how to strengthen AML/CFT programs according to the EU’s new schema.

Access the reportOriginally published 28 April 2020, updated 20 September 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).