Lending

Identify risks in real-time and onboard clients faster

Financial criminals are targeting lenders. It’s an unconventional way to launder money, but that’s what makes it attractive to them. Criminals expect it to go unnoticed.

That’s why regulators are pushing lenders to improve their due diligence. Those who fail to comply with AML regulations can be heavily fined, and suffer reputational damage.

Whether you are a single or multi-product lender, it is essential to have a robust risk-based approach to onboarding customers and monitoring loans. Our AI-driven solutions enable lenders to achieve a more effective and streamlined approach to their processes and regulatory compliance.

Why ComplyAdvantage?

Screening & Monitoring

Onboard clients quickly and efficiently

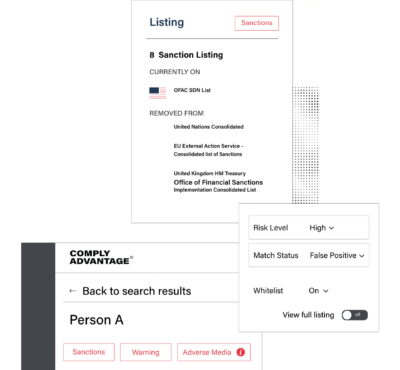

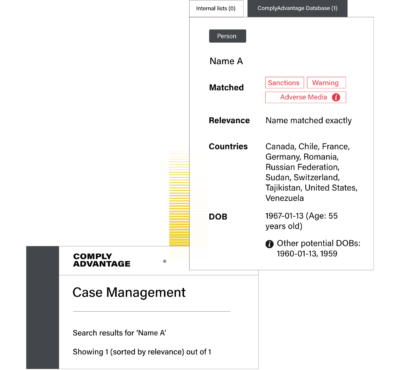

- Screen against sanctions lists, watchlists, and politically exposed persons (PEPs). Detect fraud on claims and check claim payments before processing them.

- Tailor alerts based on our FATF-aligned taxonomy. Reduce false positives and speed up customer onboarding.

- Avoid ‘over screening’ at onboarding and boost customer satisfaction. Tailor your screening according to parameters such as types of loans, customers, or country.

- Reduce manual work by automating customer screening. Streamline the onboarding of new entities and the screening of current clients requesting loans.

Adverse Media Monitoring

Get deeper insight into your risk exposure

- Cut through the noise. Focus only on the most critical information for underwriting loans.

- Identify potential high-risk entities. That includes known fraudsters who have engaged in money laundering or have filed false loan applications in the past.

- All information is consolidated into single customer profiles. Compliance teams can gain deeper insight into their customers and clearly visualize associated risks.

Transaction Monitoring

Identify patterns of loan funding and settlement in real-time

- Use lending-specific rules. Adopt our recommended rules or use your own, all tailored to your risk-based approach.

- Spot suspicious repayment patterns. Notice when the volume or frequency of loan repayments exceeds what a client should be capable of.

- Monitor with ease. Use our friendly interface or integrate seamlessly with our API.