The October 2024 Plenary meeting of the Financial Action Task Force (FATF) in Paris, led by President Elisa de Anda Madrazo, concluded with several critical updates for compliance professionals, including:

- Completion of the FATF’s fourth evaluation cycle.

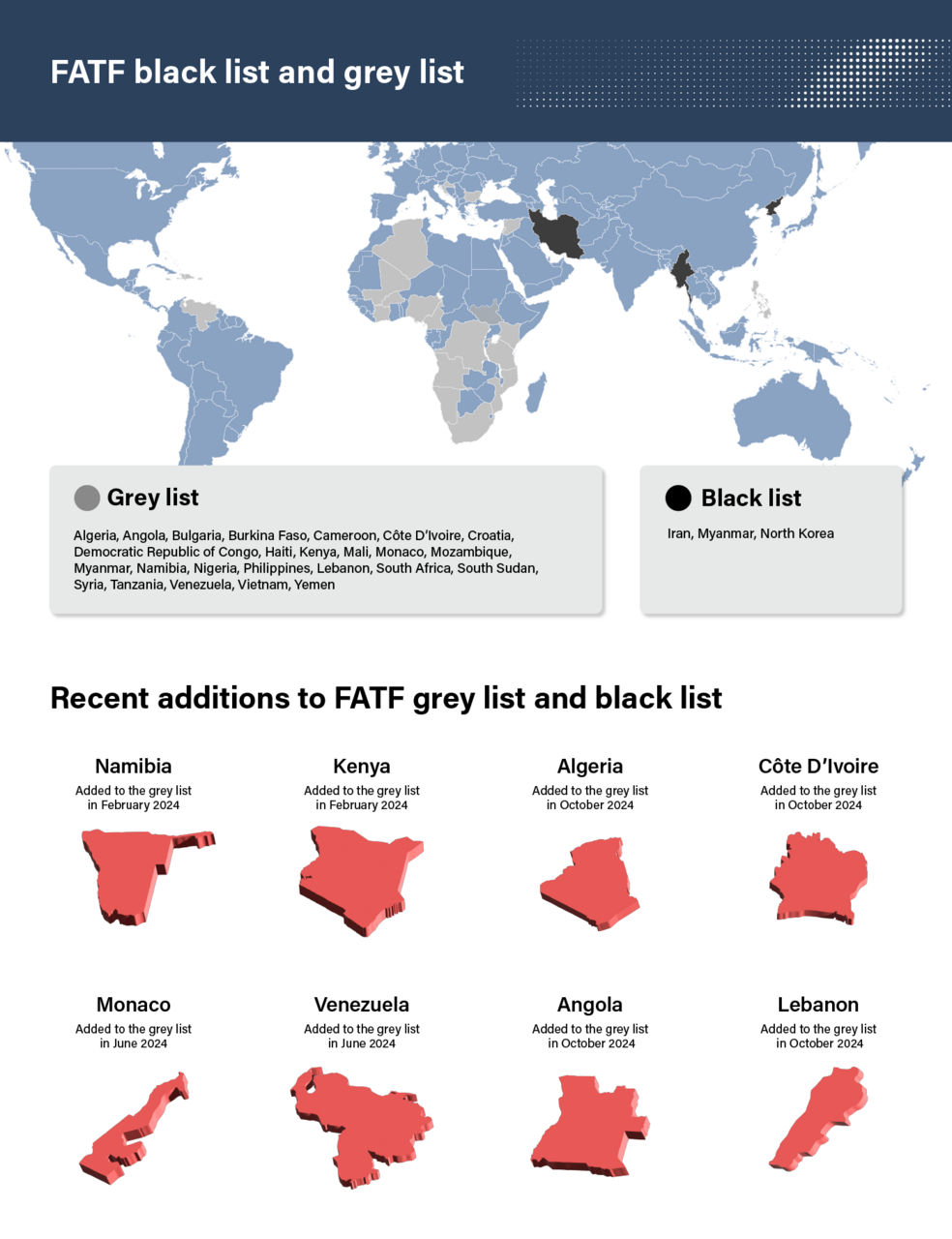

- Changes to the grey list.

- Guidance updates on financial inclusion and risk-based assessments.

- Strengthening global network cooperation.

- Initiatives for gender diversity and inclusiveness.

- Emerging standards and revised approaches for compliance.

- Russia’s continued suspension.

This article covers some of the key takeaways and what they mean for compliance professionals.

1. Completion of the FATF’s fourth evaluation cycle and new mutual evaluations

The FATF has now completed its fourth cycle of mutual evaluation reports (MERs), adopting the last two reports for Argentina and Oman.

Argentina: The joint FATF-GAFILAT evaluation for Argentina acknowledged improvements in domestic coordination but identified areas needing further enhancement, particularly in prosecuting money laundering tied to corruption and informal financial services. Compliance teams working in Argentina should pay close attention to new regulatory updates as Argentina implements further reforms.

Oman: Oman’s progress in using financial intelligence and cooperating internationally was commended, yet it was advised to strengthen measures that prevent the misuse of legal entities for financial crime. Compliance departments connected to Oman should prepare for increased scrutiny of ownership and due diligence requirements.

According to Ms de Anda, the FATF’s fifth cycle will “deliver more focused, risk-based mutual evaluations,” focusing on tailoring the MERs to each jurisdiction’s specific risk factors.

2. Changes to the grey list

Senegal removed from the grey list: Due to significant progress, Senegal exited the FATF’s increased monitoring list. Since being added to the grey list in February 2021, the Senegalese government has been implementing targeted financial sanctions, as recommended by the FATF, and adopted a new bill against illicit financing. While this marks a positive shift, Senegal will continue working with regional partners to reinforce its AML/CFT systems.

Grey list additions: Algeria, Angola, Côte D’Ivoire, and Lebanon are now under increased FATF scrutiny. Deficiencies identified in each country’s MER included a lack of effective risk-based supervision, insufficient transparency in beneficial ownership information, and inadequate investigations and prosecutions related to money laundering and terrorist financing. Each nation has made a high-level political commitment to work with the FATF to enhance its effectiveness by addressing these failings, focusing on improving legal frameworks and enhancing cooperation among authorities.

3. Guidance updates on financial inclusion and risk-based assessments

The FATF is revising its standards to support financial inclusion without compromising AML/CFT standards. The revisions aim to clarify how financial institutions (FIs) can apply simplified measures where risks are assessed as lower. These proposed revisions aim to encourage more flexibility, especially in regions where over-regulation could stifle access to essential financial services.

Financial inclusion

Compliance teams should keep an eye on the FATF’s public consultation on these revisions, which will primarily address Recommendation 1. When finalized in 2025, these updates will enable a more adaptive approach to AML/CFT in low-risk scenarios, benefiting organizations looking to foster financial inclusion in emerging markets.

Revised national risk assessment guidance

Following the watchdog’s July 2024 consultation, the FATF is due to release newly updated guidance on national risk assessments. This guidance, especially useful for countries with limited resources, aims to improve each country’s ability to understand and mitigate specific financial crime risks. Once published in 2025, compliance teams should consider integrating these insights to enhance local and international AML/CFT efforts, using the updated guidance to refine risk assessment models and country-specific strategies.

This update also follows a recent amendment to the organization’s grey-listing criteria to reduce the number of these jurisdictions added to the list. Under the revised criteria, jurisdictions will be prioritized for active review if they meet referral criteria and are:

- FATF members;

- Countries on the World Bank’s High-Income Countries list (excluding those with a financial sector of two or fewer banks); or

- Countries with financial sector assets exceeding USD 10 billion.

Countries considered the least developed, as defined by the United Nations, will not be prioritized for active review unless the FATF identifies them as posing significant risks of money laundering, terrorist financing, or proliferation financing. In such instances, they may receive a two-year observation period to progress on their Key Recommended Action roadmap.

These changes will take effect in the upcoming round of assessments, with the FATF anticipating a 50 percent reduction of low-capacity countries on the list.

4. Strengthening global network cooperation

Under its Mexican Presidency, the FATF is working on diversifying perspectives and amplifying the voices of its regional partners through its new Regional Bodies’ Guest Initiative. During this Plenary session, the organization invited Senegal and the Cayman Islands to participate as guest jurisdictions. Speaking at the end-of-plenary press conference, Ms de Anda spoke of the initiative’s aim to enhance the quality of evaluations by incorporating viewpoints from countries less represented in the FATF’s core membership.

5. Initiatives for gender diversity and inclusiveness in AML/CFT standards

The FATF is advancing its Women in FATF (WFGN) initiative, launched during the Singapore Presidency, to promote gender diversity and inclusivity in its global network. Building on this program, the FATF announced a second mentorship round, encouraging more women to participate in the FATF’s initiatives and fostering gender-balanced leadership in financial compliance.

6. Emerging standards and revised approaches for compliance

Reflecting on advancements in technology and payment systems, the FATF is updating its standards to align with new financial and digital realities. These changes may bring new obligations related to transaction monitoring and data-sharing, requiring compliance teams to stay agile and prepared for adaptation.

Cross-border payment standards: As the FATF reviews standards for cross-border payment systems, compliance teams should anticipate new obligations that could affect transaction monitoring and due diligence processes for international transactions.

Non-profit organization (NPO) protections: The FATF has also started a review project to prevent the misuse of its standards to restrict legitimate NPO activities. Compliance professionals working with NPOs should expect updated guidelines to better distinguish between high-risk and low-risk NPO activities, reinforcing risk-based safeguards without stifling legitimate charitable work.

Child exploitation prevention project: A major new initiative from the FATF focuses on detecting and preventing online child sexual exploitation. The standard setter aims to identify suspicious financial patterns related to this crime, highlighting the importance of cross-departmental collaboration in financial institutions to protect vulnerable populations and comply with AML/CFT obligations.

7. Continued vigilance on Russia’s suspension and related financial risks

The FATF upheld its February 2024 decision to suspend Russia, urging jurisdictions to monitor potential risks associated with Russia’s circumvention attempts. FATF members are encouraged to remain vigilant against transactions that may indirectly support Russian activities under international sanctions.

Next steps

Compliance staff should ensure they are familiar with the outcomes of the October plenary, particularly those relating to any upcoming MERs in the countries they operate in. Regarding the changes to the grey list, firms must update the risk scores of relevant countries, and appropriate levels of due diligence must be administered as required going forward.

Dates related to forthcoming guidance issued by the FATF should also be noted. Such guidance will help shape and inform national bodies’ future regulatory approaches.

The next FATF plenary is due to take place in February 2025.

Previous plenary coverage from ComplyAdvantage can be found here:

A Guide to the FATF Grey List

Our expert guide takes firms through the importance of the grey list, what FATF assessments look for, and how firms should respond to a grey-listing.

Download nowOriginally published 29 October 2024, updated 11 February 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).