AML Crypto Manual for Compliance Staff

Learn about the emerging use cases, and threats, that crypto compliance teams should look out for.

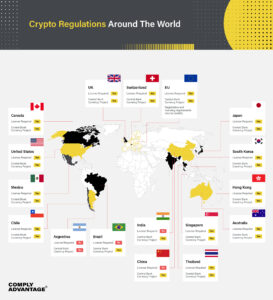

Download the guideAs cryptocurrency usage increases, so too do cryptocurrency regulations around the world that are put in place to govern them. The crypto landscape is constantly evolving and keeping up to date with the rules in different global territories isn’t easy.

To help you navigate the array of cryptocurrency regulations around the world, their legislative attitudes and the activities associated with them, we’ve put together this guide. Learn how different nations approach coin and exchange regulation and if they have any upcoming legislation which could alter their approach to cryptocurrencies.

Cryptocurrencies: Not considered legal tender

Cryptocurrency exchanges: Legal, regulation varies by state

While it is difficult to find a consistent legal approach at the state level, the US continues to progress in developing federal cryptocurrency legislation. The Financial Crimes Enforcement Network (FinCEN) does not consider cryptocurrencies to be legal tender but considers cryptocurrency exchanges to be money transmitters on the basis that cryptocurrency tokens are “other value that substitutes for currency.” The Internal Revenue Service (IRS) does not consider cryptocurrency to be legal tender but defines it as “a digital representation of value that functions as a medium of exchange, a unit of account, and/or a store of value” and has issued tax guidance accordingly.

Cryptocurrency exchanges are legal in the United States and fall under the regulatory scope of the Bank Secrecy Act (BSA). In practice, this means that cryptocurrency exchange service providers must register with FinCEN, implement an AML/CFT program, maintain appropriate records, and submit reports to the authorities. Meanwhile, the US Securities and Exchange Commission (SEC) has indicated that it considers cryptocurrencies to be securities, and applies securities laws comprehensively to digital wallets and exchanges. By contrast, The Commodities Futures Trading Commission (CFTC) has adopted a friendlier, “do no harm” approach, describing Bitcoin as a commodity and allowing cryptocurrency derivatives to trade publicly.

In response to guidelines published by FATF in June 2019, FINCEN made clear that it expects crypto exchanges to comply with the “Travel Rule” and gather and share information about the originators and beneficiaries of cryptocurrency transactions. It places virtual currency exchanges in the same regulatory category as traditional money transmitters and applies all the same regulations, including those set out in the Bank Secrecy Act – which has established its own version of the Travel Rule. In October 2020, FINCEN released a Notice of Proposed Rulemaking (NPRM) on adjustments to the Travel Rule, signaling the introduction of new compliance responsibilities for cryptocurrency exchanges.

The US Treasury has emphasized an urgent need for crypto regulations to combat global and domestic criminal activities. In December 2020, FINCEN proposed a new cryptocurrency regulation to impose data collection requirements on cryptocurrency exchanges and wallets. The rule is expected to be implemented by Fall 2022, and would require exchanges to submit suspicious activity reports (SAR) for transactions over $10,000 and require wallet owners to identify themselves when sending more than $3,000 in a single transaction.

The Justice Department continues to coordinate with the SEC and CFTC over future cryptocurrency regulations to ensure effective consumer protection and more streamlined regulatory oversight. In 2021, the Biden administration turned its attention to stablecoins, with the intention to address the danger of the tokens’ growth in value. Later that year, the President’s Working Group on Financial Markets released a series of recommendations that included a need for new legislation. Congress also debated the status of cryptocurrency service providers in 2021, with new rules included in the Biden administration’s infrastructure bill. Under the new rules, cryptocurrency exchanges are regarded as brokers and must comply with the relevant AML/CFT reporting and record-keeping obligations.

Listen to our podcast on How to Scale an AML/CFT Program for Crypto.

Cryptocurrencies: Not legal tender

Cryptocurrency exchanges: Legal, required to register with FinTRAC after June 1, 2020

Cryptocurrencies are not legal tender in Canada but can be used to buy goods and services online or in stores that accept them. Canada has been fairly proactive in its treatment of cryptocurrencies, primarily regulating them under provincial securities laws. Canada brought entities dealing in virtual currencies under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) as early as 2014, while in 2017 the British Columbia Securities Commission registered the first cryptocurrency-only investment fund. In August 2017, the Canadian Securities Administrators (CSA) issued a notice on the applicability of existing securities laws to cryptocurrencies, and in January 2018, the head of Canada’s Central Bank characterized them “technically” as securities. The Canada Revenue Agency has taxed cryptocurrencies since 2013 and Canadian tax laws apply to cryptocurrency transactions.

After an amendment to the PCMLTFA in 2019, exchanges in Canada are essentially regulated in the same way as money services businesses and are subject to the same due diligence and reporting obligations. In February 2020, the Virtual Currency Travel Rule came into effect in Canada, requiring all financial institutions and money services businesses (MSB) to keep a record of all cross-border cryptocurrency transactions (along with all electronic fund transfers).

In 2021, the Canadian Securities Administrators (CSA) published guidance for crypto issuers that own or hold crypto assets. The guidance set out regulatory expectations for disclosures that crypto issuers must provide about how they protect their assets against loss and theft, including the need to disclose relevant risk factors. Similarly, further amendments to the PCMLTFA in 2021 introduced the requirement for cryptocurrency exchanges to register with the Financial Transactions and Reports Analysis Centre of Canada (FinTRAC).

Future regulation

While regulations are constantly evolving, there are no signs of significant additional legislation on the horizon. We suspect both the Canadian government and crypto exchanges will need time to evaluate how the most recent changes have affected the crypto landscape before considering additional legislation.

Cryptocurrencies: Not legal tender

Cryptocurrency exchanges: Legal, registration with the Monetary Authority of Singapore required

In Singapore, cryptocurrency exchanges and trading are legal, and the city-state has taken a friendlier position on the issue than some of its regional neighbors. Although cryptocurrencies are not considered a legal tender, Singapore’s tax authority treats Bitcoins as “goods” and so applies Goods and Services Tax (Singapore’s version of Value Added Tax). In 2017, the Monetary Authority of Singapore (MAS) clarified that, while its position was not to regulate virtual currencies, it would regulate the issue of digital tokens if those tokens were classified as “securities”.

Although it has taken an even-handed approach, in 2020 MAS issued warnings to the public of the risks of investing in cryptocurrency products. In 2022, MAS reinforced that warning, issuing guidelines to crypto service providers that effectively prohibited the advertisement of their services to the public.

MAS has generally taken an accommodating approach to cryptocurrency exchange regulation, applying existing legal frameworks where possible. In January 2018, MAS issued a press release warning the public of the risks of speculating with cryptocurrency while Deputy Prime Minister Tharman Shanmugaratnam stated that cryptocurrencies are subject to the same AML and CFT measures as traditional, fiat currencies. The Payment Services Act 2019 (PSA) brought exchanges and other cryptocurrency businesses under the regulatory authority of MAS from January 2020, and imposed a requirement for them to obtain a MAS operating license. Since then, MAS has issued licenses to a number of high profile crypto service providers, including DBS Vickers (DBS Bank’s brokerage arm) and the Australian crypto exchange, Independent Reserve.

With the PSA in effect, crypto businesses in Singapore are largely in alignment with FATF’s most recent recommendations. However, MAS is likely to follow up with additional regulations in an effort to further align its position. These regulations may include new financial sector regulations with stronger AML/CFT standards for cryptocurrency service providers, and higher technology risk management reqreuiments in financial institutions.

Singapore’s recent regulatory efforts reflect a renewed international interest in its crypto industry. In 2021, China’s crackdown on cryptocurrencies prompted many high profile Chinese service providers, including ByBit, Huobi, Cobo, and OKCoin, and their customers, to migrate to Singapore.

Learn about the emerging use cases, and threats, that crypto compliance teams should look out for.

Download the guideCryptocurrencies: Legal, treated as property

Cryptocurrency exchanges: Legal, must register with AUSTRAC

Cryptocurrencies and exchanges are legal in Australia, and the country has been progressive in its implementation of cryptocurrency regulations. In 2017, Australia’s government declared that cryptocurrencies were legal and specifically stated that Bitcoin (and cryptocurrencies that shared its characteristics) should be treated as property and subject to Capital Gains Tax (CGT). Cryptocurrencies had previously been subject to controversial double taxation under Australia’s goods and services tax (GST) – the change in tax treatment is indicative of the Australian government’s progressive approach to the crypto issue.

Since 2018, the Australian Transaction Reports and Analysis Centre (AUSTRAC) has required exchanges operating in Australia to register, identify and verify users, maintain records, and comply with government AML/CFT reporting obligations. Unregistered exchanges are subject to criminal charges and financial penalties.

In May 2019, the Australian Securities and Investments Commission (ASIC) issued updated regulatory requirements for both initial coin offerings (ICOs) and cryptocurrency trading. Similarly, in August 2020, Australian regulators forced many exchanges to delist privacy coins, a specific type of anonymous cryptocurrency.

Australia has established a pattern of proactive cryptocurrency regulation, and these latest regulations illustrate the country’s continued effort to provide a clear framework for crypto businesses to operate in the coming years.

In particular, the Australian government is moving to increase its regulation of cryptocurrency exchanges. In December 2021, Australia announced plans to introduce a new licensing framework specifically for cryptocurrency exchanges – with a consultation period scheduled for 2022. The proposed framework would enable consumers to safely purchase and sell crypto assets in a regulated environment, and represents a move to position Australia at the forefront of the global effort to keep tech companies in check.

Cryptocurrencies: Legal, treated as property

Cryptocurrency Exchanges: Legal, must register with the Financial Services Agency

Japan currently has the world’s most progressive regulatory climate for cryptocurrencies and recognizes Bitcoin and other digital currencies as legal property under the Payment Services Act (PSA). In December 2017, the National Tax Agency ruled that gains on cryptocurrencies should be categorized as ‘miscellaneous income’ and investors taxed accordingly.

Recent regulations include amendments to the PSA and to the Financial Instruments and Exchange Act (FIEA), which took effect in May 2020. The amendments introduced the term “crypto-asset” (instead of “virtual currency”), placed greater restrictions on managing users’ virtual money, and eased regulation on crypto derivatives trading. Under the new rules, cryptocurrency custody service providers (that do not sell or purchase crypto assets) are brought under the scope of the PSA while cryptocurrency derivatives businesses are brought under the scope of the FIEA.

Cryptocurrency exchange regulations in Japan are similarly progressive. Exchanges are legal in Japan, but after a series of high profile hacks, including the notorious Coincheck heist of $530 million in digital currency, crypto regulations have become an urgent national concern. Japan’s Financial Services Agency (FSA) has stepped up efforts to regulate trading and exchanges: amendments to the PSA require cryptocurrency exchanges to be registered with the FSA in order to operate – a process which can take up to six months, and which imposes stricter AML/CFT and cybersecurity requirements. A subsequent amendment in mid-2019 extended the registration requirement to include custodian services providers.

In 2020, Japan established the Japanese Virtual Currency Exchange Association (JVCEA) and the Japan STO Association. All exchanges are members of the JVCEA while the Japan STO Association comprises 5 major Japanese financial institutions. Both regulators work to provide advice to as-yet unlicensed exchanges and promote compliance.

Japan remains a friendly environment for cryptocurrencies but growing AML concerns are drawing the FSA’s attention towards further regulation. In December 2021, the FSA indicated that it would propose legislation in 2022 to regulate issuers of stablecoins in order to address risks to customers and limit opportunities to use stablecoin tokens for money laundering. The legislation will likely include new security protocols and new obligations for crypto service providers to report suspicious activity.

Cryptocurrencies: Not legal tender

Cryptocurrency Exchanges: Legal, must register with FSS

In South Korea, cryptocurrencies are not considered legal tender and exchanges, while legal, are part of a closely-monitored regulatory system. Cryptocurrency taxation in South Korea is a gray area: since they are considered neither currency nor financial asset, cryptocurrency transactions are currently tax-free. However, the Ministry of Strategy and Finance has indicated that it is considering imposing a tax on income from crypto transactions and is planning to announce a taxation framework in 2022.

Cryptocurrency exchange regulations in South Korea are strict and involve government registration and other measures overseen by the South Korean Financial Supervisory Service (FSS). Although a rumored ban never materialized, in 2017 the South Korean government prohibited the use of anonymous accounts in cryptocurrency trading and banned local financial institutes from hosting trades of Bitcoin futures. Similarly, the Financial Services Commission (FSC) imposes strict reporting obligations on banks with accounts held by crypto exchanges.

Following legislative amendments in 2020, all South Korean exchanges must comply with AML/CFT regulations and obtain an operating license from the Financial Services Commission’s Financial Intelligence Unit (FIU). In March 2021, the South Korean government introduced legislation which requires cryptocurrency investors to use the same name on their virtual wallet accounts as they do on their bank accounts – and which requires cryptocurrency exchanges to share information with banks to verify customer identities. The FIU also delisted all privacy coins from South Korean exchanges in 2021 (effectively banning trade of the tokens).

Future Regulations

South Korea’s proposed tax on cryptocurrencies missed its original implementation date of January 2022 and has been delayed until January 2023. In addition to the tax framework, South Korea has indicated that it will continue to work to bring the industry into alignment with FATF’s anti-money laundering policies.

Explore our solutions for crypto businesses

Cryptocurrencies: Not legal tender

Cryptocurrency exchanges: Illegal

The People’s Bank of China (PBOC) banned financial institutions from handling Bitcoin transactions in 2013 and went further by banning ICOs and domestic cryptocurrency exchanges in 2017. Unsurprisingly, China does not consider cryptocurrencies to be legal tender and the country has a global reputation for harsh cryptocurrency regulation. Under a 2020 amendment to China’s Civil Code, the government ruled that cryptocurrencies have the status of property for the purposes of determining inheritances.

In June 2021, China banned all domestic cryptocurrency mining, and followed-up by outlawing cryptocurrencies outright in September 2021. The new regulation effectively banned the use of all cryptocurrency exchanges (foreign and domestic) and prompted a major token sell-off. Although domestic cryptocurrency exchanges are under a blanket ban in China, workarounds are possible using certain foreign platforms and websites that China’s internet firewall doesn’t catch.

There’s no indication that China intends to lift or loosen its ban on cryptocurrencies anytime soon but recent statements by government officials endorsing blockchain technology have led to speculation that China intends to become a leader in the digital currency space. While a timeline is still undefined, China’s central bank has been working on introducing an official digital currency for years and, in September 2021, announced that it had completed pilot tests of its e-CNY digital currency in several cities. The e-CNY token has been developed to replace cash and coins and will be accepted as payment for goods, bills, transport fares, and tolls.

Cryptocurrencies: Not legal tender

Cryptocurrency exchanges: Regulations being considered

Cryptocurrencies are not legal tender in India and the status of exchanges remains murky, as new regulations are being considered. Although there is currently a lack of clarity over the tax status of cryptocurrencies, finance minister Bhagwat Karad indicated in February 2022 that cryptocurrency transactions could face a 30 percent tax.

Cryptocurrency exchange regulations in India have grown increasingly strict. In 2018 the Reserve Bank of India (RBI) banned banks and any regulated financial institutions from “dealing with or settling virtual currencies.” The sweeping regulation prohibited the trade of cryptocurrencies on domestic exchanges and forced existing exchanges to wind down. In 2020, however, in a landmark decision, the country’s Supreme Court ruled that ban unconstitutional and relented, allowing exchanges to reopen.

In 2019, a leaked, alleged draft bill suggested that a blanket ban of cryptocurrencies was in the works – but made an exception for a proposed official digital currency. The bill even suggested prison sentences for individuals who “mine, generate, hold, sell, deal in, issue, transfer, dispose of, or use cryptocurrency in the territory of India.”

Although that draft bill did not make it to the floor of parliament, in 2021 a study from the Chairmanship of Secretary (Economic Affairs) revived the legislative push to prohibit “all private cryptocurrencies, except any virtual currencies issued by the state.” The Indian Minister of State for Finance suggested that a new cryptocurrency bill – known as the Cryptocurrency and Regulation of Official Digital Currency Bill – would be forthcoming. While the Indian government has made its opposition to private cryptocurrencies clear, in November 2021, the Standing Committee on Finance met with representatives of crypto exchanges and concluded that cryptocurrencies should be regulated rather than banned. As of February 2022, the cryptocurrency bill has not been approved by Lok Sabha, India’s parliament, meaning the legislative status of cryptocurrencies in the country remains unclear.

Cryptocurrencies: Not legal tender

Cryptocurrency exchanges: Legal, registration requirements with FCA

The United Kingdom’s approach to cryptocurrency regulations has been measured. Although the UK has no specific cryptocurrency laws, cryptocurrencies are not considered legal tender and exchanges have registration requirements. HMRC has issued a brief on the tax treatment of cryptocurrencies, stating that their ‘unique identity’ means they can’t be compared to conventional investments or payments, and their ‘taxability’ depends on the activities and parties involved. Gains or losses on cryptocurrencies are, however, subject to capital gains tax.

After leaving the EU in 2020, the UK transposed the cryptocurrency regulation requirements set out in 5AMLD and 6AMLD into domestic law. Accordingly, cryptocurrency exchanges in the UK need to register with the Financial Conduct Authority (FCA) and comply with AML/CFT reporting obligations. While it doesn’t make special provisions for exchanges, FCA guidance stresses that entities engaging in activities involving cryptoassets must comply with the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLRs). Amendments to those regulations came into force in January 2020 and incorporate the latest FATF guidelines.

It is likely that the UK’s cryptocurrency regulations will remain largely consistent with the EU in the short term but diverge from the bloc to some degree in the future. In 2021, HM Treasury guidance emphasized the UK’s intention to consult on bringing certain cryptocurrencies under the scope of ‘financial promotions regulation’ and to continue to consider a ‘broader regulatory approach’ to crypto assets. In January 2022, the government announced plans for legislation to address ‘misleading crypto asset promotions’ with the intention to bring cryptocurrency averts ‘into line with other financial advertising’.

Cryptocurrencies: Legal, accepted as payment in some contexts

Cryptocurrency exchanges: Legal, regulated by SFTA

In Switzerland, cryptocurrencies and exchanges are legal and the country has adopted a remarkably progressive stance towards cryptocurrency regulations. The Swiss Federal Tax Administration (SFTA) considers cryptocurrencies to be assets: they are subject to the Swiss wealth tax and must be declared on annual tax returns.

Switzerland imposes a registration process on cryptocurrency exchanges, which must obtain a license from the Swiss Financial Market Supervisory Authority (FINMA) in order to operate. Cryptocurrency regulations in Switzerland are also in place for ICOs, and FINMA applies existing financial legislation to offerings in a range of fields – from banking, to securities trading and collective investment schemes (depending on the structure). In 2019, Switzerland’s government also approved a motion that directed the Federal Council to adapt existing financial regulatory provisions to include cryptocurrencies. In September 2020, Switzerland’s parliament passed the Blockchain Act, further defining the legalities of exchanging cryptocurrencies and running cryptocurrency exchanges, in Swiss Law.

In 2021, Switzerland introduced the Distributed Ledger Technology (DLT) Act with the goal of adjusting Swiss laws to take advantage of cryptocurrency innovation. The DLT Act included a new type of license category for cryptocurrency trading venues.

Switzerland’s government has indicated that it will continue to work towards a regulatory environment that is friendly to cryptocurrencies. In 2016, the town of Zug, a prominent global cryptocurrency hub, introduced Bitcoin as a way of paying city fees while in January 2018, Swiss Economics Minister Johann Schneider-Ammann stated that he was aiming to make Switzerland “the crypto-nation”. Similarly, the Swiss Secretary for International Finance, Jörg Gasser, has emphasized the need to promote cryptocurrencies while upholding existing financial standards.

Building on those objectives, in late 2020, Switzerland’s Department of Finance began a consultation on new blanket cryptocurrency regulations that would enable it to take advantage of blockchain technology without stifling innovation. In 2021, the Swiss Federal Council voted in favor of a proposal to further adapt existing financial regulations to cryptocurrencies in order to address their illegal use.

Cryptocurrencies: Legal, member-states may not introduce their own cryptocurrencies

Cryptocurrency exchanges: Regulations vary by member-state

Cryptocurrencies are broadly considered legal across the European Union, but cryptocurrency exchange regulations are different in individual member states. Cryptocurrency taxation also varies but many member-states charge capital gains tax on cryptocurrency-derived profits at rates of 0-50%. In 2015, the Court of Justice of the European Union ruled that exchanges of traditional currency for cryptocurrency should be exempt from VAT.

In January 2020, the EU’s Fifth Anti-Money Laundering Directive (5AMLD) brought cryptocurrency-fiat currency exchanges under EU anti-money laundering legislation, requiring exchanges to perform KYC/CDD on customers and fulfill standard reporting requirements. In December 2020, 6AMLD came into effect: the directive made cryptocurrency compliance more stringent by adding cybercrime to the list of money laundering predicate offenses.

Cryptocurrency exchanges are not currently regulated at a regional level. In certain member states, exchanges have to register with their respective regulators such as Germany’s Financial Supervisory Authority (BaFin), France’s Autorité des Marchés Financiers (AMF), or Italy’s Ministry of Finance. Authorizations and licenses granted by these regulators can then passport exchanges, allowing them to operate under a single regime across the entire bloc.

6AMLD also had consequences for cryptocurrency exchanges. Under the directive, liability for money laundering offenses is extended to legal persons as well as individuals, meaning that the leadership employees of cryptocurrency wallet providers and cryptocurrency exchanges must exercise much greater oversight of their internal AML controls.

The EU is actively exploring further cryptocurrency regulations. An EU draft document expressed concerns about the risks associated with private digital currencies and confirmed that the European Central Bank was considering the possibility of issuing its own digital currency. In January 2020, the European Commission announced a public consultation initiative, seeking guidance on where and how crypto assets fit into the EU’s existing regulatory framework. The Commission followed-up in September 2020 with a new proposal known as the Markets in Crypto-Assets Regulation (MICA). The proposal set out draft regulatory measures for cryptocurrencies including the introduction of a new licensing system for crypto-asset issuers, industry conduct rules, and new consumer protections.

In July 2021, the European Commission published a set of legislative proposals with consequences for virtual asset service providers (VASP) across the bloc. The proposals will see transfer of fund regulations (TFR) extended to all VASPs in the EU, and will mandate the collection of information about senders and recipients of cryptocurrency transfers.

Download our guide to the EU’s new AML/CFT Framework

Cryptocurrencies: Not legal tender

Cryptocurrency exchanges: Legal, regulated under the VFA Act

Malta has taken a very progressive approach to cryptocurrencies, positioning itself as a global leader in crypto regulation. While cryptocurrencies are not legal tender in Malta, they are recognized by the government as “a medium of exchange, a unit of account, or a store of value.” Malta has no specific cryptocurrency tax legislation nor is VAT currently applicable to transactions exchanging fiat currency for crypto.

Cryptocurrency exchanges are legal in Malta and in 2018 the Maltese government introduced landmark legislation that defined a new regulatory framework for cryptocurrencies and addressed AML/CFT concerns. The legislation comprised several bills, including the Virtual Financial Assets Act (VFA) which set a global precedent by establishing a regulatory regime applicable to crypto exchanges, ICOs, brokers, wallet providers, advisers, and asset managers.

The VFA regulations (effective November 2018) were accompanied by the Innovative Technology Arrangements and Services Act which established the regime for the future registration, and accountability, of crypto service providers. The Malta Digital Innovation Authority was also established: the MDIA is the government authority responsible for creating crypto policy, collaborating with other nations and organizations, and enforcing ethical standards for the use of crypto and blockchain technology.

No new crypto legislation is currently on the horizon but the Malta Financial Services Authority (MFSA) indicated in its strategic plan for 2019-2021 that the country’s financial services regulator “will actively monitor and manage business-related risks pertaining to licensed virtual assets and cryptocurrency businesses” in order to better address money laundering and other financial crime risks.

The Maltese government has also indicated that it will turn its focus to the integration of AI with cryptocurrency regulation and may implement specific guidelines for security token offerings. With those strategies in mind, additional Maltese regulations are likely in the near future.

Cryptocurrencies: Not legal tender

Cryptocurrency exchanges: Legal, must register with the Financial Intelligence Unit

Cryptocurrency regulations in Estonia are open and innovative, especially in comparison to other EU member-states. Estonia’s government does not accept cryptocurrencies as legal tender, but regards them as “value represented in digital form”. Accordingly, it classifies them as digital assets for tax purposes but does not subject them to VAT. In 2017, the Anti Money Laundering and Terrorism Finance Act introduced robust new regulations for crypto businesses operating in Estonia.

Cryptocurrency exchanges are legal in Estonia and operate under a well-defined regulatory framework that includes strict reporting and KYC rules. Under current legislation, cryptocurrency exchanges must obtain two licenses from the Financial Intelligence Unit of Estonia: the Virtual Currency Exchange Service License and the Virtual Currency Wallet Service License. In 2019, the Estonian government passed legislation tightening licensing requirements and went further in 2020, asserting that virtual currency service providers would be treated the same manner as financial institutions under the Money Laundering and Terrorist Financing Prevention Act. In late 2020, the Estonian government revoked over 1,000 operating licenses after legislative amendments rendered many cryptocurrency service providers non-compliant with regulations.

A number of crypto initiatives with potentially significant regulatory consequences have been mooted in Estonia, including a speculative government plan to introduce a national cryptocurrency known as “estcoin”. In December 2021, Estonia published a draft bill to extend AML/CFT regulations to cryptocurrency exchanges: effectively banning the use of private cryptocurrency wallets provided by VASPs. The draft bill created fears that Estonia was banning private ownership of cryptocurrencies, and prompted the government to issue a press release in January 2022 clarifying that the law would only apply to private wallets issued by VASPs.

Cryptocurrencies: Not considered legal tender

Cryptocurrency exchanges: Legal, must register with the GFSC

Gibraltar is a global leader in cryptocurrency regulation. Cryptocurrency is not considered legal tender in the country but cryptocurrency exchanges are legal and operate within a well-defined regulatory framework. Gibraltar has a reputation as a low taxation environment: it does not impose capital gains or dividend tax on cryptocurrencies, and crypto exchanges are subject to a business-friendly 12.5% corporate income tax rate.

In 2018, Gibraltar introduced its Digital Ledger Technology (DLT) Regulatory Framework after extensive engagement with the crypto industry. Under the framework, exchanges must register with the Gibraltar Financial Services Commission (GFSC) and demonstrate that they are meeting the “principles” of the DLT framework which include a strong focus on the detection and disclosure of money laundering and terrorist financing. In September 2020, Gibraltar updated its DLT framework regulations to better align with FATF recommendations, taking into account the higher risk factors associated with some virtual asset instruments.

Gibraltar’s government is seeking to strengthen its position as a global leader by exploring further cryptocurrency regulation. In 2017, the GFSC issued a statement on the unregulated use of ICOs and suggested it will monitor their ongoing use within the DLT Framework. Similarly, the commission’s Innovate and Create Team has been established to help businesses innovate new products for the crypto-economy. In 2021, Gibraltar convened a Market Integrity working group to further define appropriate market standards for cryptocurrency exchanges in coordination with standards set by other jurisdictions such as the UK and the EU.

The government’s attitude to cryptocurrency is attracting interest from investors seeking to take advantage of Gibraltar’s progressive regulatory environment. In 2022, blockchain firm Valereum announced plans to set up a cryptocurrency stock exchange in the territory, and bought a 90% stake in the Gibraltar Stock Exchange. If sanctioned by the Gibraltar Financial Services Commission, the move would pave the way for a fully-regulated exchange dealing in both fiat and digital currencies.

Cryptocurrencies: Not legal tender

Cryptocurrency exchanges: Legal, must register with the CSSF

There are no specific cryptocurrency regulations in Luxembourg but the government’s legislative attitude towards cryptocurrencies is generally progressive. Although they are not legal tender, Finance Minister Pierre Gramegna has commented that, given their widespread use, cryptocurrencies should be “accepted as a means of payment for goods and services” in Luxembourg. In 2018, authorities issued advice on the tax treatment of cryptocurrencies which, in a business context, depends on the type of transaction involved.

While the Commission de Surveillance du Secteur Financier (CSSF) has issued warnings about the volatility of cryptocurrencies, their vulnerability to crime, and the associated risks of investing in ICOs, Luxembourg’s progressive approach to crypto has nonetheless endured. The CSSF has acknowledged the financial benefits of blockchain technology and Pierre Gramegna has spoken of the “added value and efficient services” that cryptocurrencies bring. Following those statements, in early 2019 lawmakers passed legislation that gave blockchain technology transactions the same legal status as those executed using traditional methods.

Cryptocurrency exchanges in Luxembourg are regulated by the CSSF and new crypto businesses must obtain a payments institutions license if they wish to begin trading. The licenses impose AML/CFT reporting obligations under Luxembourg’s “electronic money” statutes: the first crypto license was granted in 2016 to Bitstamp, which trades in a range of currencies, including USD, EUR, Bitcoin, and Ethereum, and passports holders into other EU member-states. In 2020 amendments were made to Luxembourg’s AML/CFT laws introducing new registration and governance requirements for cryptocurrency service providers and setting out a legal definition of cryptocurrencies for regulatory purposes.

Although there are no specific legislative steps on the radar, we expect more crypto legislation to be forthcoming in Luxembourg especially now that the EU’s 5AMLD and 6AMLD are in effect.

Cryptocurrencies: Laws vary by country

Cryptocurrency exchanges: Sparse regulation, laws vary by country

In Latin America, cryptocurrency regulations run the legislative spectrum. Those countries with harsher regulations include Bolivia which has comprehensively banned cryptocurrencies and exchanges, and Ecuador which has issued a ban on the circulation of all cryptocurrencies apart from the government-issued SDE token (in operation from 2014 to 2018). By contrast, in Mexico, Argentina, Brazil, Venezuela and Chile, cryptocurrencies are commonly accepted as payment by retail outlets and merchants.

For tax purposes, cryptocurrencies are often treated as assets. They are broadly subject to capital gains tax across the region while transactions in Brazil, Argentina, and Chile are also subject to income tax in some contexts.

In September 2021, El Salvador became the first country in Latin America to make Bitcoin legal tender, issuing a government digital wallet app, and allowing consumers to use the tokens in all transactions (alongside payments with the US dollar). The move prompted foreign and domestic criticism, but El Salvador’s government has since announced plans to build a ‘Bitcoin city’ that will be funded by the token.

Cryptocurrency exchange regulations in Latin America are sparse. Many countries have no specific laws governing the trade of cryptocurrencies and so, beyond the scope of existing legislation, do not regulate exchanges. The lack of regulation combined with high adoption rates has made Latin America an attractive option for businesses looking to capitalize on the interest in virtual currencies.

This collective stance has led to friction with the region’s traditional banking industry and in Chile, for example, some banks took steps to close accounts held by cryptocurrency exchanges in late 2018. Subsequent court rulings have offered protection to these exchanges for the time being but it is clear that more definitive guidelines are needed.

In contrast to other Latin American countries, Mexico does, to an extent, regulate cryptocurrency exchanges through the Law to Regulate Financial Technology Companies. The law extends Mexican AML regulations to cryptocurrency services providers by imposing a variety of registration and reporting requirements.

Many Latin American countries have expressed concern about the effect of cryptocurrencies on financial stability – and about their money laundering risks. Beyond issuing official warnings, however, most financial authorities across the region have yet to reveal plans for any significant future cryptocurrency regulations.

Some exceptions have emerged: Chile, for example, introduced draft cryptocurrency legislation in April 2019 but has offered scant detail on the legislation since, or how it will function if it comes into effect. In 2022, Chile’s central bank announced that it would make a decision on the rollout of its own digital currency in order to keep pace with the rapid spread of cryptocurrencies. Mexico has also announced plans to release its own digital currency by 2024, seeking to take advantage of advances in payment technology to promote financial inclusion.

In 2020, in coordination with crypto exchanges, Colombia introduced a sandbox test environment for cryptocurrencies in order to help firms try out their business models in respect of draft legislation. Brazil’s Securities Commission and its Central Bank have also introduced a regulatory sandbox while, in 2021, the Brazilian congress discussed draft legislation to impose new record-keeping regulations on cryptocurrency exchanges.

Unpack the results of our global survey on what senior compliance decision-makers believe will shape 2025.

Download nowOriginally published 05 July 2018, updated 05 February 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).