En vedette

En vedette

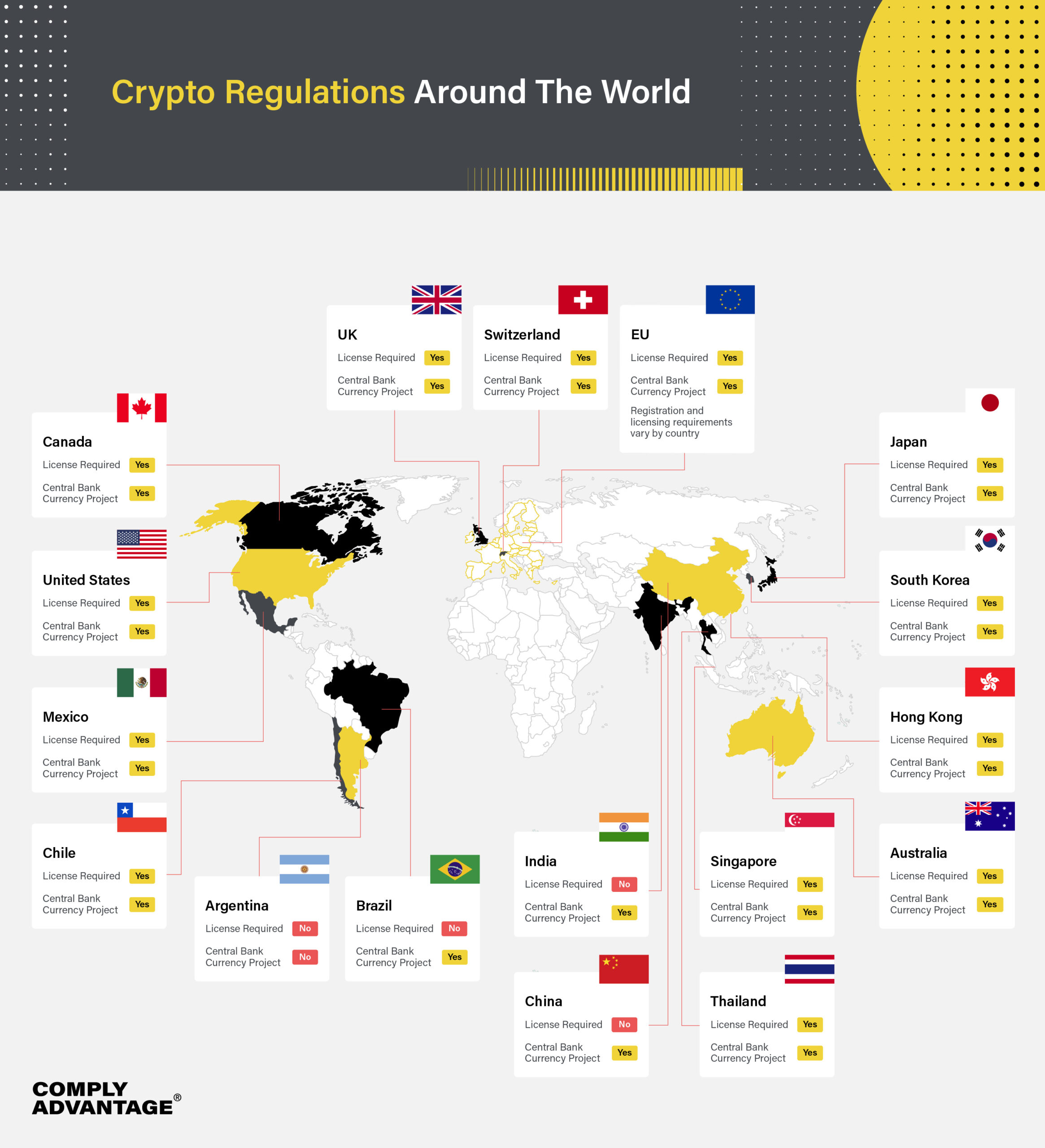

Au fur et à mesure que les cryptomonnaies se répandent à travers le monde, les réglementations mises en place pour tenter de les gouverner se déploient aussi. Le paysage est en évolution constante et il n’est pas facile d’être tenu au courant des règles en vigueur dans les différents territoires. Pour vous aider à naviguer parmi les différentes positions législatives concernant les cryptomonnaies et les activités qui leur sont associées, nous avons rassemblé ce guide. Découvrez comment les différentes nations abordent la réglementation des pièces de monnaie et des changes et si elles ont une législation à venir qui pourrait modifier leur approche des cryptomonnaies.

Etats-Unis

Crypto-monnaie : Aucun cours légal

Échange de devises cryptographiques : Juridique, la réglementation varie d’un État à l’autre

Il est difficile de trouver une approche juridique cohérente aux crypto-monnaies aux États-Unis. Les lois régissant les échanges varient d’un État à l’autre, et les autorités fédérales diffèrent en fait dans leur définition du terme » crypto-monnaie « . Le Financial Crimes Enforcement Network (FinCEN) ne considère pas que les crypto-monnaies ont cours légal, mais depuis 2013, il considère les échanges comme des transferts d’argent (sous leur juridiction) sur la base que les jetons sont » une autre valeur qui remplace la monnaie « . L’IRS, en revanche, considère les crypto-monnaies comme des biens – et a publié des directives fiscales en conséquence.

Echanges

Aux États-Unis, la réglementation sur l’échange de crypto-monnaies se trouve également sur un territoire juridique incertain, et plusieurs organismes de réglementation fédéraux revendiquent la compétence de ce pays. Parmi les principaux organismes de réglementation américains, la Securities and Exchange Commission (SEC) a indiqué qu’elle considère les crypto-monnaies comme des valeurs mobilières : en mars 2018, elle a déclaré qu’elle cherchait à appliquer les lois sur les valeurs mobilières de façon exhaustive pour les portefeuilles numériques et les bourses. En revanche, la Commodities Futures Trading Commission (CFTC) a adopté une approche plus conviviale, décrivant le bitcoin comme un produit de base et permettant aux dérivés de crypto-monnaie de se négocier publiquement.

Futur règlement

Le ministère de la Justice coordonne avec la SEC et la CFTC l’élaboration des futurs règlements sur la crypto-monnaie afin d’assurer une protection efficace des consommateurs et une surveillance réglementaire plus rationnelle. Le Trésor américain a souligné le besoin urgent d’une réglementation de la crypto-monnaies pour combattre les activités criminelles mondiales et nationales et, en janvier 2018, le secrétaire au Trésor, Steve Mnuchin, a annoncé la création d’un nouveau groupe de travail, le FSOC pour explorer le marché de la crypto-monnaie de plus en plus surchargé.

Canada

Crypto-monnaie : aucun cours légal

Échange de devises cryptographiques : Juridique, la réglementation varie d’une province à l’autre

Les crypto-monnaies n’ont pas cours légal au Canada, mais l’Agence du revenu du Canada les impose depuis 2013. Le Canada a été assez proactif dans son traitement des crypto-monnaies : en 2014, il a assujetti à la Loi sur le recyclage des produits de la criminalité et le financement des activités terroristes les entités qui effectuent des opérations en monnaie virtuelle, tandis qu’en 2017, la Commission des valeurs mobilières de la Colombie-Britannique a enregistré le premier fonds de placement exclusivement en crypto-monnaie.

Echanges

Au Canada, la réglementation de l’échange des crypto-monnaies n’est pas uniforme au niveau provincial, mais au niveau fédéral, les autorités traitent les crypto-monnaies comme des valeurs mobilières. En août 2017, les Autorités canadiennes en valeurs mobilières (ACVM) ont publié un avis sur l’applicabilité des lois sur les valeurs mobilières existantes aux crypto-monnaies, et en janvier 2018, le chef de la Banque centrale du Canada les a qualifiées » techniquement » de titres.

Futur règlement

D’autres réglementations sur les échanges de crypto sont en cours. En réponse à son évaluation mutuelle par le GAFI, les autorités canadiennes ont publié un projet de modification de la Loi sur le recyclage des produits de la criminalité et le financement des activités terroristes en juin 2018. Le règlement révisé inclura désormais les échanges de devises cryptographiques, ce qui signifie que ces entités sont assujetties à des obligations de déclaration et sont réglementées essentiellement de la même manière que les entreprises de services monétaires.

Singapour

Crypto-monnaie : Aucun cours légal

Échange de devises cryptographiques : Juridique, aucune inscription requise

A Singapour, les échanges et le commerce de devises cryptographiques sont légaux, et la ville-état a adopté une position plus amicale sur la question que ses voisins régionaux. Bien que les crypto n’aient pas cours légal, les autorités fiscales de Singapour traitent les bitcoins comme des » biens « et appliquent donc la taxe sur les produits et services (la version de Singapour de la taxe sur la valeur ajoutée).

Echanges

L’Autorité monétaire de Singapour (MAS) adopte une approche relativement souple à l’égard de la réglementation de l’échange de monnaies cryptographiques, en appliquant si possible les cadres juridiques existants. En janvier 2018, cependant, le MAS a publié un communiqué de presse avertissant le public des risques de la spéculation cryptographique et Sopnendu Mohanty, chef du MAS FinTech, a indiqué que des mesures législatives supplémentaires seraient nécessaires pour que les crypto continuent à croître. La principale préoccupation du MAS est la nécessité de veiller à ce que les crypto-monnaies ne soient pas utilisées pour le blanchiment d’argent, le financement du terrorisme ou d’autres crimes financiers. En janvier 2018, le vice-premier ministre Tharman Shanmugaratnam a déclaré que les crypto-monnaies sont soumises aux mêmes mesures de lutte contre le blanchiment de capitaux et le financement du terrorisme que les monnaies traditionnelles.

Règlements futurs

Le MAS continue de suivre de près les crypto-monnaies : en plus des mesures supplémentaires potentielles de LCB/FT, il a été signalé en mars que l’autorité financière travaillait sur des réglementations plus strictes en matière de crypto-monnaies pour protéger spécifiquement les investisseurs.

Australie

Crypto-monnaie : Juridique, traité comme un bien

Échange de devises cryptographiques : Juridique, doit s’inscrire auprès de l’AUSTRAC

Les crypto-monnaies et les échanges sont légaux en Australie, et le pays a été progressif dans sa mise en œuvre des réglementations de crypto-monnaies. En 2017, le gouvernement australien a déclaré que les crypto-monnaies étaient légales et a spécifiquement déclaré que le bitcoïn (et les crypto-monnaies qui partageaient ses caractéristiques) devait être traité comme un bien, et soumis à l’impôt sur les gains en capital (CGT). Les crypto-monnaies étaient auparavant sujettes à une double imposition controversée en vertu de la taxe sur les produits et services (TPS) de l’Australie – le changement de traitement fiscal est révélateur de l’approche progressive du gouvernement australien en matière de crypto.

Echanges

En 2018, l’Australian Transaction Reports and Analysis Centre (AUSTRAC) a annoncé la mise en œuvre d’une réglementation plus rigoureuse en matière d’échange de monnaies cryptographiques. La nouvelle réglementation sur le cryptage exige que les bourses opérant en Australie s’enregistrent auprès de l’AUSTRAC, identifient et vérifient les utilisateurs, tiennent des registres et se conforment aux obligations gouvernementales en matière de LCB/FT.

Règlements futurs

L’Australie a établi un modèle de réglementation proactive pour lutter contre la criminalité. Au-delà des échanges de monnaies cryptographiques, les ICOs font également l’objet d’un examen minutieux : les directives de l’Australian Securities and Investments Commission (ASIC), publiées en 2017, indiquent que la structure naturelle des jetons (titre ou utilité) déterminera leur traitement juridique en vertu du droit général de la consommation et de la Corporations Act.

Japon

Crypto-monnaie : Juridique, traité comme un bien

Échanges de devises cryptographiques : Juridique, doit s’enregistrer auprès de l’Agence des services financiers

Le Japon possède le climat réglementaire le plus progressiste au monde pour les crypto-monnaies et, à partir d’avril 2017, reconnaît le bitcoin et d’autres monnaies numériques comme propriété légale en vertu de la loi sur les services de paiement. Le Japon est le plus grand marché mondial pour le bitcoïn et, en décembre 2017, l’Agence nationale des impôts a décidé que les gains sur les crypto-monnaies devaient être classés dans la catégorie » revenus divers » et les investisseurs imposés à des taux de 15 à 55 %.

Echanges

La réglementation japonaise en matière de crypto-monnaies des devises est tout aussi progressiste. Les échanges sont légaux au Japon, mais après une série de piratages très médiatisés, dont le tristement célèbre casse de Coincheck de 530 millions de dollars en monnaie numérique, la réglementation de la crypto-monnaies est devenue une préoccupation nationale urgente. L’Agence japonaise des services financiers (FSA) a intensifié ses efforts pour réglementer le commerce et les échanges : les amendements à la loi sur les services de paiement exigent désormais que les échanges de devises cryptographiques soient enregistrés auprès de la FSA pour pouvoir fonctionner – un processus qui peut prendre jusqu’à six mois et qui impose des exigences plus strictes tant pour la cybersécurité que pour la LCB/FT.

Règlements futurs

Le Japon reste un environnement favorable aux crypto-monnaies, mais les préoccupations croissantes en matière de LBC attirent l’attention de la FSA sur de nouvelles mesures réglementaires – la suite de pourparlers entre les bourses et la FSA, un accord visant à créer un organisme d’autoréglementation – la Japanese Virtual Currency Exchange Association (JVCEA) – a été mis en place. La JVCEA fournira des conseils aux bourses non encore agréées et encouragera la conformité réglementaire.

Corée du Sud

Crypto-monnaie : Aucun cours légal

Échanges de devises cryptographiques : Juridique, doit s’inscrire auprès de la FSS

En Corée du Sud, les crypto-monnaies ne sont pas considérées comme ayant cours légal et les échanges, bien que légaux, font partie d’un système réglementaire étroitement surveillé. L’imposition des crypto-monnais en Corée du Sud est une zone grise : comme elles ne sont considérées ni comme des devises ni comme des actifs financiers, les transactions de crypto-monnaies sont actuellement exonérées d’impôt, mais le ministère de l’Économie et des Finances prévoit d’annoncer un cadre fiscal en 2018, la taxation devant être appliquée en 2019.

Echanges

En Corée du Sud, la réglementation en matière d’échange cryptographique est stricte et implique l’enregistrement par le gouvernement et d’autres mesures supervisées par le Financial Supervisory Service (FSS) sud-coréen. Bien qu’une rumeur d’interdiction ne se soit jamais concrétisée, en 2017, le gouvernement sud-coréen a interdit l’utilisation de comptes anonymes dans le commerce de devises cryptographiques, et a également interdit aux instituts financiers locaux d’accueillir des transactions de Bitcoin Futures. En 2018, la Commission des services financiers (CSF) a imposé des obligations d’information plus strictes aux banques dont les comptes sont détenus par des échanges cryptographiques.

Règlements futurs

Début 2018, le ministre sud-coréen des Finances a révélé que le gouvernement prévoyait d’introduire une réglementation plus stricte en matière de crypto-monnaie, mais certains signes indiquent que la position des autorités sur cette question pourrait s’affaiblir. En mai 2018, Yoon Suk-heun a pris la direction de la FSS : Yoon a parlé des « aspects positifs » des crypto-monnaies, et de la nécessité d’échanger pour servir les intérêts des investisseurs tout en respectant la réglementation.

Chine

Crypto-monnaie : N’a pas cours légal

Échange de devises cryptographiques : Illégal

La Banque populaire de Chine (PBOC) a interdit aux institutions financières de traiter les transactions Bitcoin en 2013, et est allée plus loin en interdisant les premières émissions de jetons (ICO) et les échanges domestiques de devises cryptographiques en 2017. Comme on pouvait s’y attendre, la Chine ne considère pas que les crypto-monnaies ont cours légal et le pays a une réputation mondiale pour sa réglementation sévère en matière de crypto-monnaies.

Echanges

Bien que les échanges domestiques de crypto-monnaies soient sous une interdiction générale en Chine, des solutions de contournement sont possibles en utilisant des plateformes et des sites Web étrangers que le pare-feu Internet de la Chine ne neutralise pas. Malgré l’interdiction quasi totale du commerce de crypto et des services connexes, la loi chinoise autorise toujours les activités d’extraction de crypto, bien que certains signes indiquent que cela pourrait bientôt changer.

Règlements futurs

En janvier 2018, une note de service de PBOC qui a fait l’objet d’une fuite suggérait que les opérations minières de Bitcoin seraient bientôt interdites en Chine – la note mentionnait la consommation des mineurs en ressources énergétiques et leur tendance à alimenter la spéculation financière. En février 2018, un effort conjoint du PBOC et du ministère de l’Industrie et des Technologies de l’information a révélé l’intention d’étendre la réglementation de l’échange de crypto aux bourses étrangères, interdisant l’accès aux plateformes offshore et aux sites Web de l’OIC. Par l’intermédiaire de l’Institute of International Finance, le gouvernement chinois a également exprimé son soutien à la mise en œuvre d’un cadre réglementaire mondial pour les crypto-monnaies

Inde

Crypto-monnaie : N’a pas cours légal

Échange de devises cryptographiques : Effectivement illégal – des règlements sont envisagés

Les crypto-monnaies n’ont pas cours légal en Inde, et bien que les échanges soient légaux, le gouvernement a rendu leur fonctionnement très difficile. Bien qu’il y ait actuellement un manque de clarté sur le statut fiscal des crypto-monnaies, le président du Conseil central des impôts directs a déclaré que toute personne réalisant des bénéfices avec Bitcoin devra payer des impôts sur celles-ci. D’autres sources du ministère de l’Impôt sur le revenu ont suggéré que les profits en crypto devraient être imposés comme des gains en capital.

Réglementation des bourses

En Inde, la réglementation sur le change des monnaies cryptographiques est devenue de plus en plus sévère. Bien que techniquement légale, la Reserve Bank of India (RBI) a interdit en avril 2018 aux banques et à toute institution financière réglementée de « négocier ou de régler des devises virtuelles ». La réglementation générale interdisait le commerce des crypto-monnaies sur les bourses nationales – et donnait aux bourses existantes jusqu’au 6 juillet 2018 pour se dissoudre.

Règlements futurs

Les gouvernements indiens semblent envisager la possibilité d’une réglementation moins prohibitive de la crypto-monnaie. En 2017, le Secrétaire spécial aux affaires économiques a créé un comité chargé de suggérer des moyens de traiter les problèmes potentiels de LCB/FT et de protection des consommateurs liés aux crypto-monnaies. En 2018, des rapports suggéraient qu’un comité gouvernemental était en train de rédiger une nouvelle loi qui introduisait une plus grande protection de la crypto-monnaie pour « les gens ordinaires ».

Royaume-Uni

Crypto-monnaie : Aucun cours légal

Échange de devises cryptographiques : Exigences juridiques et d’enregistrement auprès de la FCA

L’approche du Royaume-Uni en matière de réglementation des crypto-monnaies. a été mesurée : bien que le Royaume-Uni n’ait pas de lois spécifiques en la matière, les crypto-monnaies n’ont pas cours légal et les bourses sont soumises à des obligations d’enregistrement. HMRC a publié un mémoire sur le traitement fiscal des crypto-monnaies, déclarant que leur « identité unique » signifie qu’elles ne peuvent pas être comparées aux investissements ou paiements conventionnels, et que leur « taxabilité » dépend des activités et des parties impliquées. Les gains ou pertes sur les crypto-monnaies sont toutefois soumis à l’impôt sur les plus-values.

Echanges

Au Royaume-Uni, les bourses de crypto-monnaies doivent généralement s’enregistrer auprès de la Financial Conduct Authority (FCA), bien que certaines entreprises de crypto-monnaies puissent obtenir une licence électronique. Bien qu’elle ne prévoie pas de dispositions spéciales pour les bourses, la directive de la FCA souligne que les entités qui se livrent à des activités liées à la crypto-monnaies qui tombent sous le coup des règlements financiers existants pour les instruments dérivés (comme les contrats à terme et les options) doivent être autorisées.

Règlements futurs

En 2018, le gouverneur de la Banque d’Angleterre, Mark Carney, a révélé qu’une réglementation ciblée des crypto-monnaies au Royaume-Uni était à l’horizon. Dans le cadre d’une enquête parlementaire en cours, la FCA travaille avec la BOE et le Trésor britannique à l’élaboration d’une stratégie pour faire face aux risques de crypto-monnaies – en se concentrant spécifiquement sur la LCB/FT, et la stabilité financière. La FCA dévoilera de nouvelles lignes directrices en matière de crypto-monnaie à la fin de 2018.

Suisse

Crypto-monnaie : Juridique, accepté comme paiement dans certains contextes

Échange de devises cryptographiques : Juridique, réglementé par l’AELE

En Suisse, les crypto-monnaieset les échanges sont légaux et le pays a adopté une position remarquablement progressiste à l’égard de la réglementation des crypto-monnaies. L’Administration fédérale des contributions (AFC) considère les crypto-monnaies comme des actifs : elles sont soumises à l’impôt suisse sur la fortune et doivent être déclarées dans les déclarations fiscales annuelles.

Echanges

La Suisse impose une procédure d’enregistrement pour les opérations de change de monnaies cryptographiques, qui doivent obtenir une licence de l’Autorité fédérale de surveillance des marchés financiers (FINMA) pour pouvoir opérer. En février 2018, la FINMA a publié une série de directives qui appliquaient la législation financière en vigueur aux offres dans de nombreux domaines – de la banque au négoce de titres et aux placements collectifs de capitaux (selon la structure).

Règlements futurs

Pour l’avenir, le gouvernement suisse a indiqué qu’il continuerait d’œuvrer en faveur d’un environnement réglementaire favorable aux crypto-monnaies. En 2016, la ville de Zoug, une importante plaque tournante mondiale de la crypto-monnaie, a introduit Bitcoin comme moyen de paiement des taxes municipales. En janvier 2018, le ministre suisse de l’économie Johann Schneider-Ammann a déclaré qu’il souhaitait faire de la Suisse « la crypto-nation ». Entre-temps, le secrétaire suisse aux finances internationales, Jörg Gasser, a souligné la nécessité de promouvoir les crypto-monnaies sans compromettre les normes financières existantes.

L’UE

Crypto-monnaie : Juridique, les Etats membres ne peuvent pas introduire leurs propres crypto-monnaies

Échange de devises cryptographiques : Les réglementations varient d’un Etat membre à l’autre

Le Parlement européen n’a pas adopté de législation spécifique concernant les crypto-monnaies Alors que les crypto-monnaies sont généralement considérées comme légales dans l’ensemble du bloc, la réglementation du change des crypto-monnaies dépend de chaque Etat membre. L’imposition de la crypto-monnaie varie également, mais de nombreux États membres prélèvent un impôt sur les gains en capital sur les bénéfices tirés de la crypto-monnaie – au taux de 0-50%. En 2015, la Cour de justice de l’Union européenne a décidé que les échanges de devises traditionnelles contre des monnaies cryptographiques devaient être exonérés de TVA.

Echanges

Les échanges de monnaies cryptographiques ne sont actuellement pas réglementés au niveau régional. Dans certains États membres, les bourses devront s’enregistrer auprès de leurs autorités de réglementation respectives, telles que l’Autorité allemande de surveillance financière (BaFin), l’Autorité des marchés financiers (AMF) française ou le ministère des Finances italien. Les autorisations et licences délivrées par ces régulateurs peuvent alors faire l’objet d’échanges de » passeports « , leur permettant d’opérer sous un régime unique sur l’ensemble du bloc. En avril 2018, l’UE a approuvé le texte de la cinquième directive sur le blanchiment d’argent (5MLD), qui soumettra les opérations de change de devises de type crypto-monnaies-fiat à la législation européenne de lutte contre le blanchiment d’argent. 5MLD aura besoin d’échanges pour effectuer des KYC/CDD sur les clients et satisfaire aux exigences de rapport standard.

Règlements futurs

L’UE étudie activement la possibilité d’élaborer d’autres réglementations en matière de crypto-monnaie. En février 2018, le président de la Banque centrale européenne, Mario Draghi, a déclaré que les autorités collaboraient avec le mécanisme unique de surveillance pour mettre au point un moyen d’identifier les risques financiers que posent les crypto-monnaies.

Malte

Crypto-monnaie : N’a pas cours légal

Échange de devises cryptographiques : Juridique, réglementé en vertu de la VFA Act

Malte a adopté une approche très progressiste à l’égard des crypto-monnaies, se positionnant comme un leader mondial de la réglementation de la crypto-monnaies. Bien que les crypto-monnaies n’aient pas cours légal, elles sont reconnues par le gouvernement comme » un moyen d’échange, une unité de compte ou une réserve de valeur « . Malte n’a pas de législation fiscale spécifique en matière de crypto-monnaies, et la TVA n’est pas non plus applicable actuellement aux opérations d’échange de devises étrangères contre des cryptogrammes.

Echanges

Les échanges de devises cryptographiques sont légaux à Malte et, en 2018, le gouvernement maltais a introduit une législation historique pour définir un nouveau cadre réglementaire pour les crypto-monnaies et répondre aux préoccupations LCB/FT. La législation comprend trois projets de loi distincts, dont la Virtual Financial Assets Act (VFA), qui établit un précédent mondial en établissant un régime réglementaire applicable aux bourses de valeurs, aux ICO, aux courtiers, aux fournisseurs de portefeuilles, aux conseillers et aux gestionnaires de fortune.

Règlements futurs

Les règlements de la VFA (en vigueur à partir de novembre 2018) ont également introduit la Loi sur les arrangements et les services en matière de technologie innovatrice qui établit le régime pour l’enregistrement futur et la responsabilité des fournisseurs de services de crypto. L’Autorité maltaise pour l’innovation numérique a également été créée : à l’avenir, la MDIA sera l’autorité gouvernementale responsable de la création d’une politique de cryptage, de la collaboration avec d’autres pays et organisations et de l’application de normes éthiques pour l’utilisation des technologies de cryptage et de la chaîne de blocage.

Estonie

Crypto-monnaie : N’a pas cours légal

Échange de devises cryptographiques : Juridique, doit s’enregistrer auprès de la cellule de renseignements financiers

Les réglementations en matière de crypto-monnaies en Estonie sont ouvertes et innovantes, en particulier par rapport aux autres États membres de l’UE. Bien que n’ayant pas cours légal, le gouvernement estonien considère les crypto-monnaies comme des « valeurs représentées sous forme numérique ». Le gouvernement classe les crypto-monnaies comme des actifs numériques à des fins fiscales mais ne les soumet pas à la TVA. En 2017, la loi sur la lutte contre le blanchiment d’argent et le financement du terrorisme a introduit de nouvelles règles strictes pour les entreprises de crypto opérant en Estonie.

Echanges

Les échanges sont légaux en Estonie mais, après la législation LCB/FT de 2017, ils s’inscrivent dans un cadre réglementaire bien défini qui comprend des règles strictes de reporting et de KYC. En vertu de la législation actuelle, les échanges de devises cryptographiques doivent obtenir deux licences de la Cellule de renseignement financier de l’Estonie : la Licence de service d’échange de monnaie virtuelle et la Licence de service de portefeuille de monnaie virtuelle.

Règlements futurs

Un certain nombre d’initiatives de crypto ayant des conséquences réglementaires potentiellement importantes ont été évoquées en Estonie, y compris un plan spéculatif du gouvernement visant à introduire une cryptocurrency nationale connue sous le nom de « estcoin ». Après les critiques de l’UE, le gouvernement estonien a pris du recul par rapport au plan, mais continue d’examiner les moyens d’utiliser l’estcoin dans le cadre d’un programme gouvernemental de « résidence électronique ».

Gibraltar

Crypto-monnaie : N’a pas cours légal

Échange de devises cryptographiques : Juridique, doit s’enregistrer auprès du GFSC

Gibraltar est un chef de file mondial en matière de réglementation de la crypto-monnaie : la crypto-monnaie n’a pas cours légal dans le pays, mais les échanges de crypto-actifs sont légaux et s’inscrivent dans un cadre réglementaire bien défini. Gibraltar a la réputation d’être un pays à faible fiscalité : il n’impose pas d’impôt sur les plus-values ou les dividendes sur les crypto-monnaies, et les échanges de crypto sont soumis à un taux d’imposition des sociétés favorable aux entreprises de 10%.

Echanges

En janvier 2018, Gibraltar a introduit son cadre réglementaire pour la technologie des registres distribués (DLT) après de nombreux engagements avec l’industrie des crypto-actifs. En vertu de ce cadre, les bourses doivent s’enregistrer auprès de la Gibraltar Financial Services Commission (GFSC) et démontrer qu’elles respectent les » principes » du cadre DLT, qui mettent fortement l’accent sur la détection et la divulgation du blanchiment de capitaux et du financement du terrorisme.

Règlements futurs

Le gouvernement de Gibraltar cherche à renforcer sa position de leader mondial en explorant plus avant la réglementation de la crypto-monnaie. En 2017, le GFSC a publié une déclaration sur l’utilisation non réglementée des OIC et a suggéré de surveiller leur utilisation dans le cadre du DLT. De même, l’équipe d’innovation et de création de la Commission a été créée pour aider les entreprises à innover de nouveaux produits pour l’économie de la crypto-monnaies.

Luxembourg

Crypto-monnaie : N’a pas cours légal

Échange de devises cryptographiques : Juridique, doit s’inscrire auprès de la CSSF

Il n’existe pas de réglementation spécifique en matière de crypto-monnaie au Luxembourg, mais l’attitude législative du gouvernement à leur égard est généralement progressiste. Bien que n’ayant pas cours légal, le ministre des Finances, Pierre Gramegna, a déclaré que, compte tenu de leur utilisation répandue, les crypto-monnaies devraient être « acceptées comme moyen de paiement pour les biens et services ». En août 2018, les autorités ont émis un avis sur le traitement fiscal des crypto-monnaies qui, dans un contexte commercial, dépend du type de transaction concernée.

Echanges

Au Luxembourg, les échanges de devises cryptographiques sont réglementés par la Commission de Surveillance du Secteur Financier (CSSF), et les nouvelles entreprises de crypto-monnaies doivent obtenir une licence d’établissement de paiement si elles souhaitent commencer leurs activités. Les licences impliquent des obligations de reporting en matière de LCB/FT en vertu des statuts luxembourgeois sur la « monnaie électronique« . La première licence a été accordée en 2016 à Bitstamp, qui négocie dans une série de monnaies, dont l’USD, l’EUR, le bitcoin, l’éthéréum et les passeports vers les États membres de l’UE.

Règlements futurs

Bien qu’il n’y ait pas de mesures législatives spécifiques sur le radar, la CSSF a émis en mars 2018 un avertissement sur la volatilité des cryptomonnaies leur vulnérabilité à la criminalité et les risques associés à l’investissement dans les ICOs. L’approche progressiste du Luxembourg en matière de crypto semble devoir se poursuivre. En 2017, la CSSF a reconnu les avantages financiers de la technologie de blockchain et Pierre Gramegna a parlé de la « valeur ajoutée et des services efficaces » que les crypto-monnaies apportent.

Amérique latine

Crypto-monnaie : Les lois varient d’un pays à l’autre

Échange de devises cryptographiques : Peu de réglementation, les lois varient d’un pays à l’autre

En Amérique latine, la réglementation de la crypto-monnaie s’applique à l’ensemble du spectre législatif. Parmi les pays où la réglementation est plus stricte, la Bolivie, par exemple, a complètement interdit les crypto-monnaies et les échanges, tandis que l’Équateur a interdit la circulation de toutes les crypto-monnaies à l’exception du jeton « SDE » émis par le gouvernement. En revanche, au Mexique, en Argentine, au Brésil, au Venezuela et au Chili, les crypto-m sont couramment acceptées comme moyen de paiement par les détaillants et les marchands. Aux fins fiscales, les crypto-monnaies sont souvent considérées comme des actifs : elles sont largement soumises à l’impôt sur les plus-values dans toute la région, tandis que les transactions au Brésil et en Argentine sont également soumises à l’impôt sur le revenu dans certains contextes.

Echanges

En Amérique latine, les réglementations de change des crypto-monnaies sont rares : de nombreux pays n’ont pas de lois spécifiques régissant le commerce des crypto-monnaies et ne réglementent donc pas les échanges au-delà du champ d’application de la législation existante. Le Mexique réglemente les bourses dans une certaine mesure : la Loi réglementant les sociétés de technologie financière étend les lois anti-blanchiment d’argent (LCB) aux crypto monnaies par le biais d’exigences d’enregistrement et de déclaration.

Règlements futurs

De nombreux pays d’Amérique latine se sont dits préoccupés par l’effet des crypto-monnaies sur la stabilité financière et leurs risques de blanchiment d’argent. Au-delà des avertissements officiels, cependant, les autorités financières de la région n’ont pas encore dévoilé leurs plans en vue d’une future réglementation importante en matière de crypto-monnaie.

Vous voulez répondre aux attentes des organismes de réglementation du monde entier, voire les dépasser ? Découvrez comment ComplyAdvantage fonctionne avec les entreprises de crypto monnaie ici.

Publié initialement 29 octobre 2019, mis à jour 12 juin 2023

Avertissement : Ce document est destiné à des informations générales uniquement. Les informations présentées ne constituent pas un avis juridique. ComplyAdvantage n'accepte aucune responsabilité pour les informations contenues dans le présent document et décline et exclut toute responsabilité quant au contenu ou aux mesures prises sur la base de ces informations.

Copyright © 2025 IVXS UK Limited (commercialisant sous le nom de ComplyAdvantage)