A Guide to the FATF Grey List

Our expert guide takes firms through the importance of the grey list, what FATF assessments look for, and how firms should respond to a grey-listing.

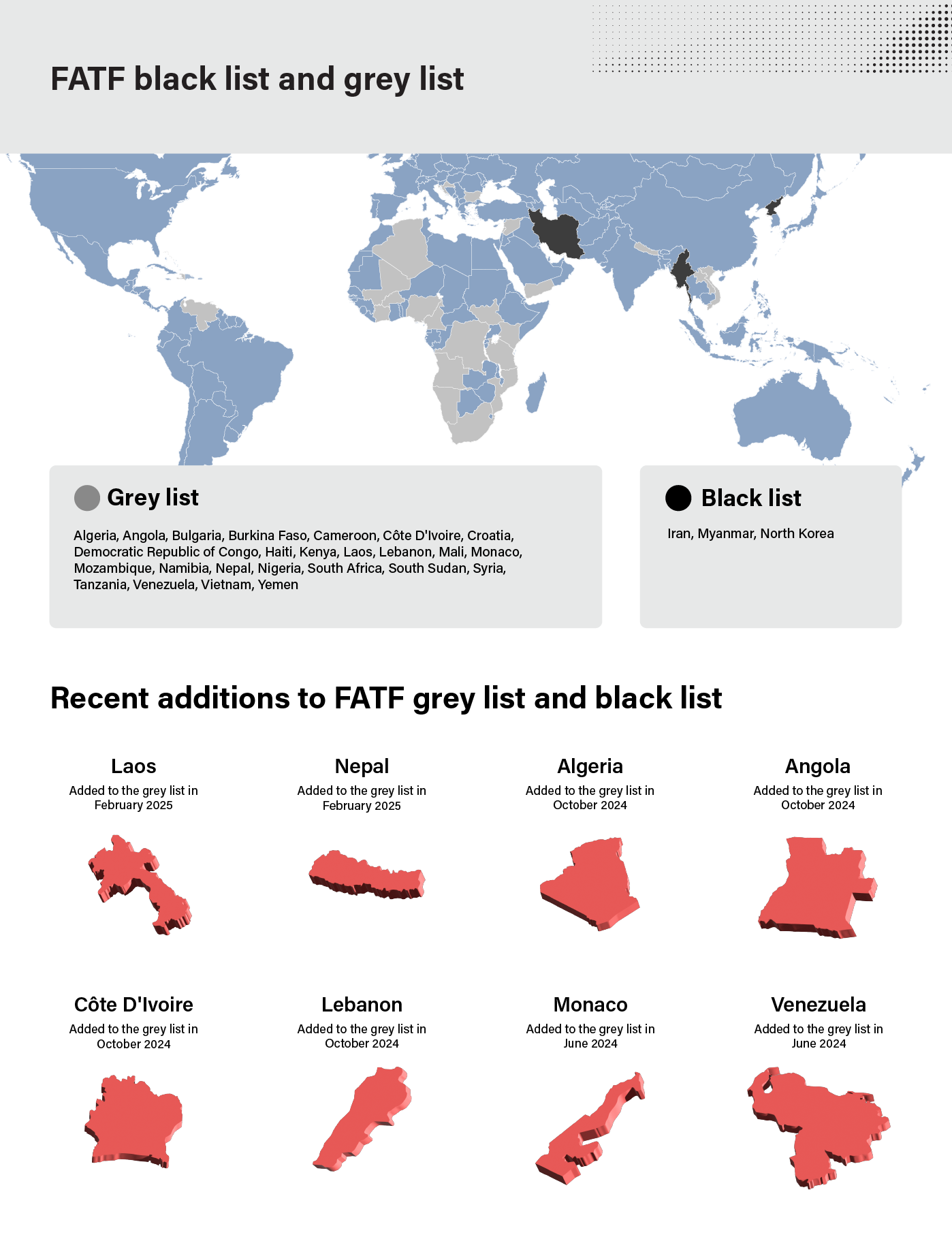

Download nowThe Financial Action Task Force (FATF) is an intergovernmental organization that monitors global money laundering and terrorist financing trends. The FATF collaborates with its member states and regional organizations to develop a legal, regulatory, and operational framework for combating these threats. As part of its efforts, the FATF maintains a black list, officially known as High-Risk Jurisdictions subject to a Call for Action, and a grey list. The grey list includes countries that have committed to addressing strategic deficiencies in their anti-money laundering and counter-terrorist financing (AML/CTF) regimes. Given the potential regulatory risk associated with countries that do not maintain international compliance standards, financial institutions should be aware of FATF black list and grey list countries and what that designation entails.

The FATF black list (sometimes referred to as the OECD black list) is a list of countries that the intragovernmental organization considers non-cooperative in the global effort to combat money laundering and the financing of terrorism. By issuing the list, the FATF hopes to encourage countries to improve their regulatory regimes and establish a global set of AML/CTF standards and norms black-listed countries will likely be subject to economic sanctions and other prohibitive measures by FATF member states and international organizations.

The black list is a living document issued and updated periodically in official FATF reports. Countries are added and withdrawn from the black list as their AML and CFT regulatory regimes are adjusted to meet the relevant FATF standards. The first FATF black list was issued in 2000 with an initial list of 15 countries. Since then, the lists have been published as part of official FATF statements and reports yearly and sometimes twice yearly.

The FATF cites significant deficiencies in the black-listed countries’ AML/CTF regimes and suggests other countries exercise extreme caution when doing business with firms based in these jurisdictions. While the FATF has called on its member-states to “apply effective counter-measures” in any business dealings with North Korea, Iran, and Myanmar, it has noted Iran’s prior commitment to improving its AML/CTF regulation. Accordingly, the FATF has set out the steps for Iran’s removal from the list, including a requirement to ratify the Palermo and Terrorist Financing Conventions.

While it has no direct investigatory powers, the FATF monitors global AML/CFT regimes closely to inform the content of its black lists. Some observers have criticized the term “non-cooperative” about countries on the black list, pointing out that some black-listed countries may not have the regulatory infrastructure or resources to enact the FATF’s AML/CTF standards rather than acting in defiance of international best practices.

The FATF grey list, officially known as Jurisdictions Under Increased Monitoring, includes countries with deficiencies in their AML/CTF regimes. Like the black list, the grey list was created in 2000 and is updated periodically. Countries on the grey list are subject to increased monitoring and must work with FATF to improve their regimes.

To do this, the FATF either assesses them directly or uses FATF-style regional bodies (FSRBs) to report their progress toward their AML/CTF goals. While grey list classification is not as punitive as the black list, countries on the list may still face economic sanctions from institutions like the International Monetary Fund (IMF) and the World Bank and experience adverse effects on trade.

The grey list is updated regularly as new countries are added or as countries that complete their action plans are removed. As of February 2025, the FATF grey list included the following countries:

Our expert guide takes firms through the importance of the grey list, what FATF assessments look for, and how firms should respond to a grey-listing.

Download nowThe FATF continuously reviews its member states’ AML/CTF performance to gauge their alignment with its regulatory guidance. The FATF has recently added the following countries to the grey list:

Algeria: In October 2024, Algeria was added to the grey list, with the country’s action plan specifying improvements around implementing risk-based supervision, establishing a framework for basic and beneficial ownership information, enhancing its suspicious transaction reporting procedures, applying financial sanctions for terrorism financing, and conducting oversight of the country’s non-profit sector.

Angola: After the June 2023 adoption of its mutual evaluation report (2023), Angola made progress on some of its recommended actions. However, the FATF has since identified deficiencies in the country’s AML/CFT regime, such as Angola’s understanding of its money laundering and terrorist financing risks, its supervision of non-financial entities, low prosecution rates for money laundering and terrorist financing offenses, and delays in sanctions implementation. In October 2024, Angola was added to the grey list.

Côte d’Ivoire: Despite making progress on some of its June 2023 MER’s recommendations, such as strengthening its legal AML/CFT framework, Côte d’Ivoire was added to the grey list in October 2024. The country will continue to work with the FATF to implement its action plan, including by demonstrating a sustained increase in money laundering and terrorist financing prosecutions, strengthening its sanctions framework, and improving its measures to verify beneficial ownership information.

Laos: Despite Laos’ steps to address recommendations from its 2023 MER – such as bolstering financial intelligence unit (FIU) resources and eliminating bearer shares – the FATF found significant challenges remained regarding the country’s risk assessment process, regulatory oversight, and law enforcement effectiveness. As a result, the FATF added Laos to the grey list in February 2025.

Nepal: While Nepal made its 2022 mutual evaluation report (MER), which highlighted persistent gaps in monitoring high-risk sectors and financial crime enforcement. These shortcomings, coupled with Nepal’s historical challenges in maintaining financial transparency, led the FATF to place the country under increased monitoring in February 2025.

Lebanon: The FATF placed Lebanon on the grey list in October 2024, with the country’s AML/CFT risk assessments, its approach to asset recovery, and up-to-date beneficial ownership information all cited as areas to be improved. However, the FATF has acknowledged the social, economic, and security-related difficulties Lebanon has faced since its invasion by Israel in October 2024, and has not recommended that enhanced due diligence (EDD) or countermeasures be applied to the country.

Monaco: Monaco, which has the highest concentration of millionaires and billionaires in the world, was added to the grey list in June 2024 due to insufficient progress in combating illicit financial flows. This decision comes after a review by MONEYVAL in January 2023 revealed that while Monaco had made some progress in identifying money laundering and terrorist financing threats, there were still significant gaps in its investigative and prosecutorial capabilities.

Venezuela: In early 2022, an assessment team visited Venezuela to prepare the country’s MER. The team raised concerns about the money laundering risks associated with the nation’s large informal economy, which includes illegal mining. They also highlighted terrorist financing threats linked to the close economic alliance between Caracas and Tehran. Consequently, Venezuela was added to the grey list in June 2024.

Just as countries are regularly added to the black and grey lists, countries that progress in addressing their AML/CTF deficiencies are removed. With that in mind, the FATF recently removed the following countries from the grey list.

Jamaica: In 2020, Jamaica was added to the grey list and committed to amending its customer due diligence obligations. Since then, Jamaica has worked to implement its action plan by developing a more comprehensive understanding of its ML/TF risk, including all FIs and DNFBPs in the AML/CFT regime, taking measures to prevent misuse of legal entities, increasing the use of financial information, and implementing targeted financial sanctions for terrorist financing without delay. As a result of these actions, Jamaica was removed from the grey list in June 2024.

Philippines: The decision to remove the Philippines from the grey list follows nearly four years of the country working closely with the FATF to address and rectify strategic deficiencies identified in its financial regulatory framework. The FATF commended the Philippines for its significant progress, particularly in enhancing legislative measures – including mandating all relevant agencies to actively participate in national risk assessments concerning money laundering and terrorism financing in October 2023. An on-site evaluation confirmed the effective implementation of these reforms, leading to the country’s removal from the list in February 2025.

Türkiye: In 2021, Turkey was added to the grey list and committed to implementing its FATF action plan by enhancing AML/CFT supervision, imposing strong penalties for violations, and improving financial intelligence use. In June 2024, Turkey was removed from the grey list due to positive improvements.

Given the increased risk of money laundering and terror financing that black-listed and grey-listed countries present, most financial authorities require firms to have suitable risk-based AML/CTF protections to mitigate that threat.

Accordingly, firms must screen customers against the FATF black list and grey list during onboarding and throughout their business relationship and monitor their transactions on an ongoing basis. To screen accurately, firms should ensure that their customer due diligence measures verify their customer’s residence in, or business with, listed countries. They should also check that their transaction monitoring software can scrutinize the size, frequency, and pattern of transactions involving high-risk countries to establish whether criminal activity, such as money laundering, occurs.

When suspicious activity is detected, firms must submit suspicious activity reports (SARs) to the appropriate financial authorities to take enforcement actions.

Uncover the evolving anti-money laundering regulatory landscape, examining global trends and key themes in major economies.

Download nowOriginally published 23 March 2020, updated 24 February 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).