Fraud Detection

Streamline onboarding with quicker and more intelligent remediation by utilizing advanced AI to swiftly identify and assess clients’ risk profiles.

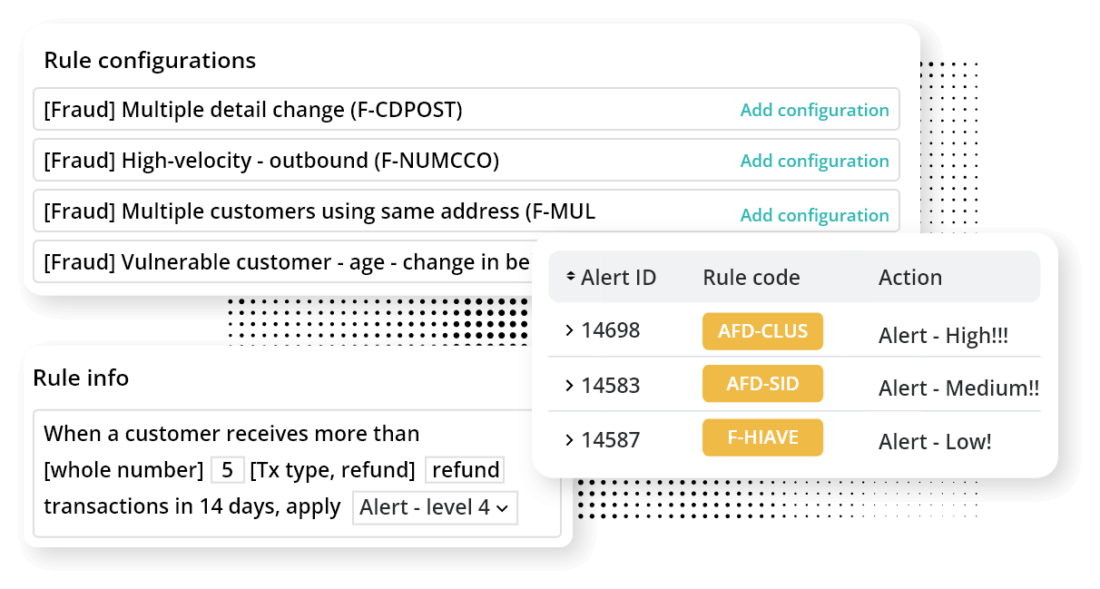

- Out-of-the-box fraud scenarios & rules library

- Market-leading machine learning models

- 50+ payment fraud scenarios covered

Detect fraud efficiently and effectively

reduction in all payment fraud-related losses

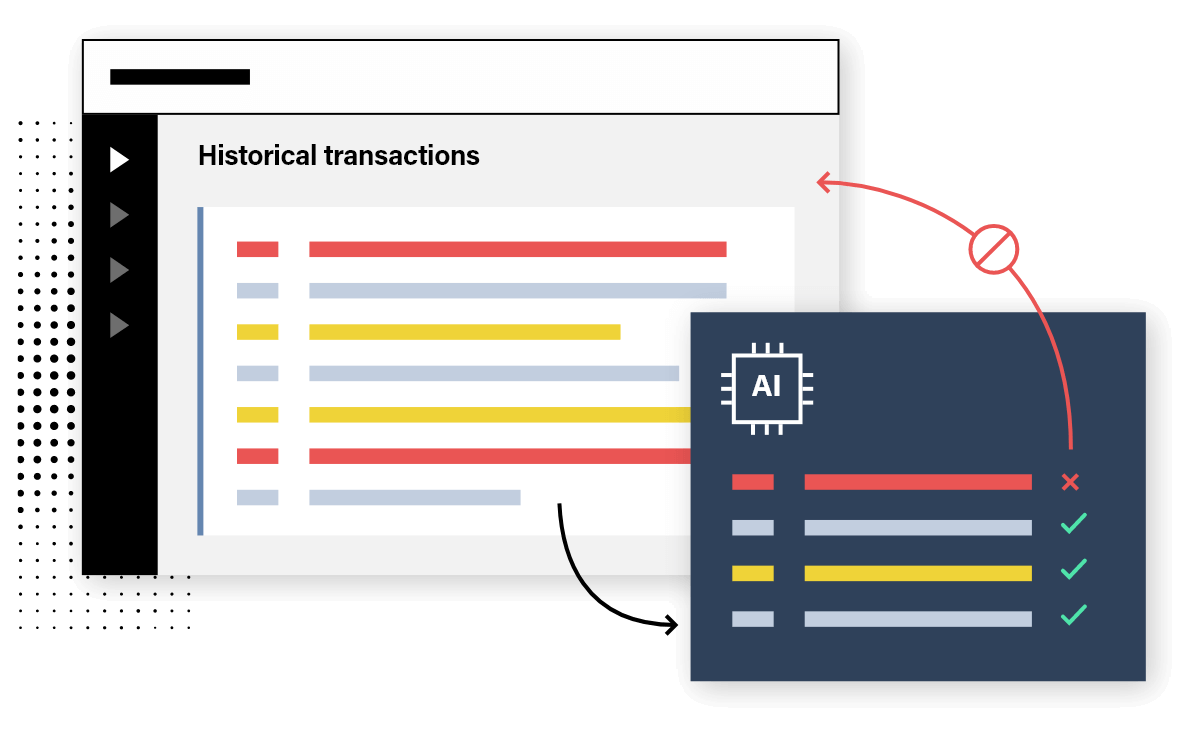

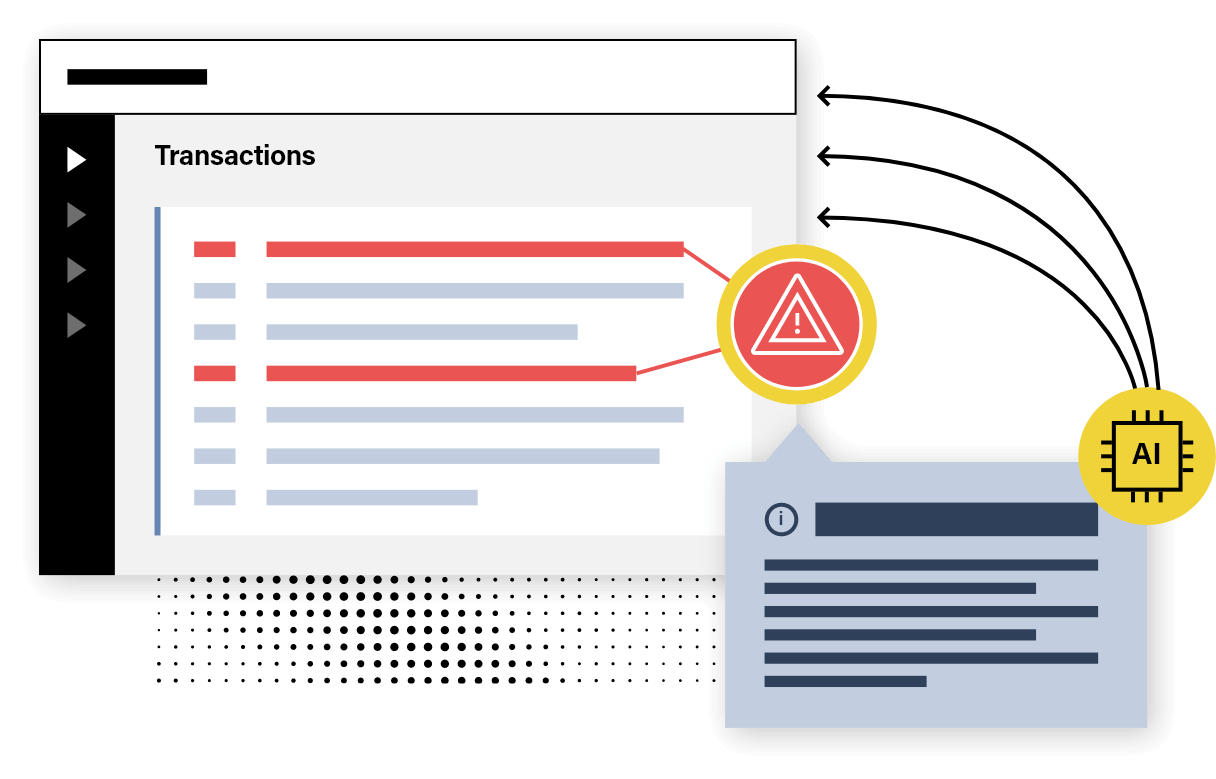

Beat fraudsters’ creativity by using machine learning models that detect a continuously evolving range of fraud attempts.

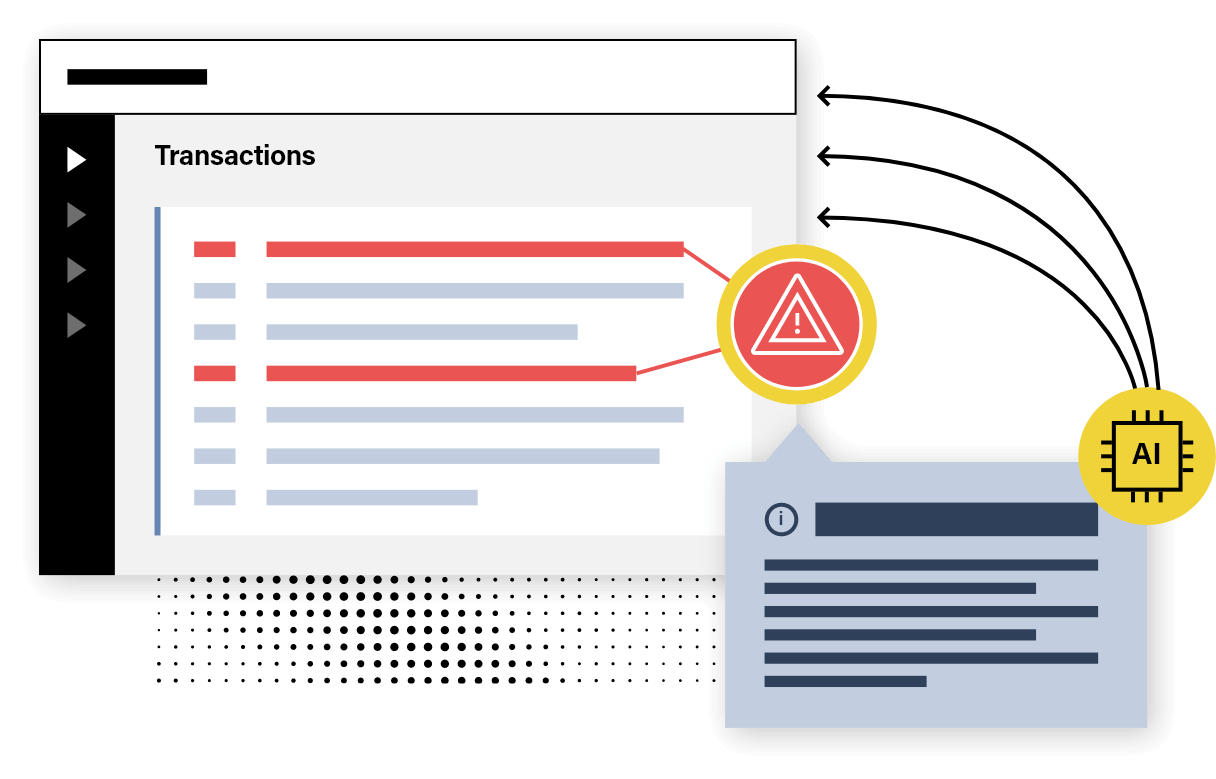

increase in analyst efficiency

Empower analysts with cutting-edge tools that help make every step of the fraud prevention process fast and low effort.

reduction in false positives

Improve alert rate quality with tailored rules and segmentation.

Explore why leading digital bank Holvi chose ComplyAdvantage for fraud detection

Manage a range of fraud risk scenarios

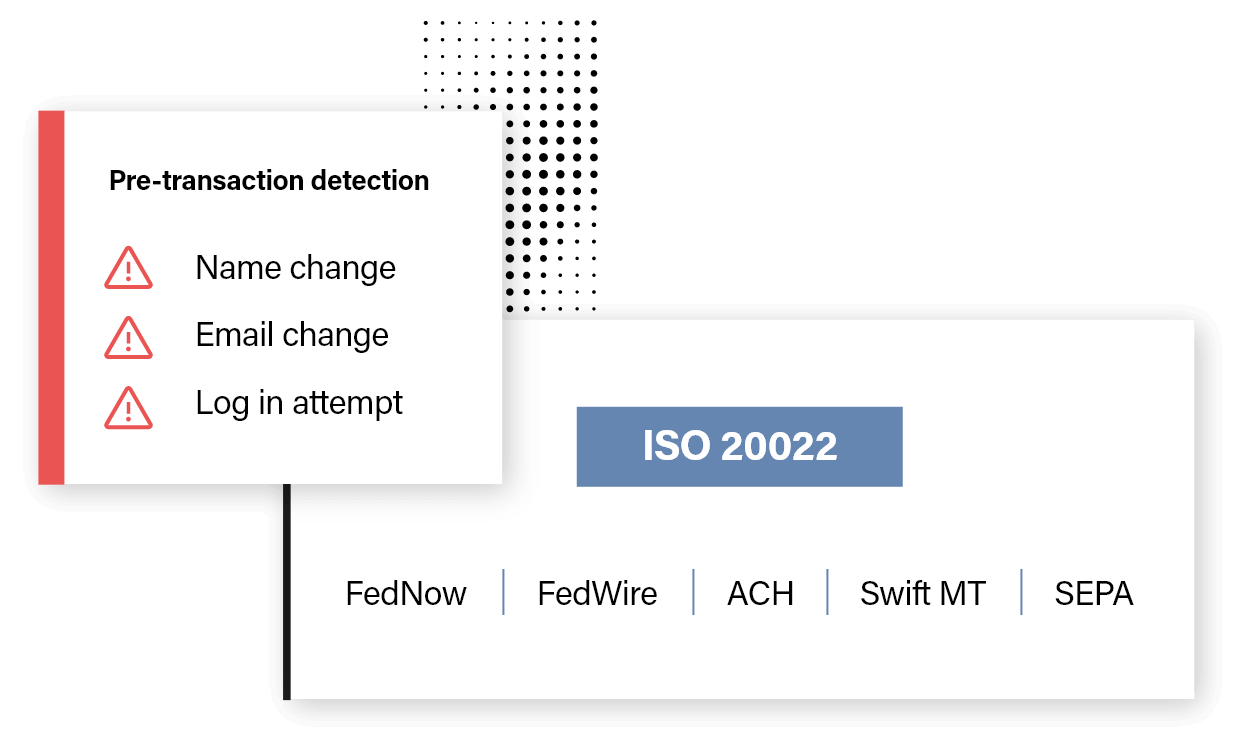

Fraud Detection from ComplyAdvantage covers a wide range of continuously evolving payment fraud scenarios.

50+ payment fraud scenarios covered

- Account Take Over (ATO) Fraud

- Business email compromise (BEC)

- Relationship Fraud

- Romance scams

- Elder Fraud / Vulnerable Adult

- Work-from-home job scams

- CEO fraud

- Employee fraud (internal fraud)

- Product & Services fraud

- IRS imposter scams

- Social Security impostor scams

- Travel scams

- Fake Item Scams

- Invoice fraud

- Authorized Push Payments (APP) Fraud

- False Claim

- Synthetic Identity

- Credit Card Fraud

- Card-Present Fraud

- Card-Not-Present (CNP) Fraud

- Credit Limit "Pushing"

- Fraudulent Card "Testing"

- Card Flipping

- Common Point of Purchase (CPP)

- Counterfeit Card: ATM, POS

- ACH Payment Fraud (US only)

- Hijacked Payroll

- Fraudulent ACH Credits

- Wire Payment Fraud

- Incoming wire fraud

- FedNow Payment Fraud (US only)

- Real Time payments (RTP) fraud

- ISO 20022 format payments

- ATM Deposit fraud

- ATM Withdrawal fraud

- Check Fraud

- Mobile Check Deposit / scam

- Duplicate Check Number

- Check Number Jump

- Stolen/Copied Check

- Advance Fee fraud

- Medical scams

- Merchant Acquirer Fraud

- False Front Merchants

- Payroll/Disbursement fraud

- Loan Fraud

- Unusual Loan Charge-off

- Unusual Active Loan

- Inactive Account Fraud

- Identity Theft

Top benefits of preventing fraud with ComplyAdvantage:

Read the story“The flexibility to build custom scenarios was important for us. Many vendors do not have the same level of flexibility.”

~ Blanca Rojas, Transaction Risk Manager, RealPage

(Real estate software and data analytics)

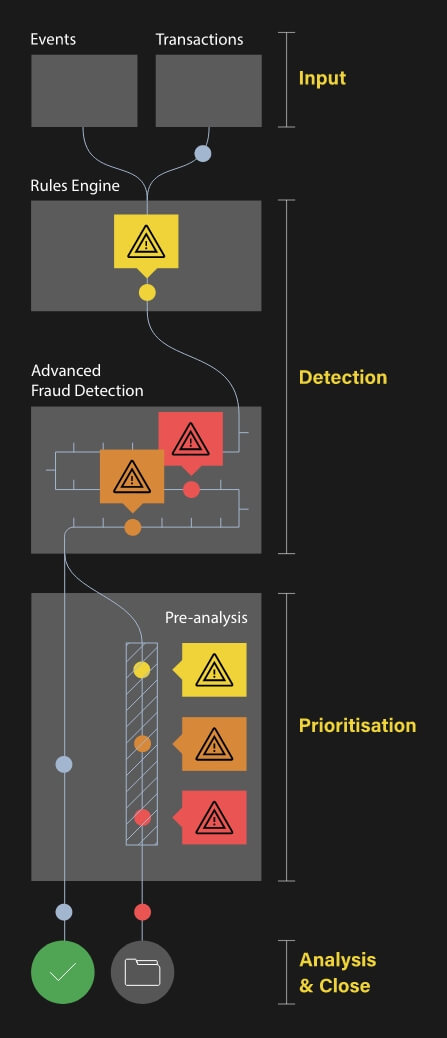

How does the ComplyAdvantage fraud detection solution work?

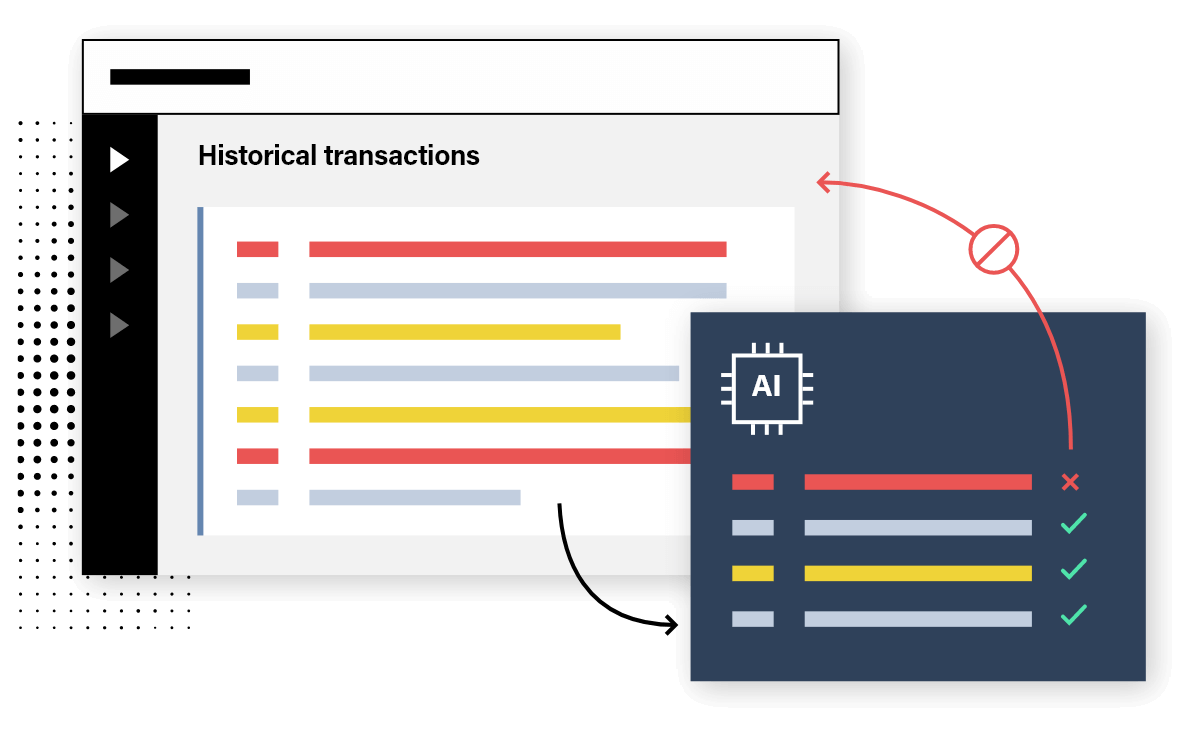

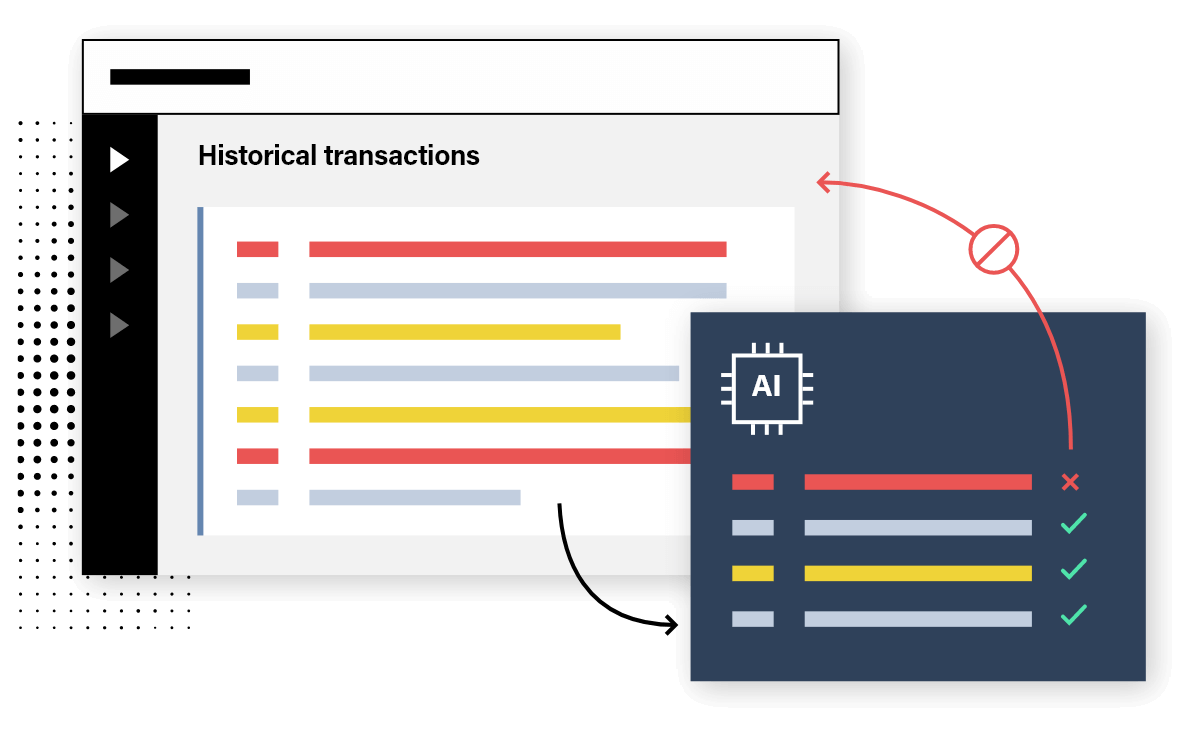

Powered by AI

Powered by AI

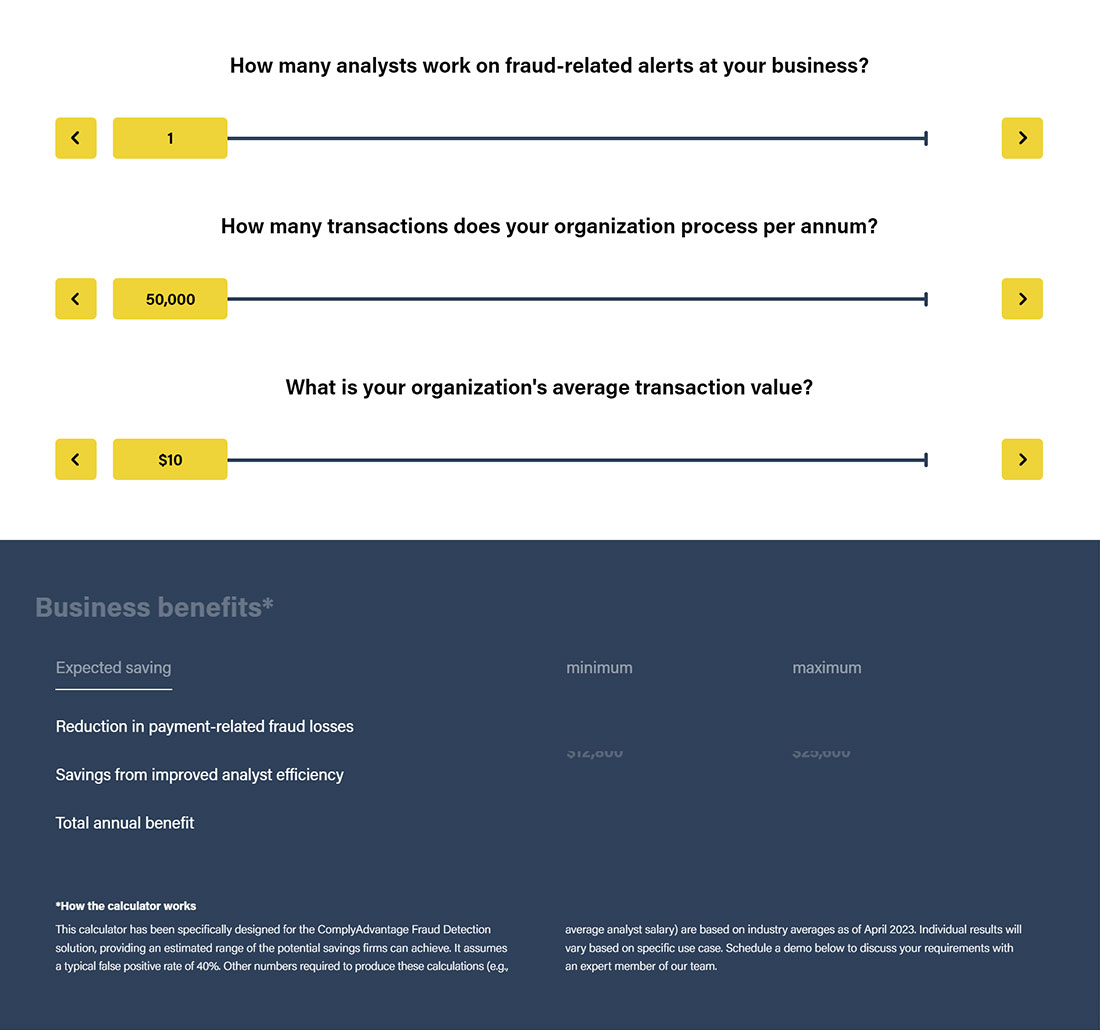

How much could Fraud Detection save your firm?

Explore our ROI calculator

Fraud isn't just a criminal issue — if expected losses aren't assessed accurately, it can undermine a firm's operational efficiency.

Use this calculator to quantify the benefits your business can achieve by using our AI-powered Fraud Detection solution.

Fraud Detection ROI CalculatorExplore our related financial crime risk detection solutions

Transaction Monitoring

Powered by AI, our transaction monitoring solution offers a no-code, self-serve rules builder and can be scaled to billions of transactions.

Discover Transaction Monitoring

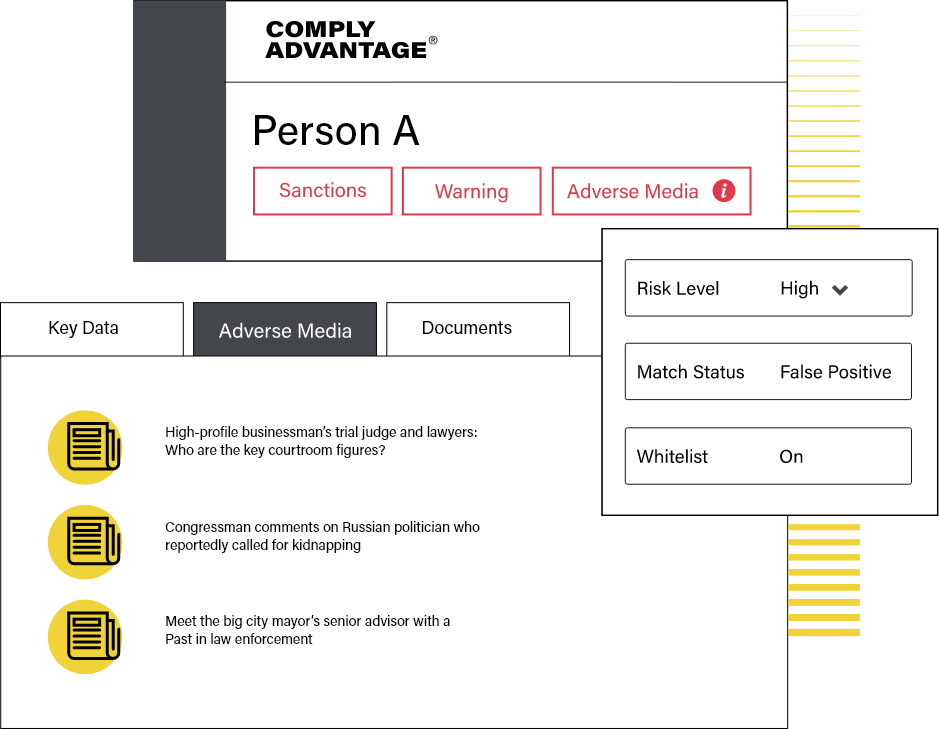

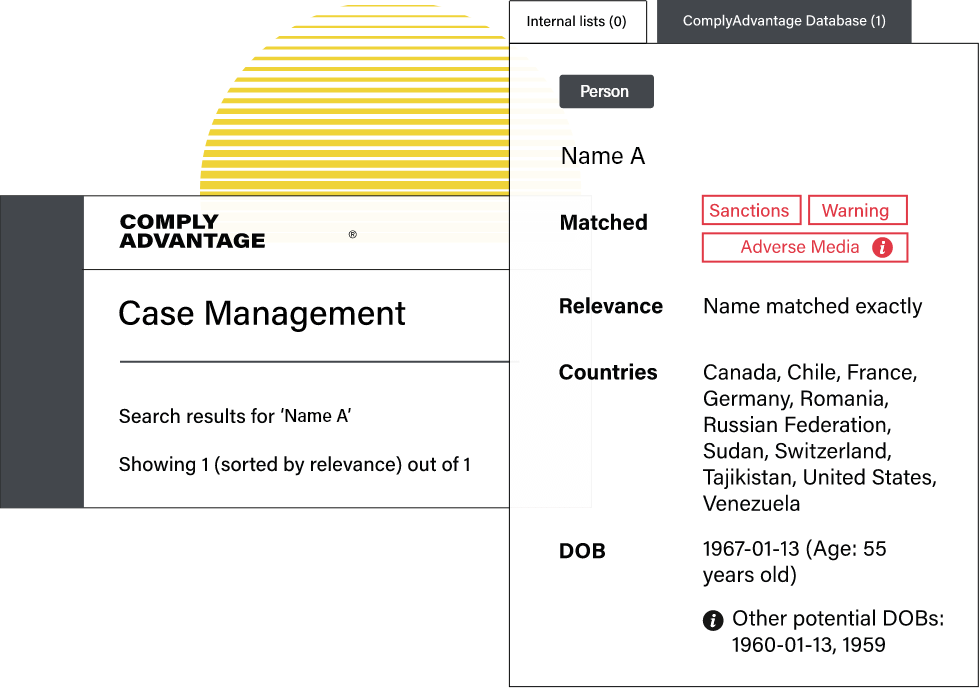

Customer Onboarding and Screening

Automate customer onboarding and screening with a real-time AML risk database and an effective KYC solution.

Discover Customer Onboarding and Screening

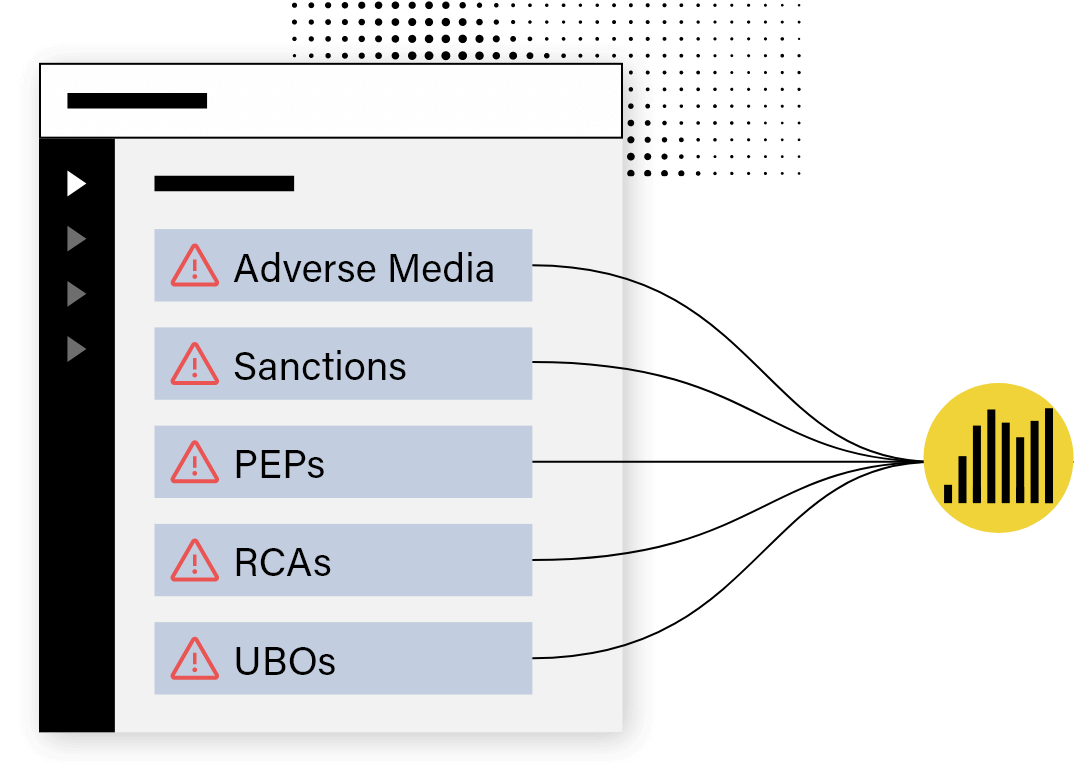

Adverse Media Screening

Cut through the noise and analyze true adverse media context at scale with our robust adverse media screening software.

Discover Adverse Media Screening

Fraud Detection FAQ

Get started with ComplyAdvantage today

Request a demo to see how our fraud detection capabilities can help you see the unseen.

Get a Demo