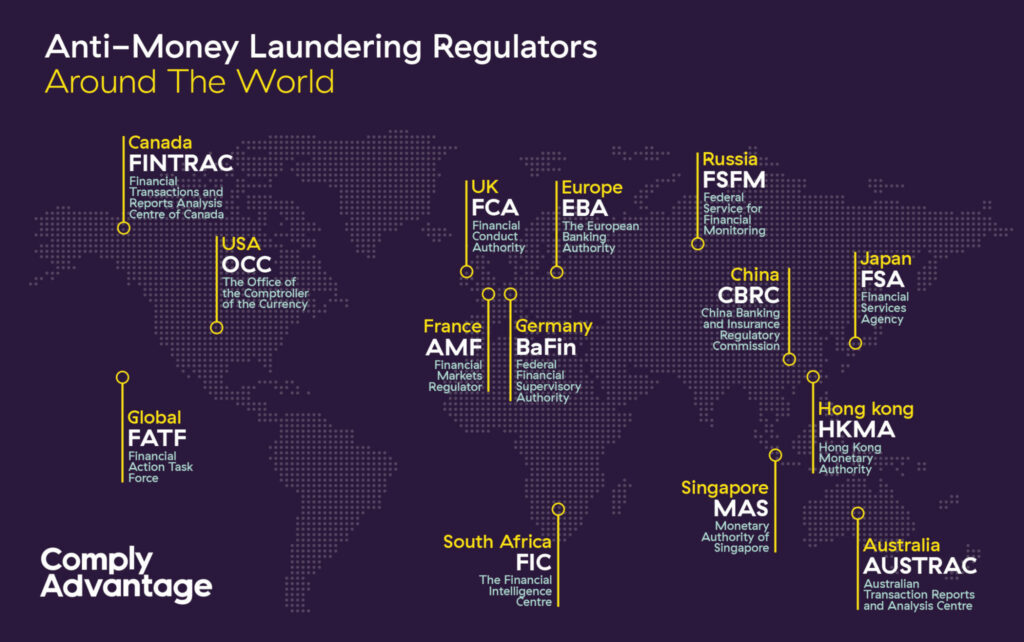

Global AML Regulations: What You Need To Know

Wherever you do business, achieving AML compliance means dealing with financial regulators and understanding legislation imposed at a national and international level. With so much legislative ground to cover, our guide to the world’s most important AML compliance regulations, and the organizations that enforce them is a good place to start. The global AML landscape is diverse and financial institutions must keep pace with developing rules and regulations in order to meet their compliance obligations.

The global AML landscape is diverse and financial institutions must keep pace with developing rules and regulations in order to meet their compliance obligations.

Global

The Financial Action Task Force (FATF)

The Financial Action Task Force is an intergovernmental organization dedicated to combating money laundering and the financing of terrorism. With 36 member states, the FATF’s jurisdiction spans the world and takes in every major financial centre. Its primary function is to set global standards for AML compliance and monitor their effective implementation. In pursuing that objective, the FATF regularly issues updated AML/CFT guidance. To comply with FATF regulations, member states and their financial institutions should:

- Implement Know Your Customer (KYC) ID verification measures.

- Perform FATF recommended due diligence measures.

- Maintain suitable records of high-risk clients.

- Regularly monitor accounts for suspicious financial activity and report that activity to the appropriate national authority.

- Enforce effective sanctions against legal persons and obliged entities that fail to comply with FATF regulations.

The European Union

EU 5AMLD and 6AMLD

The European Union’s Anti-Money Laundering Directives are the mechanism it uses to harmonise AML/CFT legislation across its member states. Published periodically, the money laundering directives are updated to reflect the current money laundering, terrorism financing, and criminal risks facing financial markets. The EU’s Fifth Anti-Money Laundering Directive (5AMLD) was published on 9 July 2018 and will come into effect on 10 January 2020, meanwhile the draft 6AMLD was published in late 2018, and will come into effect in June 2021. To comply with 5-6 AMLD rules, financial institutions should be familiar with their contents:

- 5AMLD: The Fifth Anti-Money Laundering Directive focuses on cryptocurrency regulation, introducing a legal definition of cryptocurrency, reporting obligations, and rules for crypto wallets. 5MLD also introduces new legal requirements for prepaid cards, transactions involving high-value goods, beneficial ownership, customers from high-risk third countries, and Politically Exposed Persons (PEP) lists.

- 6AMLD: The Sixth Anti-Money Laundering Directive includes provisions for a harmonised definition of money laundering offences, an extension of the scope of money laundering and the criminal liability of persons associated with it, and tougher punishments for those convicted of money laundering.

The UK

The Financial Conduct Authority (FCA)

An independent, non-governmental body, the Financial Conduct Authority is responsible for regulating the UK’s financial services industry, including combating money laundering and other criminal activities like the financing of terrorism. The FCA’s broad objectives involve protecting consumers, ensuring market integrity and stability and promoting competition. It also has the authority to introduce and enforce rules and conduct investigations in pursuit of those objectives. In practical terms, the FCA’s powers include:

- Regulation: Setting minimum legal standards for financial products in the UK and imposing bans on products which fail to comply with FCA rules.

- Supervision: Ensuring UK financial institutions operate safely and adhere to specific AML regulations, including conducting risk assessments, monitoring suspicious activity and reporting to appropriate authorities.

- Authorization: Imposing registration and requirements on financial institutions before issuing authorizations to operate in the UK.

The US

The Bank Secrecy Act

The Bank Secrecy Act (BSA) is the United State’s primary anti-money laundering regulation and is administered by the Financial Crimes Enforcement Network (FinCEN). The BSA focuses on money laundering, but its scope has expanded to include other financial crimes. For example, it was amended by the Patriot Act in 2001 to include countering of terrorist financing (CFT) measures. Under the BSA financial institutions must satisfy a number of requirements, including:

- Compliance Program: US financial institutions must develop and implement an internal anti-money laundering program to suit their risk profile. AML programs must include written policies and procedures, employee training, audit schedules and the appointment of a compliance officer.

- Reporting: The BSA involves various AML reporting and filing obligations which include Suspicious Activity Reports (SAR), Currency Transaction Reports (CTR) and 8300 forms for high-value transactions.

- Record Keeping: Financial institutions must keep detailed records of suspicious activities, including the identities of purchasers and the value of their transactions.

Financial institutions that fail to comply with BSA regulations may be prosecuted under the US criminal code with punishments including imprisonment and fines of up to $250,000.

Asia

Hong Kong Monetary Authority (HKMA)

The Hong Kong Monetary Authority is responsible for the stability of Hong Kong’s banking system and monetary policy. Under the authority of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance, the HKMA is also the regulatory body responsible for combating money laundering and the financing of terrorism. In this capacity, it works to ensure that financial institutions in Hong Kong are meeting a variety of legal requirements, the most important being the development and implementation of an effective AML/CFT program. In order to comply with HKMA AML policy, that program must feature:

- Risk Assessment: Financial institutions must develop their AML program with a risk-based approach to the unique AML/CFT threats they face.

- Procedures and Controls: AML/CFT programs must include a variety of procedures and controls, including independent audit schedules, employee training and screening, and compliance management.

- Compliance Officers: Each financial institution must appoint a compliance officer with sufficient authority to take responsibility for its AML/CFT program and the reporting of suspicious activity.

Monetary Authority of Singapore (MAS)

The Monetary Authority of Singapore (MAS) has a mandate to serve as the city-state’s central bank and regulate its financial sector. In this capacity, MAS’ duties include conducting monetary policy, supervising financial institutions, managing reserves and assets and developing Singapore’s international financial status. Financial institutions must comply with MAS’ AML policy, which is set out in its Notices on the Prevention of Money Laundering and Countering the Financing of Terrorism, and includes:

- Due Diligence: Financial institutions must perform due diligence procedures on their customers – and enhanced due diligence procedures when there is a suspicion of money laundering or terrorism financing activities.

- Know Your Customer: Customer identities must be verified through independent checks. Financial institutions must keep records of those checks.

- Reporting and Monitoring: Financial institutions in Singapore must conduct regular reviews of customer accounts, monitoring for suspicious activity and reporting incidents to MAS.

Financial institutions which fail to comply with MAS AML policy may be held criminally liable and face fines of up to $1 million.

Australia

AUSTRAC

The Australian Transaction Reports and Analysis Centre (AUSTRAC) is the Australian government’s primary financial intelligence agency tasked with combating money laundering, terrorism financing, fraud and other financial crimes. AUSTRAC operates under the authority of the Anti-Money Laundering and Counter-Terrorism Financing Act (2006), working to identify criminal threats and abuses of the Australian financial system. In this capacity, AUSTRAC’s efforts to combat money laundering involve:

- Detection and Monitoring: AUSTRAC uses its financial intelligence resources to detect and monitor money laundering and terrorism financing activities.

- Reporting: Financial institutions in Australia have certain AML/CFT reporting obligations to AUSTRAC and must detail financial transactions over a certain value along with suspicious activities of any kind.

Enforcement: AUSTRAC works with a range of governmental agencies to implement AML/CFT policy, including law enforcement, security services, and revenue agencies. Individuals and companies which fail to comply with AUSTRAC regulations face prison sentences and fines.

Get Started Now

Want to meet and exceed the expectations of global regulators? Get in contact with ComplyAdvantage today!

Originally published 05 June 2019, updated 27 July 2022

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).

EN

EN FR

FR