Over the past few years, the Philippines has made significant efforts to close gaps in its anti-money laundering and countering the financing of terrorism (AML/CFT) regime. Among the areas targeted for improvement has been sanctions screening – an essential part of effective AML compliance, which has only become more prominent in the context of a fractured geopolitical environment and the escalating use of sanctions in response.

Once identified as a specific area for improvement by the Financial Action Task Force (FATF), firms’ sanctions screening efforts have been bolstered by the release of updated guidance from AML authorities in the country.

This article unpacks the latest sanctions guidance for financial institutions (FIs) in the Philippines, explains your sanctions and other AML screening requirements, and offers practical tips on optimizing your compliance setup.

What is sanctions screening?

To address violations of international law, human rights abuses, other state-sponsored crimes, and threats to international security, governments impose sanctions against designated targets worldwide.

Sanctioned individuals or entities often look to circumvent sanctions and continue conducting financial transactions, which makes sanctions screening, or checking customers against relevant sanctions lists, crucial to effective AML compliance.

Staying updated on the latest sanctions lists, and ensuring you can efficiently screen customers against them, is therefore an essential part of customer onboarding and ongoing customer monitoring.

The Philippines’ journey: From grey list to enhanced compliance

Sanctions screening, alongside other important elements of AML compliance, has taken center stage in the Philippines’ recent compliance journey.

In the span of four years, the country was added to and then removed from the FATF’s list of ‘jurisdictions under increased monitoring’ – better known as the ‘grey list’, and one of the best-known indicators of risk in global financial crime compliance.

Why was the Philippines added to the FATF grey list in 2021?

At its June 2021 plenary meeting, the FATF confirmed the addition of the Philippines to the grey list. This was prompted by concerns about the Philippines’ AML regime, centring around:

- Effective, risk-based supervision of designated non-financial businesses and professions (DNFBPs).

- AML risks associated with casino junkets.

- Implementing registration requirements for money or value transfer services (MVTS) and sanctioning unregistered and illegal remittance operators.

- Providing law enforcement agencies with access to beneficial ownership information and ensuring this information is accurate and up-to-date.

- Using financial intelligence and increasing money laundering investigations and prosecutions in line with risk.

- Identifying, investigating, and prosecuting terrorist financing cases.

- Demonstrating that appropriate measures are taken regarding the non-profit sector without disrupting legitimate activity.

- Enhancing the effectiveness of the targeted financial sanctions framework for terrorist financing and proliferation financing.

Why was the Philippines removed from the grey list in 2025?

The Philippines’ removal from the grey list followed nearly four years of the country working closely with the FATF to address and rectify these strategic deficiencies in its regulatory framework.

The FATF commended the Philippines for making significant progress, especially in enhancing legislative measures. In 2021, the Anti-Money Laundering Council (AMLC), the jurisdiction’s AML authority, amended the Anti-Money Laundering Act (AMLA) to close gaps in existing legislation. In October 2023, the Bangko Central ng Pilipinas mandated all regulated firms to actively participate in national AML/CFT risk assessments.

In addition to these legislative reforms, the AMLC turned its attention specifically to the issue of sanctions screening, as highlighted by the FATF. In 2022–2023, it carried out a thematic review of sanctions compliance in the Philippines with the specific aim of making improvements to ensure removal from the grey list. The review assessed the performance of firms’ existing sanctions screening measures and led to detailed new guidance on sanctions screening for firms.

An on-site evaluation confirmed the effective implementation of these reforms, leading to the country’s removal from the list in February 2025. Going forward, authorities in the Philippines will look to avoid being re-added, and firms should be mindful that the bar for compliance has been raised.

The AMLC’s sanctions screening guidance: Key requirements for firms in the Philippines

The 2021 Sanctions Guidelines – Targeted Financial Sanctions related to Terrorism, Terrorism Financing and Proliferation Financing outlines the current requirements for firms in the Philippines.

Under this legislation, all regulated firms must screen relevant parties against the Anti-Terrorism Council (ATC) List and United Nations (UN) Security Council Resolutions. At a minimum, the sanctions database should include the following and their successor resolutions:

- The UNSC Consolidated List that includes UNSC Resolutions 1267/1989 (Al Qaeda), 1988 (Taliban), and 2253 (ISIL Daesh) for Targeted Financial Sanctions (TFS) on terrorism and terrorist financing.

- The UNSC Consolidated List that includes UNSC Resolution Numbers 1718 of 2006 (DPRK) and 2231 of 2015 (Iran) for TFS on Proliferation Financing.

- Domestic designations (or those designated by the Anti-Terrorism Council pursuant to UNSC Resolution 1373, Section 25 of the Anti-Terrorism Act of 2020, Rule 15.b of the Implementing Rules and Regulations of The Terrorism Financing Prevention and Suppression Act of 2012 [TFPSA]) and those proscribed by the Court of Appeals under Section 26 of The Anti-Terrorism Act of 2020.

Significantly, the AMLC’s review found an overall underperformance on sanctions screening among financial institutions (FIs) in the Philippines. It also detailed specific gaps in firms’ existing AML programs, including:

- A reliance on manual processes: This increases the chance of human error and leads to slower remediation of alerts. As an alternative, automated sanctions screening solutions improve accuracy in matches and allow compliance analysts to work through cases quicker.

- High false positive rates: These can quickly cause alert backlogs, wasting compliance resources on irrelevant matches while increasing the risk of genuine threats going undetected.

- Failure to detect manipulated names: Solutions that leverage machine learning (ML), rather than manual-first systems, tend to perform better when detecting name variants or deliberate name manipulation.

- Over-reliance on vendors: Firms that seek to offload compliance entirely onto RegTech vendors likely fail to apply a risk-based approach to sanctions screening, instead relying on preset rules. The most effective partnerships between firms and vendors capitalize on configurable rulesets and dynamic thresholds to serve disparate use cases.

- Lack of system tuning and testing: To keep up with fast-evolving sanctions risks, screening systems should be subject to regular testing and auditing.

Failure to address these weaknesses exposes firms to significant risks, including regulatory censure, substantial fines, and reputational damage. Given these stakes, it becomes a critical imperative for organizations to assess their sanctions screening systems and optimize them for robust, long-term compliance.

The State of Financial Crime 2025

Based on a global survey of over 600 compliance leaders, our annual report gives you expert insights on the most important compliance trends.

Download your copyHow to minimize the risks of non-compliance

To effectively achieve and uphold compliance with key regulations and AMLC guidance, the following points outline a strategic framework for optimizing your sanctions and AML screening solutions.

1. Foster strong governance and oversight

- Appoint a ‘responsible person’ with the necessary skills and experience to be accountable for the overall effectiveness of the sanctions screening program.

- Report management information on sanctions screening risks and performance to senior management, and at least quarterly to the Board of Directors.

- Ensure senior management demonstrates clear ownership of AML procedures. This includes actively assessing, reviewing, and approving the sanctions compliance programme, ensuring adequate resourcing across staff hiring and training, advanced technology adoption, and high-quality data technology. Promoting a culture of compliance where employees can report concerns without fear of reprisal is also an important step for leaders to take.

2. Implement robust risk management practices

- Conduct ongoing, periodic, and comprehensive risk assessments of your sanctions screening program. These should define specific sanctions risks, evaluate inherent exposures, detail how risks are managed through screening tools, and identify where customer screening data is available in a conducive format.

- Monitor for new emergent risk typologies and evasive techniques used by sanctioned individuals and entities, and update your policies and system configurations accordingly.

- Apply a risk-based approach to CDD, setting clear criteria for low, normal, and high-risk customers, and apply EDD when you identify higher risk levels.

3. Optimize technology and data management

- Ensure your sanctions screening solution is properly configured according to your risk appetite, as opposed to current resource capacity. This tuning should be evidence-based and regularly updated.

- Use high-quality, comprehensive, and up-to-date sanctions data that includes all officially mandated sources. Conduct due diligence on commercial list providers to ensure their content and frequency of updates meet your requirements.

- Implement data segmentation (i.e. for sanctions, PEP, and adverse media screening). This lets you apply different screening thresholds to optimize efficiency, especially using exact matching versus fuzzy logic as per your risk thresholds.

- Screen for adverse media alongside sanctions to ensure true visibility into risks, since some threats are reflected in unstructured data before official sources. Solutions that can automatically assign risk types to adverse media results allow you to fine-tune your response to your risk thresholds. You should also look for a solution that assesses the quality of sources before ingesting data from them.

- Automate ongoing customer monitoring to move away from costly manual re-screening and improve operational efficiency.

- Prioritize solutions with API-first integration, which ensures a more seamless implementation process that doesn’t disrupt existing workflows and allows you to connect core tech stacks.

- Optimize case management workflows for escalations and auditability. While this may appear more of a procedural point, technology adoption can help here: for example, with AI-driven alert prioritization allowing analysts to see the highest-risk cases first, or automatic data reporting to understand why case backlogs occur.

4. Ensure continuous testing and improvement

- Conduct independent, ongoing, and regular testing of your sanctions screening systems, performed by internal audit teams or external third parties. This is a mandatory requirement in the Philippines.

- Perform pre- and post-implementation testing for any new or updated systems, to ensure relevant controls are in place before systems go live.

- Monitor AML systems continuously to ensure correct tech calibration. As one key indicator of success, look for evidence that your false positive rate remains manageable without sacrificing your system’s effectiveness.

- Establish internal escalation processes for any true positives identified by screening systems.

Other AML screening types that complement sanctions screening

In light of the Philippines’ transformation of its AML regime, firms should pay attention to other crucial AML screening requirements alongside sanctions screening. From an operational efficiency perspective, your firm should ideally be able to carry out these screening types in tandem with sanctions screening via an integrated solution:

PEP screening

Regulated firms in the Philippines must apply appropriate customer due diligence (CDD) measures for politically exposed persons (PEPs), establishing their true and full identity as well as that of their immediate family members and close associates.

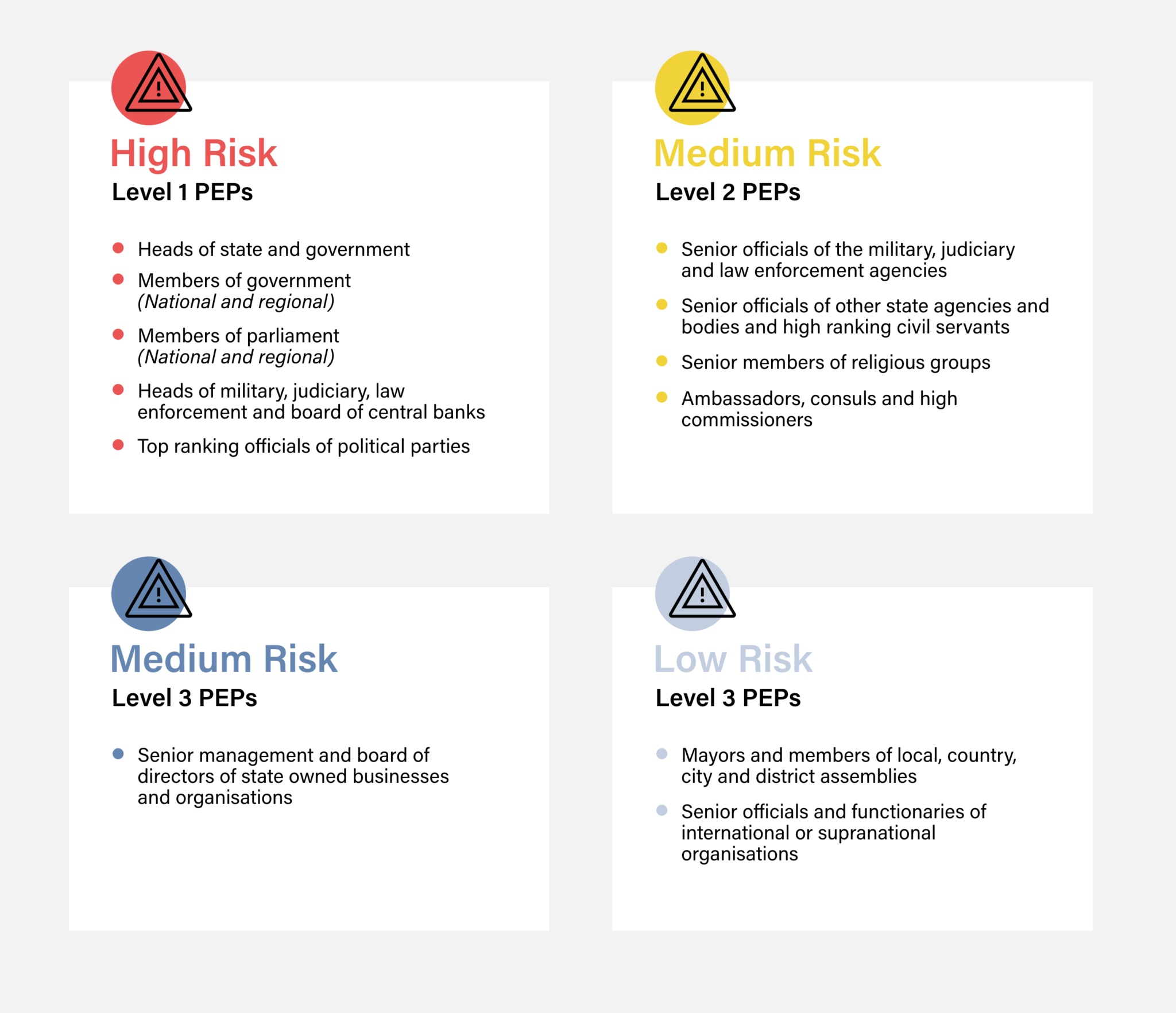

A risk-based approach is essential for PEP screening. Domestic and international PEPs are not automatically considered high-risk; in fact, PEPs sit on a spectrum of financial crime risk, as illustrated below. Instead, their risk level is determined by factors including their country of origin and residence of operations, the nature of their employment, and the nature of their business relationship with the firm, according to the AMLC’s AMLA implementation guidance. If you do identify a domestic or international PEP as high-risk, you must obtain senior management approval, establish the PEP’s source of wealth and source funds, and conduct enhanced ongoing monitoring.

Foreign PEPs automatically require enhanced due diligence (EDD) measures. Establishing or continuing business relationships with foreign PEPs also requires senior management approval, which should depend on more proactive monitoring for unusual or suspicious activities. This may include daily monitoring for adverse media, which can surface risks that are not yet reflected in official sources.

You should also continuously identify and assess customers’ PEP status, avoiding the concept of “once a PEP, always a PEP”, and declassify former PEPs based on an assessment of residual risks. Maintaining and regularly updating a database that enumerates positions or lists individuals is essential to ensure accurate PEP identification. ComplyAdvantage’s curated data, for example, allows firms to see at a glance if an individual should be considered a ‘former PEP’, and hence can be removed from the more stringent ongoing monitoring requirements.

Adverse media screening

The AMLC’s guidance highlights that adverse media screening (or ‘negative media report’ (NMR) screening) is an integral part of CDD and complements ongoing transaction monitoring.

Adverse media/NMR encompasses published or televised negative news, advisories, and reports concerning individuals and entities, especially concerning potential money laundering predicate offenses, terrorism financing, and proliferation financing risks.

Key practices for handling adverse media screening results include:

- Updating risk assessments to incorporate newly identified financial crime threats and emerging trends.

- Integrating NMR screening into CDD during onboarding and NMR scrubbing during transaction monitoring. This should extend to ultimate beneficial owners (UBOs) of accounts, authorized signatories of juridical customers, and related parties and counterparties for material and significant transactions. An NMR handling framework should be developed to define these transactions.

- Defining account management measures triggered by NMR investigation results, calibrated by severity. These may include enhanced monitoring, suspicious transaction report (STR) filing, account restriction, or termination of the business relationship.

- Ensuring an adequate management information system to analyse the significance of NMRs, assess risks, and promptly escalate significant findings to senior management to inform decision-making.

Automated sanctions screening from ComplyAdvantage

ComplyAdvantage helps fast-growing firms in the Philippines streamline compliance with automated sanctions screening solutions. Specific features supporting robust compliance without sacrificing fast onboarding include:

- Fully automated screening and monitoring: Get system-wide updates in near-real time based on global sanctions lists, watchlists, adverse media, and PEP data.

- Consolidated entity profiles: Streamline case decisions with a single alert generated with all the information needed for effective action.

- Workflow management to streamline reporting: Data feeds, case management systems, and CRMs are integrated to match your workflow.

“With ComplyAdvantage, an initial screening search can be completed in as little as five minutes, which is a significant improvement.”

Sinclair Coghill, Manager, Compliance and Executive Projects, Hafnia

Automate your sanctions screening with ComplyAdvantage

Get sanctions updates in real-time with our proprietary data, sourced straight from regulators.

Get a demoOriginally published 07 August 2025, updated 08 August 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2026 IVXS UK Limited (trading as ComplyAdvantage).