The State of Financial Crime 2024

Uncover the evolving anti-money laundering regulatory landscape, examining global trends and key themes in major economies.

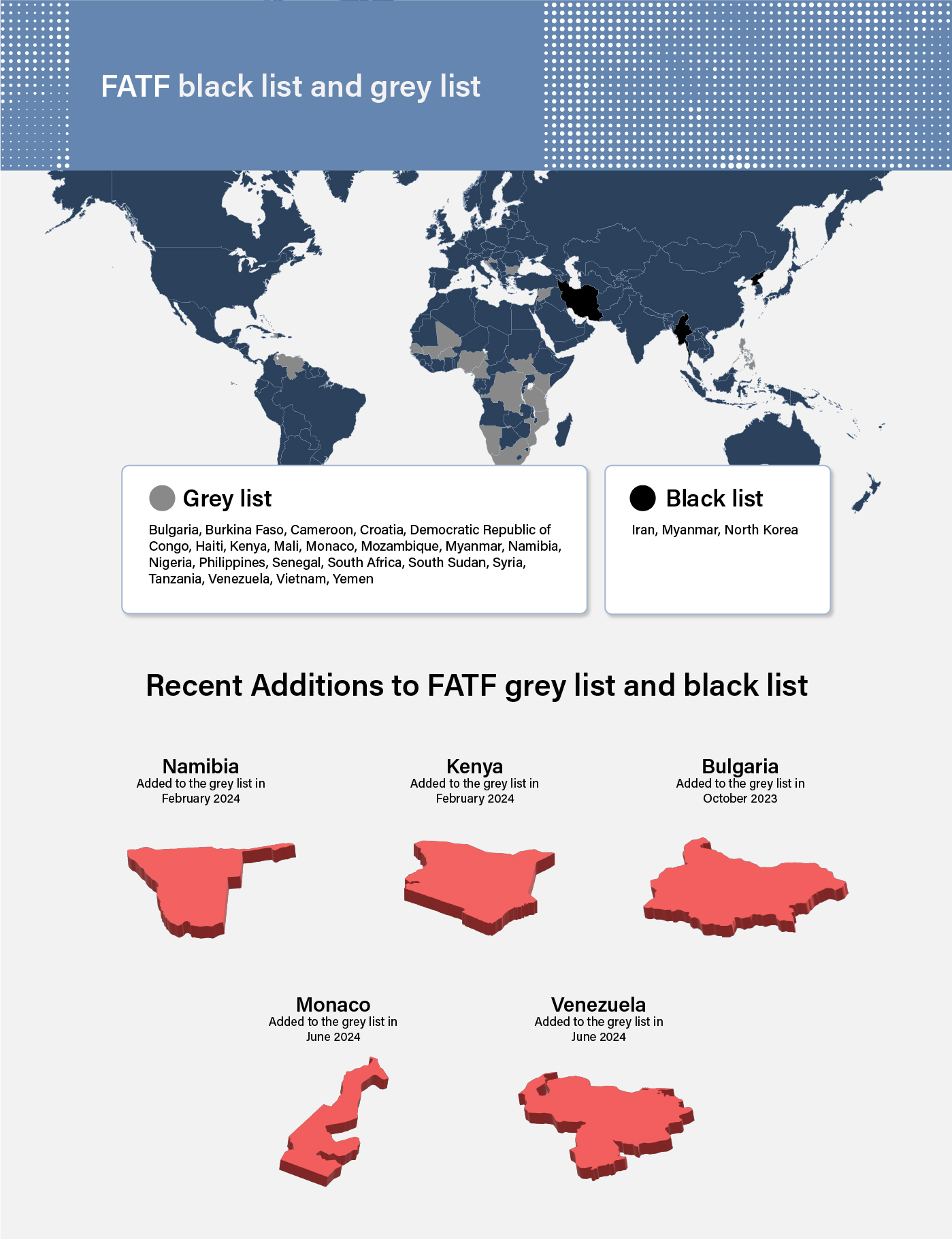

Download nowThe Financial Action Task Force (FATF) is an intergovernmental organization that monitors global money laundering and terrorist financing trends. The FATF collaborates with its member states and regional organizations to develop a legal, regulatory, and operational framework for combating these threats. As part of its efforts, the FATF maintains a black list, officially known as High-Risk Jurisdictions subject to a Call for Action, and a grey list. The grey list includes countries that have committed to addressing strategic deficiencies in their anti-money laundering and counter-terrorist financing (AML/CTF) regimes. Given the potential regulatory risk associated with countries that do not maintain international compliance standards, financial institutions should be aware of FATF black list and grey list countries and what that designation entails.

The FATF black list (sometimes referred to as the OECD black list) is a list of countries that the intragovernmental organization considers non-cooperative in the global effort to combat money laundering and the financing of terrorism. By issuing the list, the FATF hopes to encourage countries to improve their regulatory regimes and establish a global set of AML/CTF standards and norms black-listed countries will likely be subject to economic sanctions and other prohibitive measures by FATF member states and international organizations.

The black list is a living document issued and updated periodically in official FATF reports. Countries are added and withdrawn from the black list as their AML and CFT regulatory regimes are adjusted to meet the relevant FATF standards. The first FATF black list was issued in 2000 with an initial list of 15 countries. Since then, the lists have been published as part of official FATF statements and reports yearly and sometimes twice yearly.

The FATF cites significant deficiencies in the black-listed countries’ AML/CTF regimes and suggests other countries exercise extreme caution when doing business with firms based in these jurisdictions. While the FATF has called on its member-states to “apply effective counter-measures” in any business dealings with North Korea, Iran, and Myanmar, it has noted Iran’s prior commitment to improving its AML/CTF regulation. Accordingly, the FATF has set out the steps for Iran’s removal from the list, including a requirement to ratify the Palermo and Terrorist Financing Conventions.

While it has no direct investigatory powers, the FATF monitors global AML/CFT regimes closely to inform the content of its black lists. Some observers have criticized the term “non-cooperative” about countries on the black list, pointing out that some black-listed countries may not have the regulatory infrastructure or resources to enact the FATF’s AML/CTF standards rather than acting in defiance of international best practices.

The FATF grey list, officially known as Jurisdictions Under Increased Monitoring, includes countries with deficiencies in their AML/CTF regimes. Like the black list, the grey list was created in 2000 and is updated periodically. Countries on the grey list are subject to increased monitoring and must work with FATF to improve their regimes.

To do this, the FATF either assesses them directly or uses FATF-style regional bodies (FSRBs) to report their progress toward their AML/CTF goals. While grey list classification is not as punitive as the black list, countries on the list may still face economic sanctions from institutions like the International Monetary Fund (IMF) and the World Bank and experience adverse effects on trade.

The grey list is updated regularly as new countries are added or as countries that complete their action plans are removed. As of June 2024, the FATF grey list included the following countries:

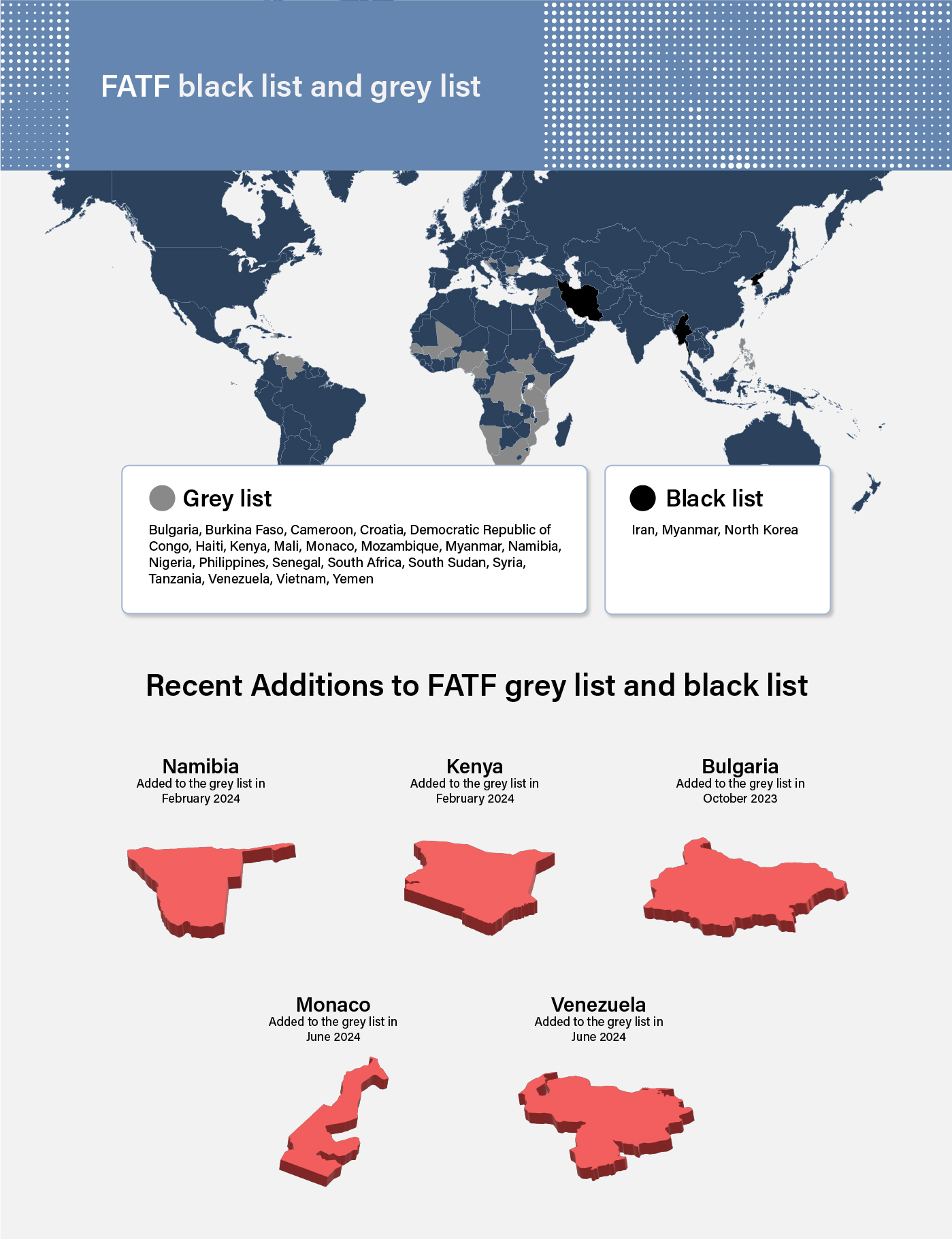

The FATF continuously reviews its member states’ AML/CTF performance to gauge their alignment with its regulatory guidance. The FATF has recently added the following countries to the grey list:

Bulgaria: Since adopting its mutual evaluation report (MER) in May 2022, the FATF noted Bulgaria’s progress on its recommended actions to improve the country’s international cooperation. However, in October 2023, the FATF highlighted several areas of Bulgaria’s AML/CFT regime that required strengthening, including the country’s beneficial ownership register and automated reporting systems. Following the watchdog’s decision, Bulgaria made a high-level political commitment to work with MONEYVAL and the FAFTF to strengthen the effectiveness of its AML/CFT regime.

Cameroon: Cameroon was placed on the grey list in June 2023. The country was commended by the FATF for enhancing the capabilities of its investigative and judicial bodies in dealing with money laundering and terrorist financing cases. However, the watchdog highlighted the need for better cooperation and coordination between competent authorities in the fight against AML/CFT, alongside other recommendations like increased risk-based supervision of financial institutions.

Croatia: Following the adoption of its MER in December 2021, the FATF noted that Croatia had taken steps to improve its system, including licensing and overseeing the registration of VASPs, implementing stronger sanctions on supervisory activities, and reinforcing preventive measures for high-risk sectors. However, the FATF deemed that sufficient progress has yet to be made, resulting in Croatia joining the grey list in June 2023. Croatia made a high-level political commitment to work on seven actions highlighted by the FATF, including completing a national risk assessment and demonstrating the ability to systematically detect terrorist financing threats in line with its risk profile.

Kenya: In 2010, the FATF added Kenya to the grey list due to severe delays in deploying laws to stop criminal financing activity and a failure to track money laundering. After they created a more efficient financial intelligence unit and introduced new laws to identify and prevent terrorist financing, Kenya was subsequently removed in 2014. However, in February 2024, the FATF re-added the country to the grey list after identifying strategic deficiencies in the agreed timeframe for continuing to implement robust AML/CTF measures. These include the need for better supervision of financial institutions, an increased understanding of preventative measures alongside increased investigations and prosecutions, and compliance with targeted financial sanctions frameworks.

Namibia: While the FATF commended some of the progress made with Namibia’s designated action plan, the country was added to the grey list in February 2024. The FAFT has said that Namibia must continue to improve and strengthen risk-based supervision and ensure that this information is available to the relevant parties while demonstrating an ability to investigate and prosecute in line with their risk profile.

Monaco: Monaco, which has the highest concentration of millionaires and billionaires in the world, was added to the grey list in June 2024 due to insufficient progress in combating illicit financial flows. This decision comes after a review by MONEYVAL in January 2023 revealed that while Monaco had made some progress in identifying money laundering and terrorist financing threats, there were still significant gaps in its investigative and prosecutorial capabilities.

Venezuela: In early 2022, an assessment team visited Venezuela to prepare the country’s MER. The team raised concerns about the money laundering risks associated with the nation’s large informal economy, which includes illegal mining. They also highlighted terrorist financing threats linked to the close economic alliance between Caracas and Tehran. Consequently, Venezuela was added to the grey list in June 2024.

Vietnam: In March 2023, Vietnam’s National Assembly passed new regulations to combat money laundering and terrorism financing. However, the FATF needed to consider the overhaul sufficient to avoid being put on the grey list. On being added to the grey list in June 2023, the FATF requested that Vietnam demonstrate effective monitoring of banks, accountants, and lawyers to prevent funding for the proliferation of weapons of mass destruction, including nuclear, chemical, or biological weapons.

Just as countries are regularly added to the black and grey lists, countries that progress in addressing their AML/CTF deficiencies are removed. With that in mind, the FATF recently removed the following countries from the grey list.

Albania: After rejoining the grey list in February 2020, Albania is no longer subject to increased monitoring after the FATF noted the country’s efforts in improving its AML/CFT regime. In particular, Albania demonstrated a noteworthy increase in the number of money laundering cases prosecuted, particularly those that involved criminal proceeds laundered in Albania from foreign offenses. As a result, Albania was removed from the grey list in October 2023.

Barbados: In 2020, Barbados was added to the grey list due to the weak measures it had in place to tackle AML and CFT. After being satisfied with the country’s progress alongside its agreed strategic plan, the FATF removed it from the grey list in February 2024. Barbados has improved its measures to prevent legal persons and arrangements from being misused for criminal purposes while demonstrating that its money laundering investigations align with its risk status.

Cayman Islands: In October 2023, the Cayman Islands was removed from the grey list after the FATF deemed the jurisdiction had made good progress in strengthening the effectiveness of its AML/CFT regime, specifically regarding the jurisdiction’s proportionate application of sanctions. The Cayman Islands was initially subject to increased monitoring in February 2021.

Gibraltar: In February 2024, Gibraltar was removed from the grey list after it applied effective sanctions for AML/CFT breaches and pursued final confiscation judgments commensurate with its risk level – the country had been grey-listed since June 2022, and is no longer subject to increased monitoring.

Jamaica: In 2020, Jamaica was added to the grey list and committed to amending its customer due diligence obligations. Since then, Jamaica has worked to implement its action plan by developing a more comprehensive understanding of its ML/TF risk, including all FIs and DNFBPs in the AML/CFT regime, taking measures to prevent misuse of legal entities, increasing the use of financial information, and implementing targeted financial sanctions for terrorist financing without delay. As a result of these actions, Jamaica was removed from the grey list in June 2024.

Jordan: In June 2021, Jordan amended its anti-terror and money laundering law directly responding to its 2019 MER. However, the amendment came into effect after the FATF’s deadline, contributing to the watchdog’s decision to add the country to the grey list in October 2021. Since then, the FATF has noted significant progress in addressing the country’s strategic AML/CFT deficiencies, resulting in Jordan being removed from the grey list in October 2023.

Panama: Panama was originally on the grey list from 2014 to 2016 due to deficiencies in the country’s money laundering laws. After amending legislation to fill gaps in coverage of financial activities and designated non-financial businesses and professions (DNFBPs), Panama was removed from the grey list in 2016. However, the country became subject to increased monitoring in 2019 when critical legislation, including criminalizing tax fraud and making tax crime a predicate money laundering offense, had not been adopted. In October 2023, Panama was removed from the grey list after the FATF said the country had substantially completed its action plan.

Türkiye: In 2021, Turkey was added to the grey list and committed to implementing its FATF action plan by enhancing AML/CFT supervision, imposing strong penalties for violations, and improving financial intelligence use. In June 2024, Turkey was removed from the grey list due to positive improvements.

Uganda: After being grey-listed in February 2020, Uganda was removed in February 2024 and is no longer subject to increased monitoring. It met the commitments set out in its action plan with the FATF, such as adopting a national AML/CFT strategy, developing the risk-based supervision of its financial and DNFBPs sectors, and demonstrating an ability to conduct terrorist financing investigations and prosecutions.

United Arab Emirates (UAE): After seeing significant improvements in its AML/CFT regime, the FATF removed the UAE from the grey list in February 2024. The FATF identified progress in increasing outbound MLA requests to facilitate AML/CFT investigations, better risk-based mitigating measures, and a better understanding of United Nations sanctions evasion among the private sector.

Given the increased risk of money laundering and terror financing that black-listed and grey-listed countries present, most financial authorities require firms to have suitable risk-based AML/CTF protections to mitigate that threat.

Accordingly, firms must screen customers against the FATF black list and grey list during onboarding and throughout their business relationship and monitor their transactions on an ongoing basis. To screen accurately, firms should ensure that their customer due diligence measures verify their customer’s residence in, or business with, listed countries. They should also check that their transaction monitoring software can scrutinize the size, frequency, and pattern of transactions involving high-risk countries to establish whether criminal activity, such as money laundering, occurs.

When suspicious activity is detected, firms must submit suspicious activity reports (SARs) to the appropriate financial authorities to take enforcement actions.

Uncover the evolving anti-money laundering regulatory landscape, examining global trends and key themes in major economies.

Download nowOriginally published 23 March 2020, updated 01 July 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).