A Guide to the Essentials of Anti-Money Laundering

Learn more about how to meet your compliance obligations, both at onboarding and beyond.

Download your copyAn ultimate beneficial owner (UBO) is someone who ultimately owns or controls a company and benefits from its financial transactions. Because UBOs sometimes seek to remain anonymous, often through a complex chain of corporate infrastructure, they may not be immediately identifiable. Therefore, it’s crucial for FIs to understand the intricacies of beneficial ownership and apply appropriate measures to accurately identify UBOs, thus mitigating risks related to anonymity.

When financial institutions (FIs) onboard businesses and other entities as customers, they must have protocols in place to ensure they know exactly who they are beginning a business relationship with. This means identifying an account’s ultimate beneficial owner (UBO).

When criminals launder illegal funds, one way they try to avoid detection by firms’ anti-money laundering/countering the financing of terrorism (AML/CFT) measures is by concealing their identities. To do this, they often use proxies such as shell companies to transact on their behalf.

Although shell companies are not illegal outright, criminals often use them to disguise illegal funds and gain access to legitimate financial systems. By properly investigating ultimate beneficial ownership, firms can mitigate the AML/CFT risks posed by the misuse of shell companies and similar financial crime typologies. UBO checks are a common regulatory requirement, meaning failure to carry them out can carry financial or criminal consequences.

AML regulations in various jurisdictions include definitions and requirements around beneficial ownership. While definitions of UBOs can vary, they typically involve a minimum ownership threshold of shares in a company. The Financial Action Task Force (FATF) guidance on UBOs, followed in many jurisdictions’ regulations, recommends this threshold not exceed 25 percent, meaning anyone who owns a percentage of an entity greater than this amount should be considered its UBO. Some further key points to understand in different countries are:

At the onboarding stage, FIs should ask prospective customers for essential information to establish their UBOs. This includes company names, registration numbers, addresses, and the names of individuals in senior management roles. This data should be backed up with appropriate documentation to verify it. Firms should research anyone – both natural and legal persons – with interest or shares in the company.

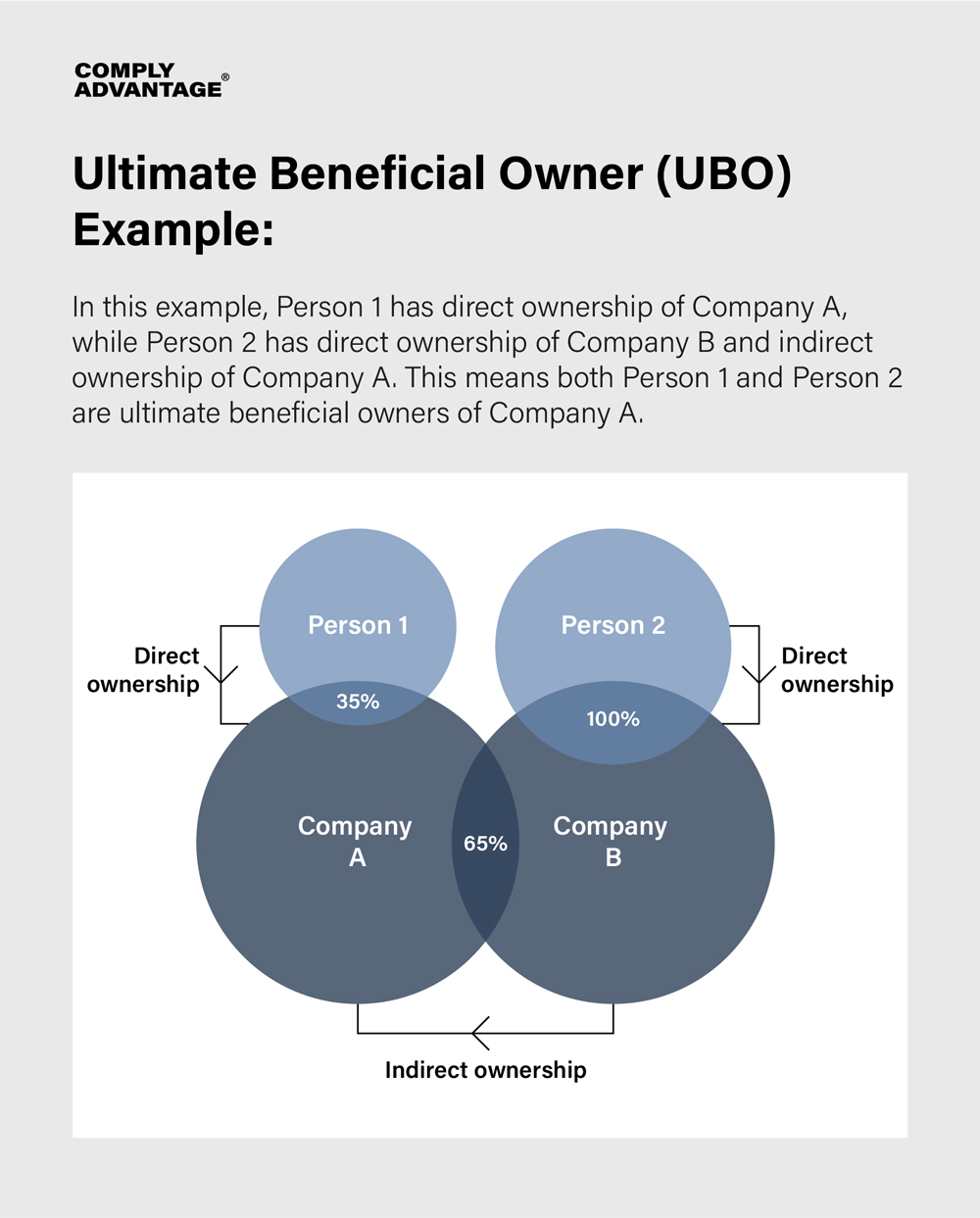

Using this information, FIs should determine who to define as a UBO. This will, as a first step, involve checking individuals against ownership thresholds. It is important to note that these thresholds apply both to direct ownership, where a UBO owns shares in a company themselves, and indirect ownership, where a UBO owns shares in an additional entity which controls the company in question. Firms should also bear in mind that an entity can have more than one UBO.

However, ownership thresholds are only one route towards establishing beneficial ownership. There are situations where it is possible for persons not meeting a threshold to exercise control over a company. The FATF gives several other examples of UBOs, including:

Once firms have identified an entity’s UBOs, they must carry out an appropriate level of customer due diligence (CDD) on them. In practice, this should involve:

In addition to implementing these onboarding measures, companies should also conduct continuous monitoring of transactions. This practice is crucial for identifying shell companies by detecting unusual transaction patterns or transactions involving high-risk countries.

Learn more about how to meet your compliance obligations, both at onboarding and beyond.

Download your copySome UBOs represent a higher risk of money laundering. This can be because of:

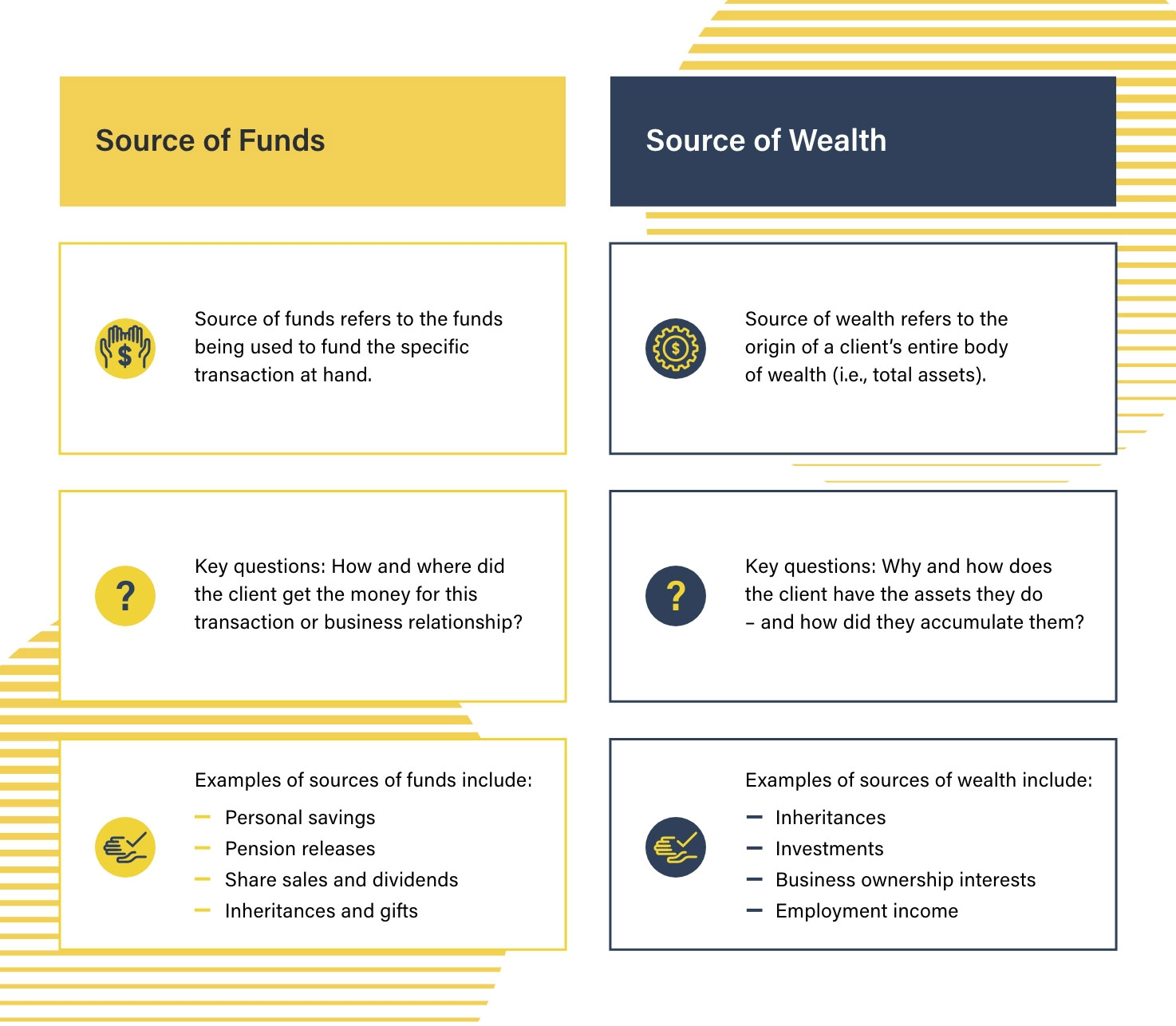

Firms should undertake further checks, known as enhanced due diligence (EDD), on higher-risk UBOs. An important part of EDD consists of source of funds (SOF) and source of wealth (SOW) checks: firms conduct these to understand how a company or its UBO has obtained its financial assets and investigate any inconsistencies. Firms can also ask for further details on the purpose of the UBO’s intended business relationship with them, or for more frequent reports on a company’s ownership as a condition of the relationship.

In cases where a UBO presents a clear risk of money laundering or terrorist financing, an FI should not onboard them or the entity they control and must report any suspicious activity to the relevant authorities.

ComplyAdvantage’s specialist AML solutions include intuitive features to help firms identify and mitigate UBO-related risks, including:

Mesh Company Screening allows businesses to protect themselves from financial crime risks with market-leading software and risk intelligence.

Get a demoOriginally published 04 April 2015, updated 08 November 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).